It’s been a while since my last journal entry of my path to financial independence, I thought it was time to fix that.

Especially since I’ve been feeling the need for several months now.

Make yourself a cup of coffee or tea and let’s get straight to the point FIRE (“Financial Independence Retire Early” :)

Psychology (of the FIRE movement — aka Financial Independence Retire Early)

I got myself a coach!

In the last chapter of my “FIRE journal”, I wrote:

Will I really quit my job overnight when I reach my ‘Fuck-You Amount’? What about the blog where I only have virtual interactions most of the time (voluntary, of course, for anonymity reasons)? Will it really fill the void of social interaction left by my old job? In short, a lot of unanswered questions, and a few answers for now. In any case, I’m preparing myself for it because I know that the psychological aspect is just as important as the monetary aspect of the FIRE movement.

Until the end of last year, I still had only a few answers.

And this feeling of uncertainty was weighing on me more and more.

Uncertainty about my future transition (even if it’s not tomorrow).

Uncertainty is also about the change in identity that such a transition to a FIRE lifestyle implies.

I felt like I was looking for a path in the middle of a megalopolis I didn’t know, without GPS or any other map…

So I decided to take action.

And I got a coach.

An ICF (International Coaching Federation) certified coach, with a holistic focus. This means that he will take the professional, and the personal while passing by the family and the analysis of oneself into account.

'Will you get off your a** MP, what's the savings rate? Seriously, retire by 40? You can't do that any faster?! I've been retired since I was 25! So get a move on!!!' (photo credit: pexels.com)

In our first session, I gave her a rundown of my life and answered questions about my FIRE journey, my job, the blog and my transition (a word I’m starting to embrace!)

And I concluded by telling her: “One of my goals with this coaching with you, is to find the ‘right path’. And to make sure I’m directing my energy to that ‘right path’, because right now I feel like I have a lot of paths available and I’m taking them all (speaking of all my opportunities in general in life — career, rental real estate, side business with the blog, etc.) without taking the time to prioritise them, and as a result, it’s a bit of a blur.”

I’m on my 4th coaching session (of only one hour each), and I’m already seeing a LOT more clearly!

It’s so interesting, and also motivating, to have this monthly hour dedicated just for me, and for my personal journey.

I have discovered fears and other glass ceilings that have been identified, and that I’m already starting to work on.

You will discover some of them below this article. And other topics will come with dedicated blog posts (I’m keeping a bit of suspense anyway!)

It should be mandatory to have a shrink/coach/mirror effect

Whatever happens, I confirm what Liz from Frugalwoods said to me 3 years ago: we all need the “mirror effect” that a coach or other psychologist can bring.

And it doesn’t matter if you are in the FIRE movement or not.

It’s a question of the mental health of our societies.

And in my opinion, it is even more necessary when you want to become financially independent.

Because a transition to a FIRE life is anything but common.

And it raises many questions…

Identity firstly, because at 40, you are suddenly no longer “Carol, HR Manager in XYZ company”.

And secondly: the social aspect.

Because yes, it’s cool to not have to work for money anymore, but it has to be planned.

Because it also means no more work colleagues, no more coffee breaks, no more human interaction brought together by teamwork, etc.

Take control of your destiny (which starts with your choices)!

So my first wish for you after reading this article: invest in yourself, and find a (certified) coach or psychologist with whom you get along well.

And live your FIRE adventure with the peace of mind!

And yes, you could do it for free with a friend or a relative, but the problem is that their view is biased and subjective.

And humans also have the annoying tendency to project their own fears and limitations onto others.

That’s why I recommend paying (investing!) for it.

“Psychology of the FIRE path”, my next book project

I’ve been hesitant to announce it because the timeline is still fuzzy…

But in the end, a blog is also a way to share this kind of information with you, dear faithful reader.

So, great news: I have a new book in the making.

The name sounds better in English: “Psychology of FIRE”. But that’s just a detail!

Just as the title suggests, the book will talk about the psychological challenges of the FIRE movement (before, during, and after).

And it will give some tips and solutions drawn from concrete experiences of people who are already FIRE, or who, like me, are in transition more or less.

And I insist on the word “transition” which is becoming more and more important in my reflections about the FIRE movement. In the sense of transition vs. overnight tipping point between life with a job / FIRE life.

Also, this topic has no boundaries per se.

