While chatting privately by email with some of you, I realized that it had been a while since I had given you any news about my portfolio, our apartment, or our building. Similarly, it’s been as long as I haven’t given an update on where we stand on our path to financial independence (I’ve been pushing back an article called “Reality check” for at least over a year).

So today I’m starting with this first “Diary” type article. We’ll see if the format holds up over time, and if I feel comfortable being so transparent with myself :)

Health (and an app)

These last few months have been quite tumultuous in terms of health (nothing serious I reassure you) with ups and downs that have prevented me from writing 1 hour a day in order to keep a certain regularity of publication on the blog.

On the other hand, these little worries have allowed me to take a step back on how good it is when everything is going well. It is an eternal ritornello that one becomes acutely aware of when one experiences death, illness, or anything else that is not pleasant.

I mentioned it quickly in my article about getting up at 5am but if you too are looking for a way to get your head out of the daily routine and realize how lucky you are to live (hopefully healthy), simply, then I can only recommend the Calm meditation app. I use the Daily Calm feature (a 10min session automatically proposed every morning) and it really allows me to take a step back and be more zen in order to enjoy the present moment.

Investments

ETFs

As far as investment is concerned, since the beginning of the year, I have had around 110-120kCHF invested into ETF (60kCHF in VT and the rest in VWRL because I have still not clarified this USA-CH double taxation treaty in the event of succession in case Ms MP or I disappear overnight) (UPDATE 17.05.2020: It’s now clarified. The US-Swiss estate tax treaty covers our case. All information in this dedicated article).

