Let’s start the year by analyzing my figures from last January!

If you are new to the blog, I recommend reading the article that introduced this series about my net worth (including my lucky number, as well as the rules of the game).

January: annual bills, Mintos is running its course, bearish market, cryptos are waking up, rental building full of tenants again

CASH FLOW AND SAVINGS (-CHF 4'212.76): At the beginning of the year and in July we always have these big outflows of money with the mortgage interests to pay for the semester. And on top of that in January all the other bills that we pay annually such as private life insurance, waste taxes, and also the filling of my pillar 3a.

Otherwise, outside the usual expenses:

- We only did one snow trip because it’s sorely lacking with those April-like temperatures

- A new orthodontic bill to continue the treatment of one of the MP children

- New clothes and shoes needed for Mrs MP who amazes me more and more with her frugal considerations (so cool!)

In terms of income, we were able to count on our respective 13th salaries. And as far as the blog is concerned, revenues were rather low due to the fact that the companies I recommend pay their December and January commissions late because of the end of the year I guess (February will be even better).

Nevertheless there was a special event for this personal project which is my blog: I did my first paid “Start investing” coaching session. It feels very weird to be paid for something outside of a “normal” job. It’s very rewarding.

Anyway, thank you Arthur for your trust. I’m really happy with this first try because before the end of our 3 hours, Arthur dared to take the step and submitted his first stock market order to buy the VWRL ETF!!

In his own words:

It was for me a very interesting exchange, we saw a lot of things and you were able to answer all my questions and expectations. I was able to learn how to choose my ETFs and this allowed me to start at the end of the session with a first investment on DEGIRO. I also appreciated the fact that I was able to check my budget with you and to shed light on a few points such as the formula to compute my savings rate, to allocate my investment according to my risk profile and to see where I could still do optimization.Arthur, reader of the MP blog.

STOCK MARKET INVESTMENTS (+CHF 3'949.68): This positive figure mainly corresponds to my purchases in value investing in order to reach the target of 30 companies in my portfolio.

In terms of the overall value of our stock portfolio, the markets were rather bearish at the end of January 2020 (but they have already recovered by the time I wrote these lines in February).

P2P INVESTMENTS (+CHF 4.08): In view of recent developments in the P2P world, namely the fact that Envestio and Kuetzal were apparently scams, I play it cautiously in this category.

Iban Wallet

I only keep 25€ with them to see what happens. But as long as their Head of Communication doesn’t communicate publicly and transparently about the who/what/how of this company, I won’t add a penny there. Nor will I put an affiliate link to their platform. So let’s see how it goes.

