6:12am. Tuesday, December 10, 2019. I finally manage to take the time to settle down and write this second edition of my journal. It looks more like a jumble than anything else, but whatever. It’s still my blog after all ;)

In this edition, we will talk about ambitious projects (including my book, an online course, and coaching), media interviews, ethics, and portfolio strategy. Nothing less!

Grab a cup of coffee/tea, and let’s go.

The blog

Autumn and winter, my allies

I noticed that my blog productivity had increased after the start of the school year. I think more bearable temperatures, and also more evenings spent at home rather than on the shores of Lake Geneva or Neuchâtel (which involved waking up later).

All this to say that I will put less pressure on myself for the blog from June to August, and on the contrary take advantage of the other months to dedicate all the time to it when I am not with the children or outside ;)

New emailing tool

I wrote less during the first half of December because I spent almost two weeks migrating my mailing list tool to be ready for 2020 (for the geeks among you, I went from MailChimp to ConvertKit1).

My goal with this change is to avoid as much as possible the spam effect for each of the blog’s readers, including you. For example, as you received last quarter, I created a lot of content for my Interactive Brokers and DEGIRO “Epic Guides”. The new tool I have chosen will make it easier for me to categorize who needs it, and who doesn’t really care because he/she has been investing in the stock market for a long time.

My ultimate goal is that every email you receive from me brings you value. So please, if you see one too many emails, reply to me rather than unsubscribe so that I can optimize the think. It’ll help me a lot!

Blogger, my future full-time job?

The blog is starting to bring in much more cash than I dared to imagine a few months ago (spoiler: we are approaching CHF 16'000 for 2019).

I’m starting to dream of taking several months of sabbatical leave to get it off the ground even more and who knows, potentially making it my full-time livelihood — but according to my own schedule: D.

If it turns out that you too have gone from being an employee to an entrepreneur (ideally as a blogger) when you had a well-established situation with children and everything, then I would be interested in talking to you :)

Medias

I am pleased to see that the mainstream media is taking an increasing interest in frugalism/FIRE (Financial Independence, Retire Early)/Mustachianism because the more we will be, the happier the people will be, and the better off the Earth will be too.

Below are the recent and upcoming interviews about the blog:

- Le Monde last October (don’t look at the comments else you’ll get scared!)

- Migros Bank last November. I

almostshouted out of joy when I saw a bank talking about the phenomenon. If even a Swiss bank comes to talk about FIRE/frugalism, it means we’re doing something that makes sense. Or is it just to appear SWAG and attract millenials among us? ;) - Another secret I have in store for you and that wil come early January: the blog will be mentioned in a TV interview on the RTS. See you on January 6th!

- The other spoiler is that I’m going to be in a book! And one serious thing moreover. I still can’t believe it! More information during the first quarter of 2020

“Playing with FIRE” documentary

At the beginning of the month, my friend Matthias from the Financial Imagineer blog shared with me a good plan allowing me to watch the documentary “Playing with FIRE” (which you could enjoy too if you are subscribed to my newsletter).

I had various feedbacks, including one from a reader who told me “If one reads your blog, they don’t learn anything new.”. I agree that it is more for newcomers to the FIRE movement.

But I still learned an important lesson for the blog.

At many moments during the documentary, I told Mrs. MP: “Hey look, darling, that’s exactly you!” or “Ahah so true, it reminds me of the beginnings with the doubts I had…”

This made me notice that on the blog I share all our good plans, financial successes, and other inspiring articles. On the other hand, I have touched very little on moments of doubt. And God knows if there were many! So this documentary made me aware of this and to use this second episode of the “MP Journal” series to talk about it. And it’s going to start today with the section “And ethics in all this?” below ;)

In fact, as I reflected on the rest of this article, the documentary allowed me to learn a second lesson. And it’s about my book project.

Projects

MP book

Before watching the documentary “Playing with FIRE”, I was thinking of telling you that I was definitely dropping my book project on “How to become financially free by 40, in Switzerland”.

But the documentary changed my mind. So if you are not registered yet but are very interested, then go here. If we exceed the 1'000 subscribers, it will help me to take the leap and make drastic decisions to move forward.

I can already hear you asking me: “But MP, why did the documentary change your mind?”

