“Can’t wait for November!”

That’s what I told myself when I saw a new month below the 50% savings rate… Too many expenses… planned, but also unexpected. As in September, it remains exceptional and non-recurring expenses, so that reassures me.

If you are new to the blog, I recommend reading the article that introduced this series about my net worth.

Also, following questions from some readers, I would like to point out that the green or red figures below correspond to the relative evolution compared to the previous month, and not to the absolute amounts of the current month.

October: Swiss vacations, continuation of family party expenses, health problem, and beginning of expenses for the book release

CASH FLOW AND SAVINGS (-CHF 13'325.54): And there is the drama… :D

As usual, let’s take a look at our unusual expenses first:

- Vacation: with everything that has happened since the beginning of the pandemic, we were looking forward to this vacation. Like many of our fellow citizens, we took the opportunity to visit a large part of Eastern Switzerland that we knew too little about. And we were not disappointed. We loved it, and our growing children enjoyed it as well. Perfect to illustrate their history and geography classes!

The four of us, for a little over a week, including lodging, food, and activities, got by for about CHF 3'000. We had set ourselves a little less, so we got a yellow card for frugality (and yes, we could have gone under the tent and just hiked, but no, we didn’t — and we assume it :)). On the other hand, in terms of memories and experience, it made up for it because we really had fun and recharged our batteries between us - Family party expenses: as I explained in my September article, we had one last payment related to this item that was charged in October. Again, this was exceptional, and it won’t happen every week or month. Phew!

- Extracurricular activities: as above, a final bill related to the toddler activities arrived in October. It’s paid! The next ones should only be in January since they are often semi-annual payments

- Remote expense: we needed a wireless mouse for Mrs. MP since we are both currently working remotely. We’ll put this as a business expense on the next 2020 tax return ;)

- Medical: small health concern for one of the MP children. The money advanced will be reimbursed to us by the insurance, but it was a nice bill of more than CHF 500… but everything is better now, nothing serious, and no after-effects. What a year 2020!

- Clothes and shoes: apart from a few extra clothes for the children, I finally took the time to replace my 9 years old hiking shoes! I took advantage of a discount and bought exactly the same ones for an amount of CHF 106. This makes a total of CHF 11.77/year if I keep them for another nine years. Nice investment considering the pleasure we get from our family treks in the Swiss Alps and Jura

- French taxes: that’s it, French taxes (related to our rental building) have woken up. We are now paying CHF 130 per month, which is more than expected because the French taxes made a mistake in calculating our tax situation (we only have to pay 7.5% of CSG-CRDS as Swiss residents, and not 17.2% — if the subject interests you, everything is explained here). Except that they take weeks to answer our correction request, so we are patient… We will also receive the 2019 tax bill to be paid in two installments in November and December. Finally, I mention this as an unusual expense because this is the first time we are paying them. As of next month, it will be usual, so I won’t talk about it anymore

- Expenses related to my book project: and more than CHF 1'800 spent, well, no, invested in my book project and blog. Between translations, video editing, and so on. But first of all, I’m very happy and proud of the result, and secondly, I intend to make this project profitable in the long term.

Concerning unusual cash inflows (i.e. excluding our Swiss salaries):

- Reimbursement of children’s medical expenses for about CHF 70

- Reimbursement of numerous advances made for various gifts and reservations (related in part to the party I mentioned above)

- Approximately CHF 450 of dividends from my VWRL ETF as well as from my Daubassses value shares

- A lot of income linked to the blog following your use of my recommendations (thank you!!) to save as much as possible on your Swiss banking fees (often more than CHF 300/year) as well as on your brokerage fees as a Swiss investor

