The month of September continues the bad momentum of August, financially speaking. We are once again below the 50% savings rate. The only good news is that a large part of the expenses are related to my book (cover, interior design, and video editing), and that therefore they will not be recurring :)

If you are new to the blog, I recommend reading the article that introduced this series about my net worth.

Also, following questions from some readers, I would like to point out that the green or red figures below correspond to the relative evolution compared to the previous month, and not to the absolute amounts of the current month.

September: two weekends of entertainment, party with friends and family, health check for children (nothing serious, phew!), extra-curricular activities, and blog/book spending

CASH FLOW AND SAVINGS (+CHF 3'737.53): Even if it remains an excuse, many expenses in September were exceptional (i.e. non-recurring) so that reassures me for the next few months.

As usual, let’s take a look at our unusual expenses first:

- Outings: we had planned two weekends for a long time. One was for the four of us and was a great experience that we keep epic memories of! And the other one was a weekend as a couple without children, and that’s priceless because it’s important for our marital balance to be only the two of us several times a year for one or two days without the kids. And frankly, that did us a lot of good as always. Zero regrets in spite of the CHF 500 spent (yes yes, you read that right… :D)

- We organized a gathering with friends and family at the end of August, but several related expenses were paid in September, and there is even one in October (and yes, we kept our distance ;)). On top of that, the children had several invitations to birthday parties. And in parallel, we had in our “planned” birthdays some people who celebrated a round number (or almost ^^), i.e. it cost us more

- Medical: one of our two children had a health concern that required a follow-up over a few weeks. Nothing serious, everything is all taken care of. And paid too, ~ CHF 750 ;)

- Extracurricular activities (including Mrs. MP’s sport): as every back-to-school period, our children have resumed their respective sports activities. And we have received the corresponding invoices for a total amount of ~ CHF 350

- Apple AirPods Pro Mr. MP: I almost bought them just before the lockdown last March (because my old in-ear headphones had died). Then, since I wasn’t going to be commuting anymore, and I was going to be outside less than expected, I managed to convince myself to wait. But after 6 months of waiting to see if I really needed it, I ordered them in September. And I don’t regret it. It’s such a life changing thing not to have a cable that rips your ear off anymore. And I’m not talking about being able to walk around the room without having to take your smartphone/laptop with you. And on top of that, I bought them at a discount of CHF 168 thanks to Galaxus vouchers earned with Zak!

- And finally, expenses related to my book project. I really wanted to treat this first book the right way, especially considering the time I’ve spent on it since February. I used online services (tell me if you’re interested in knowing which ones) for the book cover, the design of the whole interior, as well as for video editing (shhhh… these bonuses are still a secret!) In short, in total, I spent more than CHF 3'200. I see this as an investment, because these expenses should be covered with the sales of the book (at least I hope so ;))

Short aside as many of you ask me: my book (in French and English) will be officially released on Tuesday, November 24, 2020, and will be available exclusively via my blog (not in bookstores, at least not for now).

The German version will arrive in January 2021.

Concerning unusual cash inflows (i.e. excluding our Swiss salaries):

- Reimbursement for a run for Mrs. MP (which did not take place because of COVID)

- Reimbursement of children’s medical expenses for about CHF 560 (it’s not stolen considering all the expenses of the last few months ;))

- Reimbursement of numerous advances made for various gifts and reservations (partly related to the party I told you about above)

- About CHF 320 of dividends from my favorite VT ETF

- A lot of income linked to the blog following your use of my recommendations (thank you!!) to save as much as possible on your Swiss banking fees (often more than CHF 300/year) as well as on your brokerage fees as a Swiss investor. And also coaching (I won’t take anybody else before the beginning of 2021, in order to preserve my mental health), and the last kickstarter round of my book (thanks again to you if you are part of it!)