So, compared to my first FIRE book “Free by 40 in Switzerland”, this new book will not only be for the Swiss population.

If you are interested in this topic of FIRE psychology, and you want to be kept informed of the progress of my book, you can register below to get the info in the preview:

And I’ll tell you this again (because I don’t want to pressure myself): I haven’t yet decided on the release date.

Indeed, I’m using 2023 as a stabilization year as best I can in order to refocus all my Friday energy on writing for the blog, as well as polish the aspects neglected so far (fixing old links, improving the site’s speed, etc.)

All this to be able to build on a solid foundation before starting a big project like writing a book, without having an overflowing todo list :)

Entrepreneurship: is my FIRE adventure biased?

I’ve been asking myself this question a lot lately:

Isn’t the whole FIRE adventure that I write about on this blog skewed by the fact that I’m an entrepreneur (part-time) alongside my life as an employee?

Like, is everything I’m telling you really only possible because of the side income from my entrepreneurship (on top of my Swiss salary as an employee)?

Then, after consideration, I don’t see that as a bias actually.

So yes, let’s not beat around the bush: if you increase your income, you’ll be FIRE faster.

It’s simple maths.

But personally, I see it more as an inspiration for you, dear reader, to show you that it’s possible.

It’s possible to earn more income than you’re earning today.

And you can do it at your own pace, starting quietly in your free time (whether it’s starting an online shop, a blog, or even looking for your first rental investment to generate additional passive income).

This inspiration may also push you to work during nights and weekends on a new project which is important for your career (rather than starting a new business), which will give you a substantial raise.

Then, once it starts working (financially speaking), you can reduce your work time to spend more time on it.

After all, I also don’t think entrepreneurship is a must to become FIRE.

See Mr. Money Moustache and other bloggers as proof.

For me, I chose this balance (80% part-time job, and 20% entrepreneurship) because it meets my intrinsic need for entrepreneurship and freedom. But I could very well have preferred to climb the corporate ladder in XYZ company, with the big salaries that come with it.

When MY project of financial independence becomes OUR common FIRE path with Mrs. MP ❤️

Thanks to my coach, I was able to identify and realize a fear about our FIRE goal: I wasn’t 100% sure we were aligned on what we meant when we mentioned “a life together in FIRE mode”!

Because once the kids grow up, it’s just the two of us. And we’ll have to decide what we’ll actually do with our days, without obligation to use our family time.

Like, how many “slow travel” trips per year? How much time will we spend in this or that country, far away from our (grown-up) children? And what will we do in Switzerland when we don’t travel??!

Or even:

MP: “I, while discovering this or that Nordic region with its cosy and welcoming little town, still plan to write daily for my blog about our adventures… but in the meantime, what will you do? Won’t you get bored?”

Mrs. MP: “Uh, but wait, if we go to the other side of the world, are we not going to visit and discover other cultures together?!? I’m not going to spend my days waiting for you, am I?”

MP: “Of course not, I’ll only spend 1-2h in the morning every day, no more than that!”

Mrs MP: “Ah OK! That’s fine. I could read or pursue my hobbies even when I’m travelling.”

MP: “Ah phew! It’s great that we can talk about it peacefully because it’s these kinds of details that stress me out I just realised… because we’ve never talked about our FIRE life in detail.”

One of the main points of one of my coaching sessions was to create some alone time with Mrs. MP, without the kids, to talk about these topics peacefully without being interrupted.

So I invited her for lunch at a restaurant on Friday, as a date :)

We talked a lot about our respective priorities as to what we wanted to do with our lives once we were FIRE.

And since that meal, I feel a 100x stronger connection, because we talked about everything.

We used to talk about it, but we were (well, I was) in “it’s a long time away mode, let’s focus on increasing our income and saving as much as we can for now.

Except that while talking with my coach, I realised that I was more concerned about it than I thought.

Reality check, round 2!

My coaching sessions also made me realise that I was going to have to face a second round of budget"reality check”!

In 2013, we thought we were going to successfully buy our primary residence in Switzerland. Just like that. With the snap of our fingers. We were going to find tens of thousands of Swiss francs in our account one fine morning...

Except that, we had to face the fact that a first round of "reality check" was going to be necessary!

This means, using a calculator and calculating how long it would take to become a homeowner at the rate of savings we were putting aside at the time... and realising that we were going to have to get our a**es!

