I exchange many emails with blog readers about the performance of my investment portfolio.

It often raises interesting questions on my side, so I thought it would be cool to share it with as many people as possible. Especially since investing is one of the key levers to be able to live on the returns of one’s investments once financial independence is achieved.

I still don’t know how regularly I’m going to publish this kind of report. We’ll see how much interest it generates.

My investment portfolio as of 31.10.2020

To date, here is a complete list of all my current investments:

Stock exchange

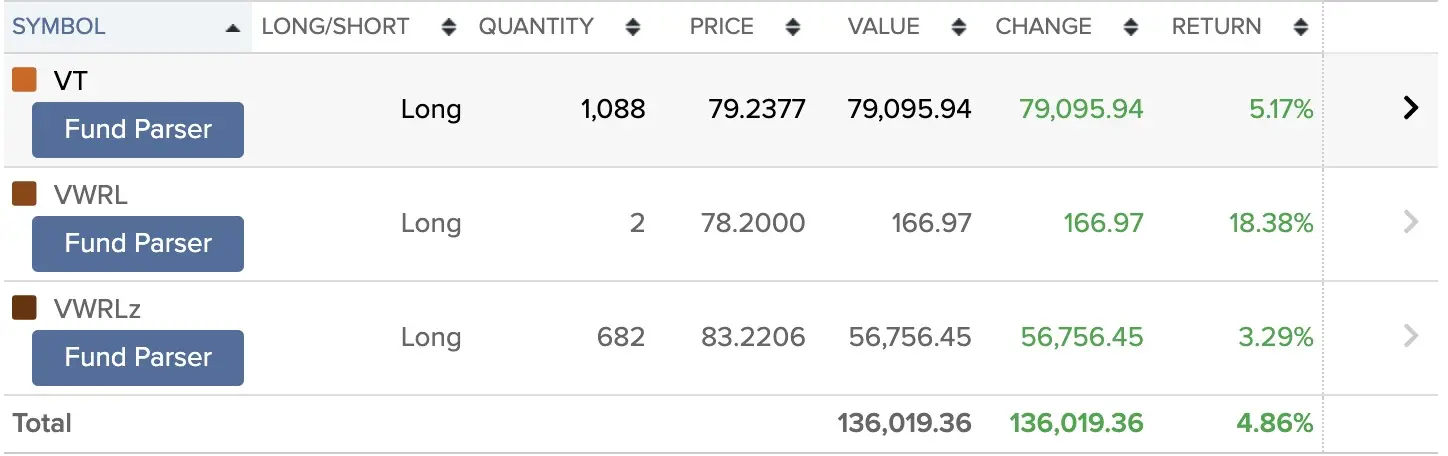

- VT ETF (my favorite world ETF world)

- VWRL ETF (which I stopped using since May 2020)

- My “value investing” stocks

- Swiss shares of my company

- Mrs. MP’s VIAC 3a pillar invested with the Global 100 strategy

- My 3a for the indirect amortization of our Swiss mortgage (I don’t really consider it as an investment because of its composition: incomprehensible structured products with lots of hidden costs)

- VWRL ETF (free of charge) for our children (we invest this cash via a DEGIRO account to separate our personal wealth, and also to test this famous VWRL as well as DEGIRO ;))