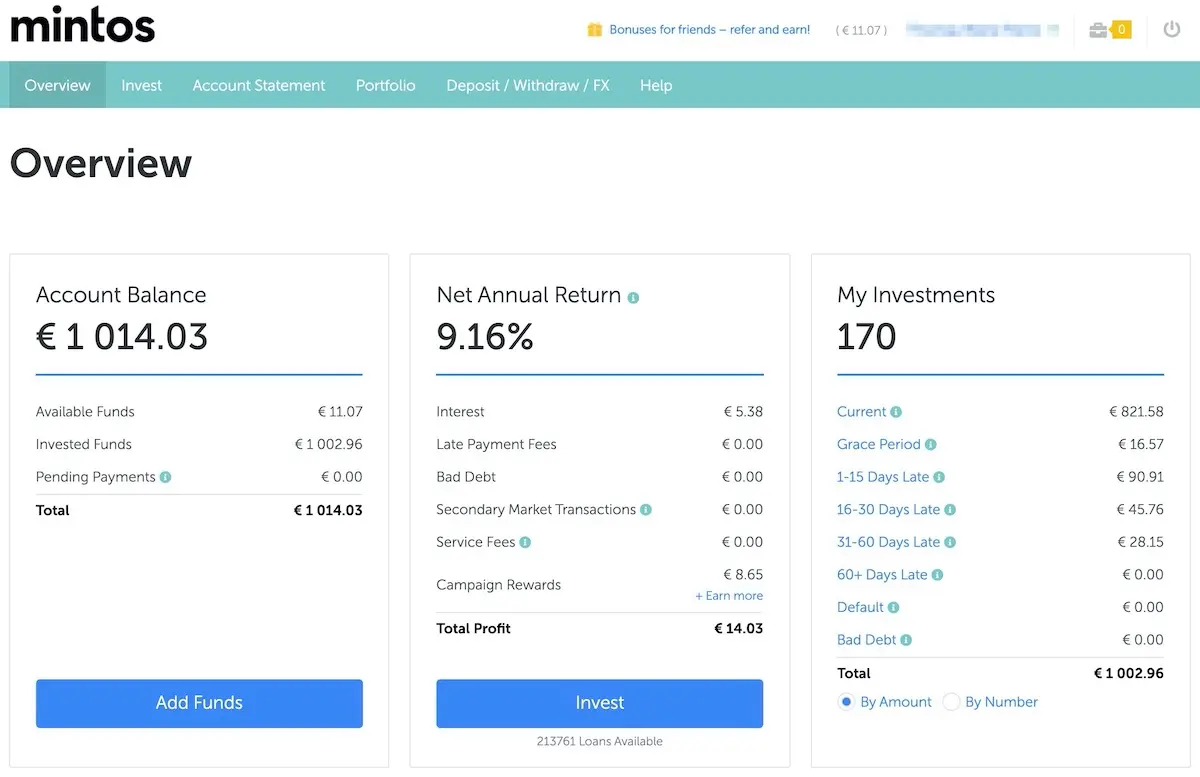

Mintos

On the other hand, I’m still satisfied with my Mintos choice (I only have 1'000€ there with their Auto-Invest program for the moment, but I’ll pour more into it in the coming months). I still expect a return of about 10% with this investment.

I’m preparing a full article about how to open an account and get started with them.

CRYPTOCURRENCIES SPECULATION (+CHF 264.47): After several months of losses, the cryptos seem to be waking up. I’m really looking forward to see if in 10 years I’ll be a millionaire thanks to them (or not!).

MP’S 2ND PILLAR (+CHF 602.85): Filling my second pillar as usual.

MRS.’ MP 2ND PILLAR (+CHF 352.20): Filling Mrs. MP’s second pillar as usual.

MP’S 3RD PILLAR (+CHF 6'768.00): There it is, another payment transferred into my suboptimal pillar 3a. Only Mrs. MP is lucky enough to be at VIAC, mine being one of the pledges for our mortgage. I’m still waiting to find out my cash surrender value to see how much we financed the insurance part of it.

MRS’ MP 3RD PILLAR (+CHF 556.33): The market was also down for Ms. MP’s 97% 3a shares. The result is positive as we pour in CHF 568/month, but as the market fell, only CHF 556.33 remains on the differential between December 2019 and January 2020.

APARTMENT AND MORTGAGE IN SWITZERLAND (n/a): Nothing to report, we still do not repay anything as mortgage rates are so low, and we have not made a revaluation of our property so we do not speculate with its value (i.e. we keep the amount of our initial 20% down payment that we had to pay when we bought our home).

RENTAL BUILDING IN FRANCE (n/a): Same as for our apartment in Switzerland, no speculation on the price of our rental property. We will wait until we want to sell it to make an evaluation.

MORTGAGE LOAN IN FRANCE (+CHF 708.46): The loan continues to be repaid from the rents that come in each month. And good news: we found our tenant for the last empty apartment, so the building is fully rented again!

SCI (SOCIÉTÉ CIVILE IMMOBILIÈRE, REAL ESTATE INVESTMENT COMPANY IN ENGLISH) IN FRANCE (+CHF 536.89): The cash flow remains positive but as explained in previous articles, I wait to be happy until we have paid French taxes.

