Time flies…

It’s been two years since I published the first performance report of my investment portfolio!

I think it’s time to do something about it, and finally talk about money and profit on this blog! :D

As I was telling you at the time, investing is one of the pillars of any FIRE (Financial Independence, Retire Early) strategy.

In fact, you will be able to live without having to work for money thanks to the returns your portfolio makes which will provide you with the necessary passive income.

Investing is one thing, but being profitable from investing is something else.

So let’s see what all my Swiss and foreign investments have brought in so far.

My investment portfolio as of 31.12.2022 (stocks, real estate and cryptocurrencies)

As a refresher for the newbies — it’s starting to get too much to handle, even for me — here’s the complete list of my investments as of the end of 2022:

- Stocks

- ETF VT (my favorite global ETF)

- ETF VWRL (the global ETF which I stopped using since May of 2020)

- My “value investing” stocks

- Swiss shares of my company

- The 3rd pillar 3a VIAC of Mrs MP invested with the Global 200 strategy

- My new 3rd pillar 3a VIAC, invested with the same Global 100 strategy like Mrs MP’s

- ETF VWRL (no cost) for our children

- Real estate

- French rental property #1

- French rental property #2

- I won’t include the P2P real estate loans we’ve had in the last two years since they’ve all been paid off

- Further, I won’t mention our rental building in Switzerland because it will be booked in 2023

- Casino

- Cryptocurrencies Bitcoin, Ethereum and Litecoin purchased twice at their peak (in 2017 and late 2021…)

My investment amounts as of 31.12.2022

| Investment Instrument | Amount CHF | Total Percentage |

|---|---|---|

| — | — | — |

| Stocks | 534'583.95 | 97% |

| ETF VT | 320'674.03 | 58% |

| ETF VWRL | 55'393.83 | 10% |

| “Value investing” stocks | 35'573.36 | 6% |

| Swiss stocks | 31'386.60 | 6% |

| Mrs MP’s 3rd pillar | 55'608.34 | 10% |

| Mr Mp’s 3rd pillar | 19'919.40 | 4% |

| ETF VWRL (MP’s children) | 16'028.39 | 3% |

| — | — | — |

| Real estate | 11'617.41 | 2% |

| French rental property #1 | 33'584.97 | 6% |

| French rental property #2 | -21'967.56 | -4% |

| — | — | — |

| Casino | 5'643.34 | 1% |

| Cryptocurrencies | 5'643.34 | 1% |

| — | — | — |

| TOTAL | 551'844.70 | 100% |

Our value investing stocks, our 3rd pillars, and the children’s ETFs all contain both global and Swiss stocks.

I suggest you to take a look at my stock market assets only to see the distribution between Swiss and global stocks.

It’s quite straightforward because when I look at the information sheet of the ETF VT and the VWRL, I see that:

- The ETF VT contains 2.4% Swiss stocks

- The ETF VWRL contains 2.5% Swiss stocks

My Daubasses sub-portfolio contains only one Swiss stock of CHF 500, so I won’t take it into account.

And finally, our two 3rd pillar 3a VIAC with the Global 100 strategy contain 38% of Swiss stocks.

Here is a summary of my stock market assets at the end of 2022, classified by geographical location (global stocks or Swiss stocks):

| Stock market assets | Amount CHF | Percentage of total stocks |

|---|---|---|

| Global | 429'442 | 80% |

| Swiss | 105'142 | 20% |

| Stock Total | 534'584 | 100% |

The World/Switzerland ratio is a bit too conservative for my 8-9/10 risk profile, being the Mustachian shareholder I am…

I would prefer having around 90-95% global stocks!

Nevertheless, I am on the right track since I almost don’t buy any Swiss shares with my company anymore and my ETF VT is growing faster than our VIAC 3rd pillars including Mrs MP’s :)

The investment performance as of 31.12.2022

Well, now let’s go to the most interesting part: the performance of all my investments at the end of 2022!

As a reminder, I use the “Money-Cost Weighted Return” when the info is available.

Just like I explained in my Interactive Brokers guide:

There are two ways to measure the % return on your stocks. And Interactive Brokers offers you both choices: time-weighted return (short TWR) and money-cost weighted return (short MWR).

