That’s it. It looks like the (first?) dip of the coronavirus crisis has passed. At least our net worth is content with that for now.

If you are new to the blog, I recommend reading the article that introduced this series about my net worth (including my lucky number, as well as the rules of the game).

April: fewer expenses in general due to the coronavirus, a new coffee table, the stock market going up, and a new real estate investment in Switzerland

CASH FLOW AND SAVINGS (-CHF 17'072.37): COVID-19 has helped significantly in limiting unforeseen expenses. This was at least a benefit :)

There were, however, some unusual cash outflows:

- A lot more shopping than usual because we ate all four of us every day at home. But as a result, there was less expenditure on lunch at work and canteen expenses

- We’ve ordered a new coffee table. We couldn’t see the old one anymore that we’d had for almost ten years. And containment got the better of her! But we were reasonable because the new one cost us less than CHF 90 because it was on sale. And we managed to resell the other CHF 20 on Anibis instead of it ending up in the rubbish dump!

- Mrs. MP also used the entire amount available in her “Freedom” budget category (more info on this specific change in a future article)

- A birthday gift from a colleague appreciated by Mrs. MP

- And finally, the biggest expense of the month was our Swiss real estate investment of CHF 30'000…

As far as income is concerned, apart from our two salaries and the blog affiliation, we had a good month of April again thanks to:

- Almost CHF 300 in dividends from our VWRL ETF

- New coaching sessions with some of you (thank you again for your trust)

- New support for my book via the kickstarter (idem, a huge thank you to all of you!)

