I decided to reconsider my credit card and budget tracking setup.

I was tired of spending hours (OK, it was just tens of minutes) reconciling my YNAB budget with my Swiss credit cards from Swisscard and Certo One.

Just a reminder for the newbies of the blog, I’m frugal and only use credit cards for the cashback.

Unfortunately, Swiss banks haven’t decided to open their interfaces (i.e. APIs) to tools such as my YNAB budget app to automate reconciliation. This means I have to keep reconciling transactions manually.

Optimize the effort/return ratio

As frugal as I usually am when it comes to my Swiss Francs (even if it takes effort), the time it was taking me over the weekends wasn’t worth it compared to the 200-300 Swiss francs in cashback I was receiving back every year.

Afterward, I started thinking that if I did that, I’d soon be getting a cleaning lady to optimize my effort/return ratio… and I had a bit of a guilty conscience. While reflecting, I realized that there’s value in what we teach our kids (at least at their ages) about taking care of your home vs. manually entering credit card transactions.

Once my brain was convinced by my reasoning (it’s quite chaotic up there ^^), we decided to implement it.

Test: 1 year without a credit card

So I decided to suggest to Mrs MP that we block all our credit cards, and only use our neon debit card.

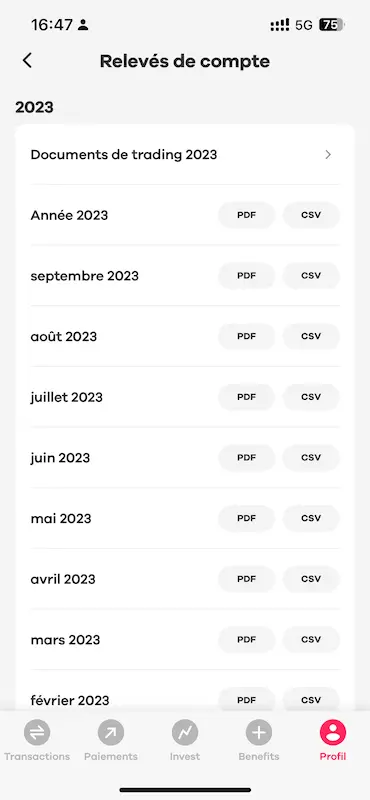

Luckily, neon allows us to export all our transactions in CSV format with one click in their mobile app.

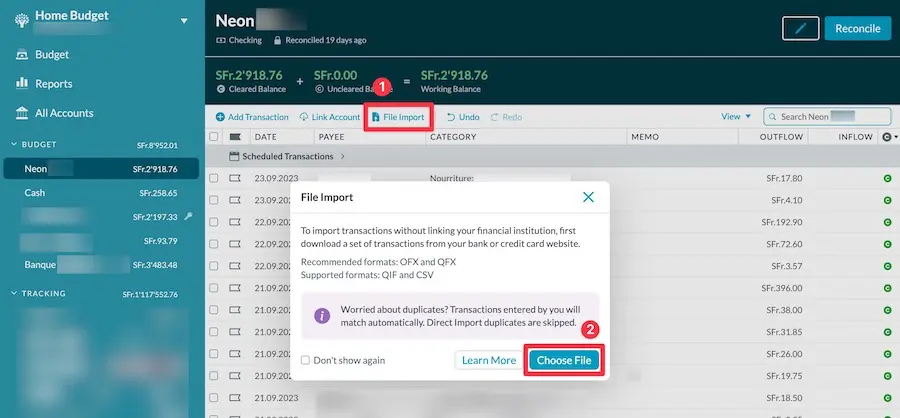

Then I adapt two columns in the file and import it into my YNAB application.

So clearly, we’re a long way from the automation that exists everywhere in other European countries (including the US), but it’s already better than the old Swisscard and Certo One PDFs!

And I can already see the benefits in terms of speed and accuracy of our balance in our YNAB budget app.

And since frugality is ingrained in our lifestyle, we’ve only been entering our expenses into YNAB twice a month for some time now (rather than daily as in the beginning).

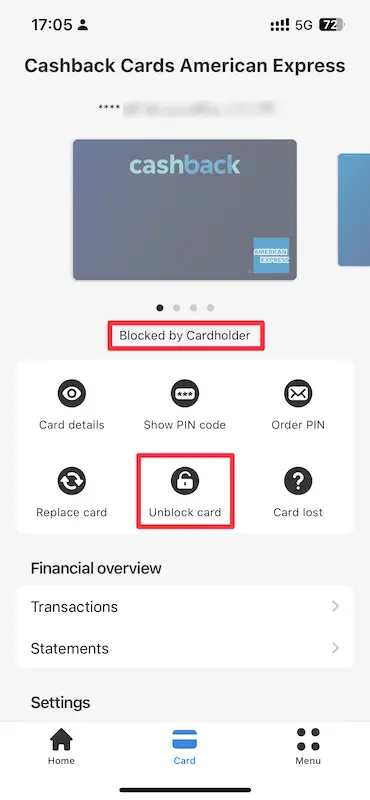

How to block your Swiss credit cards

So as to not have to worry about any more credit card transactions (especially recurring ones, such as our monthly cloud backup subscription), I’ve rediscovered a feature that’s so much more practical than before.

Credit card blocking directly from my mobile app.

When you think about how it was in the past, you had to block your card and order a new one…

And now, all you have to do is log into your Swisscard (or Certo One!) credit card app, and press “Block card”.

And within 3 seconds, your credit card is blocked.

Digitalization is improving, I tell myself :)

And all in all… more rigor

I also have to admit that even if it doesn’t change the way we spend money, the fact of having less than 1'000 Swiss francs in our neon account does reduce our spending…

And if it really is an essential expense, I managed to hold off payment until after our salaries are paid on the 25th of the month.

Hiking in the mountains to enjoy the fresh air! (rather than being nailed in front of a computer screen ;))

And, if we really need to pay right away, then in that case I unlock our credit card, pay with it, and schedule a transfer from my neon account to my credit card once our salary arrives.

Oh yes, because the MP strategy is simple:

- We only keep the bare minimum of money in our Swiss neon account (with a small margin for unforeseen events)

- And we transfer all the rest of our savings to our Interactive Brokers brokerage account to invest our Swiss francs in the stock market which will multiply over time

Conclusion (with one but ^^)

It’s been 1.5 months now since we adopted this new payment card system with Mrs MP.

And I must say, it’s great not having to waste time reconciling credit cards and budgets.

BUT, I must confess that, two weeks ago, when I had to pay for a purchase of over CHF 1'500, I couldn’t help but reactivate my Swisscard Cashback credit card in order to get the 1% cashback… and to avoid having a credit card bill at the end of the month, I made a transfer from my neon account right away…

I couldn’t pass on that chance :D

All in all, I’ve just set myself a reminder in 12 months’ time to debrief you and tell you whether to keep or change the system.

UPDATE 03.10.2024: and here is the debrief one year later!

How about you, do you prefer credit cards to maximize your cashback, or prefer simplification to optimize the time you spend budgeting?