Anyway, as I told you in 2021, I’ve been focused on increasing our income in the last few years rather than tracking our frugal budget as closely as I did at the beginning of our FIRE adventure.

And my second to last coaching session made me realize on the one hand that time was moving forward… and on the other, that I had a lingering stress of jumping on every income-generating opportunity, without really knowing if it was necessary (and to what level).

Just to be clear: I still track our net worth progress monthly. And I know if we are diverging or converging towards our goal of CHF 2'156'000 in net worth to retire early at 40.

However, what is much less clear is how we will concretely do until then because we do not only rely on the stock market but also on our real estate investments.

What I mean with real estate investments is rental income on the one hand, but also an increase in the value of the rental properties. Except that if you earn CHF 100'000 in cash or in real estate value, well it’s not the same because one allows you to live off of, and the other is only a virtual amount until you actually sell your rental investment.

So, instead of discussing our monthly expenses (which I haven’t been tracking much lately) with Mrs. MP, I’ve been burying my head in the sand and working countless hours to think and find the next real estate or side-business opportunity…

Thanks, but no thanks!

I didn’t quit one hamster wheel to start another!

Summarised, I’m currently evaluating two options to calibrate our efforts over the next few years so that we can peacefully when the time comes:

- Option 1:

Make another appointment with VZ to have them redo a financial plan based on our updated figures, including our 3 rental properties and their passive income (and potentially sell them at some point, to use the capital gain to support ourselves) - Option 2:

Change the paradigm and simplify it all, focusing on how much money we need per month and aiming for that amount

Both options have their advantages and disadvantages.

As I write this, option 2 seems to be easier, but also the most limiting because it doesn’t take the profits of any real estate into account.

But I like the first option too because if we were to choose it, Mrs. MP will support my decision since we would be completely aligned with our goal to become fire at 40 years old! This was not at all the case when I first visited the wealth management office in 2015 (when Mrs. MP still thought I was a sweet utopian dreamer!)

It's been 8 years since I walked through the door of Lausannes wealth management offices for our FIRE planning! (photo credit: Google Maps)

Anyway, we’ll let these two options mature over the next few weeks.

If you have any opinion on the matter, send me an email or write me in the comments section at the bottom of this article.

Anyway, the good thing now is that I have a coach to call me out if I try to quietly push the action plan back ;)

What is your FIRE date? When you reach 40? Or even later?

One of the other topics related to the previous point is our FIRE date.

Will we be retired at 40? Or 41? Or 43.5?

As I explained to you before, everything starts to become more concrete with the passing of time.

It was easy for the last ten years, because the ultimate goal seemed far away, and we knew what we had to do.

But now that it’s getting closer, self-doubt comes into play…

Will we actually be ready?

It’s going to be weird not having to work “for real” anymore!

And what about the kids, what are we going to do if they are going away to study at the university? Maybe we’ll prefer to stay in Switzerland all the time and continue to stay by their side? Or what else?

We are left with so many open questions as there are different scenarios.

The goal we are trying to focus on is currently that we’ll go into 100% FIRE mode between our 40s and 45s.

Is this a range to give ourselves more time, and put off a major life change?

This definitely gives us more time, that’s for sure!

Will my holistic coaching help me find the right path, and maybe leave my job before and go into full entrepreneurial mode until we reach our goal of CHF 2'156'000?

Why not! I’m still open! And so is Mrs. MP.

In the meantime, I’m enjoying the adventure and our learning experiences, because as the saying goes:

The important thing is the path, not the destination.

The blog… my life project!

I talked to my coach about my personal project, my blog.

Between my passion for writing and the fact that I could turn it into a small business, this project is still running through my veins even after 9 years!

He wanted to dig a little to understand what made me so passionate about it. And by doing so, we got to the root of it: freedom!

Freedom of choice about what I write. Freedom in my strategic decisions for the future of the blog. Freedom in the form of monetisation (in particular to send those who want to pay to ‘just’ paste a link to a crappy site that has nothing to do with it").

Along with independence, freedom is one of the values I cherish the most.

That’s why I’ve decided to do everything I can to refocus my Friday solely on writing… this creative process is unlimited in terms of possibilities!

Real estate

Mentioning real estate, we finally closed the deal on the acquisition of our first rental property in Switzerland!!

