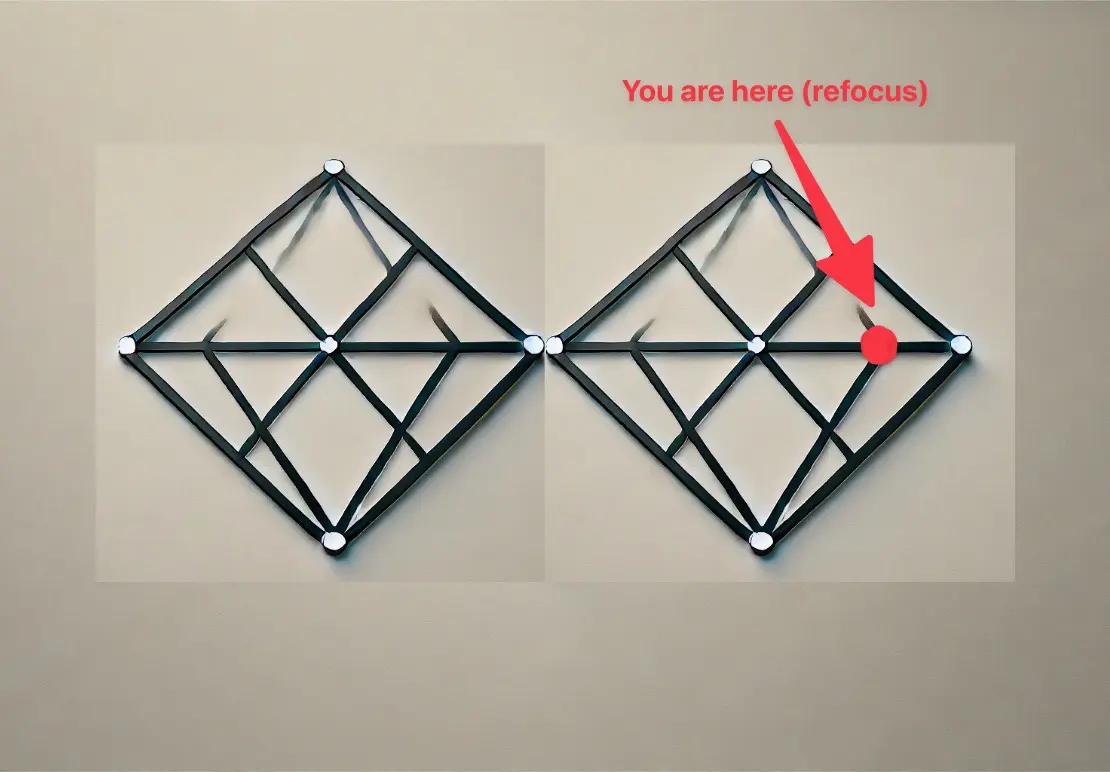

“I told you I’d win in the end,” Minimalismo shouted to Frugalisto.

“Yeah, well, admittedly we’re even. But considering how much time MP will save with this new Swiss banking and credit card strategy, you could borderline call it a tie. Because yes it’s a minimalist decision, but frugal too!” retorted Frugalisto, with a hair of bad faith…

Nope! That’s 1-1, the ball is back in the center, my friend!" concluded Minimalismo, not a little proud of himself!

For the new readers, these two protagonists are the two people in my brain (yeah, it’s crowded up there! :D) who are fighting over whether my frugal or minimalist side will win. They nag each other more than they hate each other, because in the end, they agree on one thing: efficiency is one of the most beautiful things that exists on our planet.

Save CHF 4'440 on 10 years

For the new Mustachians among you, I remind you that the average Swiss person spends CHF 300 in bank fees per year for his household.

By choosing a free Swiss digital bank that is just as reliable and secure, you can therefore afford to have CHF 300 more to invest annually, which represents an accumulation of assets of CHF 4'440 in 10 years. And all this just to make the unique effort of changing financial service provider.

“Where do I sign?!” was my reaction the first time I did my calculations.

My free Swiss online bank until the end of 2021

Since 2019, I am an avid user of the Swiss neobank Zak. It is my primary Swiss frugal bank. And neon was until then my secondary Swiss backup bank, in case the primary one had a problem (app not accessible, transfer blocking, etc.)

My 5 free Swiss credit cards until the end of 2021

In addition to these two Swiss bank accounts, I have set up a Swiss credit card system optimized to maximize the cashback we earn each year.

This is where Frugalisto won last year. Because our system consisted of 5 Swiss bank cards… not very minimalist.