To put it simply, the TWR allows you to know the return between two dates without considering account movements (such as cash deposits/withdrawals and stock purchases/sales). It's great for comparing two portfolios together.

The MWR on the other hand, allows you to know the % return of your portfolio by considering all cash and stock purchase/sale movements. It is ideal when you want to know your own return

Personally, I use the MWR to take my Mustachian decisions into account when I invest in the stock market (i.e regularly following my process, as well as during sales when there are market crashes).

Performance of my ETFs and value stocks

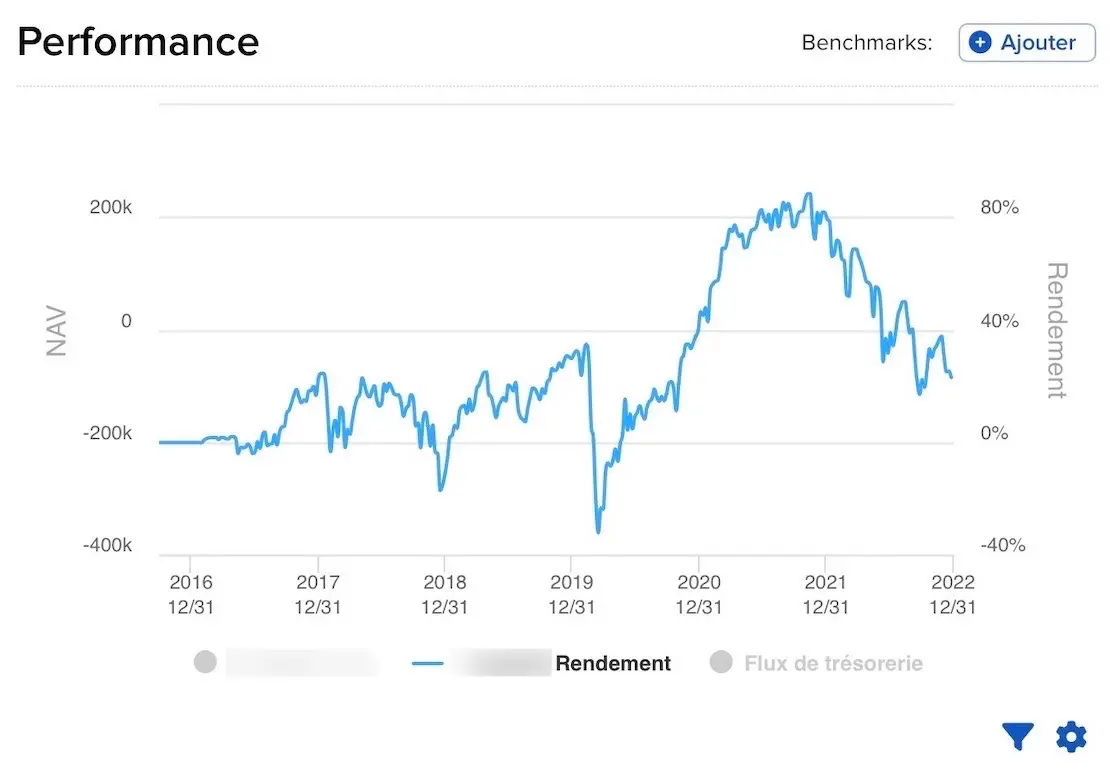

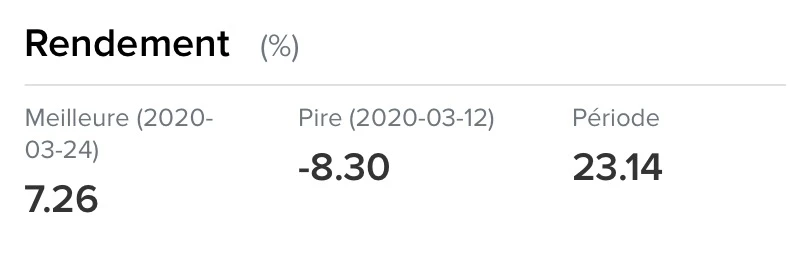

Since October 2016, I have been investing all my assets via a securities account on the online broker Interactive Brokers (*) as a Swiss investor.

