UPDATE 27.03.2025

I’ve stopped investing in my Daubasses portfolio to date, but I still recommend it. My two personal reasons are listed in this article.

Last February, I presented the Daubasses (paid) newsletter offering ideas for “value investing”.

I have been personally following their strategy since June 2019, and I have learned a lot from them. In addition to investment leads, I have gained financial knowledge that is easy to understand because it is presented in a jargon-free and very transparent way.

To date, my “value investing” portfolio amounts to about CHF 30'000 invested in about 30 different companies.

I almost have a preference for value investing rather than ETFs, because I have a much greater sense of control with it. Indeed, I understand the company and its accounts. I understand that I buy it when no investor wants it on the stock market. And I understand that I sometimes sell it more than twice as much when investors wake up and see what the Daubasses team had seen — in the accounts, not in the coffee grounds! — months or years beforehand.

Nevertheless, I remain cautious. For the moment, I am waiting to see how this part of my portfolio will perform over the long term (another 5-7 years) before investing more into it.

In the meantime, I continue to educate myself. And in view of the many questions I received about the Daubasses team, I thought I would invite them for a small informal interview on the blog, just between us.

Interview with the Daubasses team

MP: Hey there! First of all, can you introduce yourselves because in the end we don’t see you often. How many of you are in this “Team Daubasses”? Where do you come from?

Daubasses: Hi Marc. Thank you for welcoming us on your Swiss blog!

Who are the daubasses? This is a question we are often asked. It’s normal because we don’t put ourselves forward individually. What counts for us is to work with passion and to offer a quality service to our subscribers. It doesn’t matter who’s behind the keyboard. Originally, the blog was created in 2008 in Belgium by 3 Belgian friends and investors. Then a Frenchman joined the team. A few Belgians left and another Frenchman arrived. The team has moved, but the spirit and values have remained the same: transparency, independence and pedagogy. All this in a jovial atmosphere.

In short, the team is heterogeneous with different profiles. But this is not what we want to emphasize. Les daubasses is above all a team and a community, faithful and growing. Service before individuality. We don’t work to put our egos first.

MP: Additional question; are you like me, amateurs in the field of personal finance? Or do you have diplomas and everything?

D: Indeed, we are graduated (finance, accounting, etc.) at Master level. But this is not very important. Everybody knows people who are “educated” but incompetent in their fields. What counts is passion! Knowledgeable, passionate and serious amateurs have as much merit as professionals with a good reputation.

Beyond the diplomas, we have really learned on the job over the years, from our mistakes, our personal paths, our reading, our exchanges and our network. It is all this that we have been sharing with the maximum of pedagogy since 2008 with our subscribers. By the way, we invite your readers to read our 1'000 or so articles of an educational nature on our blog to learn more about the investment oriented towards the patrimonial discount.

MP note: don’t take the excuse that their blog is French only to skip their great resources. Deepl is your best ally for overcoming this small blocker.

With our Daubasses #2 portfolio, we are targeting an annualized performance of 15% over a period of 10-15 years.Les Daubasses

MP: I can already hear some readers asking themselves: “Oh, but you’re not Swiss!?! But then, does your advice apply to the Swiss? Or what?

D: We don’t give any advice, it is important to emphasize this.

As we like to repeat: “we say what we do, why we do it, but not what you should do”. In fact, what we provide to our subscribers is a great toolbox that saves time for both the novice and the stock enthusiast and allows them to read new analyses that they won’t find anywhere else.

Of course our work may be of interest to Swiss people. It seems that you have a rather advantageous taxation on capital gains on shares ;-)

Our hunting field is worldwide: Europe, North America, Asia, etc. All developed countries that ensure a minimum respect of property rights are potential hunting grounds for undervalued shares.

MP: Thank you for the warning (!), and the detailed and reassuring explanation :)

And by the way, it’s good that you’re talking about taxation! In Switzerland, we are indeed not taxed on capital gains. On the other hand, one can start to get taxed (by being qualified as a professional investor) if, for example, one starts buying and selling an asset within less than 6 months. Can you confirm me the average ownership of a Daubasses line usually (i.e. compared to during the last months of the COVID crisis where I already bought/sold 3x)?

D: Wow, 0% is excellent! One more reason to invest in stocks when you’re Swiss.