Until the end of 2021 we had these Swiss credit cards:

- Zak’s free Maestro card for ATM withdrawals and to pay at certain places that only accepted Maestro (long live the Vaud countryside :D)

- American Express Cashback credit card from Swisscard for all our expenses in CHF in order to earn 1% cashback — several hundred CHF per year in our case

- Cumulus-Mastercard credit card for all our spending in CHF when the above Amex Cashback is not accepted. And this, in order to earn as much cashback as possible in Cumulus points (CHF 0.01 for CHF 1 spent at Migros stores, and CHF 0.0033 for CHF 1 spent elsewhere than at Migros)

- Revolut Card for all our foreign currency transactions to have the best possible exchange rate in Switzerland, up to CHF 1'250 per month maximum (otherwise after that the currency conversion fees are too expensive)

- Wise Card, formerly TransferWise for all our foreign currency transactions for when we’ve exceeded the CHF 1'250 limit of our Revolut above

I was more in exploration mode back then. And I’m going back to consolidation and simplification mode now.

But first, let me explain why I am changing my main Swiss bank.

Things that have changed recently

For the MPs, 2022 is going to be the year of efficiency and simplification!

Before I list the things that led me to make these changes, here’s a reminder of my comparison that made me choose Zak over neon as my primary bank beforehand:

| Mustachian criteria | Zak | neon |

|---|---|---|

| Free | ✅ | ✅ |

| Online and mobile | ✅ | ✅ |

| Secure | ✅ | ✅ |

| Free bank transfers in Switzerland | ✅ | ✅ |

| Free bank transfers in the Euro zone (via SEPA) | ✅ | ✅ |

| Free Maestro debit card | ✅ | 🚫 |

| Free ATM withdrawals | ✅ (Bank Cler) | ✅ (2x) |

| Free cash deposit at ATMs | ✅ | 🚫 |

| ISR/QR code payment via scan | ✅ | ✅ |

| eBill support | 🚫 | ✅ |

| Accessible physically | ✅ | 🚫 |

| Download of account statements in PDF format | ✅ | ✅ |

| Live push notifications | ✅ | ☑️ (SMS) |

| Apple Pay/Google Pay/Samsung Pay | ✅ | ✅ |

(best free Swiss bank 2021 comparison)

Then, there were the following events during 2021. So I re-evaluated the situation to see if my setup was still the most optimized for our situation with Mrs. MP.

Zak Maestro card

The main criterion that made me stay with Zak was their Maestro card. Because in the countryside, this card was accepted everywhere in the small stores and grocery stores, compared to the Mastercard debit card from neon.

Except that the situation changed a few months ago and all the banks are gradually stopping Maestro in favor of debit cards. And merchants are adapting and, for my part, now accept all debit cards.

This left Zak with only the two advantages of being able to deposit cash for free, and having a network of physical branches (those of Bank Cler, which offers the Zak mobile app solution).

Free cash deposit

Regarding the cash deposit possible for free via Zak, and possible via neon but paying because via the Swiss Post, there has also been a change. Or should I say it is coming. Because neon is going to arrive all of a sudden with an extension of this service via a very widespread partner in Switzerland. But it will still be paying…

As always, I mentioned this to Mrs. MP, who replied: “First, we don’t have as much cash as before that enters with our other side business, and second, since you want to keep Zak as your backup Swiss bank, we can always use it to deposit cash, right?”

Solved! As always, have a talk with Mrs. MP :)

Zak’s physical branches via Bank Cler

I was taking a little hike with a friend in a nearby forest, when we started discussing my opinion of Zak or neon. I was explaining my point about physical agencies. And he would quickly interrupt me to ask me why I didn’t apply the same rule for my online broker. Or for my car insurance…

Good point!" I exclaimed. “Especially since I have much less to worry about with my Swiss banks, since I have a primary and a secondary one in case of a problem.”

He answered: “Yes, and especially, having tested their customer service by phone — in French and based in Switzerland! — I can assure you that it is even more convenient than having to go to a physical agency! They answer quickly and efficiently the phone from Monday to Friday from 8am to 5pm, and by email on Saturdays too.”

I talked about it with Mrs. MP, who is of the same opinion as my friend. As long as we kept Zak as a secondary bank with some cash on it, she was also for switching to neon if it simplified our Swiss personal finance management.

So I broke my own glass ceiling on this (well, halfway, because we’re still keeping Zak as Plan B with its physical Bank Cler branches).