And we also bought our second rental property in France.

But things will change soon.

Because both my coach and reading a book (about prioritising putting my energy into what I prefer) have helped me refind the place I want rental properties to take in my life.

I definitely love investing in real estate.

It’s calculations, valuations, and house openings. It mixes the analytical side with the social. Although a little too social for my taste, since I am an introvert at heart.

But I really like this area.

Always with the idea of seeing what parts of this field I like so much, I did a lot of introspection.

And finally, it’s more about acquiring and expanding my real estate holdings that I like. As much for the passive income as for the side of living as an entrepreneur.

So, as my time is limited, and rather than aiming in all directions in terms of personal projects, I decided to delegate the search for our next rental properties in Switzerland to someone else.

The ideal setup I’m aiming for is as follows:

- Hand over all my criteria (rental return, location, financing, etc.) to someone

- This someone — a property scout — takes care of the evaluations, analyses, and visits

- He only calls me when all the criteria are ✅

- Obviously, I will pay him decently (commission he will have to include in his return calculations)

- All I have to do is give the green light or not, then release the funds, and sign all the paperwork

- And then, collect the rent, that cool passive income that you see land in your bank account every month :)

I’m already conducting tests with different people.

I’ll definitely write an article about it once I’ve managed to set it up, and after I’ve made my first real estate acquisition in Switzerland through this process.

Companies, family holding, the usual!

As far as companies are concerned, our situation makes me chuckle.

As I was telling a friend the other day, after going to the notary for the hundredth time the day before:

it feels like going to the notary’s office is just like going to the bakery! 😅

When we bought our main residence in Switzerland, it was stressful and overwhelming as it was the very first time for us.

Then we had to go through it again when we bought our first rental property. And again when we created our first company to manage our side business income.

It’s just like buying your first ETF on the stock market or your first rental investment, the rule of thumb applies:

Do it once, then twice, then it becomes the new norm!

And concerning the mention of our “family holding” in the title, it is referring to the SA that we created for the MP family.

The purpose of our holding company is to hold interests in other companies if we buy a rental property together, as well as direct real estate (so it’s not a “real” holding company for that matter).

Due to the information I learned from the notary’s office, the name “holding” does not mean anything legally. It is not a commercial entity in itself.

It’s just a nomenclature used in the field to describe a company that doesn’t do any business itself and only holds interests in other daughter companies.

If my new normal makes you “dream”, then I recommend my technique to get there too: surround yourself with 5 people you want to become.

Because as the saying goes: you are the average of the 5 people you spend the most time with.

I am living proof of that!

This is good news for you reading this blog, because now you only have 4 other people to find ;)

Budget

My focus hasn’t shifted much since my last journal entry.

