I recently received the following comment from Jean-Sébastien:

The new neon Analytics statistics are extraordinarily powerful! A sort of integrated Excel pivot, ultra-recommendable for those who don’t know their monthly expenses and want to analyze everything and know where their cash is going. By category, by month, by year, by heaviest “cash drainer”… I’m completely in love. So yes, I manage my budget with neon :).

You know me: I’m still an unconditional fan of YNAB to manage my budget. But I also know that everyone has their own way of budgeting, and that it’s not the tool itself that’s important… but the one that really helps you move towards your goal of Financial Independence (FI).

Some people love YNAB. Others prefer a simpler system, integrated directly into their bank. And that’s just fine.

That’s why, when I read Jean-Sébastien’s message, I asked him if he’d be willing to share his experience. His approach is different from mine, and that’s precisely what makes it so valuable: another concrete way of managing your monthly budget, optimizing your savings and making progress towards financial independence in Switzerland.

In the hope that his story inspires you to take control of your finances and see how neon Analytics can help you optimize your budget, too, I’ll hand over the keyboard to Jean-Sébastien.

How I discovered neon Analytics (FI path in Switzerland)

Hello to all MP blog readers. I’ve just celebrated my 45th birthday. I’m employed in Zurich and have been working in Switzerland for 10 years. I rent my home.

I grew up in neighbouring France, in Moselle, near Luxembourg and Germany. That must play a part in my integration in Switzerland: we’re educated in a very Germanic and structured way over there 🙂

Like all readers of the “Mustachian Post” blog, I aim to achieve financial independence as soon as possible. More specifically, I would like to take early retirement at the end of 2029, just before I turn 50!

In my case, not to be idle or show off in a Lamborghini, but to be able to plan my future freely and serenely.

For me, FI will be an opportunity to do what I want, when I want, at my own pace: sports, tourism, helping others, doing DIY stuff, and creating projects. I also want to continue learning and passing on my knowledge. And emotions. All this in an attempt to become a better person who can choose their battles.

And it was in this context that I finally discovered neon Analytics.

Why I started using neon Analytics to control my spending

I’ve never been a big spender; I remember as a kid, I used to store my pennies in a tin box, instead of splurging them on candies 🙂

Then, as much as when I was a teenager working during the school vacations, or when I became a young working adult, I never splurged. I was very careful about spending, but never quantified what “being careful” meant. No figures, no tracking, no targets.

I satisfied myself with the bare necessities, with a little extravagance for my travel, parties, gifts and sports budget categories. After all, I had to live out my twenties!

But, once again, no tracking!

I estimate retroactively that I was saving roughly 10-20% of my income; my most reliable indicator: I never took out a single loan.

Later, with the advent of online bank statements (around 2000, if memory serves), I slowly started compiling monthly statements in Excel and making embryonic analyses.

It was cumbersome, with random copying and pasting… I was terrible at Excel, but above all: I had no vision. Even less discipline and method. Basically, I was content to stay in the black at the end of each month, and nothing more.

Around 2010 (at the age of 30), I became aware almost overnight of the importance of saving and investing, thanks to a Canadian friend. He, like many North Americans, had long been convinced that he had to rely solely on himself and his investments to ensure his retirement. Just the day before, I was naively dreaming of the guaranteed pension I’d receive from my sweet, well-meaning country, ahaha.

My friend had long been convinced that he had to rely solely on himself and his investments to secure his retirement.

Anyway, from that day on, I refined my budget and expense tracking Excel files; the online banks also improved their export tools (CSV, for example), and I also improved my Excel skills… It was cumbersome, time-consuming, but it brought results. Perhaps it was during this period that an app like YNAB would have been useful; but I didn’t know about it!

On a beautiful morning in early 2020, full of sweetness and caressed by divine light, I discovered the Swiss online bank neon. Initially, I was looking for a free, simple card to make online purchases, without having to enter the numbers of my UBS card at the time (I didn’t even know what a debit card was!)

Then I got interested in neon’s Spaces (budget pockets) and the neon Analytics feature (spending statistics).

And then my life turned upside down.

How neon Analytics analyzes your spending and increases your savings rate

So, of course, as powerful as neon Analytics is, it’s still a tool. And like all tools, if you’re not interested in it or don’t use it, it’s useless.

It’s not a magic tool that does everything by itself, like a dumbbell left in a cellar: muscles won’t come on their own.

neon Analytics (part of the July 2025 update of the neon mobile application!) has swept away all my Excel files, which were a bit of a pain to run and exploit.

When you want to get your FI moving as quickly as possible, you know you have to save (and then invest) as much as possible. But what are we talking about? How can I increase my savings rate?