Add eBill support to all this…

I love the Zak team, and their attempt at transparency via their public roadmap. Except that after many requests to their product team, I still don’t know if it’s postponed because of Bank Cler’s internal strategy, or because of technical integration issues, or what have you.

Compare that with neon who already offers eBill, AND shares sensitive info about their roadmap with me in full trust mode, and it all ended up bringing me to this idea:

“Zak or neon? neon or Zak? In the end, I’m really starting to prefer neon as a potential main Swiss neobank…”

Because frankly, I was starting to complain a lot about those paper or email invoices (vs. the simplicity of eBill).

Live push notifications?

It took a simple email from the co-founder of neon for me to decide to take the plunge and make neon my primary bank.

He explained me in his email that they would finally be able to offer live push notifications (instead of the old school SMS), with their new Mastercard! Indeed, until then, it was their future ex-card provider that was not very up to date technologically :D

What about the pot system?

In fact, I had also overlooked that Zak was a handy tool for reconciling my Swiss bank account with my YNAB budget… so I went straight back to the neon co-founder, who told me that the feature was coming in Q1 2022… OK, so that was it, I was switching my main bank to neon!

My new free Swiss online bank from 2022

neon will be my main Swiss digital bank from 2022 onwards.

And Zak, which is still a very cool product, becomes my secondary Swiss backup bank.

So here is my new best free Swiss bank comparison for 2022:

| Mustachian criteria | neon | Zak |

|---|---|---|

| Free | ✅ | ✅ |

| Online and mobile | ✅ | ✅ |

| Secure | ✅ | ✅ |

| Free bank transfers in Switzerland | ✅ | ✅ |

| Free bank transfers in the Euro zone (via SEPA) | ✅ | ✅ |

| Free debit card | ✅ | ✅ |

| Free ATM withdrawals | ✅ (2x + Sonect) | ✅ (Bank Cler) |

| Free cash deposit | 🚫 | ✅ |

| ISR/QR code payment via scan | ✅ | ✅ |

| eBill support | ✅ | 🚫 |

| Accessible physically | 🚫 | ✅ |

| Download of account statements in PDF format | ✅ | ✅ |

| System of pots for YNAB sync | ✅ | ✅ |

| Live push notifications | ✅ | ✅ |

| Apple Pay/Google Pay/Samsung Pay | ✅ | ✅ |

This change from Zak to neon also allowed me to optimize my Swiss credit card system. Since we would always have cash in our neon account (since it was our new main Swiss bank account), we would also be able to use their Mastercard debit card regularly.

My 3 free Swiss credit cards from 2022

UPDATE 01.09.2022: the latest version of my Swiss credit card strategy can be found in this article.

As a reminder, my goals are:

- Pay by credit card in Switzerland and abroad with the lowest possible charges

- Earn the maximum cashback possible

This is where Frugalisto took a hit…

But as he told Minimalismo above, he is not entirely wrong about the fact that he won a little too!

Because in addition to not having to think between 5 cards, there is especially the time I spent doing my accounting by having to look at 5 different banking platforms.

