I have a recurring concern that is growing as my FI (Financial Independence) date approaches…

What if my financial independence plan falls through because of my mortgage?

Let me explain: when I reach financial freedom, that means I’ll have enough money coming in from my investments to pay my current expenses as well as my recurring expenses (monthly or yearly).

Except that most of this income will come from my stock market returns (and rental returns to a lesser extent), and not from a salary.

And this last point is a problem.

Not for me.

But for the bank that’s lending me the money for my mortgage. Indeed, this bank assumes that the norm is to be salaried. Even as an entrepreneur, it’s much harder to get a mortgage than it is to get a monthly salary.

Side note: It’s stupid when you think about it, because behind an employee, there’s also a company that can go bankrupt — just like that of an entrepreneur. Even more so than the solo entrepreneur who fights for survival every day. But hey, I’m not going to change the system or the banking rules, let alone the FINMA rules….

To be more precise, when I renew my mortgage, the Swiss bank will check that:

- My expenses do not exceed 33% of my gross annual income (including mortgage interest)

- The mortgage value does not exceed 80% of the estimated value of the property (that’s OK, because real estate in Switzerland has risen sharply since our initial purchase)

- We have a stable income (like the last 3 pay slips)

- We’ll be able to amortize the second mortgage in 15 years or before the legal retirement age (65) (corresponding to anything over 66% of the value of the property, so generally ~14-15% if you’ve borrowed 80% of the amount of your house)

- We don’t have too many debts such as leasing or other consumer credit

The problematic line in my case (= someone who’s going to be FI), is the stable income…

Banks are very used to lending to salaried employees, since this is the norm (~85% of the working population in Switzerland!!) But when it comes to lending to entrepreneurs (unless income is very stable over several years), it’s a different matter.

And I’m not talking about rentiers (aka financially independent folks). Well, that’s what I need to find out: is an annuitant with a good million or two sufficiently considered solvent via his income (from the stock market, real estate, and other investments)? And above all, at what cost? Does the annuitant/rentier/FI-person have to invest his money with the lending bank at enormous cost…? No, thank you!

But all that remains my hypothesis for the moment, because maybe, there are plenty of smaller or private banks that are more open-minded than the average.