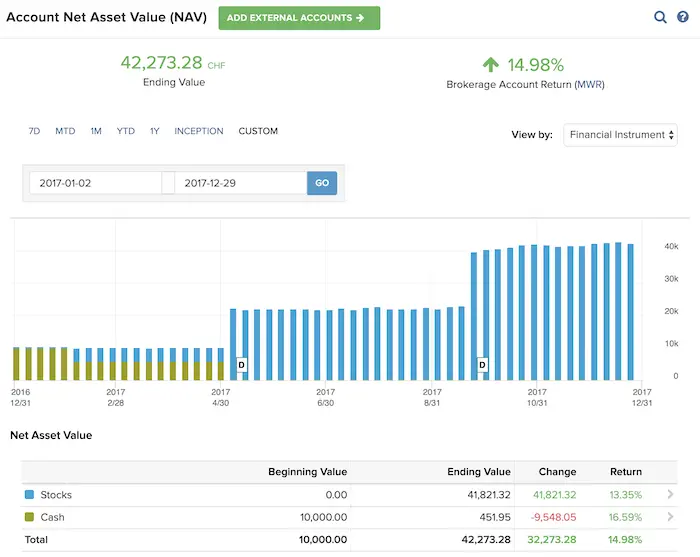

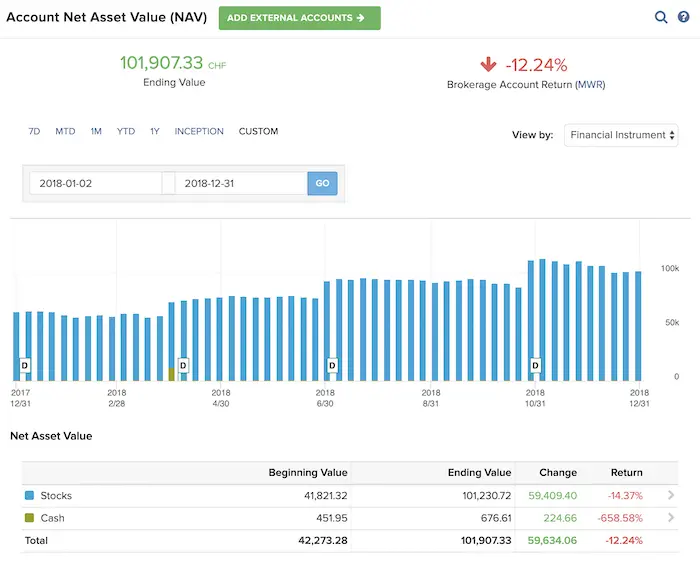

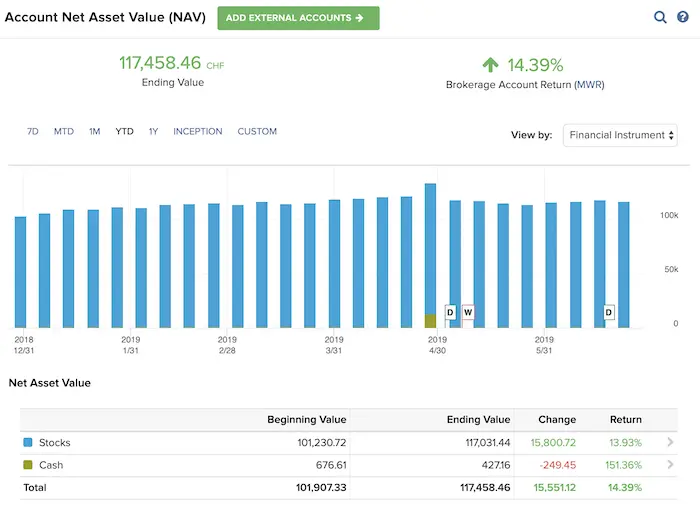

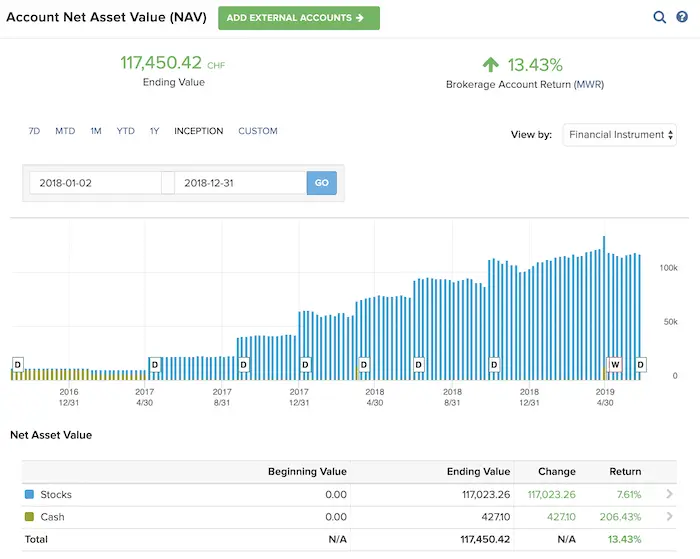

In terms of performance, it’s becoming interesting because we’re starting to have historical data. For your information, the figures below correspond to the weighted return on capital (you will find an explanation of the two main methods of calculating the return here) which concretely represents our personal returns with all our deposits made at the time they were made:

Before 2015-2016

Our portfolio strategy was different at that time, and since it was on Swissquote, I didn’t take the time to look at the performance details.

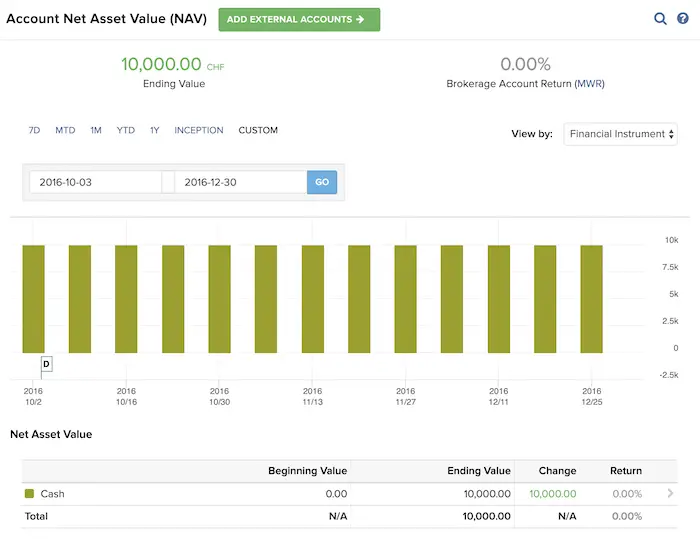

2016: 0%

0% because we only had cash — CHF 10'000 in our account at Interactive Brokers aka IB since we were finalizing our apartment purchase in Switzerland (main residence) at the time.

