With a bit of a delay, let’s take a step back on how our month of February went.

If you are new to the blog, I recommend reading the article that introduced this series about my net worth (including my lucky number, as well as the rules of the game).

February: little treat, tool license payment, gifts, low daycare fees, sports activities, Serafe (formerly Billag), coaching and blog

CASH FLOW AND SAVINGS (+CHF 7'759.22): We had an unexpected little dinner date with Mrs. MP, without the kids. We don’t get to do that very often, but it was really cool, honestly. In fact, I think it’s because it’s exceptional and not the norm that it gave us so much pleasure. It was worth every penny :)

On top of that, we spent more than usual on the following items:

- I have renewed the license of my backup tool on Mac (by the way, I use Carbon Copy Cloner that I highly recommend)

- I continue to pay my monthly subscription to Notion.so which I use as an editorial calendar, a personal wiki for the blog, and also as a task management system for my whole life (both pro and personal). It’s really good. I just saw that they have a recommendation program, so if you want to give it a try, you can click on this link from the blog to open your Notion.so account. You earn 10USD of credit and I earn 5USD (thanks in advance :))

- We visited a lot of family and friends (and that was a good idea looking at what was waiting for us a few weeks later with the coronavirus!), which was worth more gifts (flowers, wine, etc.) than usual

- The good news is that we needed less childcare in January, so the bill almost halved!

- We got the semiannual bills for the kids after-school activities. Predictable and expected, but it’s still a few hundred francs less… :(

- Serafe (formerly Billag) also sent us their annual bill, which has gone down, so it’s always a pleasure

- And finally the medical expenses: quite a few colds and vaccine reminders to be done, as well as a visit to the osteopath for me, so quite a lot of expenses but which will be covered by the kids’ KVG and by my complementary health insurance

Concering incomes, we have a small salary news but I’m saving it for a dedicated article that I’m just postponing, but it’s coming.

Otherwise, private coaching has taken off quite a bit. So this blog project as a whole allows us to increase our savings rate. It’s a pleasure, and I’d like to take this opportunity to thank you dear reader, who trusts me, and who uses the affiliate links for the services that interest you. And also, a huge thank you if you are one of those who support me financially with Patreon, as well as with my book project (I’m at the end of chapter 2, so it’s going slowly but surely — and the feedback is very encouraging!).

STOCK MARKET INVESTMENTS (-CHF 10'247.19): February witnessed the beginning of the globalization of the coronavirus crisis. Crisis that brought with it the much heralded stock market crash. This -10kCHF is only the beginning of a nice fall of my portfolio but I don’t say more.

As written in my investment strategy, I do not sell in case of crisis. On the contrary, I buy more as it’s sale time! I have strengthened two value investment positions. Unfortunately (or fortunately because in the end I may come back at an even better time), as announced in the 3rd edition of my journal, I plan to invest in a real estate project again. This means that I have to wait a few more weeks before I can invest back in the stock market…

P2P INVESTMENTS (+CHF 9.26): I’m currently hesitating to close all my P2P accounts (Iban Wallet and Mintos), or to leave them open with almost nothing on them to keep a foot in and see the evolution over a period of several years.

Iban Wallet

I have removed all my affiliate links because I no longer believe in this platform. I’ll even go so far as to say that I think Iban Wallet is a scam.

After several emails with the “Head of Communication” where I clearly explained to her that my readers and I had doubts about the stability and authenticity of the Iban Wallet company, and even that it was a scam, her only two answers were :

- “We are working hard on a new, more official communication of who we are on our site. It’s going to happen.” That was in January.

- After pinging back again in February, she says: “In the meantime, here’s a text about us on a blog that explains in more detail how we work since we’re not really P2P: https://jeangalea.com/. […] We decided to publish this information on Jean Galea’s blog, and not on our site, to change the way things are usually done.

That was one warning too many. Personally, if I’m the founder of a company and someone calls me a scam, I’ll take the phone to clarify this in publicly

As I write the lines above, I’ve just decided myself and withdrew my last 25€. One less account to follow in YNAB :) It’s a pity because the simplicity of the product was really tempting.

Mintos

As explained at length in this article, my Mintos experiment was quickly limited to 1% of my portfolio. Then last week, I lowered this limit to the 1'000€ initially invested.

When starting into this P2P world, I stayed in the circle of sites that confirmed my desires and points of view. Except that when I came out of it two or three weeks ago by googling “why P2P loans are bad”, I saw another reality.

There are many reasons and I will write a dedicated article. But in summary: the “Invest and Access” strategy is too risky compared to the potential gain; the structure of companies and holdings is very dubious behind the great brand that is Mintos; the ethics of some loan companies on the platform is very borderline (to be confirmed); and as a consequence I faced a greater complexity (more time needed vs. only a few clicks) than expected to arrive at a P2P strategy that fits my acceptance level.

I removed all the affiliate links in the previous articles because I don’t want you to follow a path that I myself no longer explore, or that I will close soon.