Real estate

- Rental building in France

- Real estate loan for a Swiss real estate project

The amounts of my investments as of 31.10.2020

| Vehicle | Amount in CHF |

|---|---|

| VT ETF | 78'863.15 |

| VWRL ETF (which I have stopped using since May 2020) | 56'923.40 |

| My value investing stocks | 30'971.94 |

| My Swiss shares | 22'566.99 |

| Mrs. MP’s VIAC 3a | 34'968.45 |

| VWRL ETF (no fees) for MP children | 10'726,09 |

| France building (notary fees and bank file) | 19'389.46 |

| Swiss real estate loan | 30'000.00 |

| Total | 284'409.48 |

The performance [1] of my investments as of 31.10.2020

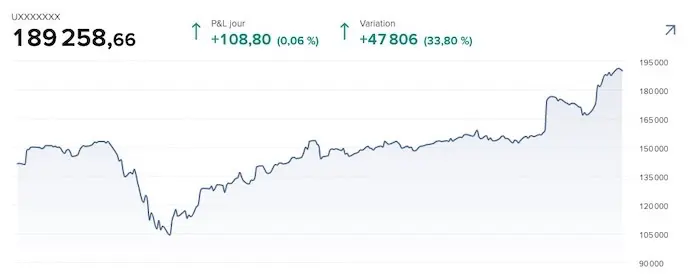

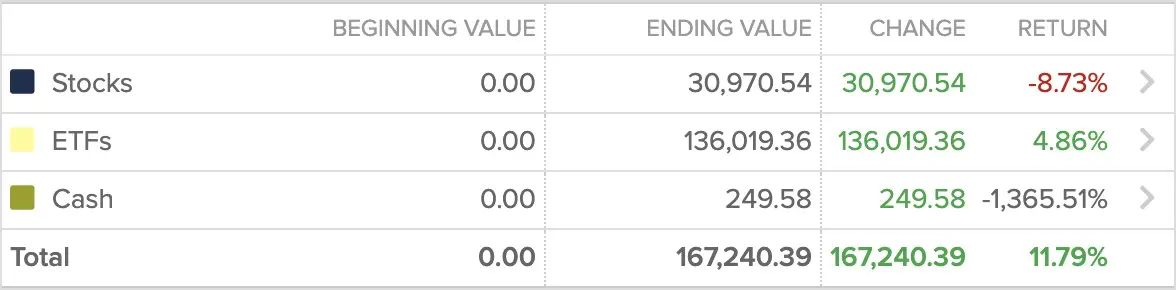

ETFs and “value” shares (via Daubasses) (invested via IBKR)

As a reminder, I started my journey as a Swiss investor in ETFs via Interactive Brokers in October 2016 (I used to invest via Swissquote beforehand, but I no longer have a report from this period).

Then, in June 2019, I started investing in value by following to the letter (for the moment) the purchases and sales of the Daubasses.

Swiss shares of my company

I buy shares of my Swiss company (not listed on the stock exchange) almost every year, and this since 2014.

I don’t have as good a report as Interactive Brokers for these shares.

Nevertheless, by entering my values in this Moneyland.ch yield calculator, I arrive at an annualized yield of 10.57%. Not so bad!

VIAC 3a pillar Global 100 of Ms. MP

As mentioned above, Mrs. MP’s 3a pillar is invested in shares as much as possible.

We moved to VIAC in June 2018.

N.B. VIAC only offers the “time-weighted return” calculation, and not my preferred “money-weighted return” calculation.

VWRL ETF of the children (invested via DEGIRO)

As a reminder for newcomers, CHF 50/child/month is paid into a DEGIRO investment account since their 2 years old. This money will serve them for an important life project (we still have to align ourselves with Mrs MP :)). But clearly, it won’t be to take a VW Golf in leasing, or to go partying in Ibiza during the summer vacations :D

We transferred our children’s investment account from Cornèrtrader to DEGIRO at the end of 2019, after Cornèrtrader added overnight inactivity fees.

During our investment period via Cornèrtrader from December 2016 to November 2019, the time weighted annualized return was 6.62%.

