Our fortune invested in the stock market continues to grow thanks to our favourite ETFs. And our cash flow is well in the green thanks to a good month of June in terms of salaries and income linked to the blog.

If you are new to the blog, I recommend reading the article that introduced this series about my net worth (including my lucky number, as well as the rules of the game).

Also, following questions from some readers, I would like to point out that the green or red figures below correspond to the relative evolution compared to the previous month, and not to the absolute amounts of the current month.

June: deconfinement that involved too many expenses, orthodontist, clothes for the kids MP, a fine, and a change of tenant (with the fees that go along with it)

CASH FLOW AND SAVINGS (+CHF 12'055.27): Deconfinement did not help with expenses such as childcare and transportation costs, and several weekends with family and friends. Nevertheless, these expenses were voluntary and calculated, so they were amply enjoyed.

As usual, let’s put our unusual expenses in the spotlight first:

- As many people did post-COVID (although it’s not over yet), and even being introverted as I am, we were happy to see family and friends again in June. So, we had a good fondue at the Café du Midi in Fribourg with our family (if you don’t know it, I recommend you, it’s an institution). And Mrs. MP, the most extroverted of us, had a second one with a friend

- We continue with orthodontics with almost CHF 2'000 in expenses last June. As I mentioned in this article on Swiss health insurance, we took a complementary orthodontic insurance policy which means that we are fully reimbursed (except for the usual 10% of coinsurance). So this disbursement will be compensated by a “cash inflow” (corresponding to the reimbursement) by next month

- Swiss semi-containment was cool enough for our MP family thanks to our beloved countryside surrounding us. Like many, we cycled quite intensively. Except that we’ve always told our kids that they should always have their bike helmet, whereas we didn’t have one ourselves until now. Since we grew up riding our bikes with our hair out in the open, we never really thought about it. Until our children pointed it out to us. So we ordered two adult bike helmets online from Decathlon. We’re all safe now (and at least we’re consistent with what we explain to our kids ;))

- Seeing some t-shirts and shorts really too small for our two cherubs, I had to concede to Mrs. MP that it was time to make a Vertbaudet order for summer and fall. Nevertheless, the usual method was applied: we took all the clothes out of their respective wardrobes, then they tried everything on, and we sorted out the clothes that were really too small. Then we made a list and took advantage of the post-confinement promotions by buying what they needed (no more, no less)

- We went for a walk up to the Schwarzsee and, as someone who knows this road well, I managed to get flashed on the way out of a small village… in short, no excuses, and CHF 250 less in our bank account. It comforts me in the idea that public transport allows me not to ask myself questions about such stuff :D

- In the same vein of “administrative” expenses, we had to order a passport for each of our children for a next trip (which has since been cancelled due to COVID, but at least we’ll have what we need when it’s possible)

- In addition to the usual expenses of translating the blog into Swiss-German, I also had to pay for my newsletter tool because slowly but surely, new readers are joining the Team MP (thanks for your trust if you’re part of it!)

Concerning unusual cash inflows (i.e. outside of our salaries):

- As every year, the month of June is synonymous with dividend payments. This allowed us to make around CHF 750 this time

- We received a reimbursement of CHF 781 from our complementary health insurance for an orthodontic payment made in the past months

- The homemade kickstarter from my book worked well again in its second iteration. Thanks again to everyone who supports the project (and who will be officially thanked in the book!). It warms my heart, and what’s more when I see the savings set aside by many of you after doing the recommended exercises at the end of each chapter

- Many of you also used my recommendations to save as much as possible on your Swiss bank fees and on your brokerage fees as a Swiss investor. Thanks again for supporting the blog using my affiliate links. It’s really nice to see the blog take off in terms of revenue while bringing value to you. Win-win as I like it so much