Well, yes, you can increase your income by keeping your initial expenses the same. It’s a compulsory path, but a long one, and not necessarily easy or guaranteed.

Much more immediately, you can (you must) reduce your expenses.

But which ones? By how much?

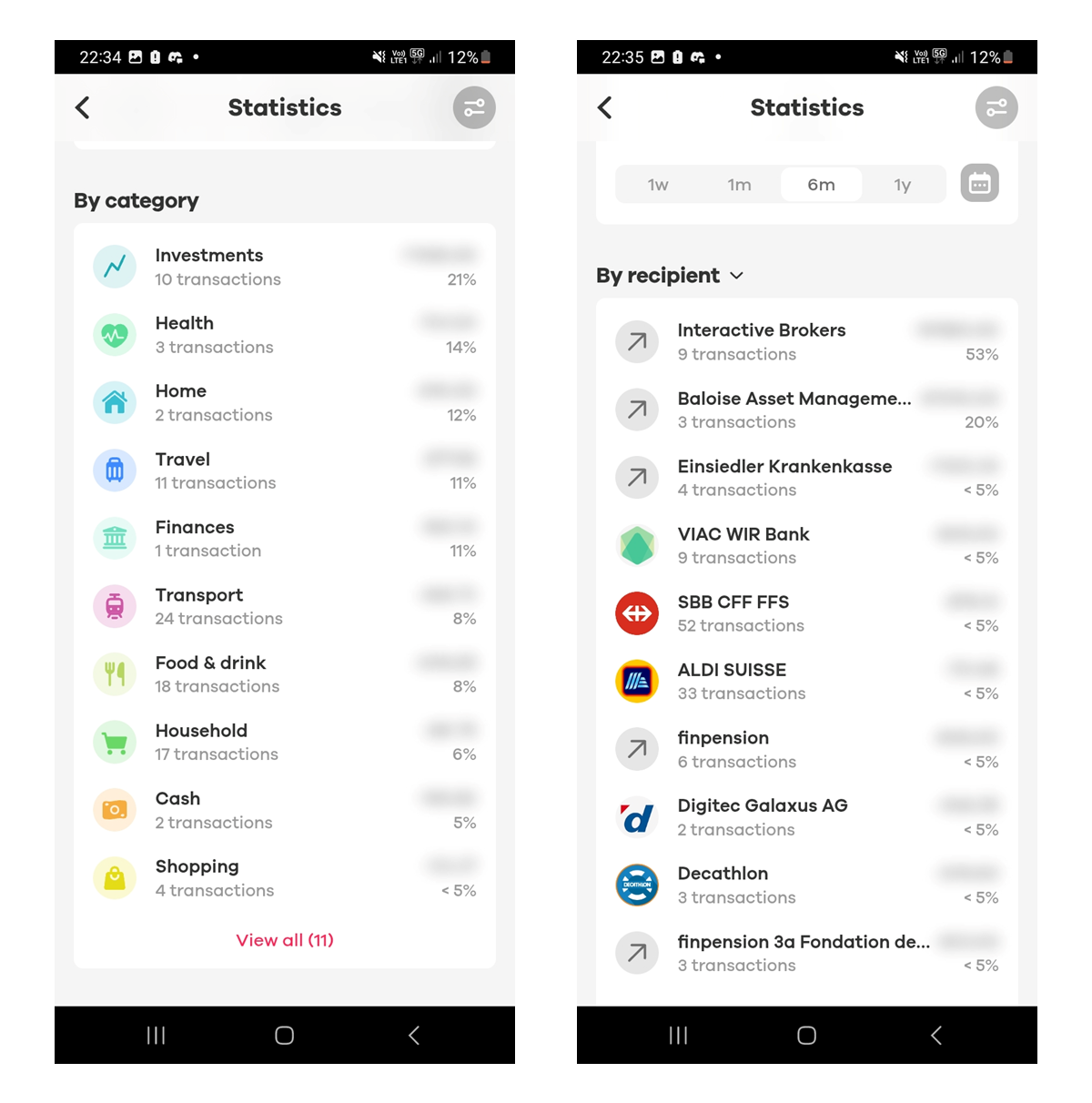

This is where the neon Analytics magic happens: after helping neon associate an expense recipient (for example: “SBB”) with one of your customized categories (in this case, the “Transport” category), in a matter of seconds you can analyze the structure of your expenses, either by recipient (SBB), or by category (“Transport”, a category in which I also have my insurance and scooter-related expenses), by week, by month, over 6 months, by year, and even by “Custom” period.

It’s at this point that the sniper (or butcher) in every FI padawan steps in to wipe out any recurring expenses deemed unnecessary!

What? 10% of my monthly expenses are linked to this thing that’s of no interest to me? Out of the way!