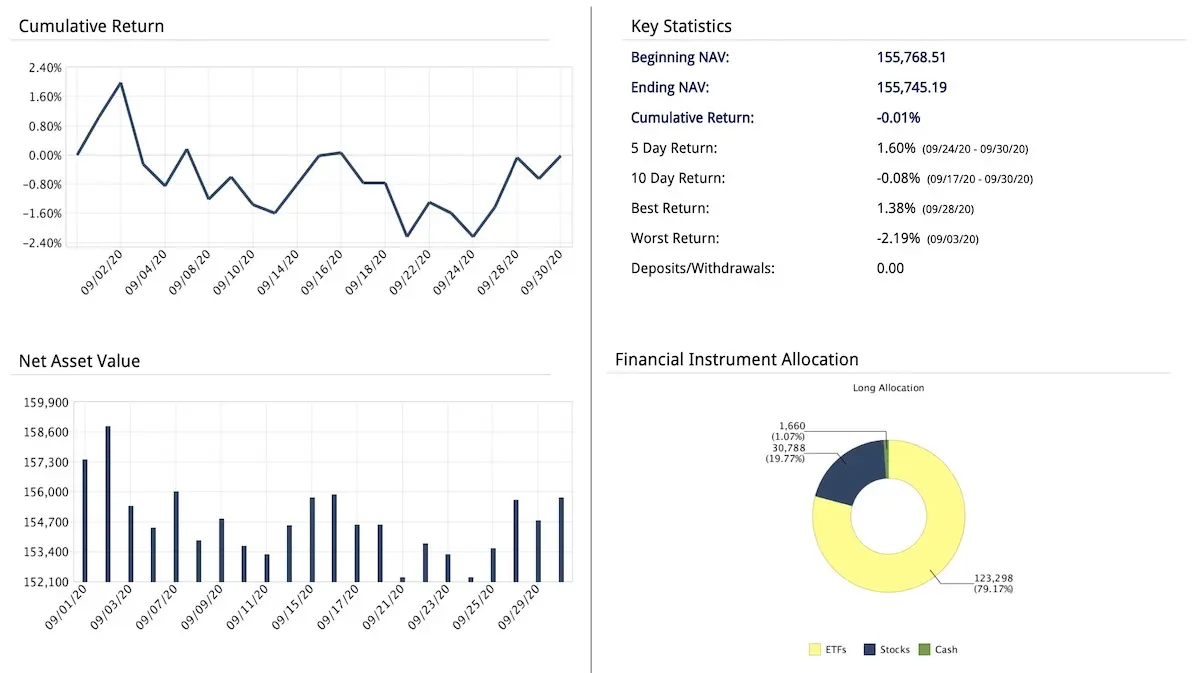

STOCK MARKET INVESTMENTS (-CHF 888.19): A small correction of the stock market in September. Nothing to do with the slap in March with the crisis linked to the coronavirus.

Otherwise, no purchase (or sale) on the horizon because I keep all our current savings in cash in view of a potential real estate acquisition in France. I’ll tell you more once we know if we’re going ahead (or not), but for the moment we’re waiting to hear from our bank. We’re talking about a 600'000€ project…!

P2P INVESTMENTS (+CHF 0.00): No surprises on the Mintos side. I’ve stopped all investment, and I’m gradually getting my cash out. It’s not that I wouldn’t want to go faster, but the Mintos “Invest & Access” program doesn’t allow me to. Once the account is completely emptied, I will close it definitively and do a post-mortem article to explain in detail my motivations for not continuing in P2P investments.

CRYPTOCURRENCIES SPECULATION (-CHF 155.68): Once it goes up, once it comes down. As unpredictable as we thought. The day I’m at +1 million CHF, I’ll sell. In a century maybe…

MP’S 2ND PILLAR (+CHF 602.85): Filling my second pillar as usual.

MRS.’ MP 2ND PILLAR (+CHF 352.20): Filling Mrs. MP’s second pillar as usual.

MP’S 3RD PILLAR (n/a): Nothing to report because I make my lump sum payment at the beginning of the year (only Mrs MP is lucky enough to be at VIAC… my 3rd pillar being one of the guarantees for our mortgage), and my updated surrender value also comes at the beginning of the year.

MRS’ MP 3RD PILLAR (+CHF 605.68): As Mrs. MP’s pillar 3a is invested at VIAC 100% in global equities, its value also varies according to the stock exchange (and not only according to the CHF 564 paid monthly). This means that this September, our portfolio has gained CHF 41.68 (= CHF 605.68 - 564.00).

SWISS LLC/GMBH/SÀRL (+CHF 0.00): As announced in a previous article, we finally opened our account (consignment one for the moment) for our Swiss LLC/GmbH/Sàrl. We will use this company to declare the income from the blog and other projects (coaching, book) and thus optimize our tax situation.

