I’ve been meaning to write a new article in this “Journal” category for a long time.

Imagine, the last blogpost was in 2023!!!

So it was tough during the past 3-4 months, as I’ve been itching to prioritize other articles over this one…

Why is that?

Simply because I’m getting closer and closer to FI (“Financial Independence”).

I’m almost financially independent…

I have to write it down to start believing it: “We’re going to be FI soon!!!”

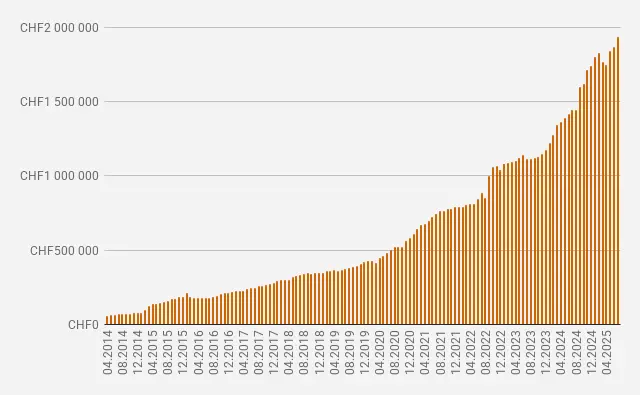

This FIRE goal 1 has been so far away for the past decade, I could hardly believe what I saw in YNAB when I last updated our accounts:

So, yes, we’ve passed the 90% mark of our goal to reach CHF 2'156'000 in net assets.

For newcomers, I arrived around this number in the first place via the 4% rule. Then, I made an appointment with VZ in 2015 to have a much more precise simulation, taking into account all the Swiss specificities. And that’s how I arrived at my new fetish number for over 10 years now: CHF 2'156'000.

And knowing that I have a real estate project (presented in this article) that will soon come to an end, in addition to other earnings from our salaries and other side gigs, it could be that we’ll pass this fateful mark sooner than expected… suspense!

As the saying goes: “Don’t count your chickens before they hatch.”

Nevertheless, it’s becoming more and more concrete, and the psychological aspect accounts for a good 60% as opposed to 40% for all the financial issues involved.

But…

FI yes, but RE (retire early)… Really?

