Here we are, 2019 is now behind us. But let’s take the time to take a look at the MP family numbers from last December.

If you are new to the blog, I recommend reading the article that introduced this series about my net worth (including my lucky number, as well as the rules of the game).

December: Christmas presents, start with Mintos, IbanWallet break, bull market, and dividends

CASH FLOW AND SAVINGS (+CHF 7'386.66): December means Christmas presents. But looking at our YNAB budget, it looks like we spent less this year compared to 2018 (to be confirmed when we expose ourselves like last year). On the other hand, we spent more on car trips to visit various family members during the holidays.

We’re also in the middle of dental expenses for the kids, but these will be reimbursed for the most part next month.

Concerning the other categories of unexpected expenses, Mrs. MP and I had more fun (hairdresser, “Famille Zéro Déchet, Ze Guide” book — thanks again Julien for the recommendation!) but without exaggerating too much either.

Otherwise, it was a fairly common month for the rest with daycare expenses, semi-annual payment for the children’s extra-curricular activities, usual and planned expenses for our apartment with a year-end payment to regularize the accounts, as well as payment of the property tax.

Then, the blog continues to bring a revenue stream that is always pleasant to have. On the other hand, December was rather a month of re-investment in the business with the subscription to my new email service for readers (see the explanation in this article) and other tools to improve the blog.

STOCK MARKET INVESTMENTS (+CHF 2'078.34): The stock market continued to climb in December. And we were able to benefit from the dividends of the last quarter. The year 2019 will have once again proved that one should not try to time the market (i.e. try to invest at the best time to get the best returns) because if I had followed this logic, I would have stopped investing at the end of 2017 when the financial crisis began to be announced. And I would have missed a 2019 with 25%+ returns (VWRL ETF for example)…

P2P INVESTMENTS (-CHF 2'901.04): It is in this investment category that there was the most movement in December.

Iban Wallet

After opening my Iban Wallet account a few weeks ago (and earning my daily interest as planned), I got stressed for my 3'750€ there by re-reading the reviews on Trustpilot.

“Is Iban Wallet a scam?” I asked myself.

Rather than panic, I decided to withdraw my money to close the loop and see if everything was going well.

Result:

- I requested the transfer of all my cash (including interests)

- Iban Wallet announced me 2-3 days of delay in order to receive the transfer

- And…as expected, 3 days later I received all my money on Zak

Since then, I have been in contact with their Head of Communication (Sigrid Arteaga).

What I take away from our first exchanges is :

- Either the founders had a hard time growing their company and they’re finally starting to get the right people in the right place (that’s my opinion right now)

- Either it’s a big scam (possible but I don’t think so)

I am continuing my investigations, and I will publish an article detailing my opinion about Iban Wallet later this quarter.