2017 : 14.98%

2018 : -12.24%

2019 (from January up until today) : 14.39%

Since inception (2016 to date) : 13.43%

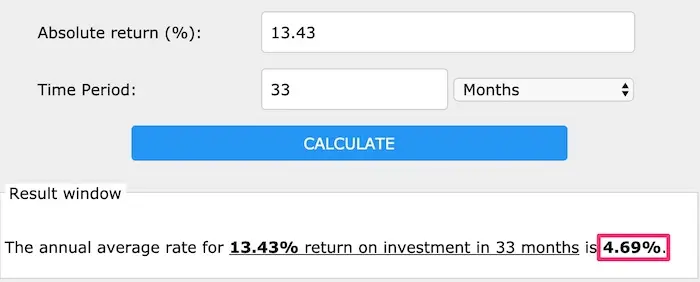

Annualized since inception : 4.69%

To calculate the annualized yield, I use this online calculator (they also explain the mathematical formula).

We are far from the desired 7-8% but it’s only been 3 years and I’m here for the long term!

With all this you might wonder:

But why didn’t you reinvest some cash since the beginning of 2019? Are you afraid of the crash that’s been announced for almost two years? Are you trying to predict the market?

Well, not at all :) If I had had extra cash, I would have clearly invested it in VWRL.

But we needed funds to pay the bank and notary fees for our first multi-family rental building.

Which brings us to the next point :)

Rental building in France

Finally, we completed our acquisition of a multi-family rental building at the end of May.

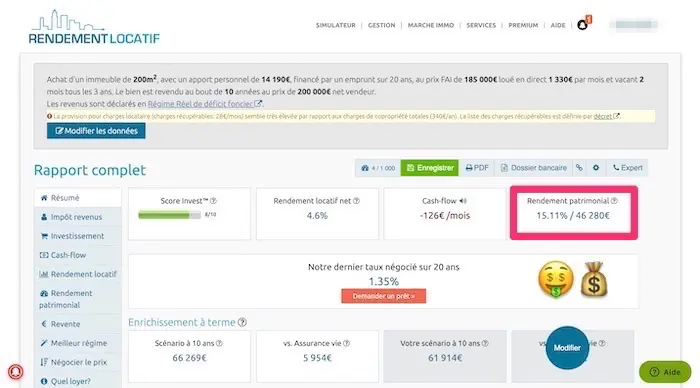

I must admit that it’s quite cool to see the rents coming in, which directly repay the mortgage, and which itself creates capital for us. According to our calculations via the great tool from Horiz.io (formerly rendementlocatif.com) (it is the best I have found, and I only use this one as soon as I have to value a property), we should get by with about 50'000€ after resale tax in 10 years (rather conservative calculation).

As far as tenants are concerned, we already have one that leaves at the end of the summer, but this was to be expected because they generally stay about 1-3 years. And I see this as a good opportunity to test the whole tenant research process. As with the purchase, I’ll document that for you too, I promise!

I am beginning to realize the workload it takes (currently sustainable) to manage it remotely with a family member. I will give you more details in the complete guide I am preparing for you.

VIAC 3a pillar

As for my recommendation of VIAC, I’m still extremely satisfied or even jealous because it is Mrs MP’s who is there. As a reminder, 97% of our investment is in equities (the maximum).

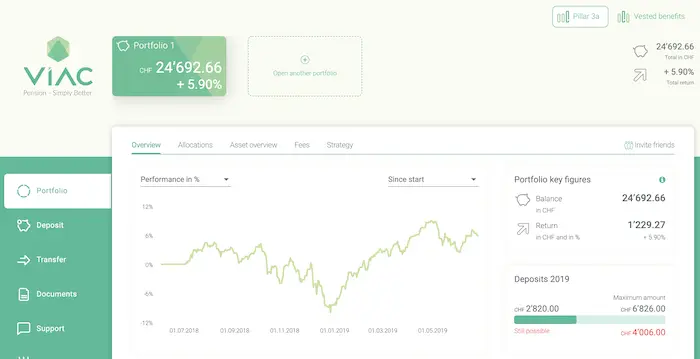

Also, good news for desktop (vs. mobile) lovers: VIAC launched its web version last May. I give you below a snapshot of our performance from their new tool:

And for the record, I asked Peter Daniel (co-founder and CEO of VIAC) if they were planning to add the value of annualized return to the app. His answer: “Those numbers are currently only available in the reporting we are about to produce next week as of the 30.06. But we already thought about adding those numbers in a drilldown on the performance on the webversion. Currently all our funding moves into the 2. pillar solution, so I can’t tell if this will be done within the next weeks.”

