I don’t know if you’ve thought about what you’ll do with your second pillar (pension assets) when you become FIRE?

For my part, I’m starting to look into it, as my date of financial independence is gradually getting closer and closer. Because, as with all my personal finances, I want to optimize my tax situation as much as possible.

Indeed, the taxation of 2nd pillar capital withdrawals varies from canton to canton (as local tax authorities are responsible for setting those themselves).

2nd pillar tax calculation: four different methods depending on your canton

Why make it simple when you can make it complicated? Each canton applies its own method of calculating tax on capital withdrawals:

1. Fixed capital withdrawal tax rate: GL, SG, TG and UR

Simple and effective, you have a fixed percentage regardless of the amount of your capital withdrawal. As you will see in the table below, there are changes depending on the amount withdrawn, as the federal tax share increases proportionally (see point 2).

2. Proportional tax rate (to the income tax rate): Federal, AG, AI, GE, LU, NE, NW, OW, SH, SO, VD and ZG

Imagine you live in the canton of Aargau, where lump-sum benefits from pension funds are taxed in proportion to the income tax rate (~1/3). You have CHF 200'000 in LPP that you want to withdraw, and the tax rate in the canton of Aargau for such an income is 8.5% (single person). For the cantonal portion, the calculation will therefore be: 8.5% x 1/3 = 2.83%, then CHF 200'000 x 2.83% = CHF 5'660. Municipal tax and federal tax must be added to this (the latter also works on a proportional basis), as they are taxed separately.

3. Tax rates using the annuity rate system: GR, SZ, TI, VS and ZH

Like the proportional rate, this system is also based on income tax, but as if you were drawing your pension benefits in the form of an annuity. It’s a little more complicated, but the result is the same: the higher the pension fund capital withdrawn, the higher the taxes.

4. Progressive tax rate (separate from income): AR, BE, BL, BS, FR and JU

This second-pillar tax is progressive, but completely separate from the income tax scale.

So much for theory. Now for the practical.