I started and still mainly buy my favourite ETF VT.

Then I started value investing via Daubasses with a small part of my portfolio in the stock market.

Performance of my ETFs and value stock portfolio since its creation in October 2016 till the end of 2022

+23.14% return since I created my Interactive Brokers account, not too shabby!!

So that’s for the “private” part of my investments.

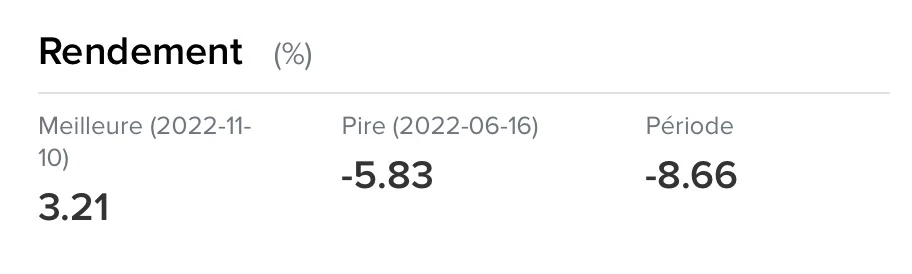

As I also invest in the stock market via my Swiss company since November 2020 and also via the online broker Interactive Brokers (*).

I only own the ETF VT on the stock portfolio with my Swiss company.

Here is its performance:

And if you wonder: “Yes, I still sleep soundly with a return of -8.66% 😱 thank you very much. This is thanks to me being in this game, which is the stock market, for the long term! Or how could you invest in the stock market successfully without worrying about fluctuations!”

Performance of my company’s Swiss shares

I have bought less shares with my Swiss company than in the past.

Nevertheless, it still represents a non-negligible part of my stock portfolio.

As per usual, I used the Moneyland.ch return calculator.

I get an annualized return of +5.72% on my Swiss company’s shares.

3rd pillar VIAC Global 100 of Mrs MP

As a reminder, Mrs MP switched her Pillar 3a to VIAC in June 2018.

And we can say that the perfomance of her portfolio is more than respectable with a nice +30.87% return since its creation :)

FYI, VIAC only offers the return calculation in the “time-weighted return” form (not the one I prefer: “money-cost weighted return”).

3rd Pillar VIAC Global 100 from Mr.MP

It feels great to share my experience on this VIAC 3rd pillar, after being able to terminate my combined 3rd pillar linked to life insurance 💪

And even though this change is recent, we celebrated a performance of +7.43% with my VIAC Global 100 portfolio. Absolutely stunning!

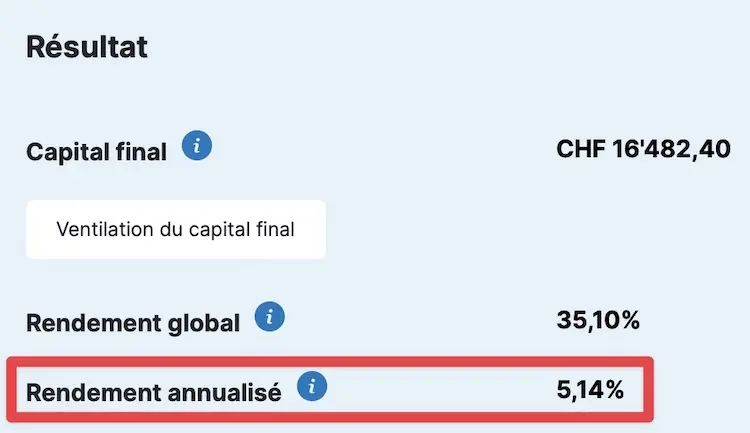

Children’s ETF VWRL Performance

We invest our children’s savings via a securities account with DEGIRO to keep it well separated from our personal assets, and simultaneously test the European broker DEGIRO.

