I finally finished filling out my Swiss tax return for 2019 last week. It took me longer than in previous years (see my Vaud tax return guide) due to the purchase of all these “value” shares in 2019.

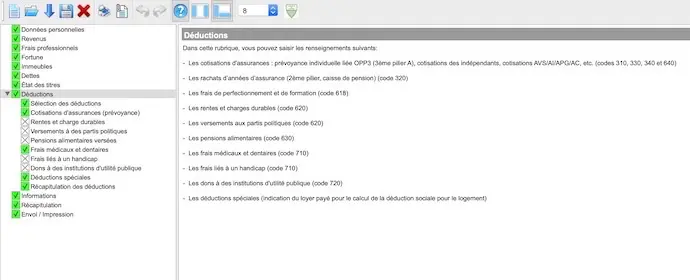

By talking with some of you, I realized that not everyone is aware of the many tax deductions they may be entitled to. Hence this article presenting what I have deducted for my taxes in 2019. It’s based on the tax laws of the canton of Vaud, but I thought it might help you to dig deeper into the subject even if you live in another canton.

The list of what I’ve deducted from Swiss taxes in 2019

| Deductions Mr. and Mrs. MP | Amount in CHF | Comments |

|---|---|---|

| Public transport | -4'980 | To be calculated pro rata to your work rate. |

| Meals away from home | -5'160 | To be calculated pro rata to your work rate. And that’s why it’s worth bringing lunch to work, because you also earn tax money. |

| Other professional expenses (flat-rate + actual amount) | -8'454 | Here we used the basic flat-rate deduction, but also combined with the actual costs (laptops, telephone) have been added. We also added an amount for clothes and shoes after recommendation of a trustee… we’ll see if it passes or not. |

| Expenses for occasional employment Ms MP (flat-rate) | -800 | Mrs. MP had a side-job for some time, but her actual costs did not exceed the flat-rate amount, so the flat-rate deduction was chosen. |

| Development and training costs (professional reorientation) (actual amount) | -4'050 | One of us had to do a professional reorientation course. Only actual amount deduction possible here. |

| Deduction for securities (flat rate) | -298 | Again a flat-rate deduction because I didn’t pay as much through my discount online brokers Interactive Brokers and DEGIRO. |

| Child Care Expense Deduction (actual amount) | -5'941 | It goes downhill from year to year as the kids get older and go to school more. |

| Medical expenses (mainly dental and health concerns 2019) | -4'799 | Usually we don’t go over the minimum to deduct but in 2019 it was the case (we could well do without it for 2020, by the way). |

| Social housing deduction / Net annual rent | -586 | So this is the newest addition this year that I didn’t know about. As a landlord in Switzerland, you can deduct the “rent” you pay in the form of mortgage interests. It’s all explained in their documentation, but generally you’re doing better by putting the amount of your annual mortgage interests and they adjust it downwards if necessary. |

| Property maintenance and administration costs (Switzerland) | -6'659 | Actual deductions as home owner in Switzerland. |

| Building maintenance and administration costs (France) | -4'859 | We also have to declare our French rental building in Switzerland, and the deductions that go with it. There were a lot of them in 2019 with all the one-time fees (i.e. bank processing fees - although I’m not sure if this will pass as in France. We’ll see). |

| Mr. and Mrs. MP’s 3rd pillars | -13'594 | Thanks @TuxRock who pointed out that I forgot to mention our 3rd pillars (it’s so obvious to me that I skipped…). We put the maximum deductible level 3a ceiling in 2020, i.e. CHF 6'826, for Mrs MP’s at VIAC, and CHF 6'768 for mine as it is sub-optimal because it is with an insurer linked to our mortgage. |

So the two big new things for me this year were this deduction from the rent as a landlord and the addition of staff in business expenses with clothes and shoes.

For the rent deduction, it’s deliberately not filled in automatically by the tax authorities because a lot of people say “Nothing to do, I’m a landlord now so I don’t have any rent.”

As far as business expenses are concerned, we will see what these authorities tell us.

Also, I have deliberately not indicated automatic deductions such as for children or for married couples because it is done automatically according to your situation.

Two questions for you that you can answer in the comments section below:

- Do you see any tax deductions that I forgot?

- Have you learned something that you weren’t deducting from your Swiss taxes so far?

Addendum 1

Thanks to Jani, who gave me two more tips on taxes:

- She deducts each year for about CHF 10'000 (as long as it is less she has never had a specific check) from “Open debts” which are quite justified for her with her open bills for taxes, credit cards, telephony, subscriptions, etc. As simple as it sounds, but I never thought about it. I’ll test it in 2021!

- Also, if you or your spouse works part-time, for example 60%, it can be spread over 5 days and not 3 days. So in terms of taxes you can deduct more transportation and meals taken outside the home. To be tried ;)

Experiment How to open a Mintos account and invest …

How to override the Zak payment amount limit (CHF...