2nd pillar capital withdrawal tax amount in 2026

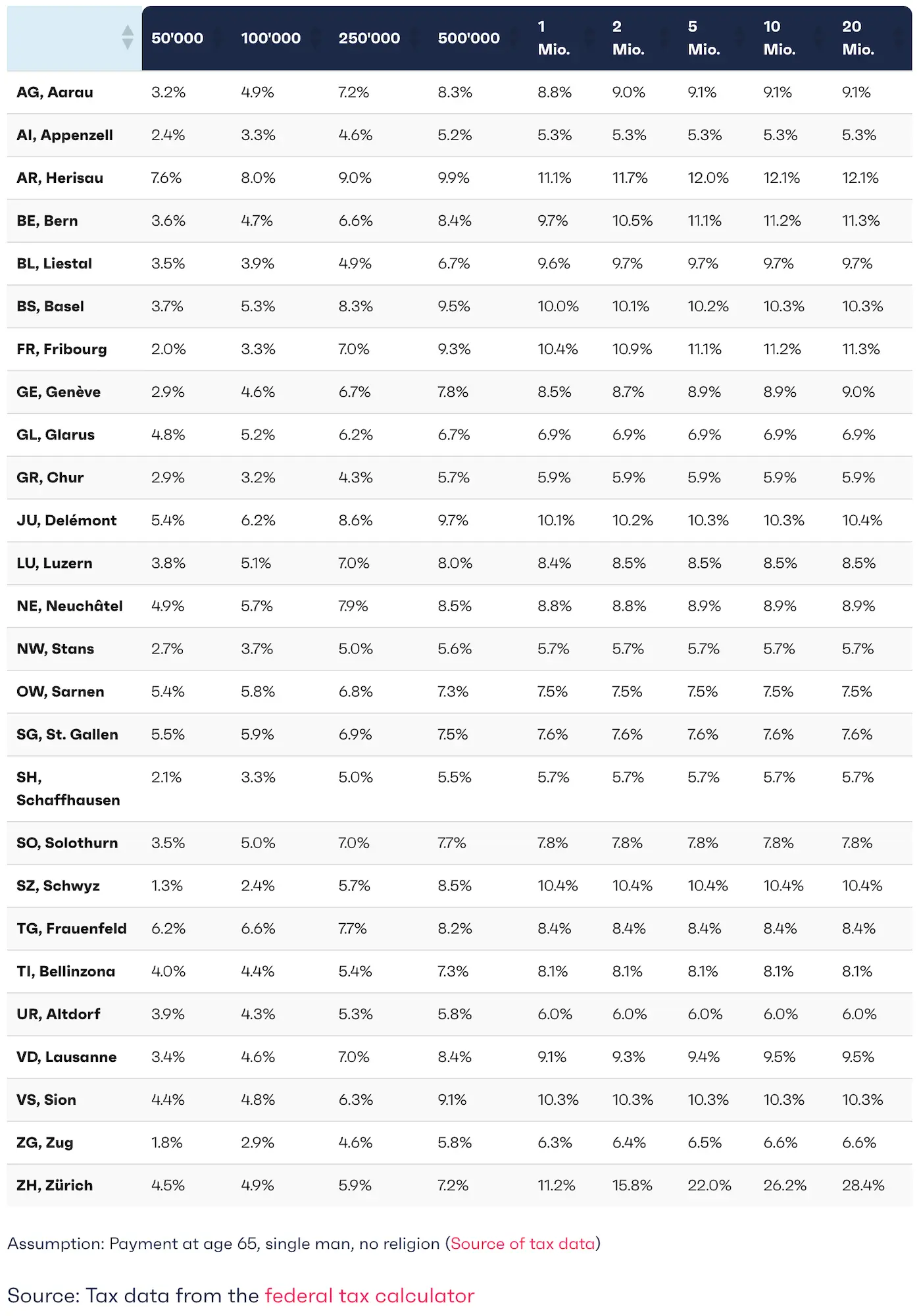

You know how much I love finpension for their financial products, which are optimized down to the last detail. On top of that, they provide a lot of free documentation about the Swiss pension system.

So rather than reinventing the wheel, I’m posting a screenshot of their complete table of all the tax amounts for retirement capital withdrawals from your 2nd and/or 3rd pillar, depending on your canton:

List of tax rates for lump-sum pension fund withdrawals, and/or pillar 3a withdrawals (source: finpension)

Whatever happens, you’re going to want to optimize your taxation on your capital withdrawal in most cases.

Staggering 2nd pillar lump-sum withdrawals (pension fund)

If you live in the cantons of Glarus, St. Gallen, Thurgau or Uri, staggering your capital withdrawal will be less attractive, as only federal taxes will be proportional to the income tax rate. And the latter is a smaller proportion (but hey, there’s no such thing as small savings!)

In all other cases, it makes sense to spread your BVG capital withdrawal over several tax years.

Why should you do this?

Because, quite simply, you’ll pay less tax.

Let’s imagine a fictitious and simplistic example where you want to opt for a BVG capital withdrawal of CHF 500'000. And let’s assume that the proportional tax is progressive in this way:

| Capital withdrawal amount | Tax rate (applied to this income bracket) |

|---|---|

| CHF 0 to CHF 50'000 | 3.5% |

| CHF 50'000 to CHF 100'000 | 6.5% |

| CHF 100'000 to CHF 250'000 | 8.5% |

| CHF 250'000 to CHF 400'000 | 11% |

| CHF 400'000 and over | 13% |

So let’s see how the progressivity of the capital withdrawal tax affects the money you have left over after the total withdrawal, depending on whether you withdraw over 1 year or 2 years:

💰 Withdrawal in 1 year (CHF 500'000)

| Tax bracket | Taxable amount | Rate | Tax |

|---|---|---|---|

| CHF 0 - CHF 50'000 | CHF 50'000 | 3.5% | CHF 1'750.00 |

| CHF 50'000 - CHF 100'000 | CHF 50'000 | 6.5% | CHF 3'250.00 |

| CHF 100'000 - CHF 250'000 | CHF 150'000 | 8.5% | CHF 12'750.00 |

| CHF 250'000 - CHF 400'000 | CHF 150'000 | 11.0% | CHF 16'500.00 |

| CHF 400'000 - CHF 500'000 | CHF 100'000 | 13.0% | CHF 13'000.00 |

| Total | CHF 47'250.00 |

💰 Withdrawal over 2 years (CHF 250'000/year)

| Tax bracket | Taxable amount (year 1 and 2) | Rate | Tax year 1 | Tax year 2 |

|---|---|---|---|---|

| CHF 0 - CHF 50'000 | CHF 50'000 | 3.5% | CHF 1'750.00 | CHF 1'750.00 |

| CHF 50'000 - CHF 100'000 | CHF 50'000 | 6.5% | CHF 3'250.00 | CHF 3'250.00 |

| CHF 100'000 - CHF 250'000 | CHF 150'000 | 8.5% | CHF 12'750.00 | CHF 12'750.00 |

| Total per year | CHF 17'750.00 | CHF 17'750.00 | ||

| Total over 2 years | CHF 35'500.00 |

In conclusion:

| Scenario | Total tax payable | Difference from single withdrawal |

|---|---|---|

| Withdrawal in 1 year | CHF 47'250 | - |

| Withdrawal in 2 years (CHF 250k/year) | CHF 35'500 | CHF 11'750 savings |

By spreading your withdrawal over two years, you save CHF 11'750 in taxes thanks to the progressive rate structure.