On average, we hold our shares for a little over 2 years. Well, it happens that we sell a line following a big increase only a few months after our purchase. In the case of a repurchase by a competitor or an investment fund. But is it really bad news to make a big gain in less than 6 months? :-)

In the case of a takeover bid on a company, it is always possible for example for the shareholder to keep his line a little longer and not to rush on the “Sell” button as soon as the bid is announced. To wait to realize your capital gain. Between the time of the announcement of the offer and then the actual sale to acquire it, long months can elapse.

MP: When I see the time I spend looking for my articles, I was wondering how you manage your process given the immensity of the job? What’s a week at the Daubasses team? How do you scan all the stock markets so you don’t miss any opportunities? What tools do you use to apply your in-depth analysis and sort through the markets?

D: We are craftsmen. Everything is handmade here ;-)

We systematically look at what is happening on all the stock markets of the capitalist countries with the help of a few computer tools to rough out, but afterwards there is no secret: we open the balance sheets of companies over several years to see what they have in their stomachs.

Investment leads can also come from the Daubasses forum, where subscribers suggest ideas that are well worth the detour. We can also look at the recurrent and massive share buybacks, the sharp declines in certain sectors because “old-fashioned”, etc.

Our main source of ideas comes from our network. It is made up of several thousand subscribers and former subscribers. After more than 12 years of service, we have contacts of informed amateurs but also investment professionals all over the world. Not all the ideas proposed are good to take, but sometimes we miss the obvious and it is a contact that will remind us of a stock.

We generally retain barely 5% of the ideas that are proposed to us. But this is more than enough for us. This network is an opportunity, and it is also what makes the difference!

With the Daubasses, you are never alone. We like to talk about “family”: passionate individual investors who support each other to improve their process, find new ideas and sometimes even avoid big mistakes.

MP: As a reminder for new readers, you had a “Daubasses #1” portfolio from 2008 to 2018. What was the annualized performance in % of this first “Made in Daubasses” portfolio?

D: 978.6% (x10.8) from November 26, 2008 to September 28, 2018, a life of 9 years and 308 days. We can therefore say in less than 10 years ;-) This gives an annualized return > 27%. More details here.

This is a real portfolio. All account statements are freely available on the site (for subscribers only). For us, transparency is an essential value.

MP: Let’s get to the uncomfortable questions.

Seeing the performance history of this “Daubasses #1” portfolio, some readers mention that if we remove the extraordinary performance of 2009, we come back to an average not as attractive as at first glance (if you can give us the annualized performance without 2009, that’s top). What do you think about that?

D: Why delete the 2009 performance?

Having just one excellent year between +200% and +300% per decade and then performing like the market over the other 9 years suits us very well.

The main thing is to be comfortable with your investment style. Beyond performance (which we hope will be as high as possible, of course), what matters is to be comfortable with your investments. To go to bed at night without stress, and to have a long-term vision. By buying tangible assets (cash, accounts receivable, inventory and real estate) at a high discount, we are comfortable and sleep soundly.

MP: In 2018, you decided to move to a new portfolio #2. Why did you decide to move to a new portfolio? Why didn’t you sell some positions to take new ones? Was it to “rig” the performance numbers a bit, because you felt that a crisis was coming, and that it could only help the marketing of your newsletter? (I said it was getting embarassing :D)

D: After 10 years of good and loyal service, we wanted to return the profits to all the owners of this portfolio which included our money, but also those of our relatives (family and friends). We started from 15'152.00 EUR on November 12, 2008 to reach more than 300'000 EUR at the end of 2018 (there were some contributions over the period). There are also many technical reasons mentioned in this article.

If our motivation is marketing, it’s stupid not to continue to present the Portfolio daubasses 2 included in the performance of the Portfolio daubasses 1! This would allow us to still show a very nice outperformance.

We suck at marketing: look at our blog, it’s old school (not to say “old-fashioned”…) and the title “Les Daubasses”. Sexy isn’t it? Do you think they talk about us in the big Swiss investment banks? :-)

MP: I continue with the devil’s advocate. The annualized performance of your Daubasses #2 portfolio between 2018 and 2020 is -2.19%, while an index such as “Lyxor MSCI World EUR - CAP” gives us 14.31%! Is it me or do I actually have better time to stay quietly invested in ETFs, and save the amount of your newsletter in the end?!

