My frustration with our budget and finances has completely disappeared", replied Mrs. MP.

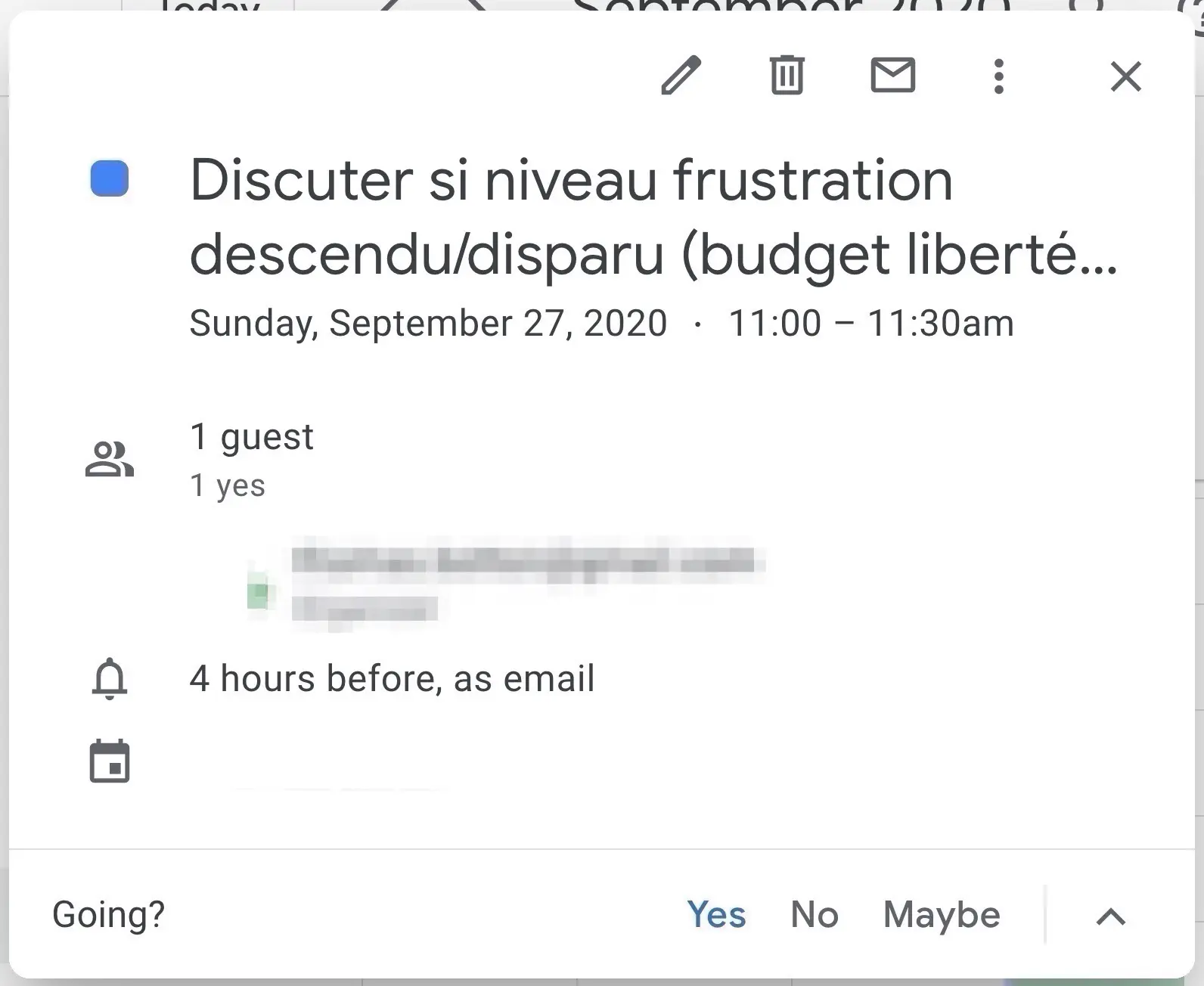

I had just read her the reminder that we had put ourselves 6 months after adapting our couple’s budget system, which said “Discuss if frustration level decreased/disappeared (“Freedom” budget Mrs. MP)”.

Mrs. MP’s “Freedom” budget category

As I have already explained in the past on the blog, we have set up a budget category called “Freedom” within our couple budget.

We took the idea from the founder of YNAB (you know, my favorite software that brought us from 50 to 600k in 7 years).

He and his wife had one concern at the time: since they had all their finances in common, they felt obliged to justify their expenses to each other; even when one of them bought a coffee or a magazine for less than CHF 5.

So they set up a budget category called “Freedom”. They allocated 50 USD per person in each of the categories “Freedom - Mrs.” and “Freedom - Mr.” And each of them could spend this 50 USD without any justification to the other person.

So we decided 6 years ago to set up this system with Mrs. MP, after I gave her my PowerPoint presentation to convince her to combine all our finances as well.

We talked a lot about how much money we were allocating to each other.

For my part, I had announced CHF 50 per person, knowing that I myself would never use this budget. Because the few things I bought, such as books or online services, I budgeted them in advance.

Mrs. MP voted for CHF 100, citing the high cost of Switzerland. She explained it to me:

With CHF 50, I have a lunch with a friend in Lausanne, and then I have nothing left for the month!

Our points of view differed, but when budgeting as a couple, you have to make compromises if you want to have a chance that it will work in the long term 1.