Moral: when it comes to 2nd or 3rd pillar withdrawal, tax timing can have a major impact on what you keep in your pocket. And personally, I’m not against keeping CHF 11'750 to grow myself, rather than giving it to the taxman ;)

Especially as we’re “only” talking about cantonal taxes on the 2nd pillar in our fictitious example, but to that you have to add federal taxes (also proportional), as well as taxes on any withdrawals from your pillar 3a capital.

Withdrawal of 2nd pillar capital over a maximum of two years

The next question is: why not withdraw my 2nd pillar capital over more than two years?

The answer is simple: it’s the law!

As much as you can withdraw your pillar 3a capital over five consecutive years (see my detailed article on staggered withdrawals of the pillar 3a), that’s the maximum number of years allowed by law. And to be precise, the law states that you can withdraw your pillar 3a at the earliest 5 years before AVS retirement.

As for the tax on 2nd pillar withdrawals, the maximum number of withdrawals is two (= in two different years).

Or, to be more precise, BVG law states that when you take early retirement (or even normal retirement), you can transfer your BVG capital to not one, but a maximum of two different vested benefits accounts. This is known as splitting.

Once we've sorted out the tax details for the lump sum payment of my pension plan, we'll be off hiking again! (at the Blue Lake in Arosa) (Quelle: valais.ch/en)

⚠️ Important note: this splitting into two vested benefits accounts can only be carried out when you leave your job and transfer your pension funding assets to a vested benefits institution. This is THE thing to not forget to do when you become FI.

Then, when you want to withdraw the money from your vested benefits, it’s either take it all or take nothing. So, since you’ll have two vested benefits accounts, you can spread your withdrawal of 2nd pillar capital over a maximum of two years.

Good to know: your pillar 2 and pillar 3a capital is added together for tax purposes

When you make a capital withdrawal from your 2nd pillar, the amount withdrawn is added to any capital withdrawal from the 3rd pillar, and taxes are then calculated on this total amount. So you want to take both your 2nd pillar and your pillar 3a into account when you optimize your withdrawals for tax purposes.

As a general rule, it’s recommended that you withdraw your 3rd pillar capital before the official retirement age (because if you want to do so afterwards, you’ll need to prove that you’re still working, which isn’t the case when you’re financially independent), and your vested benefits capital (= BVG capital) after the legal retirement age (because you don’t need to prove that you’re still working for the latter).

Which is the best pension institution for a vested benefits account?

In our case of financial independence, we’re going to retire much earlier than the standard legal retirement age. This means that our 2nd pillar capital will have to be transferred into a vested benefits account until we can withdraw it when the time comes.

As with all other financial services, there is a plethora of solutions available, many of them bad ones, with lots of charges to pay for the famous Porsche of our banker friend or so-called financial “advisor”.

So I’ve written you a detailed comparative article to find out which is the best vested benefits account to date. And, spoiler, there’s one player in particular who’s really gone the extra mile to get this splitting right, and all automated!

FAQ on 2nd pillar withdrawal

What should I do with my vested benefits account if I change employers?

When you change employers, the law states that you must transfer your vested benefits account to your new employer. But this is a gray area. I explain my reasoning in this detailed article: What to do with your vested benefits account when you change employers.

Conclusion 2nd pillar withdrawal tax

Because of tax progression (the fact that the larger the amount of your 2nd pillar capital, the higher the tax), you’ll want to optimize your tax by staggering your BVG capital withdrawal over two years (the maximum possible within the current legal framework of the Freizügigkeitsverordnung, also known as FZV).

There is an exception for the cantons of GL, SG, TG and UR, where the tax on the withdrawal of pension capital is flat-rate. But you can still save a few hundred francs. Indeed, the federal tax on capital withdrawals is progressive anyway (but that’s a small part of the taxes to pay).

So, as an aspirant to financial independence, when you retire (very) early, you will transfer your BVG capital to two vested benefits accounts with two separate foundations, then withdraw each of these accounts over two separate tax years.

This tax planning will save you several thousand or even tens of thousands of Swiss francs.

And yourself, how do you plan to make your 2nd pillar capital withdrawal?

Headline photo credit: pexels.com

Last updated: January 7, 2026