At the end of last year, one of the readers challenged me on the fact that my Interactive Brokers (aka IB) account was based in the UK and that I could have problems with Brexit.

So I contacted my IB Switzerland advisor and asked her several questions (in bold):

Interactive Brokers and Brexit, what to do ?

MP: With my IB account located in the UK, and the Brexit thingy, should I worry about my assets/money? Are there some impacts I should be aware of?

The account as such is not located in the UK. Indeed, our US entity (Interactive Brokers LLC) is the carrying broker of client assets globally. You’ll find here an overview of locations with whom we have accounts on behalf of our clients. Those central depositaries and other banks are located in the US or outside the US.

Also, cells “A46-55” indicate the banks in Europe which we use for cash deposits for our European clients.

A hard Brexit outcome will therefore not affect our clients who who have opened the account with IB UK.

European clients have been contracting with IBUK til date. Since everyone is expecting a hard Brexit, we have took care of contingency arrangements (aka B plans) in the meantime. We have set up an entity in Luxembourg. Once we know the exact outcome in March, I can image that new European clients will contract with IB EU / Luxembourg in future.

MP: So all my assets (aka ETFs) are held by Interactive Brokers LLC in the US, right?

Correct.

MP: And what about the small amount of cash I have at the moment. When I do the transfer, it’s to Citibank. Isn’t this located in the UK?

Depends which currency you send. Citi UK is our payment agent for CHF and GBP wires. EUR are send to Citi in Frankfurt while USD are sent to Citi in New York. We don’tforesee any issues with Citibank UK. Otherwise we have contingency arrangements in place thanks to our longstanding relationships with numerous other counterparts.

So, yes, if you send CHF, they go to Citibank in the UK. Clients should not be worried about the cash amounts held with our various banks. After all, they also have the cash protection of up to USD 2.75 mio if a client has that much with us.

MP: And now that we’re in March, do you know something new about Brexit impact on IB?

No Brexit impact expected. We are doing everything to have IB Luxembourg up and running by ends of March. Besides, if there is a Hard Brexit, it’s not that IBUK would loose all European passporting licenses from day one. There is a transition period granted by most EU countries (France, Germany etc) of moving clients who currently are under UK over to Luxembourg. We will be prepared for it.

I looked for more information about this transition period, and it exists also for Switzerland. It runs until the end of 2020, and is possibly renewable if Switzerland and the United Kingdom so wish.

Also, the European Securities and Markets Authority issued a press release last month to explain that if no deal Brexit is found with UK, then they signed a gentlemen agreement (they call this officially a “Memoranda of Understanding”) to still allow infos to flow between countries so that business can keep going on while contingency plans are put in place.

So what are you doing MP with Interactive Brokers?

My plan is quite simple: I will continue my little journey by transferring CHF each quarter to Interactive Brokers, and by buying ETFs right afterwards.

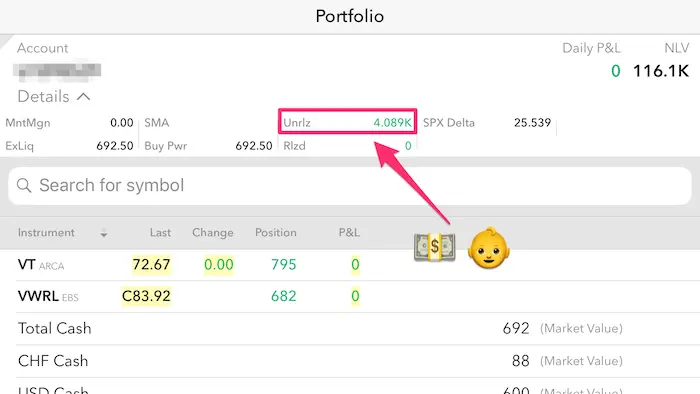

Then, without any worries, I’ll go and serve myself a nice cup of tea while watching my cash work for me on my IB mobile application:

And in the end, this Brexit doesn’t change much for me because I never have any cash in reserve at IB UK because as soon as it’s on my Citibank UK account, I buy ETFs with it.

Also, I have enough confidence in IB to inform its customers if there is a need to transfer one’s account from the United Kingdom to Luxembourg.

When you think about it, doing a Brexit overnight would impact negatively everyone: the United Kingdom, the countries doing business with them, the businesses themselves, and the citizens. No one has an interest in breaking all the agreements without finding others that would prevent the United Kingdom from being isolated from the rest of the world.

And you, what is your strategy with Interactive Brokers? You stay with them or change for another (such as Cornèrtrader or DEGIRO)?