To which I answer you that people like you and me wanting to change the world must share their visions with as many people as possible because the more frugal we are, the better the world will be with less consumption and innovative companies that customers will ask for (I plan to write more about this in the coming weeks).

The documentary reminded me that even if I’ve been blogging about frugalism/FIRE/Mustachianism in Switzerland for 6 years, we (aka Team MP) remain precursors of the movement and that it is far from being a dominant state of mind even today.

Potentially, until I reach the 1'000 subscribers, I will draft the chapters and send them to the registered people on the page to collect feedback. I’m still hesitating.

But in any case I’m not putting the project in the closet yet ;)

Real Estate in France: online course

I have received several requests for details on the acquisition of our investment property in France because some of you also want to achieve returns of 15%+.

I am setting up an online course explaining how I acquired my first building in France in 70 days. We’ll start from “I don’t know where to start as I don’t know anything about it” to “That’s it, I signed at the notary’s office and in 10 years I’ll have 60k€ more in my account, thanks MP!!!”

There is only one seat left for the first quarter of 2020 because it will be quite interactive while we work out the details depending on the feedback. The price will be CHF 1'000. With this, you will have my whole process described that you can use as many times as you want (and not just for one building).

Important point: the course will be based entirely on the French system via an SCI, because it is this latter that I know.

If you are really motivated and serious (there is work to be done!) about investing in real estate in France, then you can register via the form below (as said, only 1 seat left for the first round):

Start investing: private coaching (1/2 day)

Your biggest concern right now is to overcome the administrative paralysis to start investing somewhere?

Then know that you are not alone! I’ve been there, and other readers are currently at the same point :)

I already have a private session in January-February where I will sit 3-4 hours next to one of the readers on a Saturday morning. He will be able to ask me all the questions about my investment processes, portfolio choices, budget and banking system, etc. We will also open his brokerage account together and buy his first ETF.

Same as for the online course above, I only offer one additional seat for the first quarter of 2020 (because I still have a full-time job, and children, and a wife too ^^). In terms of location, I limit myself to French-speaking Switzerland for the time being. The price is CHF 300 for the morning, and I bring the croissants if you offer the coffee :D

If you feel concerned and really want to get started with investing in 2020 (once you register, no more choice, you’ll have to take the leap!), then you can register below:

Investments

My portfolio at the end of 2019

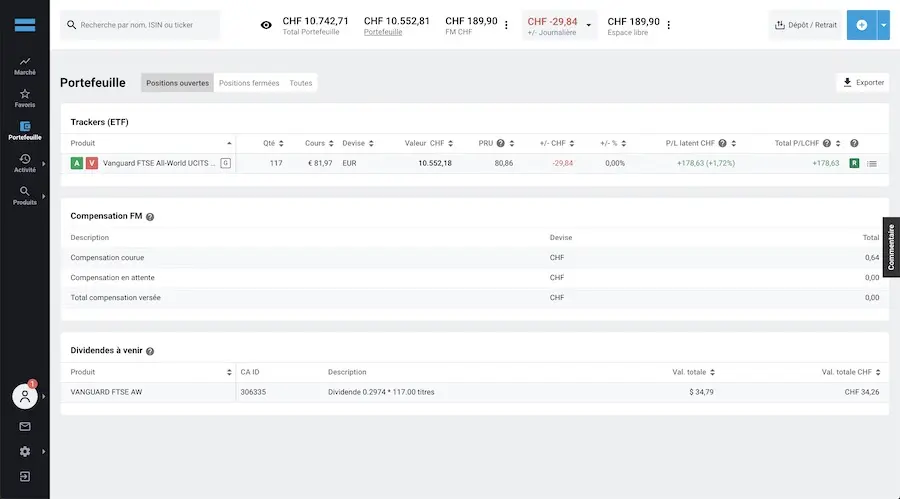

Many of you have written to me in recent weeks to find out where I stood regarding my investments and portfolio because my dedicated page only talks about ETFs but I keep talking about value investing and also P2P loans.