D: Perfectly! We think that buying ETFs is a great idea for investors who are not passionate, who don’t have the time, etc. It’s certainly the best “yield/energy” ratio. What annoys us more is that the ETF investor does not really master the underlyings. It is more a way to buy a trend on a market (geographical or sectoral).

-2.19% is not the annualized performance, but the total performance of Portfolio daubasses 2, the “model” portfolio. Well, OK, it doesn’t wear its name very well in view of the current performance (laughs). But it’s one tool among others. Subscribers often do better than us because they select in our work only what they are interested in. Few actually (rightly or wrongly) blindly replicate all our buying and selling operations. And fortunately! As they often say: experience it for yourself. Take some ideas from us if you like them or not according to your appetence, your profile, your investment strategy, etc.

As for the pure performance, we’ll talk about it again in 10 years? We are serene with the current assets in our portfolio. At the last checkpoint, we have a weighted average potential on all our lines of +200% and an average price-to-book ratio of 0.44x vs. 3.63x for the S&P 500 and 1.45x for the Stoxx Europe Small-Cap 200.

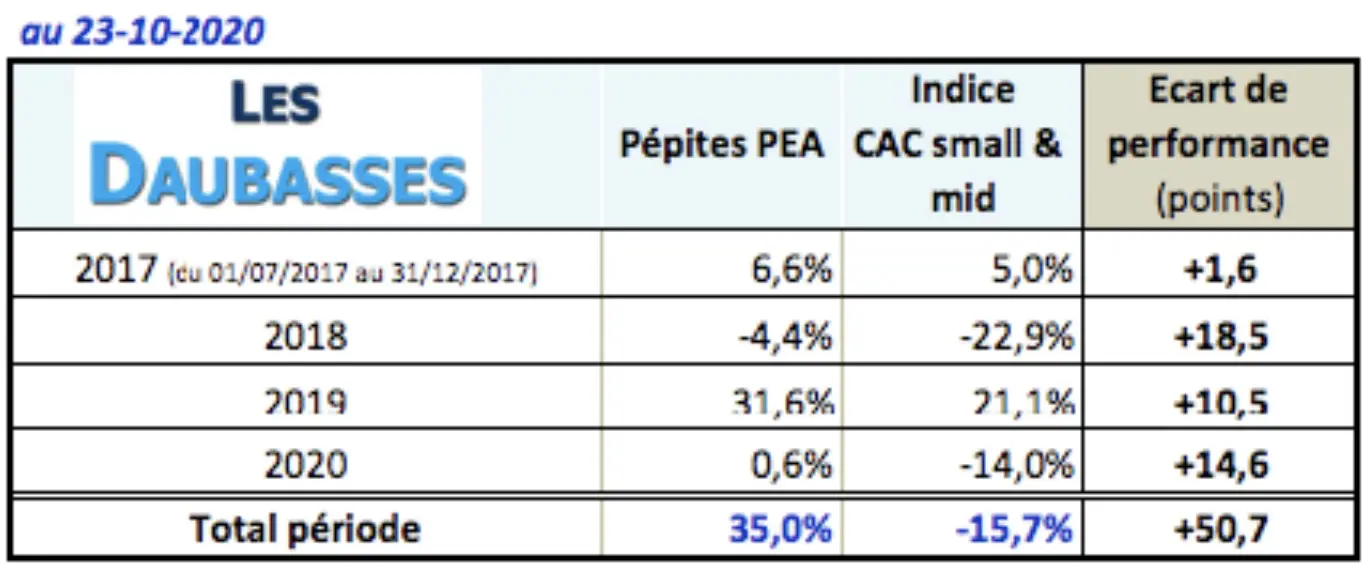

Finally, the Daubasses, it’s also the PEA Nuggets. And here we have outperformed every year since the creation of this portfolio dedicated to European stocks:

MP: Other readers of the MP blog were talking about betting on value investing ETFs that allow you to diversify even more, with less monitoring (i.e. following your newsletter to the letter) to do. What do you think about it? And by the way, are there any value investing ETFs that are worth it, with frugal fees (like <0.4%)?

D: Why not. It’s supermarket versus grocery store. There are those who want to spend as little time as possible on their investments and those who want to know and control what they put in their stock portfolio.