I don’t regret leaving BCV with their 0.60% interest rate at all! (that is only up to CHF 25'000, because beyond that it’s only a mere 0.05%…)

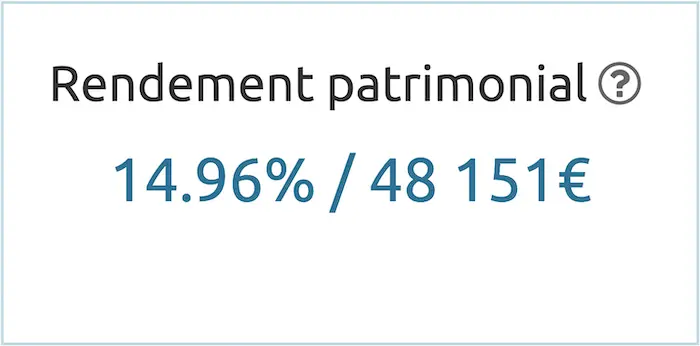

Rental return of 1st building in France

This building is on its right path with rents that are coming in, expenses that are being paid, and a real estate loan that is gradually being repaid. A beautiful and successful investment so far!

We’re still expecting a internal rate of return of 14-15% after resale at 10 years via the tool Horiz.io (formerly rendementlocatif.com) *:

Expected internal rate of return for our 1st investment property in France (after resale 10 years after purchase)

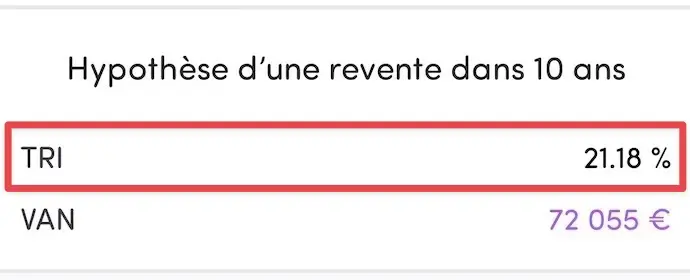

Rental return of 2nd building in France

We acquired a second rental investment in late 2022. All details are in this article.

The projections are even better than our first building.

In fact, this building has been fully occupied for over 15 years. And its location is even better than our first rental building.

We are aiming for a return of +21.18% after resale in 10 years.

Expected internal rate of return for our 2nd investment property in France (after resale 10 years after purchase)

Performance of our cryptocurrency portfolio

We couldn’t finish our performance report without talking about our little “casino” investments :)

My portfolio consists of Bitcoin, Ethereum and Litecoin.

I bought these at the worst time ever(i.e. crypto peak)… twice in a row! :D

Which gives us a astonishing return of -7.5%.

You can find more info on how I created my portfolio (at the time, it’s changed a lot since then!) via this link.

As I like to say, I keep this cryptocurrency portfolio for the long term for two reasons:

- To keep an eye on this fascinating and crazy world of cryptos

- You never know, maybe in 30 years I’ll be a billionare thanks to this ^^

Investment Performance Summary as of 31.12.2022

| Instrument | Creation date | Annualized return |

|---|---|---|

| ETF VT, ETF VWRL, and value stocks (private account) | 2016 | +23.14% |

| ETF VT (corporate account) | 2020 | -8.66% |

| My Swiss shares | 2014 | +5.72% |

| 3a VIAC Mrs. MP | 2018 | +30.87% |

| 3a VIAC Mr. MP | 2022 | +7.43% |

| ETF VWRL children of MP | 2016 | +5.14% |

| French rental property 1 | 2019 | +14.96% |

| French rental property 2 | 2022 | +21.18% |

| Cryptocurrencies | 2017 | -7.5% |

Comments on the performance of my investments

Below I share with you the thoughts I had about my investment portfolio while writing this article.

I’ll gladly take your feedback in the comments at the bottom of the article.

1. Combined view by “Stock type” in my Interactive Brokers account

In my last investment report, I was able to find the performance by stock type in my IBKR account (this was the case since I created my securities account in 2016).

In other words, I could see the separate performance of my ETFs on one side, and my value stocks on the other.

It seems that this comparison does not exist anymore (I asked Interactive Brokers support and I am waiting on their return).