The good news is that I received the VIAC report as of 30.06 and we have had a nice 5.91% annualized return since the beginning.

Mr. MP’s 3a pillar (I don’t quote the company to be able to grumble as much as I want!)

The worst news comes from my 3rd pillar opened when I bought our apartment.

As every year they update the surrender value on January 1st. According to my advisor’s explanations at the time, a large part of my annual CHF 6'768 (which rose to CHF 6'826 in 2019) could be invested in equities, although their fees are exorbitant and their structured products incomprehensible…

The oldest readers probably still remember how much I hate the 3rd pillar tied to a life insurance. In our case, we had to take out death benefit insurance to obtain the mortgage from this institution. But I thought I understood everything well this time and that it would be different — i.e. we would build part of our capital from day 1, and not only X years after financing the risk part.

I won’t go through all the mathematical details, but basically it’s another big, incomprehensible piece of crap. Even internally they have hired a “specialist” to explain the underlying structured products to their clients — and even the latter only informs me with jargon (blah, blah, blah!) so that we get lost.

Let me tell you that I sent a very harsh email in March to this company to tell them that I was looking forward to reaching the end of my contract (another 7 years!) to terminate everything, even if it meant losing money.

My advice if you want to buy your home: choose the independence between your mortgage and your 3rd pillar even if the bank (never again an insurance for me!) offers you a higher rate. Because in my case, even with the lowest rate at the time, I will lose out with all the risk capital I have to finance through my pillar 3a. Capital that therefore does not work at all for me during this time.

In short, I have now swallowed the pill and told myself that it is a good way to relearn that you don’t buy what you don’t understand (i.e. each line of the contract). And even less when it comes from an insurance company!

It hurt me to admit it, and even more so to write it here on the blog, but well, that’s the reality.

Our own apartment

On the main residence side, we are really the happiest people in the world with our acquisition — that’s at least that! Both in terms of location in the countryside, as well as the apartment itself. After more than 3 years, no major construction problems (it can still come:)), and all materials seem to want to keep up with the times.

I repeat this to everyone who asks me for advice on a purchase: one of the most important points apart from the financing is the builder. Choose him as if you were going to marry him. He must be upright and honest if you don’t want to have to call lawyers in the future. We were very lucky to buy in a small condominium ownership construction, which means that it was only local craftsmen who worked on the site (vs. the huge sites with huge companies that are very difficult to reach once the site is completed).

In terms of market valuation, I regularly look at what is happening and prices increase slowly but surely. This confirms the statements of several local people that our region has been free of any real estate bubble for several decades (unlike the Lausanne area, for example).

Let’s agree, I’m not counting our apartment as an investment. That is, in YNAB I only record the purchase value (minus the mortgage) to arrive at our net worth, because as long as we have not sold it, any other value would only be speculation.

Coinbase (cryptocurrencies)

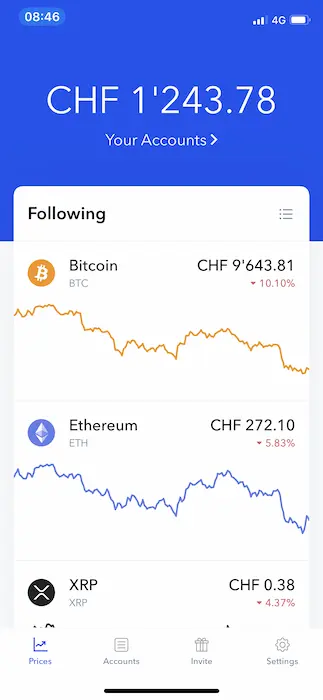

I almost forgot about this experiment with cryptocurrencies started in December 2017. At the time, I had transferred 1'000€ (CHF 1'100) to Coinbase to buy some Bitcoin, Ethereum, and Litecoin.

