I received several requests from readers who wanted to know my opinion about the online broker DEGIRO 1 who launched its services in Switzerland at the end of last year. I’ve even been blamed (politely nevertheless, we’re a cool community!) for posting a biased review ; I supposedly dismissed DEGIRO because they do not offer an affiliate program, whereas they were simply not established in Switzerland when I wrote this article.

So it was time to answer these questions about this newcomer to the world of low cost online brokers.

DEGIRO, what is it?

DEGIRO was founded in 2008 by five former employees of Binck Bank. They launched their online brokerage platform in 2013, and set out to conquer Europe in 2014, first with Belgium and France, then with Switzerland in November 2016. They are now present in 18 European countries.

The 180 employees of DEGIRO currently manage more than 200'000 investors, with 9 million transactions a year, representing 30 billion euros under management (i.e. 35 billion USD, or 35 billion CHF). Comparatively, Interactive Brokers has a portfolio of 450'000 clients valued at 115 billion USD (i.e. 115 billion CHF).

How much does DEGIRO cost for a Swiss Mustachian investor?

DEGIRO doesn’t have any custody fees for ETFs (nor for most other products except some funds).

Like many players in the low-cost market, the company offers a long list of ETFs free of transaction fees in which we find my two favorites from Vanguard. For other ETFs, such as those from UBS for the Swiss market, you have to pay transaction fees of 2€ + 0.02% of the transaction amount.

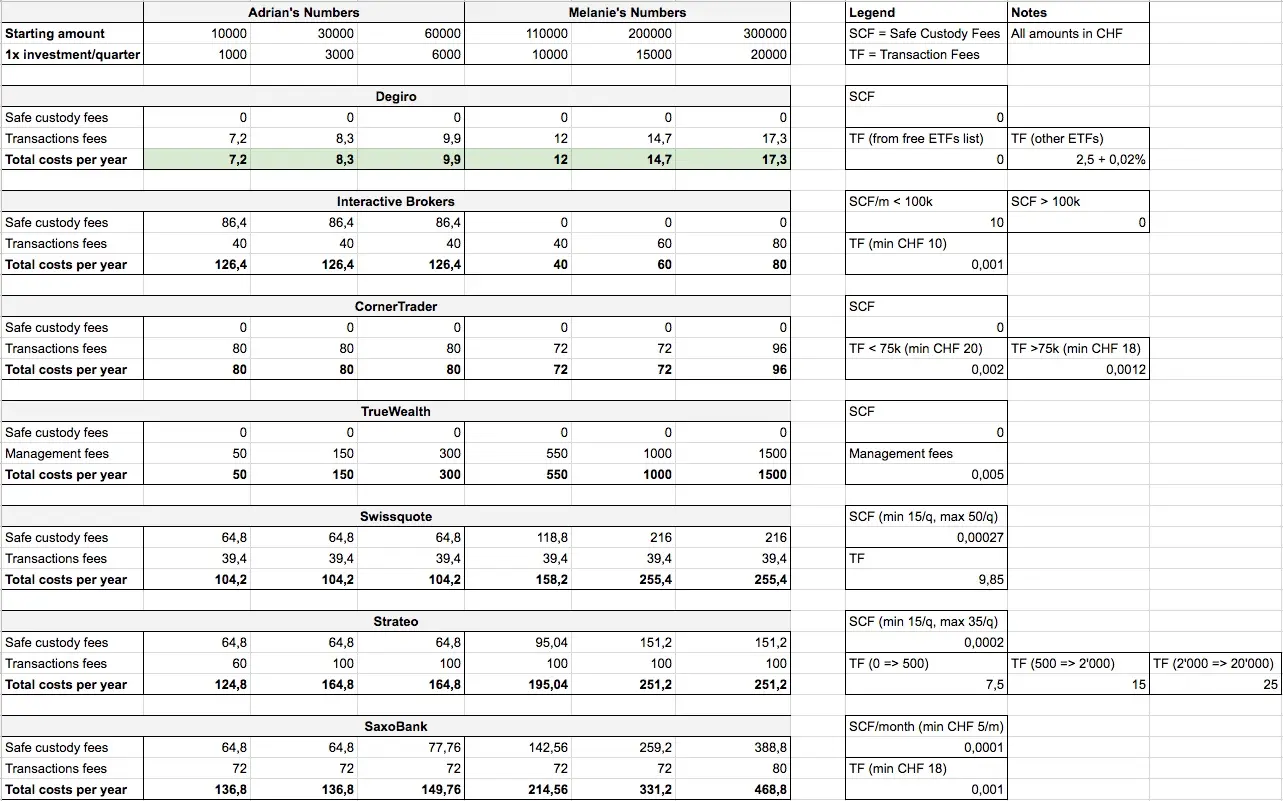

So I updated my table comparing the best online brokers for a Swiss investor, and the result is clear: DEGIRO is the big winner.

A clarification concerning DEGIRO’s commissions on currency exchange: when you want to buy securities in a currency other than CHF (for example an ETF in USD), DEGIRO requires “0.10% of the amount” for the automatic conversion mode, or “10€ + 0.02% of the amount” with the manual conversion mode.

As a comparison, Interactive Brokers charges 0.002% of the transaction amount (with a minimum of 2 USD) up to $1 billion.

With our scenario where we invest quarterly between CHF 1'000 and CHF 20'000, it does not change much: DEGIRO remains far ahead with its very low fees.

Also, if you choose a deposit account (i.e. an account that DEGIRO won’t use to make money on your back), you will be taxed on the dividends paid by your ETFs up to 1€ + 3% dividend (maximum 10%).

For more information, you can find a detailed list of all their fees for a deposit account by following this link.

My opinion about DEGIRO

Mathematically, the decision is clear: DEGIRO 1 leads the ranking of online brokers.

Nevertheless, I still have some reservations before leaving Interactive Brokers knowing that DEGIRO exists “only” for 9 years compared to Saxo Bank whose bank was founded in 1992, and Interactive Brokers in 1978.

If it was to invest a few thousand or even tens of thousands of CHF, I would not hesitate, but there, we still speak about hundreds of thousands of CHF.

So, for the moment, my online broker will remain Interactive Brokers and I will wait to see where the wind takes DEGIRO, and how the latter reacts to the next global economic crisis, even if it means that I lose a few hundred CHF by then.

And you? Did you choose DEGIRO? Do you have any information in favor or disfavor of this newcomer?

Note: if you choose to open an account at DEGIRO 1 via one of my links, you won’t notice any difference — but the MP’s blog will get a referral commission. I thank you for this.

I long hesitated before subscribing to their affiliate program because I am not entirely convinced by their service. I therefore reiterate my advice here: subscribe to DEGIRO only after doing your own research and being fully aware of the advantages and disadvantages of this online broker.