For your information, although I will detail it later, we chose to go with the Migros Bank which, at the time of writing, is the most frugal bank for corporates in Switzerland with its fees of CHF 3/month (no limit on the number of transactions).

APARTMENT AND MORTGAGE IN SWITZERLAND (n/a): Nothing to report, we still do not repay anything as mortgage rates are so low, and we have not made a revaluation of our property so we do not speculate with its value (i.e. we keep the amount of our initial 20% down payment that we had to pay when we bought our home).

REAL ESTATE INVESTMENT IN SWITZERLAND (n/a): As a reminder, the 30kCHF invested here is a participation in a Swiss real estate project (i.e. not in my own name). I am still considering getting 55% of annualized return.

RENTAL BUILDING IN FRANCE (n/a): Same as for our apartment in Switzerland, no speculation on the price of our rental property. We will wait until we want to sell it to make an evaluation.

MORTGAGE LOAN IN FRANCE (+CHF 720.35): The magic of real estate investment: the loan repays itself “on its own” thanks to the rents.

SCI (SOCIÉTÉ CIVILE IMMOBILIÈRE, REAL ESTATE INVESTMENT COMPANY IN ENGLISH) IN FRANCE (+CHF 384.69): Cash flow continues to be positive pending taxes.

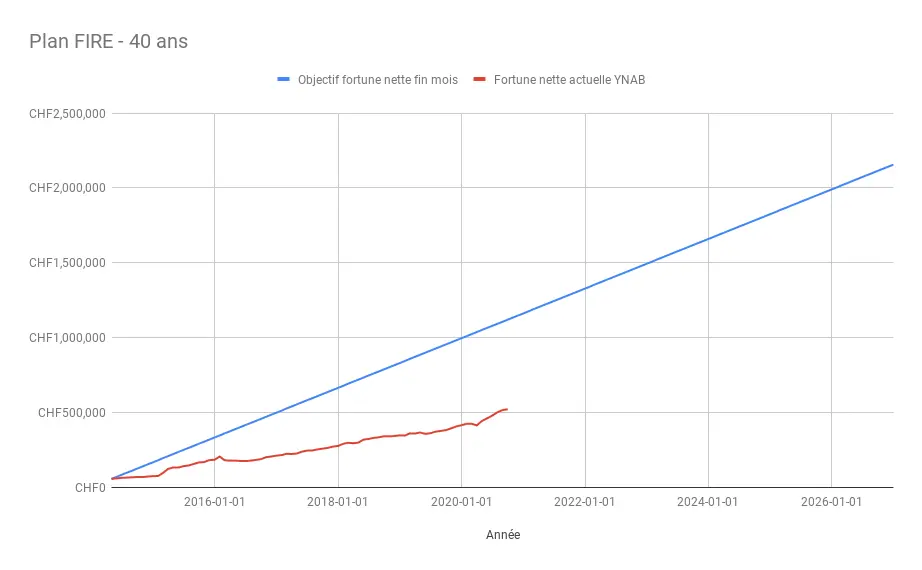

In terms of financial independence, we are at 24% of our objective of CHF 2'156'000 with our net worth of CHF 522'727.20.

Which visually gives us this:

Savings rate for September

In the end, we finished with a savings rate of 32% for September 2020. We continue to move towards a very good vintage of more than 50% of savings rate for 2020. But we remain focused, because the second half of the year has just begun, and we still have half a year to continue optimizing our revenues and expenses to widen the gap between the two as much as possible (and above all to calm down a little bit with the restaurants and “exceptional” expenses :D).

And you, what was your net worth and savings rate in September?

PS 1: if you also want to have access to bonuses such as the screenshot revealing the amount of each of my assets (I post it every month when this net worth update’s article is published online), then you just have to become a patron of the blog via Patreon.

PS 2: I’ve added a new “bonus” for the blog’s patrons. Since last month, I publish a live notification of my buy/sell on the stock market and other investments (translated into three languages like the blog — i.e. EN, DE, and FR). Just to be clear, I follow a rather passive investment methodology with ETFs disclosed on my blog, so you won’t learn anything transcendental. But if it can motivate you to invest regularly and in a disciplined way, then I will have succeeded in my wager.