Regarding volatility, I haven’t found better so far: D

Our portfolio rose to CHF 2'700 in December 2017, only to fall back to abysses close to CHF 300 a year later. And to date we are back on the rise with a portfolio value of CHF 1'243.78 to date!

So in terms of cryptocurrency strategy, I keep the same as at the end of 2017: these CHF 1'000 are cool to have fun as at the casino but I will not add a dime to it. On the other hand, I keep them on the long term just to see the evolution (and you never know, maybe become a millionaire!)

My doubts about our current investment strategy (as a Swiss investor)

I am currently thinking about adapting our stock market investment strategy in order to significantly increase our returns.

As a reminder for newcomers:

- Since the beginning of the blog, I recommend a boglehead portfolio of max 3 ETFs for simplicity’s sake. Long-term performance objective (minimum 8-10 years): 7-8%

- Since I need CHF 75'000 of cash per year to stop working by 40, I went up to the next step by buying our first multi-family rental building in France (as a Swiss resident). 10-year return objective (calculated via this tool) : 15%

In recent weeks, I have become increasingly interested in value investing, popularized by the famous Benjamin Graham and adopted by Warren Buffett and many others.

The yields we are talking about in this field are around 15-25%.

Although real estate is more predictable with rents and tangible (and yet it’s not sure), investing in value has the advantage of being dependent only on your own brain, a computer, and having time at home from your couch. Compared to real estate where one has to handle contractors, real estate companies, tenants, etc.

These are clearly two strategies that take time and energy, but not in the same way. And if I have to be honest with myself (it’s my journal after all!), I admit that I’m more attracted to the geek side than to the human and project management side (I’m having enough fun at work and with the blog on that level).

In short, rather than going around in circles about where to invest my time, I jumped into value investing with some first steps.

I started by reading Rule #1: The Simple Strategy for Successful Investing in Only 15 Minutes a Week! by Phil Town following a reader’s recommendation (thanks again!)

Then I had a lot of discussions with other members of the community to try to get a 360° view of this field.

My current reading is a bit of the Bible in this area: The Intelligent Investor by Benjamin Graham. My goal is to understand where the movement started from.

And I went even further by starting a portfolio dedicated to value investing to be really immersed and to be forced to understand the ins and outs. So far I’m quite convinced but I’m waiting to learn more before making a decision.

To summarize, my current tendency is to keep what I have invested in ETFs as is (i.e. the 120kCHF in VT and VWRL).

The same goes for keeping our first rental building to assess how it is going.

And as for the rest, unless we have a very, very big opportunity in terms of pricing for the new rental building we’ve been looking at for several weeks, then I think we’re going to go all-in with value investing in terms of our savings (and the time I’m going to spend diving into it). And it will really have to be big as for the real estate potential building because with the crash that’s announced (sale time!), I will really need all the cash available! (for newcomers, for us Mustachians investors, it’s a godsend when the market falls apart because it means you can buy shares at a discount price :)).

My (new) Swiss bank account and Swiss credit cards

Regarding our Swiss bank account and credit card system, I have re-evaluated everything in recent months.

About the bank, the idea is to gradually move from BCV to Zak (all the information about why and how are in this article, including welcome discount codes up to CHF 50).

I will give us the option of keeping BCV until the end of 2019 in case Zak is too slow or too buggy (like their mobile app in recent days for example…). Because after some usage, BCV’s app is far better than Zak or Neon. But the desire to say bye-bye to BCV (just like my mortgage insurance) is too strong! The follow-up will be in the next episode :)

On the other hand, my new credit card setup is the Eldorado. The combo Cumulus-MasterCard and Revolut satisfy me as never before. Both for the Cumulus bonus cashback, as well as for obtaining the interbank exchange rate with Revolut.

If you are interested, you can read all the details of my choice in this article (including CHF 50 of welcome cash for MasterCard, and free shipping for the Revolut card).

And as some people have asked me, yes, we still use YNAB heavily even if I talk less about it than I should, looking at how a fanboy I am. I plan to make a complete guide of it soon.

The blog

Big news: the German translation of the blog is completely finished! I will finally be able to refocus all my efforts on creating blogposts rather than translating. I was so looking forward to it because it was getting long!

