The rally in stock market prices that began last month has continued its upward trend. With our net worth being fairly invested in ETFs, this latter has continued to grow.

If you are new to the blog, I recommend reading the article that introduced this series about my net worth (including my lucky number, as well as the rules of the game).

Also, following questions from some readers, I would like to point out that the green or red figures below correspond to the relative evolution compared to the previous month, and not to the absolute amounts of the current month.

May: Containment helps keep expenses down, the stock market goes up, we’re going for some more sales, osteo, several gifts for Mrs. MP, and gifts for Team MP’s members

CASH FLOW AND SAVINGS (+CHF 3'349.50): As in April, coronavirus containment has reduced our expenses for childcare and activities, as well as for professional transportation costs. Long live remote, I say!

Regarding unusual expenses:

- A little mix of “too much work on the couch or even the bed” coupled with less sport during lockdown resulted in lower back pain… We were fooled like rookies, and the result: one osteo session each for the modest sum of CHF 234 (partially reimbursed by my complementary health insurance, that’s already it). So I went back to my good old habits since then, and it’s muscle strengthening every evening for me since that salty note!

- We had a special birthday to celebrate with Mrs. MP (in addition to Mother’s Day), which was worth a slightly inconsiderate expense of almost CHF 550. But the date was really exceptional (read rare), so I wanted to celebrate the occasion <3

- May was the month of gifts :) because in addition to the usual blog expenses like translation of articles into German or web hosting, I (finally!) took the time to thank the most active and long-time members of the MP forum without whom this space wouldn’t be what it is today. Thanks again to them! Likewise, the winners of the March 2020 Challenge received the same goodie ;)

Regarding the cash flow:

- Our usual salaries

- A good month for blog affiliation and private coaching 1-1

- Some dividends (less than CHF 50 in total)

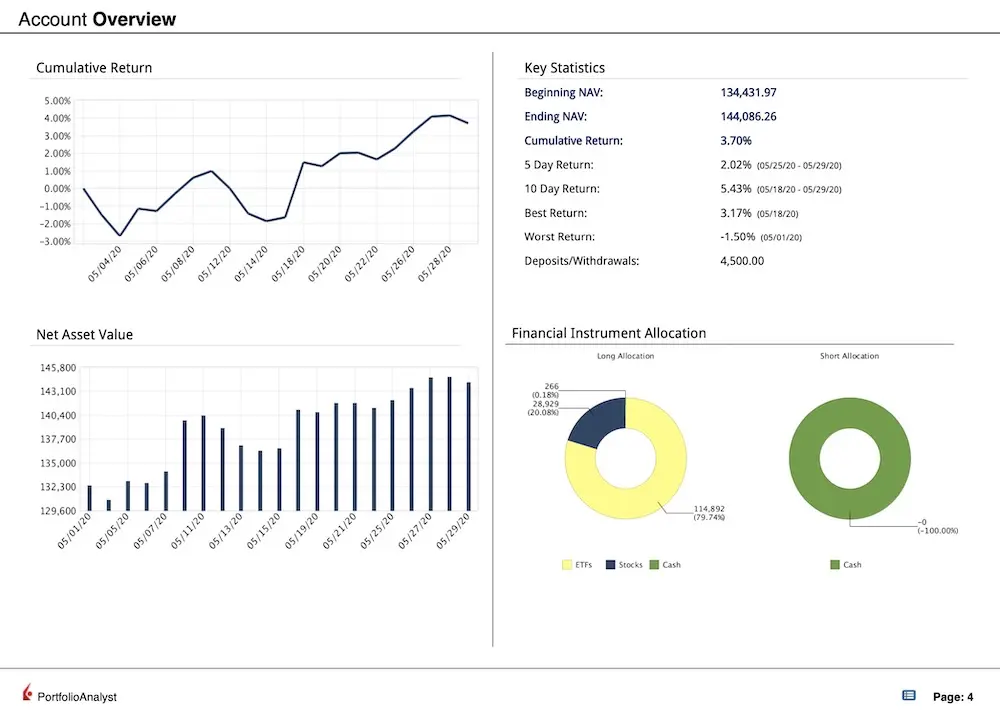

STOCK MARKET INVESTMENTS (+CHF 9'593.30): It’s always nice to see that number go up. As the patrons of the blog knew it live: we bought back over CHF 4'000 of VT ETFs at the beginning of the month when it was still below USD 70 (and no I didn’t specifically time the market, it’s just that I had the cash flow in the bank). And I also bought a few shares of Berkshire Hathaway (class B) on a “value investing” basis knowing that the price I paid for them was cheaper than the price Warren Buffett paid at the end of 2019 when he bought them in spades. Let’s be clear, it was more for the fun of having a piece of Berkshire than for diversification or long term capital gain (although I believe in it).

I hope that you’re holding your ground and following your IPS to the letter by continuing to invest regularly, even in these times of high fluctuation, and that you don’t try to get in/out by playing smart!

P2P INVESTMENTS (-CHF 195.93): As explained in detail in this article from last March, I’m getting my P2P beads out. My Iban Wallet account is closed until I’m sure it’s not a Ponzi scheme. And concerning Mintos which I also stop, I think they listened too much to Alain Berset because their so-called “Invest & Access” account seems to follow the precept of COVID-19: “You have to act as fast as possible, but as slowly as necessary.” At the time of writing, I still have 200€ blocked to withdraw.