What? 3% recurring for this? Can I kill this expense, or reduce it with an alternative? Let’s do it!

Whaaat? CHF 400 in monthly meals since the start of the year? Are you serious?

And so on, you get the idea.

Navigating in neon Analytics is immediate, fluid, and the default ranking is descending… a tool which I consider perfect. 😍

Again, it’s just a tool. The dumbbell that stays in the cellar, blabla, is useless.

neon Analytics, and Spaces, are simple yet very powerful tools, if you have the will to use them to achieve your FI.

neon Analytics: automatic consolidated spend identifications, over different time intervals, either by category or by recipient

Why I decided to manage 100% of my budget with neon (and abandon my other bank accounts)

To avoid biasing and distorting spending analyses (I’m not in politics, after all), there’s no point in making certain expenses via neon and others via different banks (I also have a Yuh bank account and Revolut, as a backup, just in case).

So I went from two UBS accounts, 3 accounts in France, to an exclusive migration to neon for all financial flows, so that neon Analytics can analyze 100% of my expenses without bias.

Of course, there’s a very small surcharge on vacation payments in EUR, in my case, we’re talking about 10-20 CHF/year (0.35%). I can live with that, given neon’s added value overall. (update as I was finishing writing my article: I’ve just switched to “neon plus”, and while it’s no longer free, it’s the cost of a pizza a year, for many advantages, including neon Analytics, and on top of that, I no longer have random exchange fees).

And ditto, I have all my income transferred to neon, to have a complete view of my flows, how many expenses compared to my income, which neon Analytics allows you to visualize, OBVIOUSLY. 🙂

How neon Analytics helped me cut 20% of my expenses and automate my budget

As a result, in iterations over 1 to 2 months (consolidation by category, recurring payment destinations), neon Analytics has enabled me to gain a finer knowledge of my expenses, refine and above all optimize my budgets, cut a bunch of superfluous expenses, and, de facto, increase my savings rate. I’d say I’ve cut around 20% of recurring expenses.

Nothing that couldn’t have been done with pencil and paper, but then again, I still prefer to have my clothes washed by a machine rather than having to beat them myself in a lake washhouse.

I’d say I’ve cut about 20% of recurring expenses!