It’s quite a shame because I find it very interesting to be able to see the performance of each type of stocks.

2. Stock investments Global vs. Switzerland

As I mentioned above, my risk profile is around 8-9 out of 10.

This means that whenever my stock portfolio loses 20-30% of its value as it did last year. Don’t worry, I still sleep well since I am in on this adventure for the long term. And such fluctuations are part of the game.

Therefore, I will continue to concentrate my future investment in my ETF VT in order to increase my share of global stocks in my portfolio.

3. Increasing the focus on the US stock market?

The performance of the US stock market is fairly well reflected in the VT ETF, which is composed of 62.10% US stocks.

Nevertheless, given the historical performance, I am tempted to increase my exposure to the US (via an S&P500 ETF).

For now, it’s just a thought.

You’ll be the first to know when I adjust my portfolio.

I have to say I also like the simplicity of investing only in my ETF VT… ;)

4. Real estate investment in France

The second rental property purchase in France was not on the agenda..

The opportunity was just too good to be true.

However, unless there is a similiar opportunity, we will not be actively looking for a new French property for the following reasons:

- The laws governing real estate change too regularly with each new goverment

- The same goes for the taxation of investors, which changes according to the political situation… not great for your return calculations

- The Swiss administration is much better regulated and reliable than in France, where you feel powerless because they are so distant and unreachable directly… (we are really lucky, and yes, I am talking about the Swiss administration :D)

- The legal environment landlord is much less qualified in France than in Switzerland. Even if it’s not great here, it’s still easier to enforce the laws in Switzerland than in France

5. Real estate investment in Switzerland

After our first acquisition of a rental property in Switzerland (SPOILER: we signed recently, an article is coming soon), we see a huge opportunity to increase our wealth in large steps.

When I say large steps, I mean a few hundred thousand CHF at a time.

And notably via the following techniques:

- Leverage effect of mortgages

- Potential to increase value of the assets, with a mortgage revaluation to fee up cash to reinvest in other assets

- Use of our Interactive Brokers margin account to capture rental investment opportunities without having to sell our ETFs

My switch to 80% part-time is not a factor either.

This time freed from any professional constraint allows me to have more energy to manage this type of rental real estate project in Switzerland.

Again, this is the plan for the near future and we’ll see how we can adapt it according to my feedback.

To be continued!

6. The money of my 3rd pillar invested in the stock market, FINALLY!!!

I’m going to repeat myself but you can’t imagine how happy I am to have finally gotten rid of my old mixed 3rd pillar which was linked to life insurance!

What a pleasure to have all this money in one of the best 3a products on the market!

7. Finpension test

You know very well that I always test what I recommend.

The only exception so far is the 3rd pillar Finpension.

In fact, apart from a demo account, that’s all I’ve tested with them. But I still recommend it as being equal with VIAC in my ranking of the best 3rd pillar in Switzerland for us Mustachians.

So it’s decided, this year I’m going to put in at least CHF 100 to be able to observe how the platform works in the real world (for the upside as well as the downside), and share my experience with you in a dedicated article.

New readers: how to invest in the stock market (and in rental real estate)

If you didn’t start investing in the stock market because of some irrational fear, remember one thing:

Yesterday was the best time to start investing. The second best time is today!

So don’t drool over the success of my investments and take action!!

A quick reminder: I have created two programs in order to guide you and to answer all of your frequent questions:

- How to buy stocks?

- How do I buy stocks in Switzerland?

- Is 2023 the right time to start investing in the stock market?

- How to make your money grow in Switzerland?

- Which Swiss stocks to buy in 2023?

The first program guides you to start investing in the Swiss stock market. If you don’t know anything and are terrified of the stock market, then you are just clicks away!

My second program is designed to guide you from A-Z in rental investment in Switzerland.

What about you?!

What’s new on your end in terms of stock market and real estate portfolio performance?

(*) This symbol indicates where my article contains affiliate links. If you click on one or more of them, you will see no differnce compared to the standard link - but the blog will receive an affiliate commision and I sincerely thank you for this. As usual, I only write about and review things that I use in my daily life, or that I trust