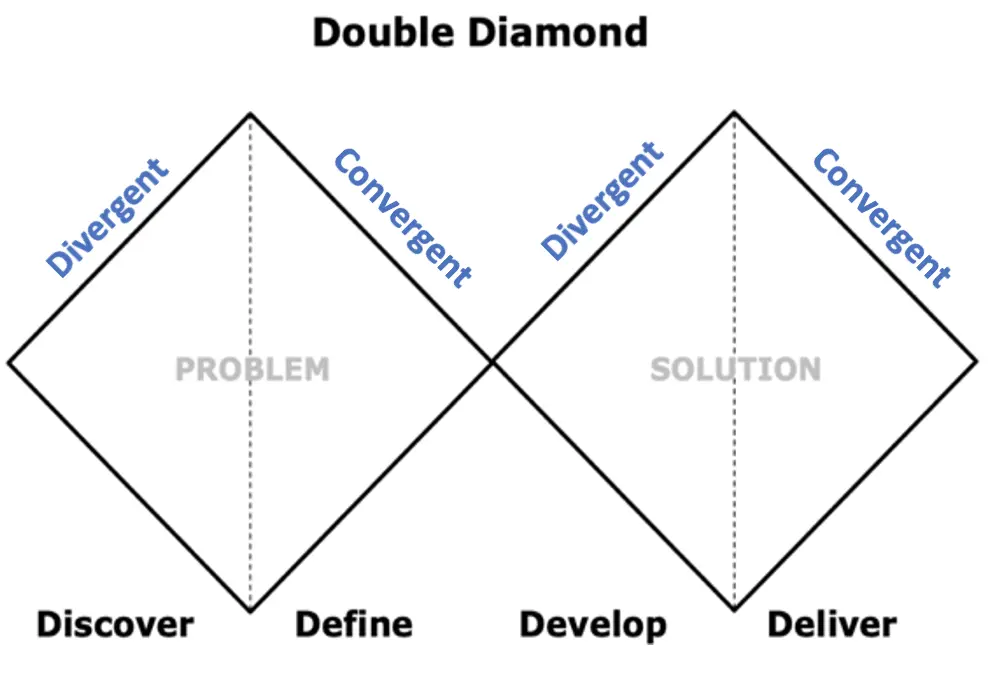

I’m still in the same phase of creating income and wealth (which I see as “Divergent” on the diagram below), rather than optimising expenses (“Convergent”).

The double diamond principle of diverging and converging (subheadings are for the project management field, so nothing to do with our FIRE movement)

Regarding our YNAB budget, we stayed on a monthly budget tracking, in order to always control and keep an eye on our expenses.

Concretely, this means that I enter all of our expenses and income into YNAB once a month, not after every expense like I did when I joined the FIRE movement.

So we’re still living frugally by default, and all of our energy is deployed to increase the cash coming in (via rental real estate, new business ideas, etc…)

Millionaire and 50% FIRE. So how does that feel?!

If you are new to the blog, I’ll just remind you of these two facts:

- In October 2022, we became millionaires (in Swiss francs)

- And in January 2023, we passed the 50% mark of our FIRE goal(“Financial Independence, Retire Early”), surpassing CHF 1'078'000 of net wealth (we are aiming for CHF 2'156'000 of net wealth to be able to stop working at 40 in Switzerland)

And so, to the question “So, how does it feel?!?”, well, I’m almost ashamed to sound cynical while writing this…

…but nothing much has changed…

Of course it was cool, and I also had a small drink with Mrs. MP to celebrate.

But honestly, the next morning when we woke up, we went back to our usual frugal and creative routine.

To sound even more cynical: we didn’t even celebrate the 1.1M CHF milestone…

Ditto for crossing the 50% mark of our FIRE goal. After that, I think it became too blurry and intangible because of our old wealth management report which only included stock market investments.

Whereas now, we’re starting to have a certain amount of net worth locked up in concrete.

Anyway, regaining clarity and tangibility in our FIRE objective is going to be one of the next areas we’re going to focus on with Mrs. MP.

And finally, I’ll conclude this chapter by confirming that all the cash in the world doesn’t change who you are inside. Yes, it increases your self-confidence and self-esteem (which is already quite a lot, I must admit), because you know that you have been able to achieve this. But in terms of desires and values, it doesn’t change anything.

We are approaching the CHF 500'000 mark of investments in the stock market!!!

This news, on the other hand, makes me excited!

That’s gigantic!

To be precise, to date, we have CHF 433'383 invested in the stock market!!