To summarize the situation for everyone, here is the situation:

- ETFs: I have 60kCHF in VT, and 60kCHF in VWRL

- Value investing: I am gently getting to the 10kCHF of investments — almost everything in Japan! I have a draft article that will come in the next few weeks explaining to you what process I am following to start

- Real estate investment: we have our building in France as already mentioned above

- P2P loan: IbanWallet and Mintos (see below for details)

With this in mind, I would like to reach a portfolio in 2020 with:

- 5-10% max of P2P loans

- 5-10% max in real estate (because I prefer the stock market while being behind my computer, but it will depend on whether we find big opportunities, in which case the % may change)

- 40-45% in value investing

- 40-45% in ETFs

And over the next few years, depending on how I evolve in value investing and depending on the returns, I may be more into value investing than in ETFs.

Don’t worry, I still recommend ETFs if you are looking to buy regularly (once a month/quarter for 15min max) and forget about it the rest of the time. On the other hand, if you are like me and like investing more and more, then the other options can be more interesting in terms of performance — but more time-consuming!

Real estate in France: new purchase?

As I was saying, investments are above all opportunities ;)

3 weeks ago, we received an email from a person of the network that we activated a lot at the beginning of the year to find our first property and… it could be that we acquire a second property. We will compute the yield via Horiz.io (formerly rendementlocatif.com) as usual. More news on this subject in early 2020.

We even had a 3rd building in sight, but when I announced to the seller that we would only pay 30k€ maximum after my calculations on Horiz.io (formerly rendementlocatif.com) instead of the 185k€ requested, the man almost had a syncope! So we passed our turn.

P2P loans

It’s decided, I’m going to add P2P loans to my portfolio. I want to exclude everything that is car or consumption loan to stay a bit aligned with my financial guiding principles.

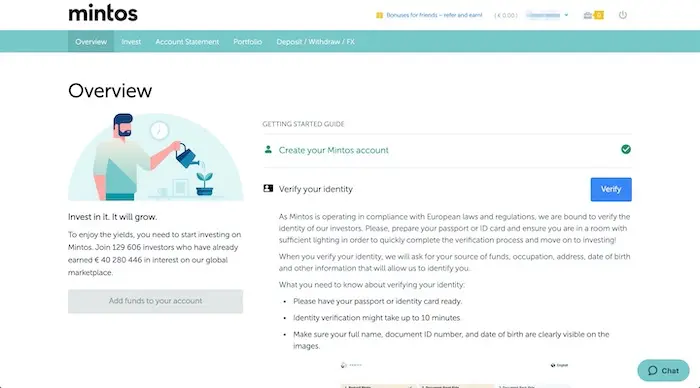

I chose to go with Mintos.

I will write a series of articles on the subject, starting from the basics, i.e. I didn’t know anything about it until 4-5 weeks ago, until my first investments.

Thanks again to all the readers who shared their experience with me following this article.

All my cash must bring at least 2.5%!