CRYPTOCURRENCIES SPECULATION (-CHF 44.26): From a financial point of view, I’m happy to have a few more cryptos to see how it behaves during a crisis. We’ll draw some conclusions once we get past the coronavirus. In the meantime, nothing transcendental happened in February.

MP’S 2ND PILLAR (+CHF 602.85): Filling my second pillar as usual.

MRS.’ MP 2ND PILLAR (+CHF 352.20): Filling Mrs. MP’s second pillar as usual.

MP’S 3RD PILLAR (+CHF 1'128.49): I received the surrender value of my pillar 3a that I had underestimated, so that’s for a small adjustment in the positive.

MRS’ MP 3RD PILLAR (+CHF 402.48): The market was also down for Mrs. MP’s 97% shares in her 3a. The positive result can be explained by the fact that CHF 568/month is paid in, but as the market fell, the remaining was of only CHF 402.48.

APARTMENT AND MORTGAGE IN SWITZERLAND (n/a): Nothing to report, we still do not repay anything as mortgage rates are so low, and we have not made a revaluation of our property so we do not speculate with its value (i.e. we keep the amount of our initial 20% down payment that we had to pay when we bought our home).

RENTAL BUILDING IN FRANCE (n/a): Same as for our apartment in Switzerland, no speculation on the price of our rental property. We will wait until we want to sell it to make an evaluation.

MORTGAGE LOAN IN FRANCE (+CHF 702.90): The loan continues to be repaid through rentals. And on top of that, the building has been full since the beginning of the year, so everything is running smoothly on this side.

SCI (SOCIÉTÉ CIVILE IMMOBILIÈRE, REAL ESTATE INVESTMENT COMPANY IN ENGLISH) IN FRANCE (+CHF 213.85): Cash flow continues to be positive. I am excited to know how much tax we will pay in France and Switzerland in order to make my calculations of the returns for 2019.

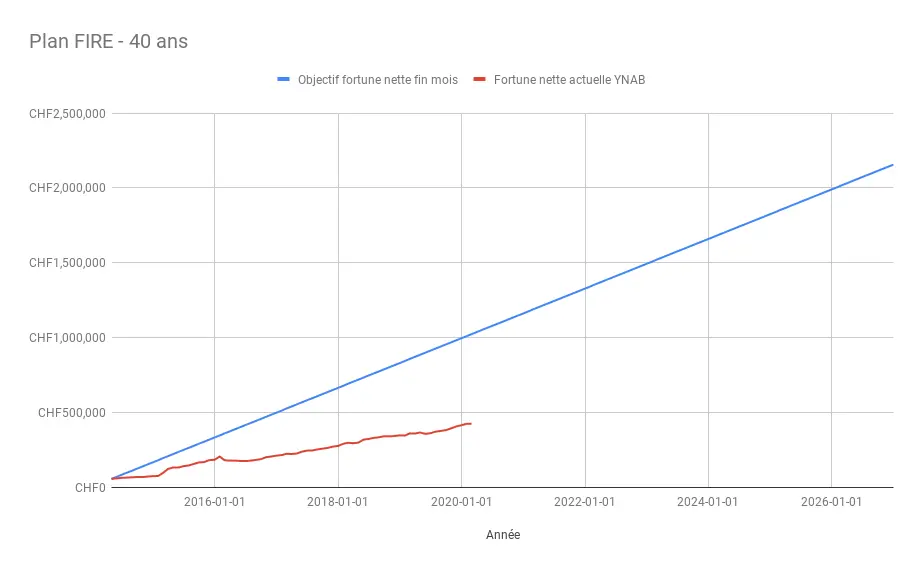

In terms of financial independence, we are at 20% of our objective of CHF 2'156'000 with our net worth of CHF 426'463.42.

Which visually gives us this:

I'm looking forward for the crisis to be behind us so that we can see the effect of our additional income which will help to bring the two curves closer together ;)

Savings rate for February

In the end, we finished with a savings rate of 56% for February 2020. So we continue our good momentum in 2020 by staying above the 40-50% minimum!

And you, how much net worth and savings rate were you at in February?

PS 1: if you also want to have access to bonuses such as the screenshot revealing the amount of each of my assets (I post it every month when this net worth update’s article is published online), then you just have to become a patron of the blog via Patreon.

PS 2: I’ve added a new “bonus” for the blog’s patrons. Since this week, I publish a live notification of my buy/sell on the stock market and other investments (translated into three languages like the blog — i.e. EN, DE, and FR). Just to be clear, I follow a rather passive investment methodology with ETFs disclosed on my blog, so you won’t learn anything transcendental. But if it can motivate you to invest regularly and in a disciplined way, then I will have succeeded in my wager.

PS 3: if you are currently in the process of taking early retirement (i.e. it’s in a few months, or you just passed it), then I would be interested in interviewing you on the blog, to see what’s awaiting me in a few years with all the questions that one can ask himself during such a period. My email: contact [at] mustachianpost.com.

Cut your own hair freedom and frugality (CHF 4'740 …

How would I invest CHF 10'000 in the stock market...