Mintos

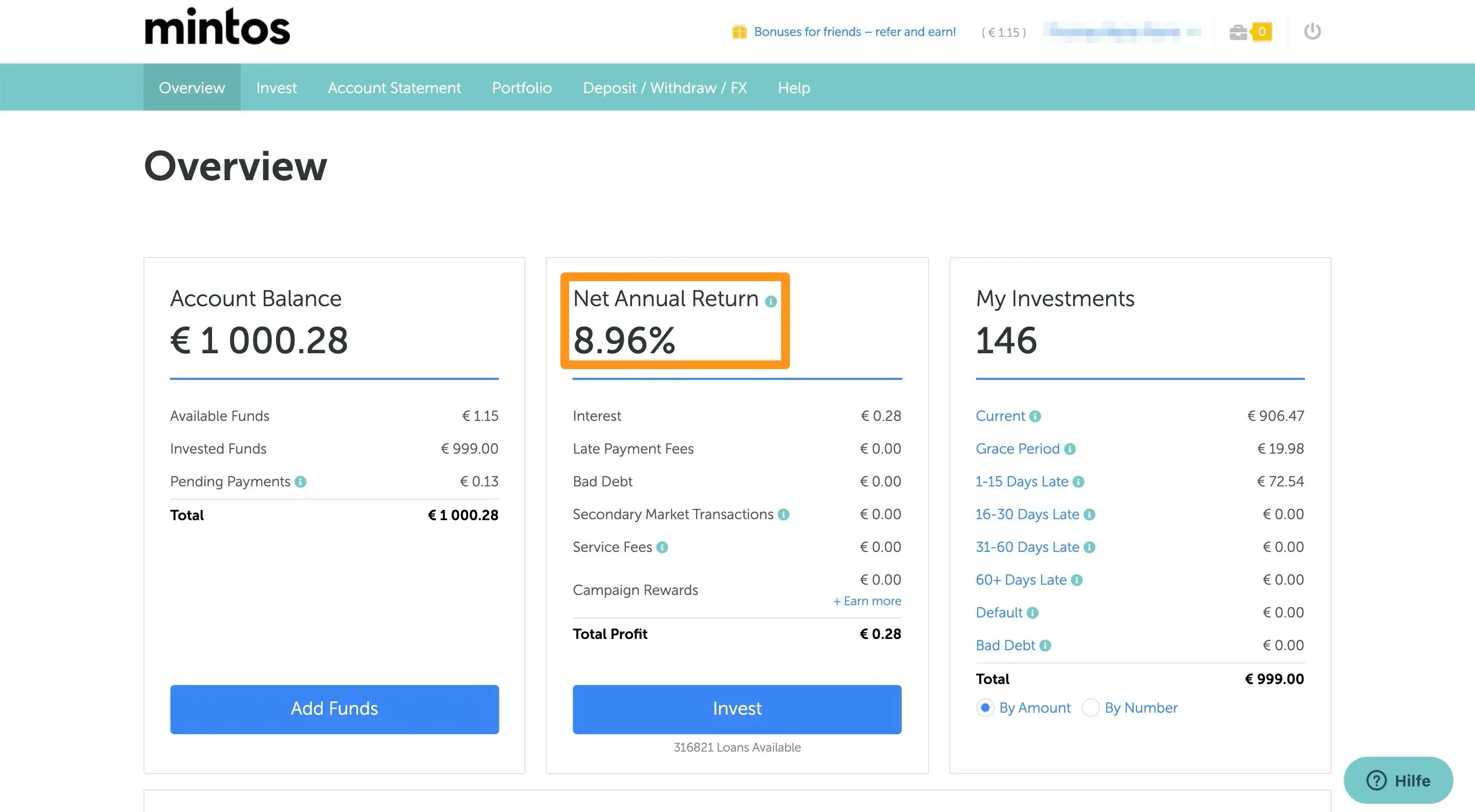

I finally took the time to invest in P2P with the most reputable platform in this field: Mintos.

To make it simple, I started with their “Invest & Access” program which looks pretty much like Iban Wallet since I simply created my account, transferred money, and clicked on a button to invest my 1'000€ (I’m preparing a detailed article that should be released this January).

The expected return with this automated investment program is about 10%.

My next step with Mintos is to create a personalized portfolio for myself (excluding car and consumer loans).

Last reminder: I target a maximum of 5-10% P2P in my overall investment portfolio.

CRYPTOCURRENCIES SPECULATION (-CHF 232.20): The crypto-currencies are going down. How many beers you want to bet that it’s going up in January? And down in February :D?

MP’S 2ND PILLAR (+CHF 602.85): Filling my second pillar as usual.

MRS.’ MP 2ND PILLAR (+CHF 352.20): Filling Mrs. MP’s second pillar as usual.

MP’S 3RD PILLAR (n/a): Nothing to report because I make my lump sum payment at the beginning of the year (only Mrs MP is lucky enough to be at VIAC…my 3rd pillar being one of the guarantees for our mortgage), and my updated surrender value also comes at the beginning of the year.

MRS’ MP 3RD PILLAR (+CHF 1'198.91): We made our final payment to reach the CHF 6'826 deductible from Swiss taxes (maximum amount for 3rd pillar 2019 and also for 2020 by the way). On top of that, the bull market allowed us to make a capital gain of almost CHF 600 (if you’re interested, I have an article about VIAC which is the service we use for Mrs. MP’s pillar 3a).

APARTMENT AND MORTGAGE IN SWITZERLAND (n/a): Nothing to report, we still do not repay anything as mortgage rates are so low, and we have not made a revaluation of our property so we do not speculate with its value (i.e. we keep the amount of our initial 20% down payment that we had to pay when we bought our home).

RENTAL BUILDING IN FRANCE (n/a): Same as for our apartment in Switzerland, no speculation on the price of our rental property. We will wait until we want to sell it to make an evaluation.

MORTGAGE LOAN IN FRANCE (+CHF 716.90): The loan continues to be repaid from the rents that come in each month. One of the apartments is still empty but we are still on track regarding the “Rental Vacation” reserve that we calculated in our yield forecast.

SCI (SOCIÉTÉ CIVILE IMMOBILIÈRE, REAL ESTATE INVESTMENT COMPANY IN ENGLISH) IN FRANCE (-CHF 1'013.67): The repayment of overpayments of rent announced in my last report in November was in fact recorded in December. Add to that the payment of the Non-Owner-Occupied insurance (billed annually), and all this explains why we are in the negative this month. As expected :)

In terms of financial independence, we are at 19% of our objective of CHF 2'156'000 with our net worth of CHF 416'053.42.

Savings rate for December

In the end, each expense adds up and we ended up with a savings rate of 34% for December 2019.

Savings rate for the year 2019

And our average savings rate in 2019 amounts to 23.3%. This is much lower than our acceptable minimum of 40%. But (here we go again with the excuses), if we take out the very exceptional expenses of our purchase of an investment property and others related to our professional life, then we fall back to 36.8%. Which reassures me already a little about our frugal capacities :)

And you, how much net worth and savings rate were you at by the end of December 2019?

PS: if you also want to have access to bonuses such as the screenshot revealing the amount of each of my assets (I post it every month when this net worth update’s article is published online), then you just have to become a patron of the blog via Patreon.

PS2: I usually answer with a maximum delay of 1 week to all emails and blog comments. But since the TTC TV show about frugalism on the RTS, I’m struggling to manage the load :)

So be patient, I’ll answer as always to every message I get. I should be back to normal in 2-4 weeks, I think.