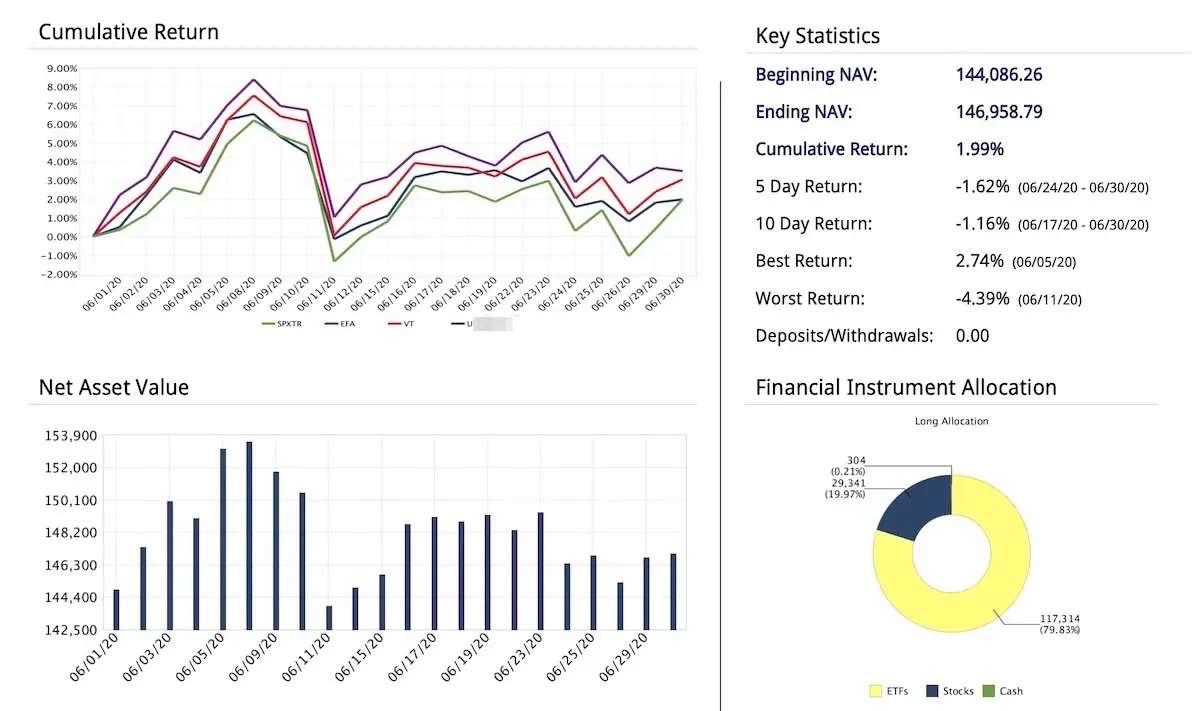

STOCK MARKET INVESTMENTS (+CHF 2'833.58): It’s interesting to see how the stock market rallied fairly quickly after this COVID-19 crisis. Nevertheless, we remain cautious because I’m waiting to see how the world economy will react in early 2021 after a big infusion of cash in all countries. For my part, I am following the process I have set myself and investing all my savings in ETF VT at the moment as I still have too many Swiss stocks as well as bonds (via our Swiss 2nd and 3rd pillars).

Those who follow me closely will have noticed something suspicious since I did not buy large quantities of ETFs in June… well spotted buddy! Indeed, I am in the process of putting aside the CHF 20'000 needed to set up my LLC in Switzerland (see some details in this article). I think I’ll be able to do it in August (and thus meet my deadline!), and I’ll start my journey on the stock market again afterwards.

P2P INVESTMENTS (-CHF 126.81): No surprises on the Mintos side. I’ve stopped all investment, and I’m gradually getting my cash out. It’s not that I wouldn’t want to go faster, but the Mintos “Invest & Access” program doesn’t allow me to. Once the account is completely emptied, I will close it definitively and do a post-mortem article to explain in detail my motivations for not continuing in P2P investments.

CRYPTOCURRENCIES SPECULATION (+CHF 89.53): Once it goes up, once it comes down. As unpredictable as we thought. The day I’m at +1 million CHF, I’ll sell. In a century maybe…

MP’S 2ND PILLAR (+CHF 602.85): Filling my second pillar as usual.

MRS.’ MP 2ND PILLAR (+CHF 352.20): Filling Mrs. MP’s second pillar as usual.

MP’S 3RD PILLAR (n/a): Nothing to report because I make my lump sum payment at the beginning of the year (only Mrs MP is lucky enough to be at VIAC… my 3rd pillar being one of the guarantees for our mortgage), and my updated surrender value also comes at the beginning of the year.

MRS’ MP 3RD PILLAR (+CHF 1'508.59): As in May, the month of June was salutary for our stock market investments via our 3rd pillar at VIAC with, in addition to the CHF 564 that we transfer each month, a nice capital gain of CHF 944.59 for the month of June alone.

APARTMENT AND MORTGAGE IN SWITZERLAND (n/a): Nothing to report, we still do not repay anything as mortgage rates are so low, and we have not made a revaluation of our property so we do not speculate with its value (i.e. we keep the amount of our initial 20% down payment that we had to pay when we bought our home).