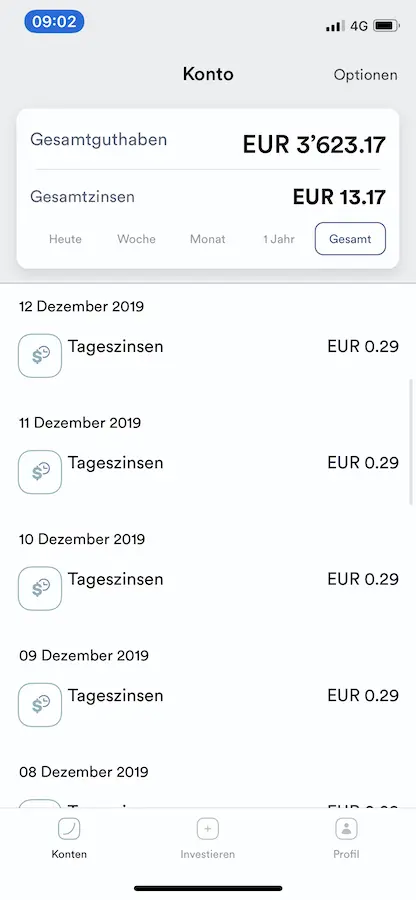

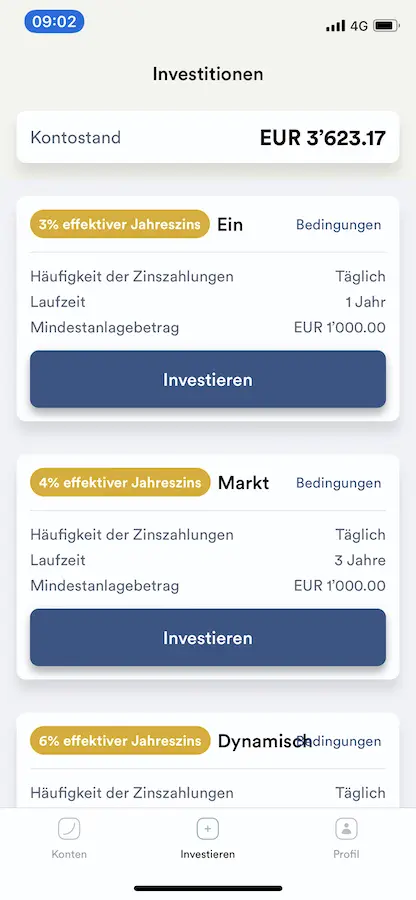

While analyzing the different existing P2P loan platforms, I came across Iban Wallet.

This solution led me to think that I could store all my cash flow there instead of letting it sleep at the bank for 0% return. Basically, it would work this way: we receive our salaries, we make all payments on the 2nd or 3rd of the month, we keep CHF 1'000 of security cushion, and we transfer all the rest (which we do not invest because we need it in the next 1-2 months for large invoices or planned expenses) to Iban Wallet. Then we take it off at the end of the month to pay for everything we need. And so on and so forth.

If you don’t know Iban Wallet : it’s a company that offers a system a little different from the platforms where you can choose P2P loans because there you transfer cash, and automatically it’s invested for a minimum return of 2.5%. And this on a daily basis. And you can take out the cash whenever you want with the interest earned. A bit like a savings account (at the time eh!) except that you don’t have to wait until the end of the year to see the interest coming in (I also saw that Mintos offers a similar system with the “Invest & Access” system but I have not yet looked at the conditions in detail).

“What about ethics in all this MP? Because they’re consumer and car loans, right?”

I agree. But if you think about it further: what do banks do with the money you leave in your account before you use it to pay your taxes or any other planned expenses? Well, they use it for consumer credit or mortgages! And what do you get in return: negative interests :D

I am in the testing phase of this system and I have some reservations about Iban Wallet’s seriousness (i.e. difficult to access support so what if a problem occurs once). I still transferred 3'610€ and I have to say that it’s pretty cool to see my cash working for me, even at 2.5%.

I’ll write an in-depth article when I’ve decided whether or not to continue with this.

If you like to experiment, you can use the Iban Wallet code of the blog RMARIEUETZ which will give us 25€ each if you credit your account with at least 1'000€ (UPDATE: code no longer valid after 31.12.2019, but the link of the blog is - thanks in advance!).

Platforms

A quick tour of where we stand before my next more in-depth articles:

- Broker for us: Interactive Brokers

- Broker for the money we set aside for our children: DEGIRO — we finished the migration from Cornèrtrader!

- Our bank: Zak — idem, I have completed the transfer, and we will be able to close everything at BCV at the beginning of 2020 :D

What is the mindset in the MP family these days?

Watching the documentary “Playing with FIRE” made me re-discuss the subject of our financial independence (and no, Ms. MP is not of the type to like to talk about it every minute like me :D).

I told her that I thought we were increasingly in the same frugal state of mind. I even caught her saying “No, but come on, they make a little more money (salary or unexpected income), and here they go, big shopping time the following weekend…I can’t get it!”

I then explained to her how the protagonist of the documentary went through moral highs and lows.

And I went on to ask her how she felt right now about our goal of stopping working at 40.

Her answer: “I’m frustrated”, in a rather serious tone.

Argh. “The discussion will be fun,” I thought… “What’s she going to tell me…”

She continued: “The objective in itself is not the problem, but it is my ‘Freedom’ budget category of CHF 100 that is the issue. I have one dinner with friends in the month, and I have nothing left after that…”

So I ask her, with great caution: “By staying within reason, and assuming that we have extra margin in 2020 in terms of salaries, what do you think would be the right amount for your ‘Freedom’ budget category to avoid feeling this frustration? (because until 40 years old, it’s gonna be long and that’s not the point either!) But really, think realistically, like not CHF 1'000 a month eh ^^”

Her answer: “CHF 300 I think”.

Hmmm… 3x more. But at the same time it’s not 30x more…

We stopped the discussion there. But in parallel, I just calculated and that gives us about 35kCHF less in 10 years. So basically, about 6 months of extra work, for 10 years less frustration.