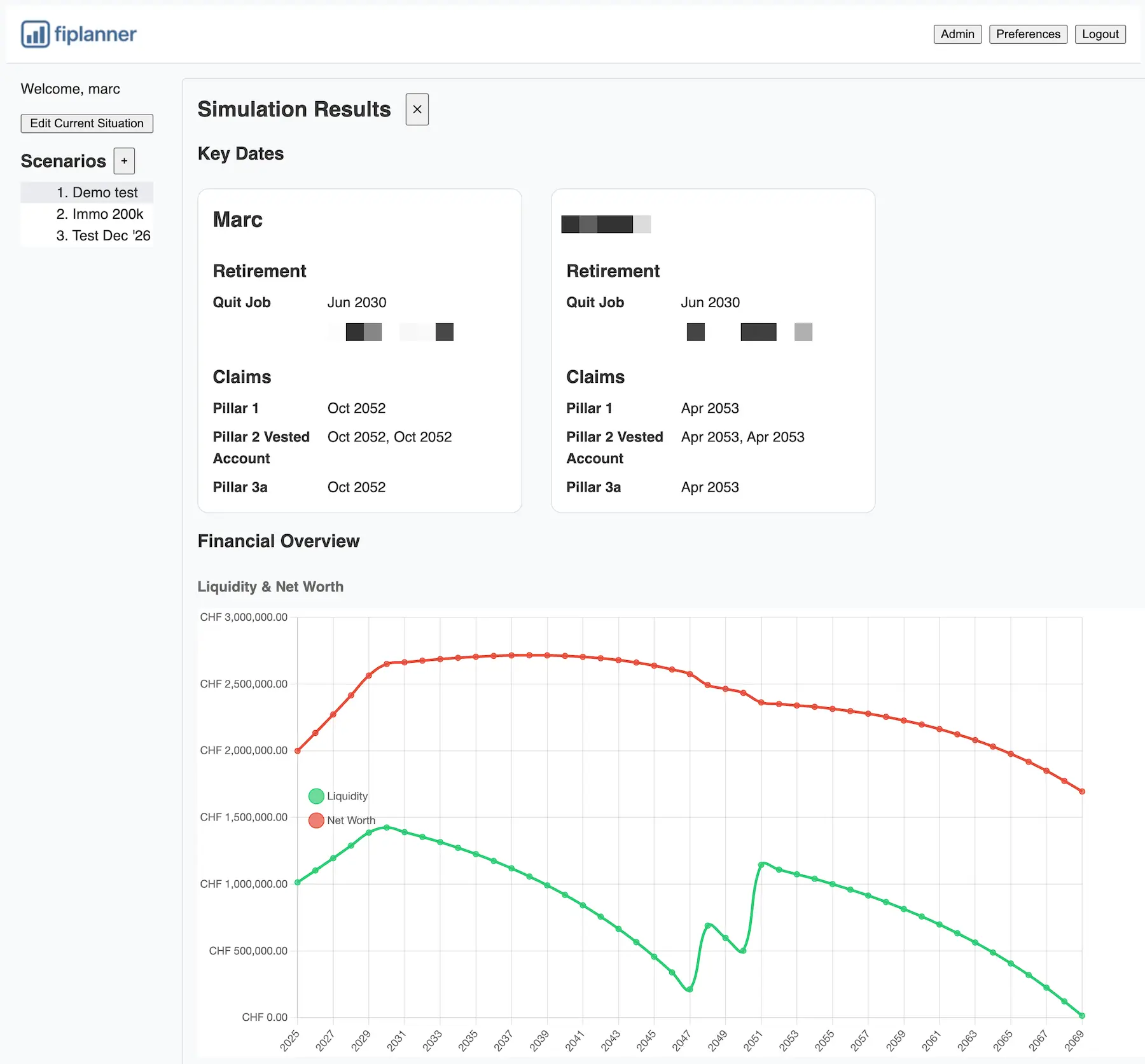

As we pass the symbolic 90% mark for our goal of financial independence in Switzerland, we’re making great strides with our Swiss FI planning tool with Patrik.

The results screen of our 'FI Planner' web application (currently being finalized before official launch)

But anyway, the tool also confirmed to me that all the real estate I’ve invested in so far isn’t… liquid. What a surprise!

So, as we don’t want to sell our home (this scenario was favored by VZ at the time), and we have part of our wealth in rental property, this would technically mean that all told (liquid and non-liquid wealth), we’d need to reach around CHF 2'600'000 (instead of CHF 2'156'000).

A comical aside: one of the close-to-reality simulations gave me CHF 2’651‘000 as the FI target… :D

All this to say: yes, we’d be FI on paper at CHF 2'156'000 if we sold all our real estate (including our home, by becoming a tenant again).

But now that we’re almost there, we can pretty much say with certainty that our decision is made, and that we want to remain homeowners.

The next question is logically…

But what are you actually going to do, MP?

It’s a pity in a way that I’m not just an employee, that I only have two simple ETFs, and that we’re tenants. That way, it would be simpler and more representative.

But would it really be representative?

Not so sure…

Because, when I go through all the readers’ emails, I can see that everyone has this or that parameter that changes a little: a self-employed husband, young children (or who are finishing school very soon), a wife who has US nationality and not Swiss (and that complicates things quite a bit), or an Italian or Portuguese husband with a life plan to return to live in his country of origin once he reaches FI, and so on.

So, on the contrary, our current situation with Mrs MP is a good illustration of the fact that there are as many situations as there are people on the road to FI.