We have no ETFs to recommend because we are not interested in this market.

MP: Let’s say that a reader decides to subscribe to your newsletter because he finds (like me) that your process is simple, humble, careful, diversified, and focused on the long term. Do you advise him to follow your portfolio movements to the letter, while checking the reports you provide himself by self-educating through your articles and forum? Or would you suggest an alternative path?

D: Back to our previous answer: we don’t give any advice! Sorry to repeat it but it is important for us. An investor subscribes to us to look for a plus, to bring a missing piece to his investor’s briefcase. We don’t provide the whole in one. We accompany subscribers, we answer their questions, we publish thought-provoking articles related to investment and financial analysis, but we don’t take them by the hand. They are autonomous in their investment decision.

The subscriber picks up from us what seems to make sense for him in his overall investment strategy. Among the dozens of companies analyzed every year, some will be more appreciated than others (sector, geographical area, quality of management, strong accounts, etc.). It is then up to the subscriber to dig into the figures or not, according to what emerges from the analysis and then possibly invest a few euros (or a few Swiss francs). There is no rule, each subscriber takes what he wants from us.

With the Newsletter, our educational articles, the investment leads proposed in addition to the companies in the portfolios and, since last year, the private forum with currently more than 1'400 members, there is plenty to do!

MP: Since we’re talking about your forum. Happy birthday to it by the way! What are the lessons learned after 1 year of existence? A few stats to share such as the number of users, the number of nuggets proposed by the community, the number of messages posted?

D: Thank you! The first candle has just been blown out.

Since its launch on November 11, 2019, there are 1'424 registered members, 4'224 messages and 351 topics created.

Out of these 347 topics, 21 have been made public (everyone can consult them). Do not hesitate to have a look at them to make your own opinion: public part of the Daubasses forum.

For us, this forum is a culmination. Of course, it’s not the most technical thing at the moment. But it allows exchanges with subscribers and also directly between subscribers. In this age of social media where instantaneity is of the utmost importance, the structure of the forum is the guarantee of messages written in a qualitative and non-invasive way (we take care of it). In the long term, it is thus easy to find a subject, a company or specific information. It is collective intelligence: the knowledge of some benefits everyone. It is almost limitless!

The other advantage of the forum is that we quickly add to it all the information published concerning the companies in our portfolios (Daubasses and PEA nuggets). Thus the subscriber has access to all the information, commented by us, rather quickly instead of waiting for the monthly Newsletter as was the case before. We try to give our subscribers as many means as possible, as part of our approach, so that they can make their own investment decisions with the maximum of turnkey solutions.

There are also investment ideas related to insider purchases and commodity stocks with special situations (for example with abundant, not to say “excessive”, cash flow). This is still a vast subject, we’ll talk about it another time.

MP: Without any commitment, I say that I aim for 5-8% with my ETF portfolio. Without any guarantee whatsoever 1, what annualized performance do you aim for with your Daubasses #2 portfolio over a period of 10-15 years? 8-10%? 10-15%? 15-20%? More?

D: 15% per year. It’s not going well at the moment. This means that the Daubasses #2 portfolio will have to wake up seriously! :-)

Investing in the stock market is a marathon, not a sprint.

MP: By the way, if I follow you to the letter because I don’t have the time to do all the research you’re doing, how can I be sure that you’re not going to close store in 3-5 years, and that I might lose a lot of money?

D: There is indeed no guarantee on the paper. The only one we have is to be several people and passionate. This is the best guarantee. We have a job that is also our hobby. Why stop it?

And well… Losing “a lot”, that’s the amount of the subscription? 119€ TTC/year?

MP: Same if you propose a new portfolio #3, and drop the #2. How do I know when to sell what?

D: It seems unlikely that we would want to sell Portfolio daubasses 2. It is young, the amount invested is modest and it has great potential. But anyway, let’s play the game.

If we decide to sell all our lines, it is certainly because we feel that the potential is too low and that it is then preferable to become 100% cash again (really unlikely given the bargains we are finding at the moment…). Let us imagine that it is the case nevertheless… OK.

It would then be possible to continue to exchange with us and the other subscribers about these stocks we gave up, with in the topic dedicated to each stock on the forum.