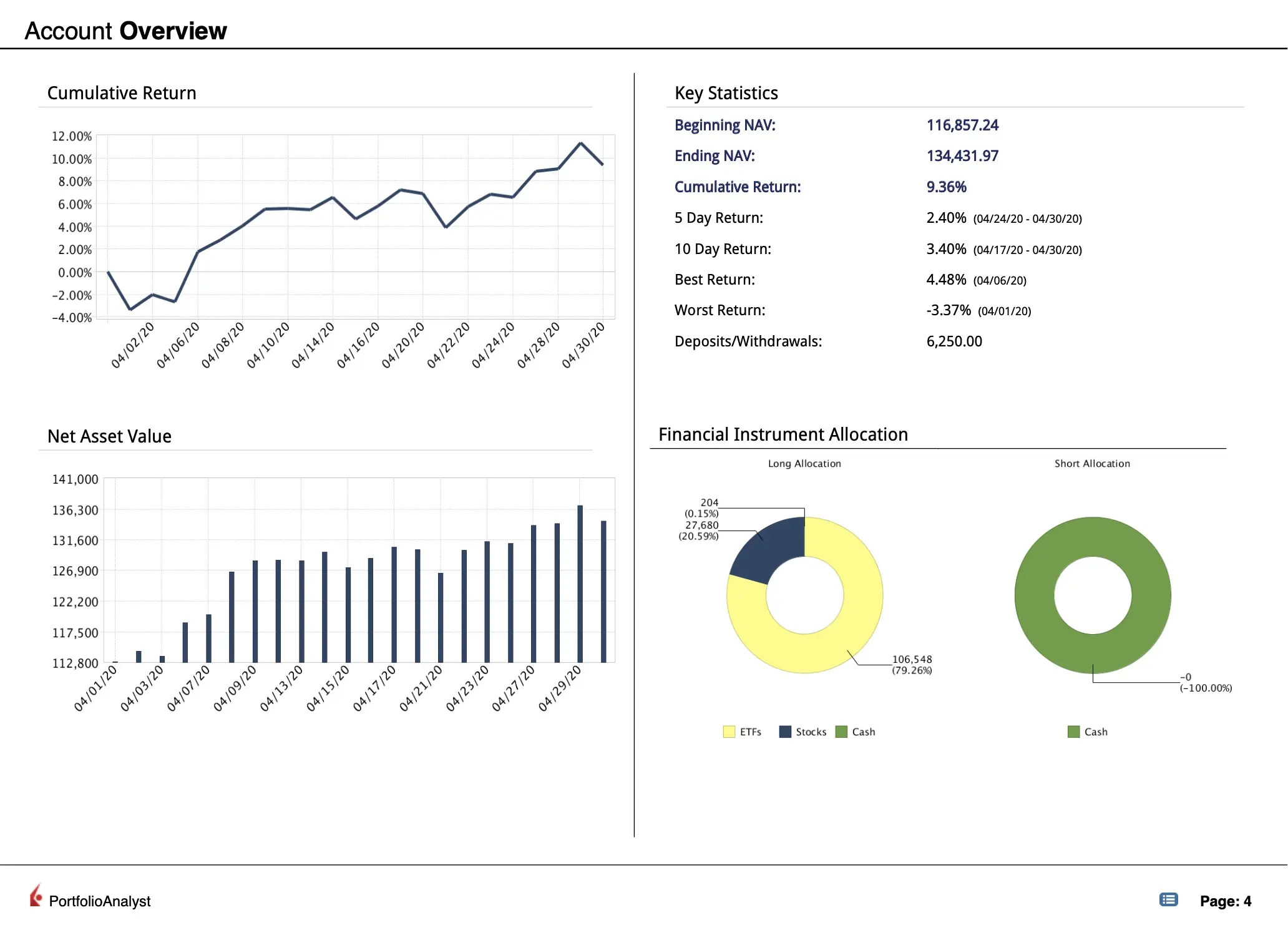

STOCK MARKET INVESTMENTS (+CHF 18'048.49): The low point of the coronavirus crisis seems to be behind us. The markets have rebounded and so have our net worth. I have continued to buy VT ETFs (as I am finally assured that we are OK with the US-Switzerland estate tax treaty) as well as value investments with many big discounts especially (and still) in Japan (reminder: all the info is disclosed for the sponsors of the blog).

I don’t talk much about investor psychology on the blog, and wrongly so. I will correct that soon. In the meantime, this coronavirus stock market crash will have been the first I’ve experienced with more than CHF 150'000 invested in the stock market. We went down to CHF 103'000 at the bottom of the fall. And, proudly, I can tell you that it didn’t make me feel hot or cold (maybe it will be different the day I’m about to take early retirement). I didn’t sell anything. On the contrary, as planned, I took advantage of the opportunity to enjoy the sale period. And it didn’t stop me from sleeping once — except for wondering if I should wait a day or two in case the market goes down again ;)

I’m interested to know how you reacted, and how much you invested, so don’t hesitate to leave a comment with that information.

P2P INVESTMENTS (-CHF 512.97): As stated in my March net worth update article, I’m stopping all P2P investments. I have closed my Iban Wallet account, and I’m getting my cash out of Mintos gradually (as fast as I can, but the “Invest & Access” program is not as instantaneous as its name suggests…).

CRYPTOCURRENCIES SPECULATION (-CHF 55.89): If you want something volatile and unpredictable then go for the cryptocurrencies :D

For my part, I’m still keeping a record of my crytpocurrencies experiment in case it goes up one or two million in ten years. One can always dream ^^

MP’S 2ND PILLAR (+CHF 602.85): Filling my second pillar as usual.

MRS.’ MP 2ND PILLAR (+CHF 1'325.00): We received Mrs. MP’s pension situation and surprise, there was CHF 1'000 more because my estimates following her last salary change were conservative :)

MP’S 3RD PILLAR (n/a): Nothing to report because I make my lump sum payment at the beginning of the year (only Mrs MP is lucky enough to be at VIAC… my 3rd pillar being one of the guarantees for our mortgage), and my updated surrender value also comes at the beginning of the year.

MRS’ MP 3RD PILLAR (-CHF 3'570.56): As I enter the VIAC infos at the beginning of the month in YNAB (i.e. beginning of April for this article), we can still see the COVID-19 effect on our favorite 3a. But that’s okay, we continued to pay the CHF 568 as usual.

