Voyeur? You? Nahhhh ;)

But I don’t blame you, I’m the same!

If you are new to the blog, I recommend reading the article that introduced this series about my net worth (including my lucky number, as well as the rules of the game).

October: blog revenues, health refunds, dividends, bull market, and Mrs. MP’s 2nd pillar increase

CASH FLOW AND SAVINGS (+CHF 8'095.84): It was a rather frugal month and, above all, quite huge in terms of cash flow. We’ve had several medical expenses reimbursed.

At the same time, the blog is becoming more and more profitable on its side, with many payments that arrived in October. I would like to take this opportunity to thank you because each reader participates by using this or that tool that I recommend after having tested it and labelled it “Team MP approved!”

It's like a waking dream to see this passive income stream coming in thanks to a personal project like this blog

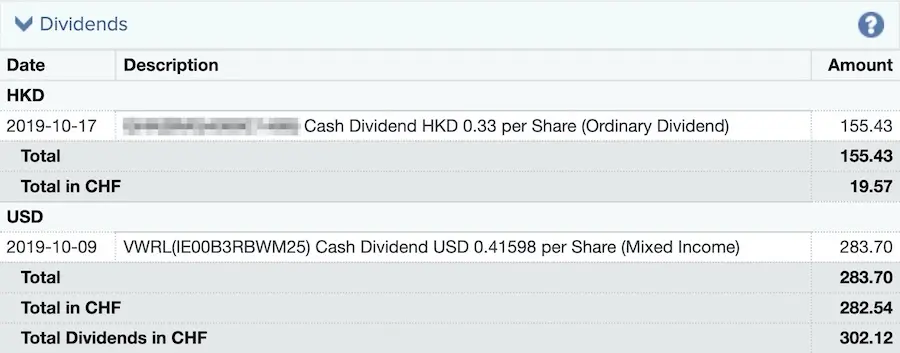

STOCK MARKET INVESTMENTS (+CHF 1'828.84): The market was somewhat bullish in October. This, combined with dividends helps to boost our net worth.

COINBASE SPECULATION (-CHF 154.77): Crypto-currencies continue to drop in value, slowly but surely…

MP’S 2ND PILLAR (+CHF 602.85): Filling my second pillar as usual.

MRS.’ MP 2ND PILLAR (+CHF 352.20): Mrs. MP finally has the final version of her 2nd pillar with a higher amount than before!

MP’S 3RD PILLAR (n/a): Nothing to report because I make my one-time payment at the beginning of the year, and my 3rd pillar cash value is also updated at the beginning of the year.

MRS’ MP 3RD PILLAR (+CHF 515.18): Compared to our ETFs, those of VIAC underperformed by a few tens of CHF. Nothing very dramatic. As a reminder, the 3rd pillar we use is 97% invested in equities.

APARTMENT AND MORTGAGE IN SWITZERLAND (n/a): Nothing to report, we still don’t reimburse until mortgage rates are so low, and we haven’t revalued our property so we don’t speculate on its value (i.e. we keep the purchase value).

RENTAL BUILDING IN FRANCE (n/a): Same as for our apartment in Switzerland, no price speculation. We’ll wait until we want to resell it to get an evaluation.

MORTGAGE LOAN IN FRANCE (+CHF 726.26): The loan continues to be repaid slowly but surely. It’s quite a beautiful thing this real estate investment! We had tenants’ turnover with two apartments, one of which is still not rented. But we had planned a little rental vacancy in our yield calculations, and for the moment we are still in the 15% range :)

SCI (SOCIÉTÉ CIVILE IMMOBILIÈRE, REAL ESTATE INVESTMENT COMPANY IN ENGLISH) IN FRANCE (+CHF 53.51): We had to refund the deposits of the outgoing tenants, withholding fees because they were not 100% clean during the checkout.

In terms of financial independence, we are at 18% of our objective of CHF 2'156'000 with our net worth of CHF 395'137.13.

Anyway, it looks like we get closer and closer to CHF 400'000 :D Are you betting on next month or December? Or 2020?

Savings rate for October

We return finally to a reasonable category, namely the “Badass Savers Gold”, with a savings rate of 56% for October 2019!

And you, how much net worth and savings rate are you at by the end of October 2019?

PS: if you are a patron of the blog, you should have received the screenshot revealing the amount of each of my assets via Patreon.