MP: If a new reader on the blog wants to see what you concretely publish in your paid newsletter, is there a way to see somewhere one of your full reports for an acquisition or sale?

D: To get an idea, there is the public part of the forum (which includes the old monthly Letters from 2011 to 2013, the following years will follow soon). Ideally, you should read one of our recent analyses.

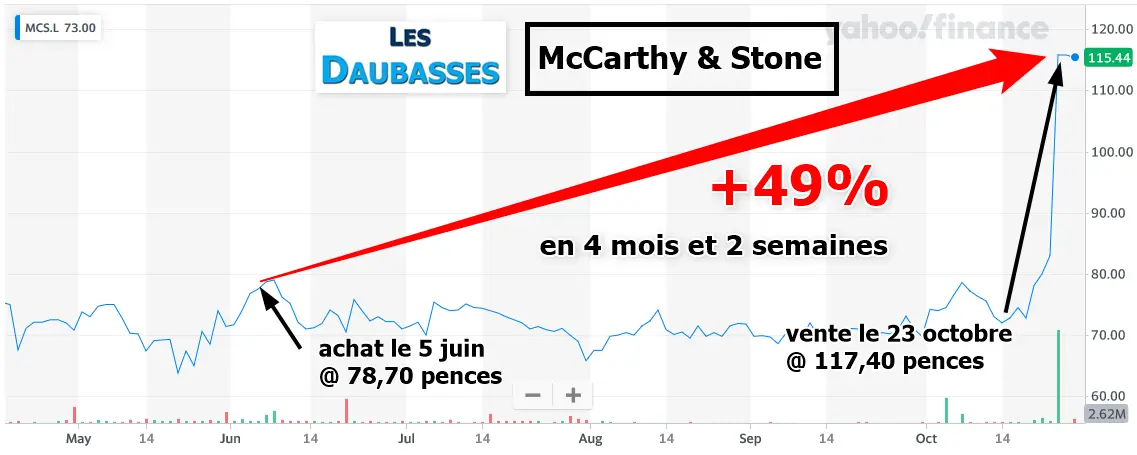

For example, here is our latest sale. It concerns the shares of the company McCarthy & Stone, a British developer of housing for “senior citizens” bought 40% below the value of its tangible equity last June. The outcome was favorable and fairly quick. The story can be found on the blog.

MP: Thank you again for your open-mindedness in your constructive answers. If some readers want to subscribe to your newsletter, is there a way to get an offer like in the beginning of 2020…!?

D: Thank you for these questions Marc. Good luck to you and your readers with value investing.

What we have agreed with the team is to offer your blog readers the following offer — reserved for new Daubasses members only: for any 1 year subscription purchased before Monday 30th November at 11:59pm, we offer 6 months (value of 59.50€) for free. That’s 18 months of subscription at the price of 12 months.

With this exceptional offer, we hope to meet soon many Swiss readers on the forum!

MP: Wow, thanks for this special offer on behalf of the Team MP, really!

D: Our pleasure :) See you soon. Les Daubasses.

Conditions for the offer “6 months free subscription Daubasses.com when buying 1 year”

To take advantage of the special offer of 6 months of free subscription to the paid newsletter of the Daubasses, here are the conditions:

- Be a new subscriber between the 11.11.2020 and 30.11.2020

- Subscribe for 1 year between the 11.11.2020 and the 30.11.2020 at 23h59

- It doesn’t work with the 2 and 3 years abo

- In order to activate the offer, send an email to contact [at] daubasses.com AND with me in copy (contact [at] mustachianpost.com) with the title “OFFER-MP” and a content like “Thank you the Daubasses team for your 6 months free offer! It’s really nice :)”

Your questions for the Daubasses team?

If you have any questions for the Daubasses team, please know that I am planning a new interview with them in 2021. So if you have any specific question for them, you can write it down as a comment below (or via email) with the prefix “Question for the Daubasses:”. I’ll make sure you get an answer next year ;)

Please note that investing involves risk. Everyone (the Daubasses and myself) here speaks from their own experience, and nothing can be considered as financial advice. This article is to be considered for entertainment purposes only. Your investment decisions are your own responsibility. ↩︎

MP Investments' Portfolio — Performance Report #1

Review Cashback Swiss credit card (incl. bonus CHF...