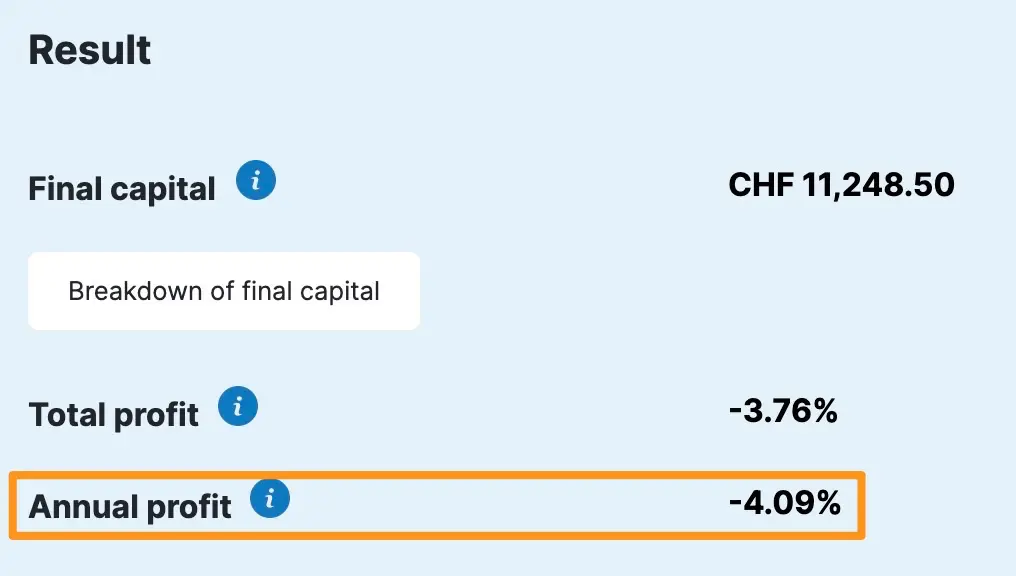

As DEGIRO does not currently offer a view with the annualized return, but only the performance in nominal value (i.e. how much I earned in CHF compared to the money I put in), I calculated the return myself via this Moneyland calculator. This gives us this result:

By combining the periods of the two platforms, we arrive at an annualized return of 3.91%.

Building in France

Concerning our rental building in France, rents are falling and repaying the property loan at the expected rate (including the planned rental vacancy).

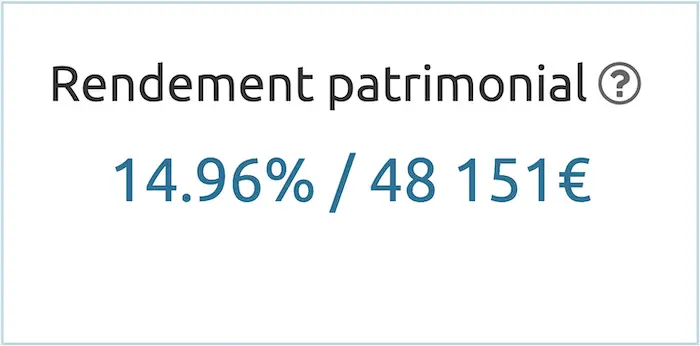

We are still counting on an internal rate of return of 14-15% according to the forecasts of the Horiz.io (formerly rendementlocatif.com) tool:

Expected internal rate of return for our investment property in France (after selling it back 10 years after purchase)

Real estate loan for Swiss real estate project

I don’t think I’ve ever given you so many details about this project.

To sum up, a real estate entrepreneur proposed me to invest in the construction of a small Swiss real estate project by lending him cash. CHF 30'000 to be precise. High risk, little diversification, and therefore correspondingly high return. 55% to be transparent.

It sounds crazy written like that, but I’m not crazy and don’t drop 30kCHF like that. We went past the notary’s office for an IOU. And also, the 55% is how I calculate my return. For the entrepreneur, it’s different. First of all, thanks to my cash, he was able to carry out the project — otherwise it wasn’t possible. And secondly, my “55% return” corresponds to “only” 10% of the total capital gain he will make. Pure win-win as I like it :)

Summary of MP performance as of 31.10.2020

| Vehicle | Inception date | Annualized return |

|---|---|---|

| VT ETF | 2016 | 5.18 |

| VWRL ETF (which I have stopped using since May 2020) | 2016 | 3.29 |

| My value investing stocks | 2019 | -8.73 |

| My Swiss shares | 2014 | 10.57 |

| Mrs. MP’s VIAC 3a | 2018 | 6.37 |

| VWRL ETF (no fees) for MP children | 2016 | 3.91 |

| France building (notary fees and bank file) | 2019 | 14.96 |

| Swiss real estate loan | 2020 | 55 |

Comments to myself

I share below the comments I made to myself while writing this article. If you have others, share them with me via the comments section at the bottom of the article.

1. Portfolio allocation

I’m late with the evaluation (usually annual) of my allocation between the different vehicles. In recent months, I have been operating more on performance opportunity than on a strict methodology. This needs to be corrected. Although at first glance I’m pretty much in stocks, which suits me well.