APARTMENT AND MORTGAGE IN SWITZERLAND (n/a): Nothing to report, we still do not repay anything as mortgage rates are so low, and we have not made a revaluation of our property so we do not speculate with its value (i.e. we keep the amount of our initial 20% down payment that we had to pay when we bought our home).

REAL ESTATE INVESTMENT IN SWITZERLAND (+CHF 30'000): This is the communicating vessel of our cash flow. As I have already mentioned on the blog, I am involved in a real estate project in Switzerland which is very interesting. I’m waiting for it to be finished before I can fully document it.

RENTAL BUILDING IN FRANCE (n/a): Same as for our apartment in Switzerland, no speculation on the price of our rental property. We will wait until we want to sell it to make an evaluation.

MORTGAGE LOAN IN FRANCE (+CHF 701.05): The magic of real estate investment: the loan repays itself “on its own” thanks to the rents.

SCI (SOCIÉTÉ CIVILE IMMOBILIÈRE, REAL ESTATE INVESTMENT COMPANY IN ENGLISH) IN FRANCE (-CHF 67.65): Little problem with the water heater that we had to replace in one of the apartments. Nothing bad, especially since it’s part of our annual maintenance budget for the moment.

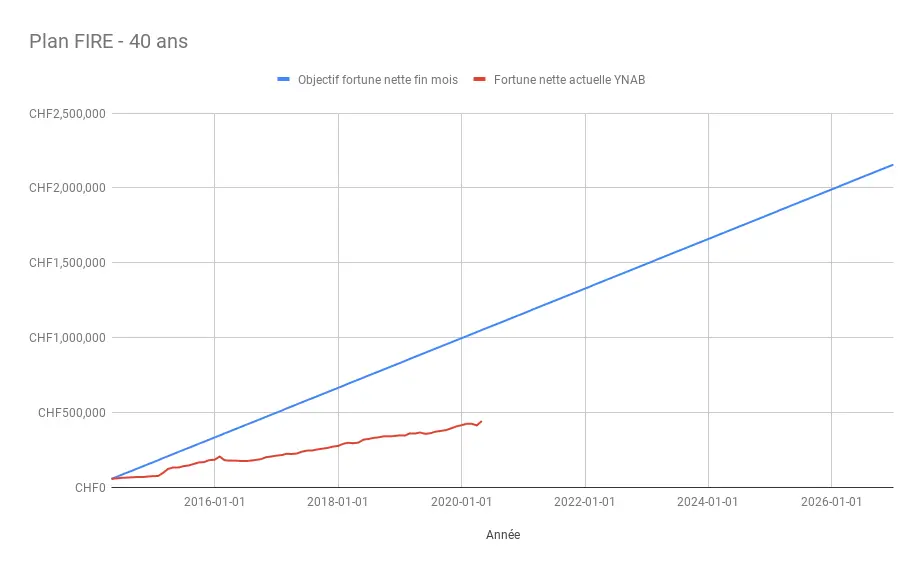

In terms of financial independence, we are at 21% of our objective of CHF 2'156'000 with our net worth of CHF 444'206.97.

Which visually gives us this:

Savings rate for April

In the end, we finished with a savings rate of 75% for April 2020. We’re sticking with a very good 2020 vintage for the moment. But it’s only the first half of the year. So we’re staying focused and we’re optimizing our income and expenses to maximize the gap between the two.

And you, what was your net worth and savings rate in April?

PS 1: if you also want to have access to bonuses such as the screenshot revealing the amount of each of my assets (I post it every month when this net worth update’s article is published online), then you just have to become a patron of the blog via Patreon.

PS 2: I’ve added a new “bonus” for the blog’s patrons. Since last month, I publish a live notification of my buy/sell on the stock market and other investments (translated into three languages like the blog — i.e. EN, DE, and FR). Just to be clear, I follow a rather passive investment methodology with ETFs disclosed on my blog, so you won’t learn anything transcendental. But if it can motivate you to invest regularly and in a disciplined way, then I will have succeeded in my wager.

PS 3: I’d like to take this opportunity to thank the new patron of the blog linlin. A big thank you for your support!