So we started with CHF 100/month of “Freedom” budget for Mrs. MP.

12 months ago

At the beginning of last year, I was still feeling some tension about the budget flexibility allocated to Mrs. MP, but I didn’t address the unfortunate subject (it was a big mistake for me to bury my head in the sand! — I am not perfect unfortunately ^^)

While several of my blog posts mentioned this CHF 100 “Freedom” budget for Mrs. MP, the message from one of the readers in particular caught my attention. She basically said “I’m voting for an increase in Mrs. MP’s Freedom budget. CHF 100 is clearly not enough for a woman in Switzerland!”

I joked about this and told Mrs. MP that she had some female readers who supported her.

And that’s when she explained to me with an open heart that it weighed on her, and that she felt frustrated on a regular basis…

Her two main points were:

- Her monthly Freedom budget was too low

- She was frustrated to dare to go to the hairdresser (or to get a beauty treatment) only twice a year on our common budget 2. Her only option was her “Freedom” budget, but it was problematic considering the Swiss prices in the field of aesthetics…

For my part, I realized the obvious.

I didn’t want Mrs. MP to feel this level of frustration for decades to come because, even after FIRE (Financial Independence, Retire Early), we would have to respect our set spending level.

And above all, because I am the first to argue that the FIRE path through frugality should not mean deprivation. But that’s what she felt.

It was hard for me to admit it, but we had to consider increasing these expense items (“Freedom” and “Beauty care”).

I really wanted to play it “open-minded” and asked Mrs. MP what we could test to decrease her frustration, while remaining reasonable (it was this last point that made me afraid to discuss this budget category again, as I was afraid it would increase too much).

After several discussions on the subject, we came up with the following proposal:

- Increase of the “Freedom” budget of Mrs. MP to CHF 250 (instead of CHF 100 before)

- Budgeting on our common budget of 4x hairdresser per year and 1-2 non-essential beauty treatments (non-essential from my point of view that is :D)

The Cartesian that I am reported this in CHF: an increase of about CHF 2'000 per year, or CHF 20'000 over ten years (without compound interest).

The pill was hard to swallow.

But looking back, this 20kCHF represented only 1% of our net assets of CHF 2'156'000 so that Mrs. MP could live our common project in a pleasant way in the long term.

We therefore decided to test this new budget over 6 months.

And to put all my good will into it, I told Mrs. MP that we were going to put a reminder 6 months later in our family calendar, in order to verify that things were going better. Immediately said, immediately done!

6 months later

One Sunday morning, as we were clearing the breakfast table, I said to Mrs. MP with some apprehension: “Ah, by the way, we’ve been testing the new amount for your ‘Freedom’ budget category for 6 months now and more times at the hairdresser’s. We had put this reminder on to see if your frustration had diminished, you remember. What do you think of it now?”

Drum roll with all the possible scenarios running through my mind: from “It’s not enough, we have to increase to CHF 1'000…”, to “I’m fed up with this FIRE objective, I want us to stop everything. And that we stop budgeting above all!”

Mrs. MP’s response: "My level of frustration with our budget and finances has completely disappeared. Thank you, especially for not charging extra beauty care to my Freedom budget. Because they are important to me. And frankly, if they stay that way, as far as I’m concerned, you can save and invest as much as you want :)"

I was almost shocked.

So much so that I asked her: “OK. What a good news! But then, from 0 to 100, how frustrating do you feel now about our budget as a couple?”

“Zero”, she said.

My reaction:

Conclusion

You can’t imagine my relief to know that Mrs. MP no longer has any frustrations, and that she is now 100% aligned with our budgeting to be able to stop working both at age 40.

In short, this is what I have done to improve budget management in our couple:

- The basis: dare to talk about it with an open mind (vs. discuss it with MY solution in mind)

- Explain her my fear that it will get out of control with potential inflation of CHF 100 to 200, then 300, then 500, then 1'000, etc. (which in the end was unfounded…)

- Ask her how much of the “Freedom” budget she would think of as a frustration suppressor

- Tell her that we’re testing this over 3 or 6 months, to see if it’s viable for her (but also for me in terms of savings rate :D)

- And above all, put a checkpoint to talk about it again after these 3-6 months

This method of budgeting as a couple via a “Freedom” category worked for us. And I think it can work for many others because the risks are less since we only talk here about “discussing budgeting as a couple” :) Anyway this is the key to our success in the MP family!

And you, do you manage your budget as a couple together? If so, how do you manage this type of “Freedom” expense? Feel free to share any example of a couple budget, or any method you use!

For the newcomers on the blog, the project to become FIRE in Switzerland at 40 years old came from me at the base. Except that I didn’t see myself stopping working while Mrs. MP would still have 25 years to go, because it means we wouldn’t be able to do long trips or that kind of thing. So I decided to take my dear and dearest on board this crazy FIRE project. She still has trouble visualizing what it will look like, but seeing our net worth evolve from month to month, it’s no longer a utopia for her now. It seems mathematically plausible ^^ ↩︎

I had proposed to go with this “2x/year to the hairdresser” at the beginning when we started budgeting. But in the end, I had never dared to reopen Pandora’s box by asking if it was OK or not… Mrs. MP was moaning a few times but I thought it wasn’t that bad… yeah yeah, I know, big red card for me on this one… ↩︎

Swiss tax savings through staggered withdrawal of …

The blog celebrates its 7th anniversary 🎉 (with a...