My mortgage options once I’m FI

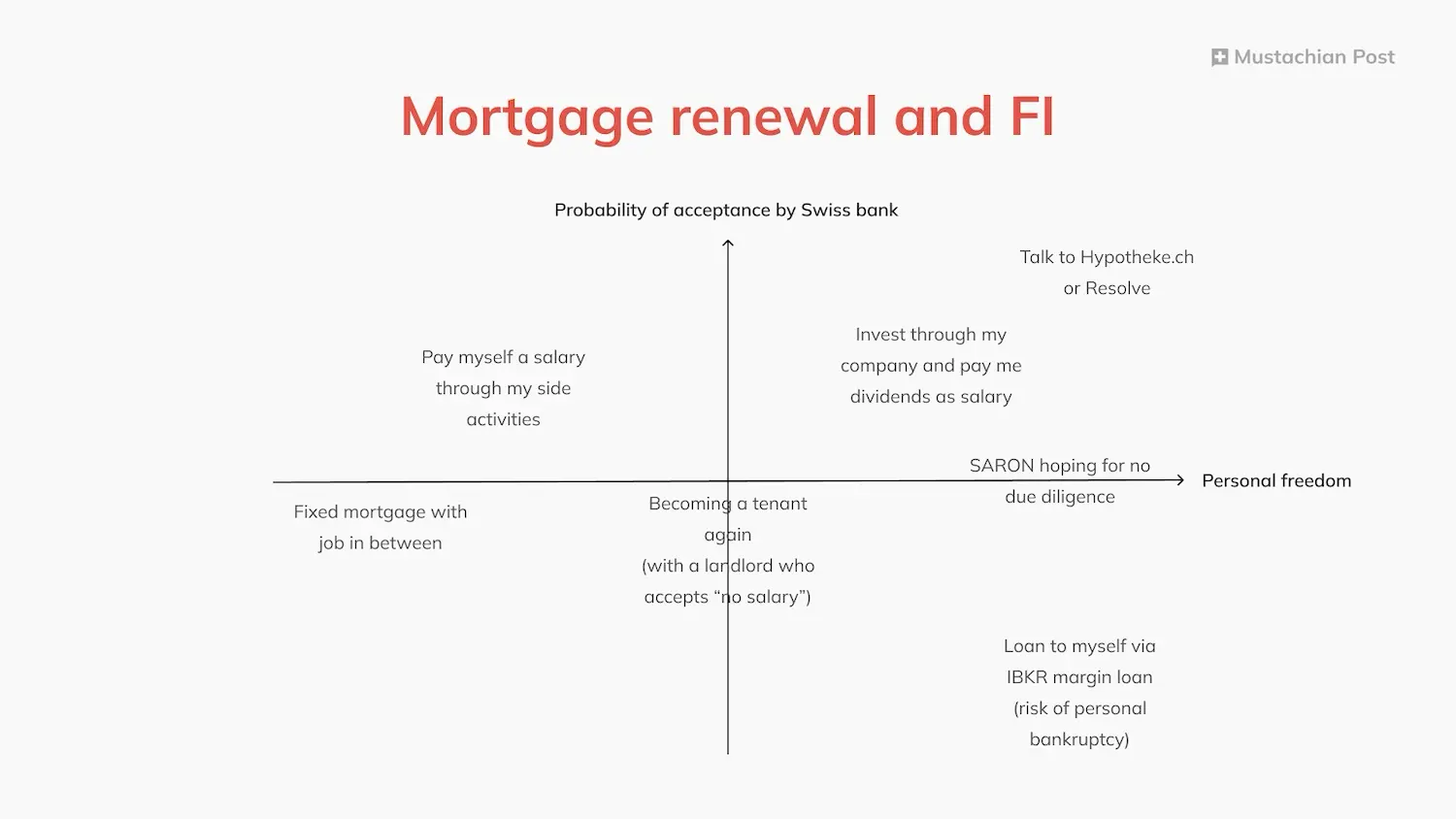

So I’ve been thinking about my mortgage options once I’m financially independent:

- Create a limited company (AG or GmbH), then invest my stock market assets via the latter, receive my dividends and other ETF sale’s money, and pay myself all this as a fixed salary (N.B. this isn’t necessarily the wisest from a tax optimization point of view…)

- Set up a company with my side activities (blog, real estate, etc.) and pay myself a salary. This is one of the most likely solutions, but I’m trying not to have to work at all (for money), and also to fit in with the reality of as many readers as possible, who may not have any idea of an ancillary activity that pays a salary

- Take out a fixed mortgage for 10 or 15 years, and then, in year 12-13, find a job for 2-3 years (err…) to meet the banks’ requirements (heuu, is this a financial independence blog or…?!)

- Sell our home, and go back to renting so no one bothers us (we still have to provide the landlord with wages to prove our solvency, but I think a simple screenshot of my Interactive Brokers account should reassure him pretty quickly :D)