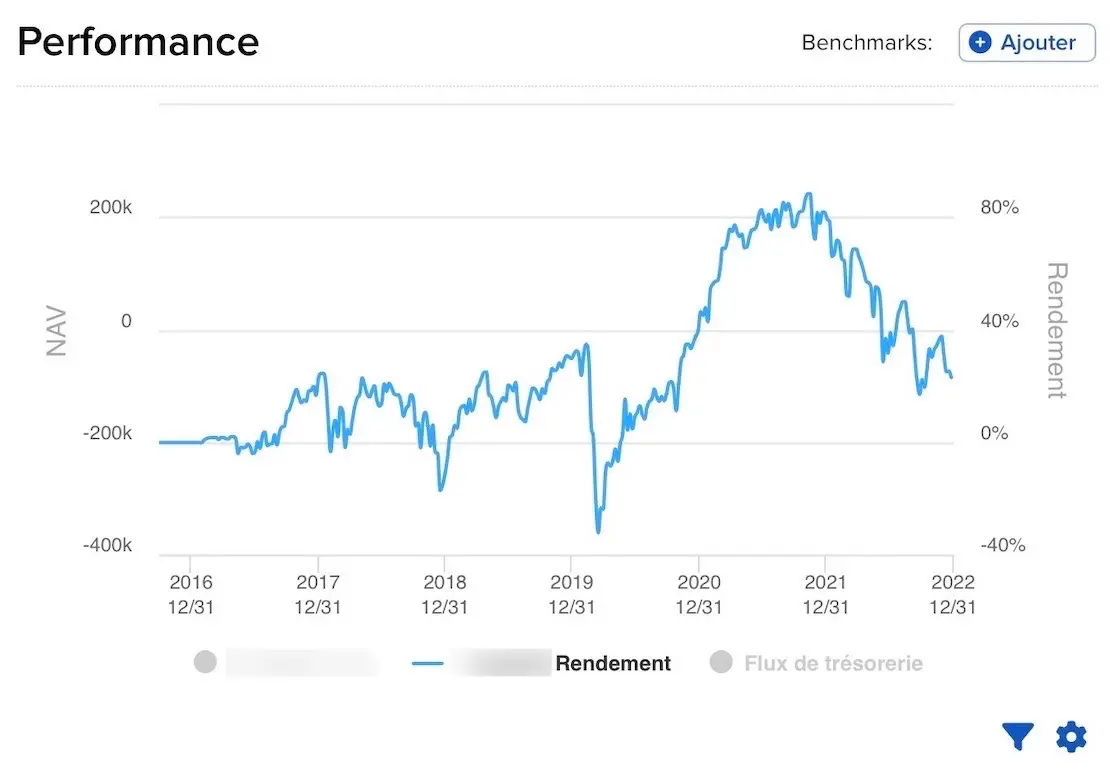

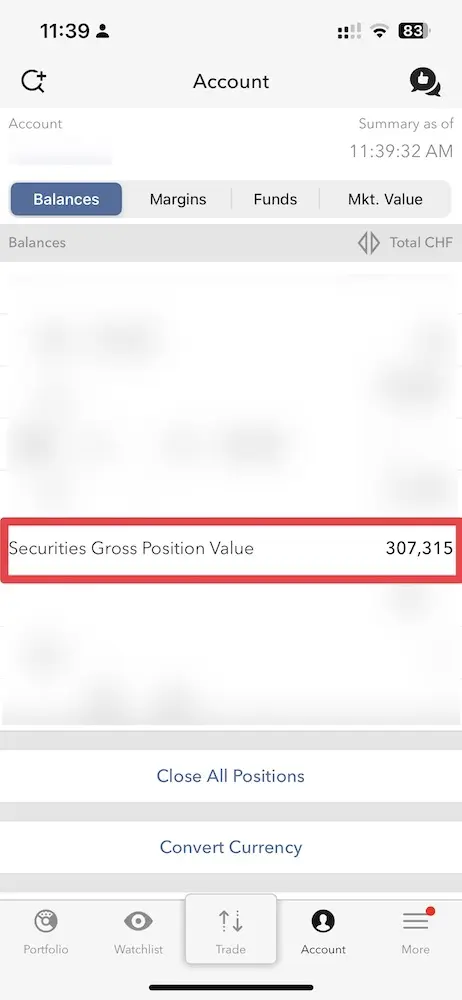

Part of our stock market investments on Interactive Brokers (private account) - the other part is on our corporate Interactive Brokers account

I still remember my very first ETF buy order at less than 100 CHF…

By the way, at the time, I didn’t know much about it and I had chosen a Swiss trading platform that was way too expensive (the orange one that supports soccer thanks to its too-high fees ;)).

So don’t make the same mistake as me, and choose the best ETF trading platform which is Interactive Brokers (*)!

Kids and spending money

I really wasn’t a fan of it initially.

I always thought it would get our kids used to believe that money grows on trees.

Except that after many discussions with Mrs. MP (who had been entitled to it during her childhood, unlike me), and after having informed myself on the subject of financial education, we decided to start giving our children pocket money in 2021 (⬅️ you will also find on this link the amounts of how much we give them according to their age).

And what a great decision that was!

Just last week, we were planning a trip to a place that one of the MP kids has been dreaming of seeing for a long time.

Obviously, it’s a place he knows he’ll want to take a souvenir from.

So far, so good.

As we discuss what we’re going to visit there, I see our kid thinking and starting to calculate out loud how much pocket money he has left.

Suddenly, his face tightens, and he says to us: “Aw but then, if I buy a souvenir, I won’t have the money I’m saving for the PS5 I’m dreaming of?!”

“Welcome to the adult world!” I told him.