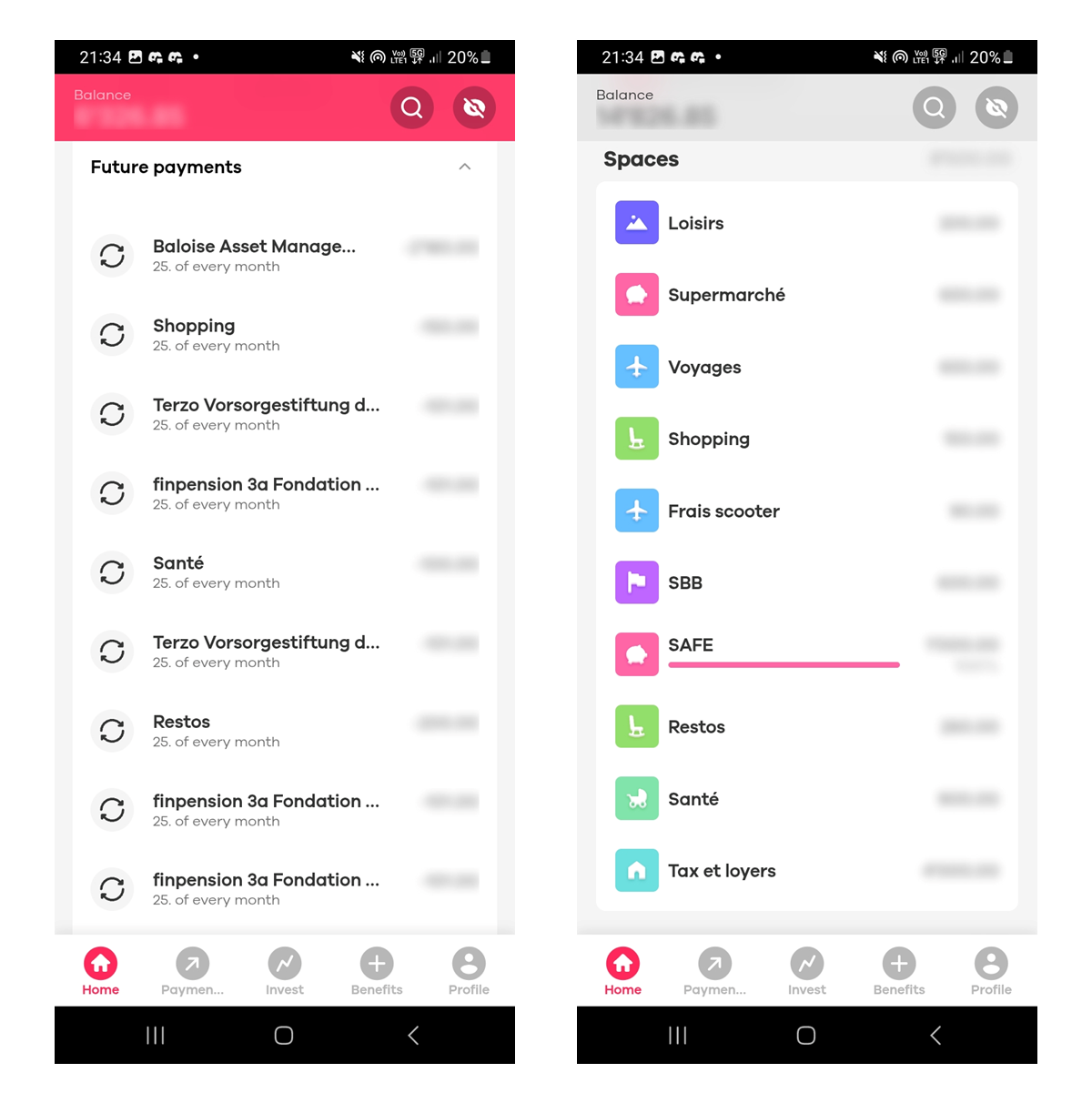

Once the expenses deemed superfluous have been eliminated and the budget is well established (how much for rent, how much for LAMal, how much for future travel, how much for future healthcare costs, how much for my future clothes or sports equipment, etc.), that’s when neon’s Spaces can shine.

As soon as my salary arrives, automatic transfers feed these Spaces for the coming month, followed by a transfer to my online trading platform (“Pay yourself first!” as the saying goes). Then, as the month progresses, I release funds from my Spaces to the checking account to pay for day-to-day expenses. This way, you control your spending.

For the first 2 months, I recommend that you plan a little more ahead, as your knowledge of expenses won’t be perfect yet.

And since automatic transfers have been made to “F-U Money” accounts in advance, there’s no remorse about splurging a little now and then! (woah that state-of-the-art egg cup on Galaxus 🤯)

Optional, but recommended, a “safety net” Space is useful for really unexpected expenses (professional expenses, a mobile phone or computer that suddenly decided to leave us…)

Except for the “Health” Space, the ideal month is one in which the Spaces end at 0, after transfer for investments. This is an indicator of a well-controlled budget.

The impact of neon Analytics on my financial life and my next steps towards FI

In the 5 years I’ve been using neon, I’ve lost weight, my back no longer hurts, my hair has grown back and many beautiful women surround me.

On a more serious note, neon Statistics and Spaces are two basic but super-powerful tools for making life easier and concreting the ABCs of personal finance: spend less than you earn and pay yourself first. Both are indispensable tools if you have the vision.

Many adults don’t do this, and that’s a big mistake. It’s also something to show and teach teenagers. And the excuse of heavy and complicated Excel files is obsolete, thanks to neon Analytics.

My vision of financial independence? A calm, zen, beautiful and serene place... Swiss nature basically

neon also offers investments, but I prefer to use an outside broker (see MP’s comparison of the best trading platform), which is cheaper.

Personally, my ritual savings are invested in my 3a pillars and ETFs, capitalizing if possible. The lack of diversification into other assets (cryptos, rental property, crowdfunding, etc.) may be criticized, but that’s not the subject of this blog post. Every month brings me closer to my theoretical FI date…

To reach Financial Independence, you need to have invested your money. To invest, you need capital. To have capital, you need to have saved money. And that’s exactly what neon, my (beloved!) neobank, is helping me to do.

And you, what method do you use to plan your monthly budget and achieve financial independence as quickly as possible?

FAQ neon Analytics

How does neon Analytics work?

neon Analytics automatically analyzes your spending by category and recipient to help you visualize where your money is going.

Does neon Analytics help to reduce expenses?

Yes. By showing your recurring expenses, you can quickly identify unnecessary costs and adjust your budget.

Can I use neon Analytics to track my savings rate?

Yes, by comparing income and expenses, you can estimate your savings rate and track its evolution.

How many Spaces can I create in neon?

A maximum of 10 Spaces can be created in neon’s mobile banking application. And you can choose any name you like for each category.

Is neon Analytics free?

Yes, neon Analytics is free for anyone with a neon bank account.

Is neon enough to manage a complete budget?

Yes, on one condition: you must have all your income and expenses processed through neon. Between Analytics and Spaces, it covers budget tracking, optimization and organization.

Last updated: December 11, 2025