On our side, the potential choices I imagine:

- We both continue our jobs until 2 years from now, as planned, and this way we maximize our liquid assets (and, potentially, if all real estate is up in the meantime, this gives us a big cushion in almost “Fat FIRE “ mode)

- Mrs MP continues to work for 1-2 years in order to be psychologically ready (because yes, that too is a reality to be taken into account in the plan), and I stop before 40 while continuing to pay myself a salary for two years via real estate (which I’ll be stepping up) and some new projects linked to the blog, to ensure that we reach 2.6M at 40 years old

- We’ll stop working together in a year’s time, and we’re confident enough in our entrepreneurial side projects to reach 2.6M in the following 1-3 years, in “Barista FIRE” mode, kinda

A little bird tells me it’ll be between plan 1 or 2, knowing our need for financial security and the psychological aspects that go with it (leaving a job, impact on social life, etc.) Yet, we’ll mostly live with the flow, and adapt as we go along.

But the reality is: it’s getting closer!

As an aside, I can already hear the FIRE police laughing: “Muahaha, what a liar that MP is, that’s not early retirement!!!! You’re either both on a beach with cash falling from the sky, or everything you’re saying is BS, period!” I recommend you change blogs if you’ve just said that to yourself ;)

Finally, some action, after a dull moment of boredom

Anyway, all that to say that we’ve still got a little over 2 years to go before I live up to the title of my book, and a lot can still change. In any case, it’s super interesting to get to this part, because, honestly, it’s been lacking action for the last 3-4 years (apart from rental real estate).

Because it was cool in 2013-2015: optimizing all our expenses, maximizing our income, etc., it was also exciting.

Then, we had the purchase of our home, which kept us busy for 1-3 years.

Then the blog grew, and along with it my real estate business.

But becoming financially independent is a long road. And I have to admit that the lack of concreteness, and of simply having to follow a “Earn -> Save -> Invest” thread, was starting to get long since the post-COVID period.

So here we are: we’re now entering the planning phase of the change from employee to financially independent, and I’m looking forward to sharing the challenges of the next few months with you (did someone say mortgage?!)

CHF 450'000 in two years?

Um, MP, if I understand correctly, you think you can earn +450'000 Swiss francs in net worth in two years? Please tell me your secret!

Ahaha, you’re taking the words right out of my mouth. Because if I’d read that in 2013, I’d have had the same question as you!

And yet, the explanation is simple:

- The effect of compound interest is crazy. When there’s a small jump in the value of the VT ETF by +CHF 2, my Interactive Brokers brokerage account shows us +CHF 15'000. And when it’s more violent, like in April (Trump tariffs), we lose 70kCHF over two months, then +CHF 67'000 again between last June and August.

- Yes, we’ve now exceeded CHF 900'000 invested in the stock market, and we’re closing in on the million mark! So things are moving fast at the slightest positive jolt

- I’ve got a fifth real estate project in the pipeline, which will also help us to reach our target of 450kCHF quickly

- And then there are our salary increases and various bonuses

- And the side blog activity on top of all that (with my programs, my book, and soon FI Planner)

So, re-reading this list, I’m not too worried that it’s going to go up nicely, and quite quickly!

And as I always say: at first your money adds up slowly, but when compound interest really starts to kick in, it really boosts your net worth!

We've gone from CHF 48'000 to CHF 1'000'000 in 9 years, and we're going to go from 1MCHF to 2MCHF in 4 years 💰

Side note: you can follow the evolution of my net worth and savings rate in real time (updated monthly) on this page.

Conclusion

So much for my journey to financial independence! It gives me great pleasure to be able to share all this with you, who’ve been following me since the beginning (it’s been over 10 years already!)

I’ll give you a more complete rundown of all my current projects in a future article in this “Journal” series, but for now, I wanted to keep the focus on the fact that it’s getting closer… that it’s becoming concrete… and that it’s all a bit stressful (in a good way)!

And you, are you close to being FI? Or do you feel like there’s still a long way to go?

I am increasingly using the acronym FI rather than FIRE because I know that I will still have a variety of activities once I am financially independent. So the “Retire Early” part makes less sense. For newcomers, FI or FIRE, ultimately, the concept is the same: no longer having to work for money. But there’s nothing stopping you from having passions or other personal projects that still bring in cash. ↩︎

Last updated: September 25, 2025