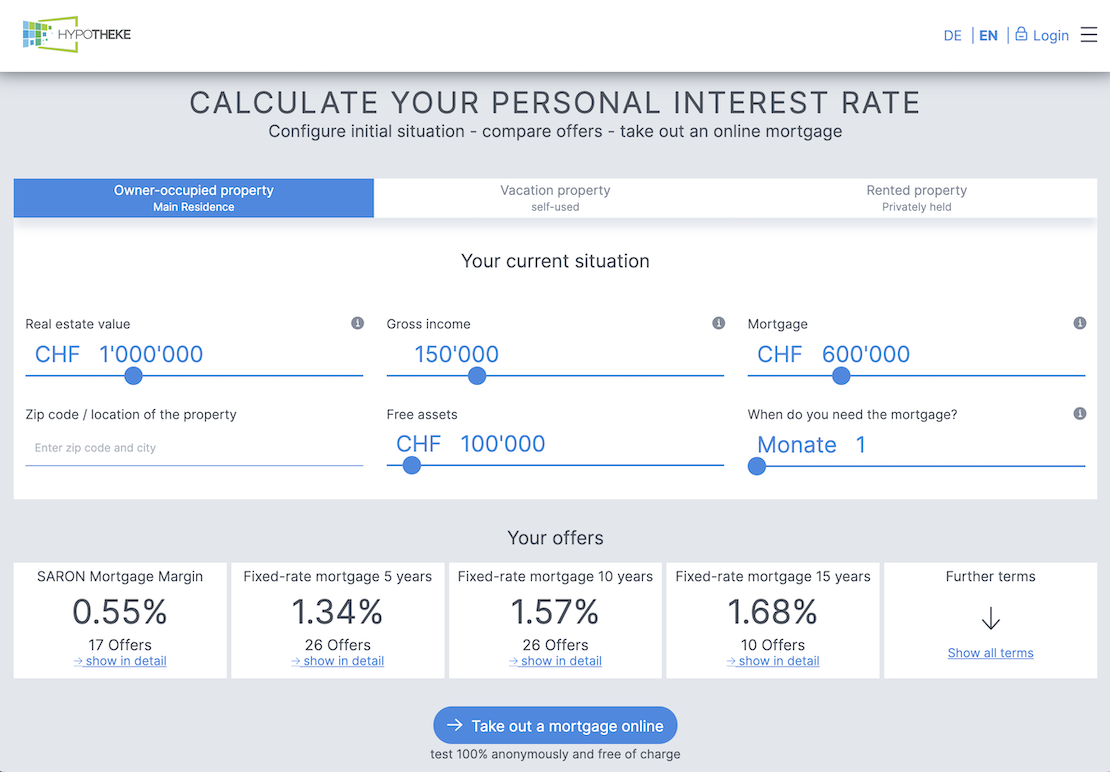

- Talk to Hypotheke.ch or Resolve, as they have much more open-minded partners, who might come up with other creative solutions rather than just my last three payslips

- Keep my VIAC mortgage in SARON and crossing my fingers that the bank doesn’t contact me one day to update their compliance requirements…

- Lend money to myself via my Interactive Brokers margin account (and risk personal bankruptcy if the stock market takes a huge dive… unless I build up such a huge amount of capital in the meantime that it works out easily)

And I’ve ranked these options according to the probability of acceptance by the bank on one axis, and what it implies for my personal freedom on another axis:

I can already hear people telling me that renting is the ultimate solution. Fair enough. But for me, it’s not so much a personal freedom, because I want to remain an owner… so it forces me to make a choice I don’t want to make.

My plan A and my plan B

The biggest problem is that I currently have a mortgage in SARON, and nobody asks me whether I have a salary or what… So I’m very tempted to say nothing, and make it my plan A.

But realistically, to sleep soundly, the solution that seems most reliable to me is to talk early enough (like 6 months or 1 year before taking early retirement) with Hypotheke.ch and/or Resolve. That way, I can ask them what they can offer me and on what terms. One of the fears I have is that they won’t accept my pillar 3a invested 100% in stocks as collateral… but hey, if that’s the price to pay, it’ll still be cheaper than a bank asking me to put a million with them as an investment… with astronomical fees!!!! That would be my plan B..

Conclusion

My concern with this whole mortgage/bank/financial independence thing is that I won’t be able to check off all the compliance boxes, not that I won’t be able to pay them. After all, I could buy a whole building if I wanted to!

So I’m thinking of paying the necessary fees to Hypotheke.ch and/or Resolve to have an analysis “as if” I were going to have to take action, and see if they really can find me a solution. And if they do, then I’ll be reassured.

But whatever happens, I’ll stay with my VIAC mortgage in SARON for as long as possible; that is, until they redo their due diligence and tell me they’re no longer OK to finance me, and then I’ll move on to my plan B.

Got another idea?

As you can see, I’ve been thinking about all this lately. It’s not for tomorrow, but it’s getting closer as time goes by.

So, if you went through it or soon will be, I’d be very interested in discussing with you (and obviously debriefing it all in a future blog post). You can contact me via the comments below or by replying to any of my newsletters.

Last updated: July 24, 2025