2. ETFs my dear, ETFs

Seeing the performance of my VT and VWRL ETFs, as well as my VIAC strategy, this only confirms my recommendations that this is the way to go for any “average investor”.

In any case, I continue to transfer all our savings to it happily, and regularly!

3. Stock market rather than real estate it seems for MP

The more real estate opportunities I have (in France), the more I tell myself that it’s quite a lot of work to manage (purchase, notary, tenants, repairs, etc.), and that I much prefer to invest in the stock market where everything is just a click away. On the other hand, buying a rental property in Switzerland, close to home, might please me. At least once, for the experience.

4. Comparison of Swiss Pillars 3a

I saw that Frankly and Finpension were coming to titillate VIAC’s business model. Seeing how things are moving these weeks, I let all the announcements happen before updating my comparison (in early 2021 I think). What’s more, the marketing figures of the newcomers have to be dug up to make sure we’re talking about the same thing. And also in terms of the security of each new tool, in particular finpension, which does not offer formal identity verification when opening a 3a account with them.

5. Too many risks with my Swiss stocks

Part of my brain is telling me: “You should sell all the Swiss shares of your company, and transfer that cash into a Swiss index ETF. It’s far too risky to acquire shares in the company that employs you. Because you have your salary and cash depending on them… “

Then, the other part of my brain replies: “Yeah, but you’ve seen the great performances all along. It’s just getting better and better. Yes it’s anything but diversified, I’ll give you that, but it’s only 20kCHF. Come on, I promise, let’s make a deal; I’m not buying it again for tens of thousands of CHF, and you let me keep them, please…!”

It’s hard to be me, I swear :D

6. Value investments

I don’t jump to any conclusions about this portfolio because we haven’t even had it for a year. Nothing to add :)

7. I don’t care about performance from month to month

Since I invest for the long term, I don’t really care about the month-to-month volatility of my investments. I really don’t. So each of my reports of this type will always be “since the inception date of the said portfolio “, and never “since last month”.

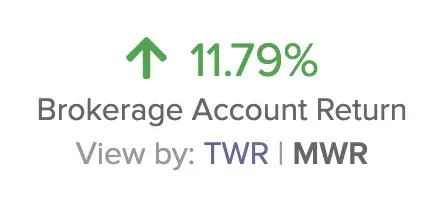

8. Understanding MWR calculation on Interactive Brokers

I understand the difference between MWR and TWR (see end of article). On the other hand, I cannot explain how I arrive at an overall average TWR of 11.79% when my shares are at -8.73% and my ETFs at 4.87%. Either I really didn’t understand something (quite possible!), or there is a bug at IB (I wrote them an email to understand the why of the how).

9. Overview of my performance…

A member of the Sharesight team contacted me a few months ago to introduce me to their product. I told him that with IB and their PortfolioAnalyst, I had everything I needed to get a good overview.

And then, while writing this article, I had to admit that his tool would have actually helped me a lot… except that their price of 24USD/month is really expensive for just an annual checkpoint…

I could also get into Excel but that’s a lot of platforms to reconcile, not to mention the potential miscalculations.

Anyway, for now, I’m sticking with the status quo.

And you?!

How have your investment portfolios performed since their inceptions?

In case you haven’t started investing yet, the first best time for that was yesterday. And the second best time is today! I recommend these two links to get you started:

- How would I invest CHF 10'000 in the stock market if I started today? (with or without a coronavirus crash, it doesn’t matter!)

- Guide to choosing your online broker as a Swiss investor

[1] When available in the reports provided by my different platforms, I prefer “Money Weighted Return” (MWR) rather than “Time Weighted Return” (TWR).

As well explained on the website Starlight Capital:

- Money-weighted return measures the rate of return on an account over a given period of time, including your investment decisions and business activity on the account (e.g. withdrawals, deposits, transfers). This is the right method when you are looking to analyze your personal investment experience and account performance. It also helps clarify the impact of your investment decisions on your account.

- Time-weighted return measures the rate of return of a fund over a given period of time, excluding your investment decisions and business activities related to that fund (e.g., withdrawals, deposits, transfers). It is the method you use when you want to measure the performance of fund managers and compare it to that of benchmark funds. It allows you to obtain a rate that can be compared to that of other funds.