Two and a half years ago, we became homeowner in Switzerland. This was the first major step in our financial life, which brought us many new questions.

But what will be our new rent?

One of the main questions related to home ownership was how much rent we’d pay once we’d’ve bought.

Before signing, we heard a lot of answers ranging from “You’ll see you’ll pay much less than when renting” to the complete opposite “Be careful because yes, you’ll pay less but there’s the property tax and other fun stuff like the rental value (“valeur locative” in French, and “Eigenmietwerte” in Swiss German)… so it’s not so advantageous…”

We’re therefore quite lost and, even if the banks each announced a forecast estimate, we’re looking forward to only one thing (well, me, the family budget geek): it was to spend a few years in our new apartment and do our own calculations, based only on concrete numbers.

Things to consider when calculating your rent as a homeowner in Switzerland

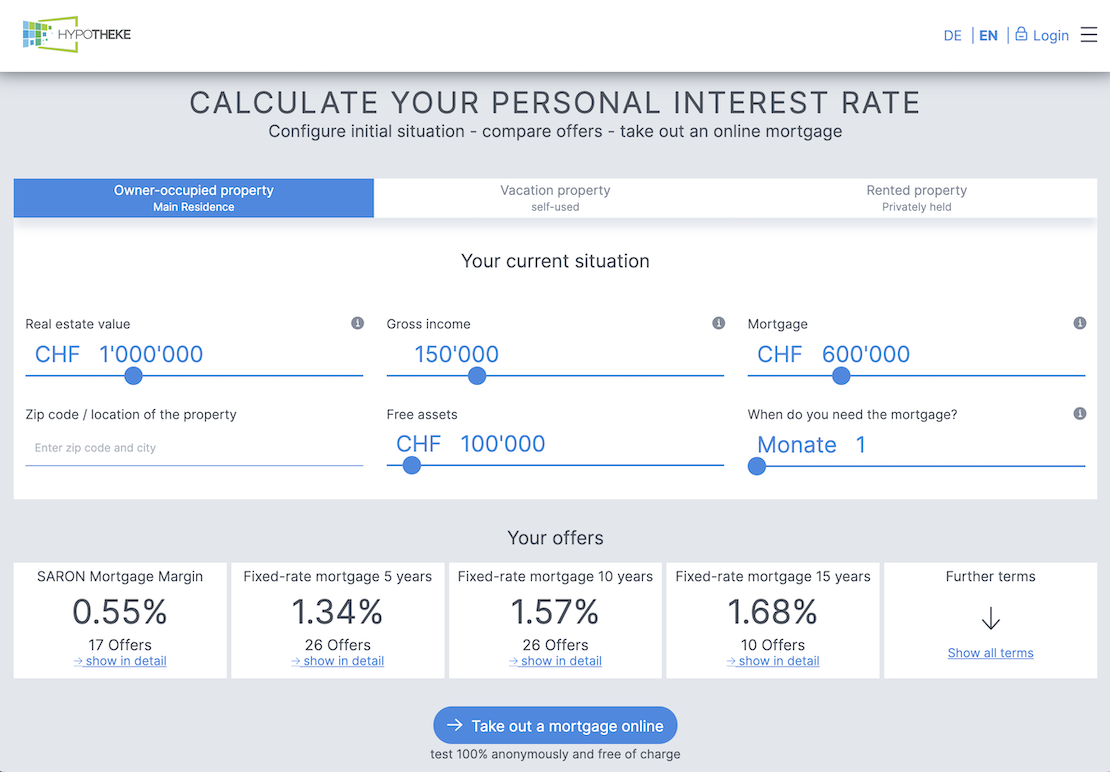

Mortgage interests

The first thing to include in our equation is the mortgage (unless you bought cash, of course…). In our case, it’s a mortgage with a fixed rate over 10 years, with indirect amortization through my third pillar that’s pledged.

Until 2026, we must therefore pay CHF 9'328.80 in interest (we’re at 1.69%) per year, which amounts to CHF 777.40 per month.

Co-ownership fees

As we’ve a condominium apartment, we’ve co-ownership costs including things like the renovation fund (for future work on the building), shared areas’ electricity (corridors, cellars), administratration fees of our condo (we go through a real estate agency to have someone neutral in this position), or the building’s wastewater treatment tax.

We pay a monthly fee of CHF 330.65 per month for these costs.

Wastewater treatment tax

As homeowner, we’re the ones who’ve to pay the wastewater treatment tax to the municipality (vs. before where it was included in the rent).

This tax amounts to CHF 51.70 per month. It depends a lot on where you live, but I think it’s easy to get the amount by calling the administration of your future place of residence.

Property tax

Since we use a piece of land in our municipality, we’ve to pay a property tax (also called real estate tax, additional real estate tax, or real estate contribution depending on the canton).

Again, you may check with your place of residence to find out the amount. This tax may actually not exist at all. Also, it’s an entirely different tax than the rental value (which we’ll see in the next point).

We receive an annual invoice directly from the municipality, which costs us CHF 38.70/month.

Note about the rental value

When you become a homeowner, you no longer deduct rent in the “Housing Deduction” category when you do your taxes. On the other hand, you have a rental value (representing what you’d pay to live in the dwelling you bought) that is added to your income sum, with the positive counterpart that you can deduct your administrative expenses, taxes, and mortgage interests.

Indeed, the Swiss system “makes the postulate of equality of all human beings regarding the law. This key principle of the Swiss legal system also has its effects in the field of tax law, through the requirement of equal treatment of all taxpayers. In the context that we care about, it’s a question of the fair treatment of homeowners in relation to tenants […]”, as explained by the Swiss Federal Tax Administration in this very detailed document on the rental value. (in German — go to the French version of this article if you want it in French).

That being said, as a tenant, you never take into account the impact of your rent when you tell someone about it. As a result, it makes no sense to take into account the impact of rental value and other potential deductions as a homeowner.

But as I’m curious, I did a simulation: I took back our 2017 tax document and turned us into tenants with the amount of our old rent. In the end, you win CHF 25.85 on the total amount you pay in taxes when you own your property.

Nota bene

In our equation, I don’t take into account elements that are paid separately from the rent such as electricity, water, heating, or ECA because it depends on everyone’s consumption.

Our rent amount as a homeowner in Switzerland

Before becoming a homeowner, our rent was CHF 1'833 (including charges) for a 110m2 (4.5 rooms) in the North of the Vaud canton.

Now that we’ve bought our home, we pay a rent of CHF 1'198.45 as homeowner in Switzerland for a 130m2 (5.5 rooms) property located between Lausanne and Yverdon-les-Bains.

CHF 777.40/month (mortgage interests)

- CHF 330.65/month (co-ownership charges)

- CHF 51.70/month (wastewater treatment tax)

- CHF 38.70/month (property tax)

= CHF 1'198.45/month = our monthly rent as homeowner in Switzerland

This simple rent comparison shows that it’s clearly advantageous to be a homeowner. But we must not forget that the rent is only what we pay each month. Because there is also everything we paid up front when we bought our property, such as the notary or taxes paid only once.

This is what I plan to cover in a future article to see how much the apartment has really cost us since we have been living there.

I hope that after this blogpost, I’ll finally have all the elements in hand to write the famous article “Buying or renting in Switzerland as a Mustachian, what’s THE answer?” that I’d have dreamt to have available three years ago.

What is your rent as a tenant or homeowner currently? For how much surface area, and in which region?

The impact of my education on my money — Step 1 …

How to onboard your partner on a common budget and...