Some of you have asked me when the Italian version will be available, but the percentage of potential visitors is currently too small compared to the workload it represents. Maybe next year ;)

In any case, if you have friends/family who prefer to read in German, you can gladly share the URL with them: https://www.mustachianpost.com/de/.

The (project of the) book

There has also been a lot of movement around my book idea in recent months.

More than 200 of you have registered to receive information as soon as it is released. That’s great! My objective to start the finalization/publication process remains, however, to reach a minimum of 1'000 people so that it is worth it. If you know people who are potentially interested, idem, don’t hesitate to share with them the dedicated page to register.

The other news is that a publisher has shown interest in publishing me! On the one hand, it’s great because once you become an author, journalists are much more open to writing articles about you according to blogger friends who have published their own book through a publisher. But on the other hand, it would mean being dependent on the will of a publisher, and also going from 60-70% of income in my pocket to 1-2%…

I hesitate.

But for the moment my focus is mainly on the blog and my future investment strategy. So, story to be continued!

Financial independence

Concerning our objective of being financially independent in Switzerland by 40 (i.e. “to stop working definitively” for new readers), it is a little mixed.

I am still very motivated to find solutions to reach the CHF 75'000 we are short of each year, for example through real estate and also through my new hobby of value investing.

But I also see that things are going too slowly to reach our 40 years old goal. I know that compound interest is starting to accelerate the process as we move forward over the years, but for now it seems a long way off. And time flies by quickly. That’s why I want to determine in the next few weeks if we’re going to go all in with rental real estate or with value investing to really immerse myself in it and get back on the path to financial freedom :)

Currently we cool off in Geneva on weekends, but after our 40th birthday we'll do it on Tuesday afternoon :) or on Thursday, we'll see what happens depending on our mood!

After that, we still have the option of living abroad, but uno, we really like our life in Switzerland a lot, and secondly, it depends on a lot of parameters such as where our children will be later, how our respective parents will be, our desires of the moment, etc…

In short, a lot of intermittent motivation with moments of doubt in recent weeks…

Ah and last but not least, as several of you have asked me by email: our current net worth target level to be able to stop working at 40 (45?) is between 1.25MCHF and 2MCHF depending on the parameters we use. Now that we have more data on the last few years thanks to YNAB, I really need more time to calculate our expenses in detail by excluding those of children (another todo !)

One thing that I’m sure about is that we keep maximizing our income as much as possible, saving as much as possible, and optimizing the returns on our investments as much as possible!

Because in the end, that’s what counts and will help us to stop our respective jobs :)

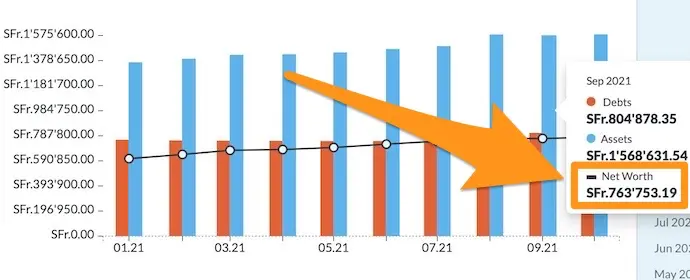

Net worth

We were kindly approaching CHF 400'000 (it feels strange to write this!) of net worth but we went down just over CHF 360'000 because of my 3a pillar (-14.5kCHF that I thought I had aside, but in fact not…), as well as bank and notary fees for our rental building acquisition in France (-18kCHF). For this last point, the advantage is that it is an investment compared to my 3rd pillar which looks more like a chasm these days…

Depending on the bonuses at work and whether we have tenants continuously with our investment property, I think we will pass the CHF 400'000 mark at the end of the year, or early next year. I look forward to it!

Conclusion

As you may have noticed, only change is constant. But that’s what I feel that’s what makes the journey towards our financial independence (I dream of my ideal schedule often in recent days !) so exciting!

On the other hand, it also implies that for you, dear reader, it is more difficult to follow. That is why I will try to be more regular about my portfolio updates and other investment strategies. But as time is limited in the same way for everyone, keep writing to me by email if you have any questions about something that I wouldn’t have covered enough.

And what about you? How do you feel these days? Do you have a clear vision of your path to the day when you will write your resignation letter with a mega smile on your face? Or are you also having questioning right now?