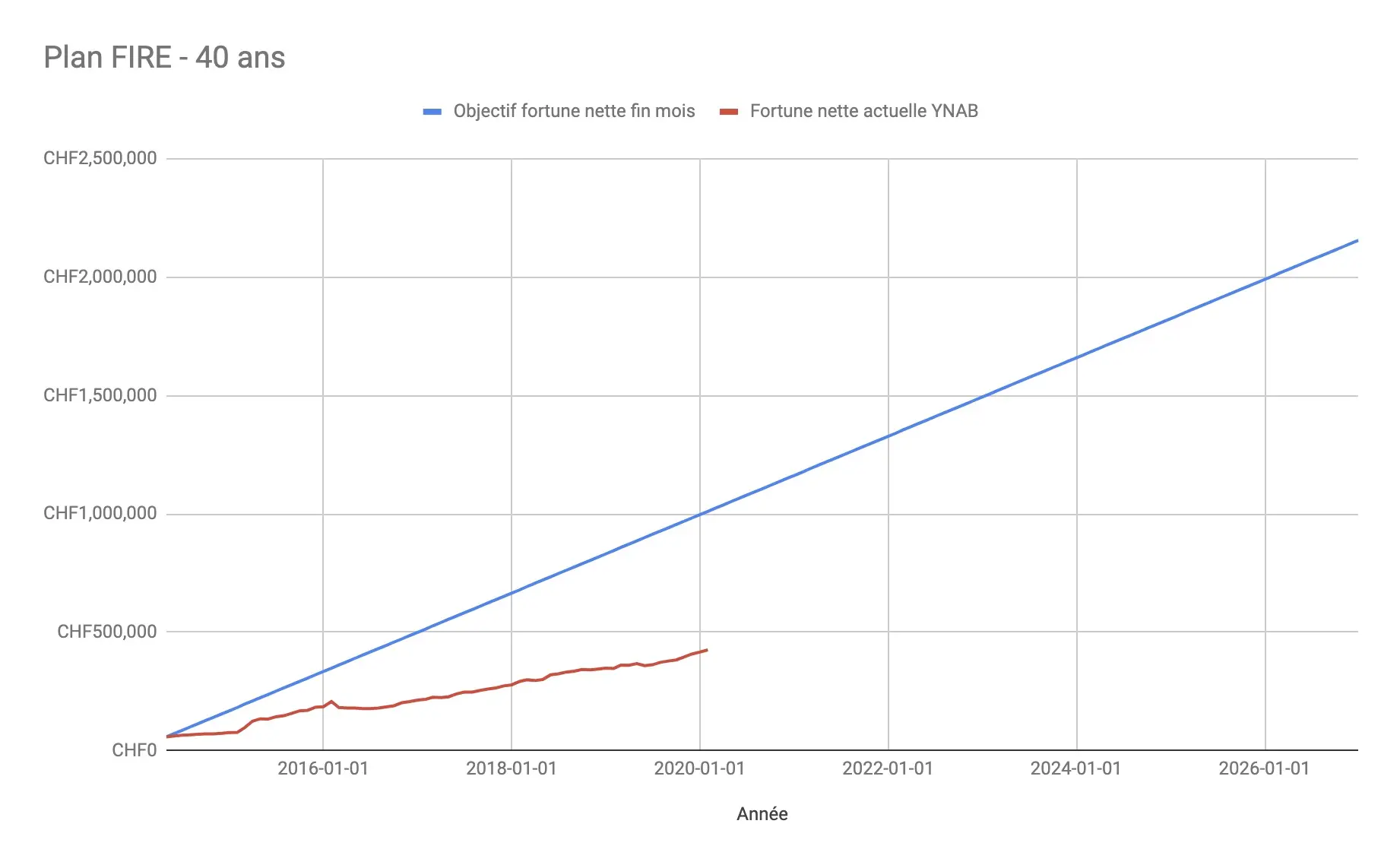

In terms of financial independence, we are at 20% of our objective of CHF 2'156'000 with our net worth of CHF 425'583.62.

Which visually gives us this:

Discouraged? Me? Why? On the contrary, it motivates me. I think it’s a great goal to have to be creative to find that CHF 570'000!

Savings rate for January

In the end, we finished with a savings rate of 48% for January 2020. This allows us to start the year within our target range of 40-50% :)

And you, how much net worth and savings rate were you at in this first month of the year?

PS: if you also want to have access to bonuses such as the screenshot revealing the amount of each of my assets (I post it every month when this net worth update’s article is published online), then you just have to become a patron of the blog via Patreon.

Poll: are you aiming for financial independence or …

Reader case study second pillar pension or capital...