Obviously, this discussion would never have happened if your kids weren’t used to thinking about managing their pocket change.

As for our second kid, pocket money is teaching him the art of… negotiation!!

He too wants to save money to buy something bigger than just candy.

So, every opportunity is great to try and negotiate a little extra CHF 1 and a little CHF 1 there!

Like “OK no problem, I’ll vacuum the trunk of your car, but give me CHF 2, OK?” with a big smile on his face.

My response: “Well, that is a household chore like any other, you will have to do it anyway, so no thanks!”

Same here, this kind of discussion would not have taken place if not for the pocket change which is the engine of their financial education.

So basically, no regrets!

I can only recommend that you start with pocket money with around 6-8 year-olds.

Delegate (i.e. pay someone), or do it all yourself?

Several of my recent posts contradict the fundamental principle of my frugal financial education, and how I use my money.

I’m talking about boring administrative tasks (invoices, taxes, accounting of my Swiss companies), as well as more complex tasks such as managing software updates of the forum of our community “FIRE Switzerland”.

The principle proposed by these authors is to focus all my energy on what nourishes me the most and produces the most value.

And to delegate everything else.

Because if I don’t do this, again according to these authors, I am selfish, because I don’t allow other people to benefit from a complementary income, and also selfish towards myself because I keep tasks that I don’t like…

Before I would have closed the book saying to myself that it was not for me…

But here, due to the way it was mentioned, it spoke to me.

So I’m elevating the option of an administrative assistant for some blog-related tasks already.

And the same for Swiss taxes and VAT declaration for my companies. I’m testing the option of delegating some of these to my trustee.

I see it as an experiment. And If I don’t like it, worst case scenario, I’ll go back to the way it was before.

On the other hand, concerning the chores like cleaning, I want to keep them to keep a culture of effort for the children and not let them believe that everything can be delegated in a snap of the fingers. And there is also the materialism side (cf. the citation below) that I want to instill in them; that is, to take care of what we have because we consider the materiality of our home.

We are too materialistic in the everyday sense of the word, and we are not materialistic enough in the true sense of the word. We need to be true materialists, that is to say, to really care about the materiality of goods. — Juliet Schor

Here is a change I didn’t see coming.

Let’s talk about it again in a few months.

Is entrepreneurship, the only path to getting rich quickly?

Finally, I’m currently reading the book “The Millionaire Fastlane” which was recommended to me by one of you.

Just like the other books I’m reading at the moment, I chose to start this book because it goes against some of my beliefs (especially frugality).

That’s how you broaden your horizons and adjust your worldview.

And actually, in terms of a different point of view, I am served.

But I am not entirely closed to his approach, quite the contrary.

I’m particularly interested in the subject of entrepreneurship.

I’m only a little more than halfway through the book, and I must admit that some of my glass ceilings (job = security, entrepreneurship = risk) are starting to crack…

And there are also a few highlights about the power of the choices you make every minute of your life.

Anyway, I’ll tell you if I recommend this book when I finished it. But anyways, I’m glad I didn’t stop at the title or at the pitch about Lamborghini and show-off :)

All in all, thanks to you dear reader who told me about this book (sorry, I couldn’t find your name in my emails…)

Conclusion

I am really happy with the current situation.

Why you ask?

Simply because I am active and make conscious choices about our future (vs. being passive and suffering from what life chooses for us).

On the one hand, I am refocusing my FIRE adventure with coaching (the convergence side of the double diamond process), in order to put all my energy in the right place to unfold and optimise my path to financial independence at 40.

The alignment with Mrs. MP was also a great source of pleasure, satisfaction, and peace for the future.

And on the other hand, I am exploring (divergent side of the double diamond process) new entrepreneurial horizons with my readings - and especially putting them into action via experiments that are not irreversible.

As for the money aspect, one of the core subjects of my blog, well, I must say that everything is on the right track. As much on the real estate investment level, whose share has increased in our investment portfolio, as on the stock market level with the next milestone of CHF 500'000 invested in ETFs via our favourite trading platform (*).

And you, what’s new on your path to financial independence in Switzerland?

(*) This symbol indicates where my article contains affilite links. If you follow one or more of them, you won’t see any difference compared to a standard link - but the blog will receive an affiliate commission. Thank you for this. As usual, I only write about and review things I use in my daily life, or trust.