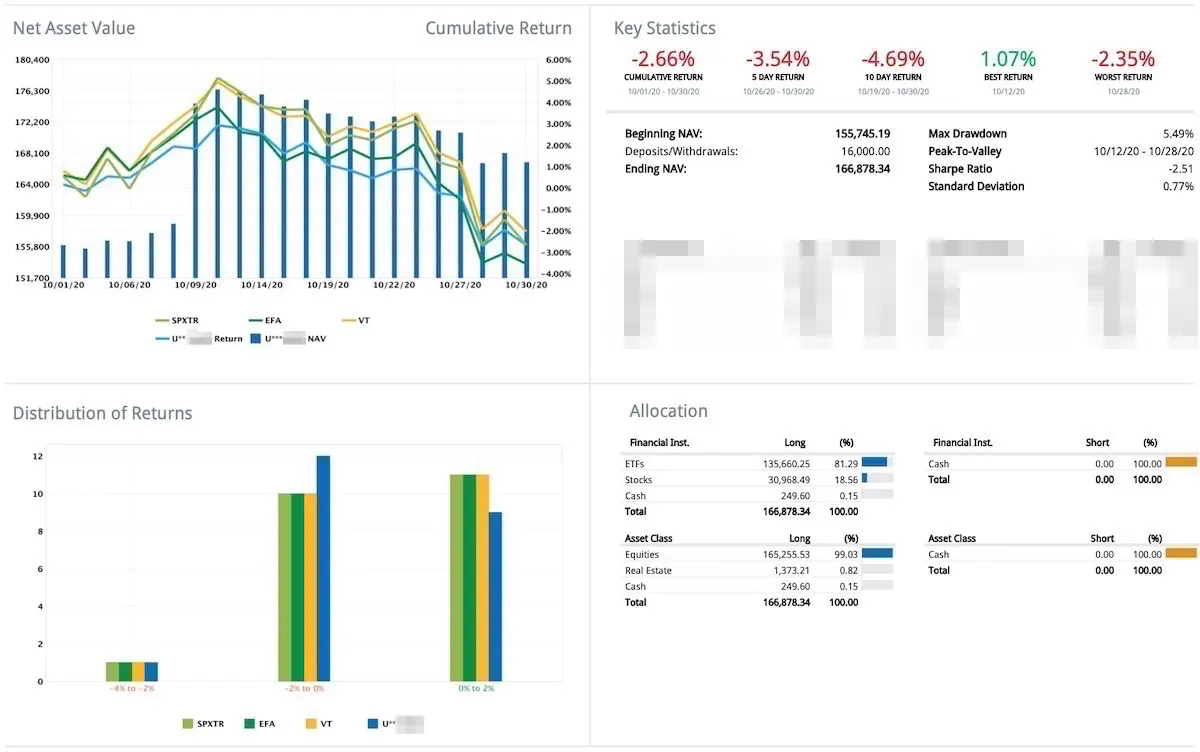

STOCK MARKET INVESTMENTS (+CHF 14'313.27): And it’s on the rise again.

In terms of the movement of my investment portfolio, it has moved quite a bit. Indeed, the French bank we used for our first investment property did not want to follow us for this new commercial building project of 600'000€. Honestly, it was more of a relief than a disappointment since I much prefer the simplicity of managing the stock market (cf. the comments to myself section in this recent article).

As a result, I didn’t wait a second, and I made a transfer from our Zak account to our Interactive Brokers investment account of CHF 16'000! And we bought about CHF 16'600 of ETF VT, and the rest in Japanese and European Daubasses shares.

Speaking of Daubasses, we also sold an American company line for a nice annualized return of 246%. But don’t get too excited because it’s only one stock in a portfolio of 30, and the goal is that the overall return over 7-10 years should be about 15%. Which is not at all the case at the moment. So we enjoy the appreciation, but we stay calm, we breathe, and we go about our business while our bills are making babies, slowly but surely.

P2P INVESTMENTS (+CHF 0.00): No surprises on the Mintos side. I’ve stopped all investment, and I’m gradually getting my cash out. It’s not that I wouldn’t want to go faster, but the Mintos “Invest & Access” program doesn’t allow me to. Once the account is completely emptied, I will close it definitively and do a post-mortem article to explain in detail my motivations for not continuing in P2P investments.

CRYPTOCURRENCIES SPECULATION (+CHF 181.52): Once it goes up, once it comes down. As unpredictable as we thought. The day I’m at +1 million CHF, I’ll sell. In a century maybe…

MP’S 2ND PILLAR (+CHF 602.85): Filling my second pillar as usual.

MRS.’ MP 2ND PILLAR (+CHF 352.20): Filling Mrs. MP’s second pillar as usual.

MP’S 3RD PILLAR (n/a): Nothing to report because I make my lump sum payment at the beginning of the year (only Mrs MP is lucky enough to be at VIAC… my 3rd pillar being one of the guarantees for our mortgage), and my updated surrender value also comes at the beginning of the year.

MRS’ MP 3RD PILLAR (+CHF 917.01): As Mrs. MP’s pillar 3a is invested at VIAC 100% in global equities, its value also varies according to the stock exchange (and not only according to the CHF 564 paid monthly). This means that this October, our portfolio has gained CHF 353.01 (= CHF 917.01 - 564.00).

SWISS LLC/GMBH/SÀRL (-CHF 2'200.00): As announced in a previous article, we finally opened our account for our Swiss LLC. We are going to use this company to declare the income from the blog and other projects (coaching, book) and thus optimize our tax situation.

And we were able to observe our first disbursements on our LLC account at the Migros Bank:

- CHF 200 to pay the fees for the consignment account, which is now closed. So we now have a real corporate bank account: 🎉

- CHF 2'000 notary fees for the constitution of our Swiss LLC

I’ve planned a feature article to tell you the whole story. Be patient, it’s coming!