REAL ESTATE INVESTMENT IN SWITZERLAND (n/a): As a reminder, the 30kCHF invested here is a participation in a Swiss real estate project (i.e. not in my own name). I am still considering getting 55% of annualized return. But, potentially, this whole story will take on a much larger scale than expected in terms of project size. We have an appointment with my potential future partner and a lawyer in August, so stay tuned, it should be moving (if we get going) by the end of August or September.

RENTAL BUILDING IN FRANCE (n/a): Same as for our apartment in Switzerland, no speculation on the price of our rental property. We will wait until we want to sell it to make an evaluation.

MORTGAGE LOAN IN FRANCE (+CHF 712.16): The magic of real estate investment: the loan repays itself “on its own” thanks to the rents.

SCI (SOCIÉTÉ CIVILE IMMOBILIÈRE, REAL ESTATE INVESTMENT COMPANY IN ENGLISH) IN FRANCE (+CHF 47.43): Cash flow continues to be positive pending taxes. I’m still waiting for my accesses to make my tax return online, but hey, we’re talking about the French government :D On the other hand, we had a change of tenant, which resulted in costs because we now delegate the entrances/exits to a real estate agency that takes us “only” 240€ for an outgoing inventory + one incoming. As for the rest, i.e. the management of the accounts and the small interventions to be managed, we take care of it ourselves.

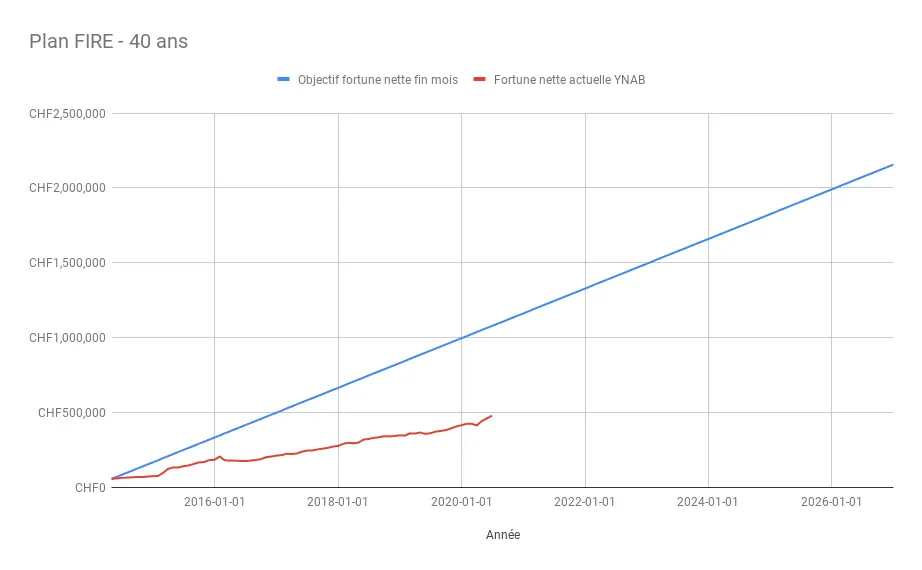

In terms of financial independence, we are at 22% of our objective of CHF 2'156'000 with our net worth of CHF 480'178.87.

Which visually gives us this:

I'm starting to think about how we're going to celebrate the half-million CHF milestone with Mrs. MP! If you have any (frugal!) ideas, don't hesitate to share them with me :)

Savings rate for June

In the end, we finished with a savings rate of 57% for June 2020. We’re still heading towards a very good vintage for 2020 for the moment. But we remain focused because the first half of the year has just ended, and we still have six months left to continue optimizing our revenues and expenses to maximize the gap between the two. But clearly, the fairly constant new revenues from blog/coaching/book are starting to pay off, and I like that!

And you, what was your net worth and savings rate in June?

PS 1: if you also want to have access to bonuses such as the screenshot revealing the amount of each of my assets (I post it every month when this net worth update’s article is published online), then you just have to become a patron of the blog via Patreon.

PS 2: I’ve added a new “bonus” for the blog’s patrons. Since last month, I publish a live notification of my buy/sell on the stock market and other investments (translated into three languages like the blog — i.e. EN, DE, and FR). Just to be clear, I follow a rather passive investment methodology with ETFs disclosed on my blog, so you won’t learn anything transcendental. But if it can motivate you to invest regularly and in a disciplined way, then I will have succeeded in my wager.

PS 3: as a patron or future patron of the blog, don’t hesitate to let me know what other bonuses you’d like to have.

PS 4: I’d like to take this opportunity to thank the two new patrons of the blog Bocherens and Ale. A big thank you for your support!

We're half-a-millionaire! 🎉 (CHF 501'215.32 to be …

Best Swiss car insurance for 2020 (with CHF 100...