CRYPTOCURRENCIES SPECULATION (-CHF 46.74): “It comes and goes” as the song says. For my part, I’m still keeping a record of my crytpocurrencies experiment in case it goes up one or two million in ten years. One can always dream ^^

MP’S 2ND PILLAR (+CHF 602.85): Filling my second pillar as usual.

MRS.’ MP 2ND PILLAR (+CHF 352.20): Filling Mrs. MP’s second pillar as usual.

MP’S 3RD PILLAR (n/a): Nothing to report because I make my lump sum payment at the beginning of the year (only Mrs MP is lucky enough to be at VIAC… my 3rd pillar being one of the guarantees for our mortgage), and my updated surrender value also comes at the beginning of the year.

MRS’ MP 3RD PILLAR (+CHF 3'000.34): As announced in April, this is the post-COVID effect with almost CHF 2'500 in capital gains on top of the CHF 568 paid each month.

APARTMENT AND MORTGAGE IN SWITZERLAND (n/a): Nothing to report, we still do not repay anything as mortgage rates are so low, and we have not made a revaluation of our property so we do not speculate with its value (i.e. we keep the amount of our initial 20% down payment that we had to pay when we bought our home).

REAL ESTATE INVESTMENT IN SWITZERLAND (n/a): As a reminder, the 30kCHF invested here is a participation in a Swiss real estate project (i.e. not in my own name). I am still considering getting 55% of annualized return. But, potentially, this whole story will take on a much larger scale than expected in terms of project size. I will know more over the summer, but it will only be positive if it happens!

RENTAL BUILDING IN FRANCE (n/a): Same as for our apartment in Switzerland, no speculation on the price of our rental property. We will wait until we want to sell it to make an evaluation.

MORTGAGE LOAN IN FRANCE (+CHF 698.58): The magic of real estate investment: the loan repays itself “on its own” thanks to the rents.

SCI (SOCIÉTÉ CIVILE IMMOBILIÈRE, REAL ESTATE INVESTMENT COMPANY IN ENGLISH) IN FRANCE (+CHF 543.00): Cash flow continues to be positive pending taxes. I’m still waiting for my accesses to make my tax return online, but hey, we’re talking about the French government :D

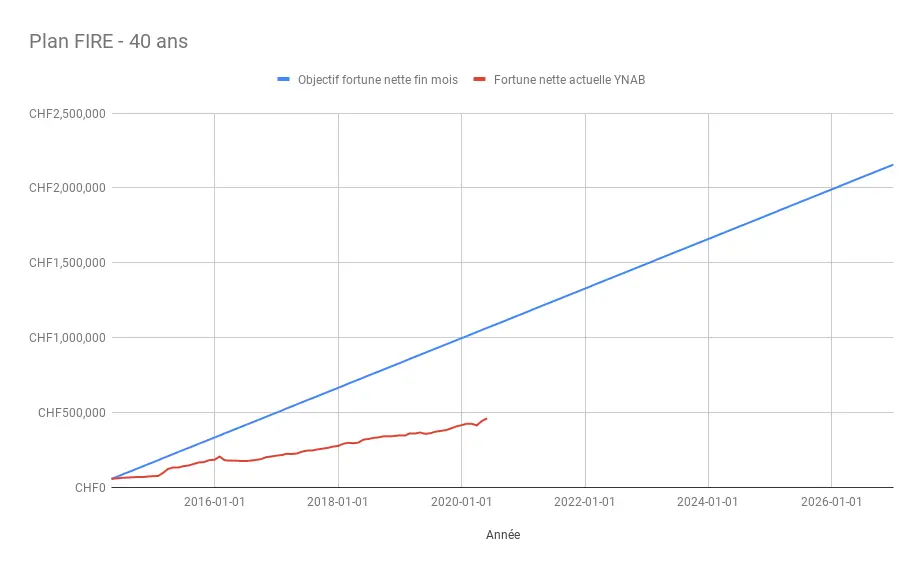

In terms of financial independence, we are at 21% of our objective of CHF 2'156'000 with our net worth of CHF 462'104.07.

Which visually gives us this:

Savings rate for May

In the end, we finished with a savings rate of 57% for May 2020. We’re still heading towards a very good vintage for 2020 for the moment. But it’s only the first half of the year. So we’re staying focused and we’re optimizing our income and expenses to maximize the gap between the two.

And you, what was your net worth and savings rate in May?

PS 1: if you also want to have access to bonuses such as the screenshot revealing the amount of each of my assets (I post it every month when this net worth update’s article is published online), then you just have to become a patron of the blog via Patreon.

PS 2: I’ve added a new “bonus” for the blog’s patrons. Since last month, I publish a live notification of my buy/sell on the stock market and other investments (translated into three languages like the blog — i.e. EN, DE, and FR). Just to be clear, I follow a rather passive investment methodology with ETFs disclosed on my blog, so you won’t learn anything transcendental. But if it can motivate you to invest regularly and in a disciplined way, then I will have succeeded in my wager.