APARTMENT AND MORTGAGE IN SWITZERLAND (n/a): Nothing to report, we still do not repay anything as mortgage rates are so low, and we have not made a revaluation of our property so we do not speculate with its value (i.e. we keep the amount of our initial 20% down payment that we had to pay when we bought our home).

REAL ESTATE INVESTMENT IN SWITZERLAND (n/a): As a reminder, the 30kCHF invested here is a participation in a Swiss real estate project (i.e. not in my own name). I am still considering getting 55% of annualized return.

RENTAL BUILDING IN FRANCE (n/a): Same as for our apartment in Switzerland, no speculation on the price of our rental property. We will wait until we want to sell it to make an evaluation.

MORTGAGE LOAN IN FRANCE (+CHF 717.15): The magic of real estate investment: the loan repays itself “on its own” thanks to the rents.

SCI (SOCIÉTÉ CIVILE IMMOBILIÈRE, REAL ESTATE INVESTMENT COMPANY IN ENGLISH) IN FRANCE (-CHF 799.55): The cash flow is negative in October because we had to pay the property tax which amounts to about CHF 1'275.

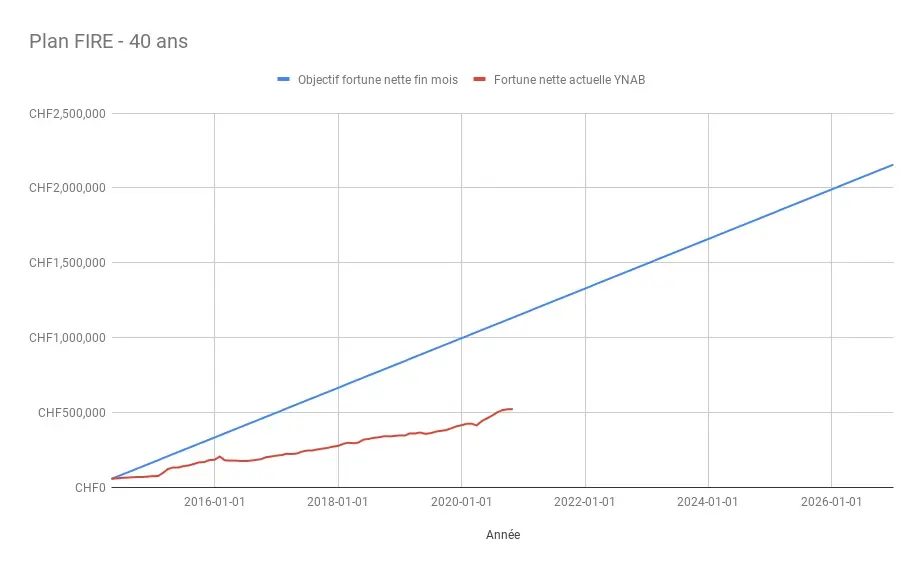

In terms of financial independence, we are at 24% of our objective of CHF 2'156'000 with our net worth of CHF 523'486.11.

Which visually gives us this:

Savings rate for October

In the end, we finished with a savings rate of 23% for October 2020. We continue to move towards a very good vintage with a savings rate of more than 50% for 2020. But we have to be careful with the last two months of the year not to be unreasonable in terms of expenses.

MP family expenses for October 🟥

As mentioned in this article, I have decided to hold myself accountable to you for our monthly expenses. This is in order to continue to train our frugal muscle.

As a reminder, our goal is to be below CHF 8'500 for our Swiss family of four.

Also, I don’t take into account the business expenses related to blog/book/etc., nor the advances we make for people who will reimburse us later. On the other hand, I do take into account the medical expenses (including orthodontics which cost us an arm) even though we know we will be reimbursed for them. And I also take into account the expenses related to our investments such as the property tax of our investment building for example.

Of course, I’m starting with the worst month in a long time, but I’m assuming the situation! Drum roll… CHF 13'316.96

I avoid the purple card because the expenses were “one-shot” like vacations and medical. But it’s still a good red card :)

And you, how much net worth, savings rate, and spending were you at in October?

PS 1: I celebrate with this article the 200th blogpost on the blog 🎉 — thanks to you for your fidelity

PS 2: if you also want to have access to bonuses such as the screenshot revealing the amount of each of my assets (I post it every month when this net worth update’s article is published online), then you just have to become a patron of the blog via Patreon.

PS 3: I’ve added a new “bonus” for the blog’s patrons. Since last month, I publish a live notification of my buy/sell on the stock market and other investments (translated into three languages like the blog — i.e. EN, DE, and FR). Just to be clear, I follow a rather passive investment methodology with ETFs disclosed on my blog, so you won’t learn anything transcendental. But if it can motivate you to invest regularly and in a disciplined way, then I will have succeeded in my wager.

My comments about Zak after 1 year of experience …

My Swiss health insurance and supplementary health...