I will discuss this with Ms. MP tonight and will keep you informed in the next journal series’ article ;)

My biggest fear is that CHF 300 will not be sufficient anymore again in 1 year, and CHF 500 will be the new rule. But I will also explain this point to her to see her reaction.

If you have an opinion on the subject, I wanna hear about it!

Thought in my mind these days

What about ethics in all this?

I’ve been thinking a lot lately about being aligned with myself between my ethics and my investments.

Because when I hate Facebook on the one hand, I own a good part of it through my favorite VT ETF…

I’m not falling into anti-capitalism and questioning our rental building either… but we have to admit that being frugal and wanting to achieve financial independence is something very paradoxical. In a way, we want to stop working so we can do things we like more, and for my part, things that impact the world (which I’m already trying to do through this blog). But on the other hand, to achieve this objective, we make full use of the capitalist model.

I have read and watched several topics on this topic, and my opinion is by no means set in stone. But at the moment, I tend to think that through the blog I preach the good word of frugality. If it works a bit, readers like you will buy and consume more consciously. And as a result, companies will have to adapt their offer and become more innovative to meet (in my opinion) a better way of consuming. And the stock market (including index ETFs) will follow the winning companies as they do well.

I think I understood that the debate “Investor or consumer, who is most responsible for the evolution of our society?” was always a little intense so if you have a clear opinion, do not hesitate to share it below, but be constructive please ;)

In any case, the point remains that by being frugal, I consume less, so I save more. I could do nothing and leave my money to the bankers who would invest themselves for their own profits. I prefer to do it myself and take the profits in my pocket, to do what I want with them (like making donations or paying my own salary to blog even more).

It’s nevertheless still an excuse because it’s selfish as a point of view. Because anything I don’t consume, I could also invest it directly in ESG funds (abbreviation of “Environment, Society and Governance”). But when I see that in the top 10 positions of the “Vanguard ESG International Stock (VSGX)” ETF there are Nestlé, Alibaba, and Roche, I think I have better time to stay on a normal low-cost ETF and use returns to satisfy my own sense of ethics…

Then there are also donations or social entrepreneurship in which I could put 100% of my wealth.

But I’m not at that level (it’s not for nothing that ethics is complicated, it’s so personal) either.

So for the moment, I’m staying on “standard” investments and living with this paradox while trying to “change the world” as much as possible through my own consumption and through the articles on this blog. And when I have exceeded CHF 2.156 million, I will surely adapt my model to share my wealth even more.

Final word

As you can see, I’m far from stopping with the blog :) I have the impression that it’s a new start (as often in November/December, who knows why). I have to be careful not to promise too much, but at the same time I will especially follow the concrete opportunities that come along. No hassle, it shouldn’t become a job either :D

And you, what’s up? Are you already retired? Or are you demoralizing with the end-of-year bills you didn’t see coming?

Note: I have updated my Resources page with the tools I use daily to increase my wealth. Feel free to visit it, and tell me if you use any other tools that might be useful to me!

I had come across this service several times and every time I read “email marketing tool”, my brain raised a big red flag with an alert like “Bullshit marketing”, “American blabla”, etc. In addition, I often saw the name of it in web links inside US blog newsletters that I follow, and I thought to myself, “Here you go with people who track you to resell your data or advertise you…”

But in fact, at least for ConvertKit, it’s a really good tool, with the goal that each email brings value to readers. Once I started testing it, I immediately saw that a former blogger created it! ↩︎

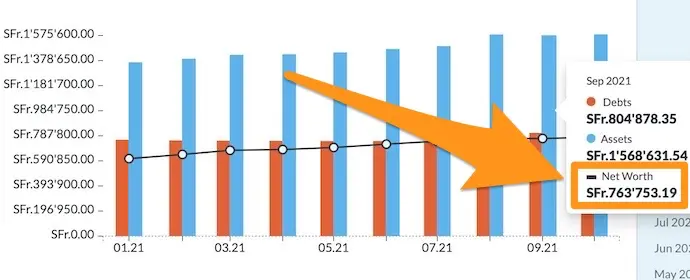

Net worth and savings rate update November 2019 …

Net worth and savings rate update October 2019 CHF...