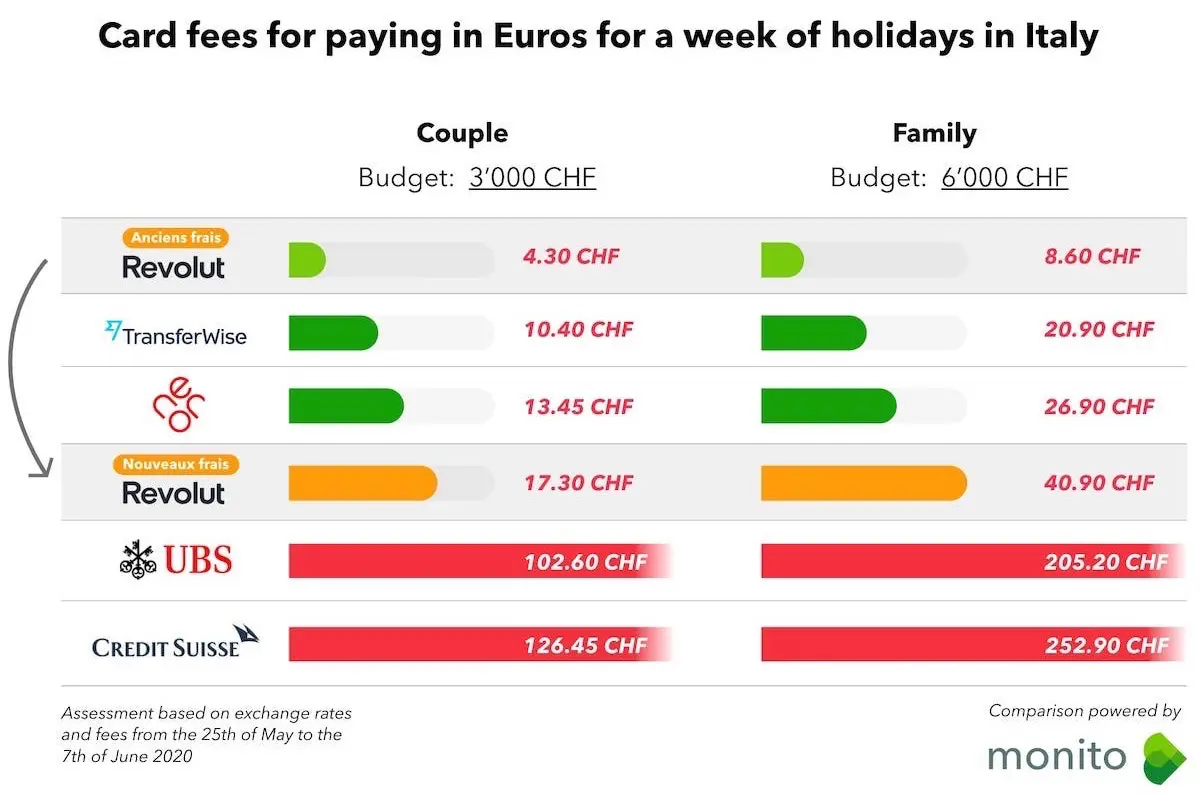

Thinking about the Monito comparison (see picture above), and the fact that we don’t spend that much in foreign currencies, I decided to switch to a Swiss 3-credit card system, even if it means losing a few CHF per year.

So here is — in order — how I minimize my Swiss credit card fees, and maximize my cashback:

Payments in Switzerland in CHF

- American Express Cashback credit card from Swisscard for all our expenses in CHF in order to earn 1% cashback — several hundred CHF per year in our case

- Cumulus-Mastercard credit card for all our expenses in CHF when the above Amex Cashback is not accepted. And this, in order to earn as much cashback as possible in Cumulus points (CHF 0.01 for CHF 1 spent in Migros stores, and CHF 0.0033 for CHF 1 spent elsewhere than at Migros)

- Free Mastercard debit card from neon to pay anywhere in Switzerland where credit cards are not accepted (including the countryside!), and abroad

Payments abroad or in foreign currency

- Free Mastercard debit card from neon to pay anywhere in the world, and in foreign currencies, with the lowest possible fees

Withdrawals of CHF

- Free Mastercard debit card from neon which allows 2 free withdrawals per month in any Swiss ATM, and then switching to Sonect if needed (also free)

Best Swiss credit cards according to MP for 2022: Cashback from Swisscard, Cumulus Mastercard, and Debit Mastercard from neon

And for the day I have large amounts to exchange between CHF and another currency, I always keep my Wise account. Although by default, if we are talking about large amounts, I will go through Interactive Brokers first for my foreign exchange transactions with the lowest fees.

Zak promo code and neon promo code, valid in 2022

neon and Zak continue to offer the following coupon codes to blog readers:

(N.B. the app may not reflect the bonus directly, but it'll be taken into account, I checked with their support)

If this is your first time to open such an online bank account in Switzerland, you will find a detailed tutorial of how to create a Swiss bank account at neon (and also Zak) with supporting screenshots in this blog post.

Zak (backup Swiss bank of MP): the promo code “Y06JPR” entitles you to CHF 25 welcome cash

Conclusion Swiss banking system and credit cards for 2022

If you wanna know more about my neon bank opinion, check this article.

And to summarize, here is the Swiss Mustachian setup that I recommend to you from now on:

My free Swiss bank accounts

- neon (primary bank)

- Zak (secondary backup bank)

My Swiss credit cards

a. Payments in CHF in Switzerland

- Amex from Swisscard wherever accepted

- Cumulus Mastercard, if Amex not accepted

- Debit Mastercard neon, if credit card not accepted

b. Payment in foreign currency and/or abroad

- Debit Mastercard neon

c. Withdrawals of CHF

- Debit Mastercard neon

And you, what bank setup do you have in Switzerland nowadays?

PS: if you ask why I don’t talk about Yuh, BCV, Credit Suisse CSX, or Raiffeisen, it’s because my opinion about them hasn’t changed. These banks are not Mustachians enough :)

PS2: if you are in couple, I recommend you to read this article to manage your couple finances without a Swiss joint account in a serene way