What would happen if the person in our MP couple who has the Interactive Brokers account in their name were to suddenly pass away?

It would be a mess…

Succession and Interactive Brokers (IBKR) trading account

For personal reasons, until now, we had one single Interactive Brokers account for Mrs MP and me, in one of our names.

Every time someone we knew passed away, we said that we ought to change that.

Beyond the emotional impact, an unexpected death would also create financial complications. The surviving person could be locked out of the majority of our net assets for weeks or even months while the succession process is finalized. This is an important factor to consider when choosing an online broker, as access to funds during such situations can be critical.

We sorted that all out properly with a will and power of attorney each, but as Interactive Brokers (IBKR) is an American company, and we are Swiss, I think it would be a real mess and take a lot of time!

As we were talking about succession with my parents, I decided that we should stop talking about it and take action ;)

Transform an individual IBKR account into a joint account?

I didn’t want to sell all the ETFs in the individual Interactive Brokers account, to then transfer all this money into the joint account, and buy back the ETFs.

Why? To avoid exiting the stock market at the worst time (the lowest), and entering at an equally bad time (the highest). I can’t explain to you all the questions that you might have in such a case.

I therefore wrote to Interactive Brokers Switzerland support to ask them if it’s possible for a Swiss investor to simply transform an individual account into a joint account.

The response of the brokerage firm:

“Dear Mr Pittet,

Please note that IBKR does not support direct reclassification and conversion of one type of account into another, as each entity generally requires specific information about the account holder, legal agreements and, in certain cases, declarations by the taxpayer. Unfortunately, it is not possible to change the type of account into a joint account.

Please see below for the procedure to follow in order to open a linked joint account: […]

Best wishes,

IBKR Client Services”

Oh, well, that’s a shame…

So I then asked if it was possible to create a joint account into which I could automatically transfer all our stocks from the individual account.

The response:

“I would like to inform you that the following criteria for the IB accounts must be fulfilled in order for an internal transfer to be possible:

- The account names, national IDs, tax IDs, country of legal residence and the IBKR entities must match on both the accounts.

As your account is an individual account and the other account is a joint account, the internal transfer option is unfortunately not possible. In this case, you may request a manual internal transfer, but that can take from 1 to 3 weeks due to the need to review the case from a compliance perspective, and there is no guarantee that it will be accepted.

There are two types of manual transfer: partial transfer and full transfer. For a partial transfer, you are only seeking to transfer some of the holdings from the source account to the destination account. In the case of a full transfer, this means transferring the entire account. When a full transfer is requested, the source account is closed shortly after the transfer has been completed.

If you wish to request such an undertaking, you will need to create a ticket in the Client Portal (select the “Funds & Banking” category and “Other Deposits and Withdrawals” as the topic).

In the ticket, you must specify the account numbers of the source and destination accounts and state “Full manual account transfer” in the subject if you want to transfer everything. State “Partial manual account transfer” if you only want to transfer a certain amount of funds and/or positions and list everything that you want to transfer.”

It’s a shame that this can’t be done automatically (via their IBKR website or IBKR mobile app), especially with the best online broker. But I get that it’s a rare case they don’t encounter often.

So, even though it’s a bit of a hassle, we decided to go ahead with a manual internal transfer.

Transfer of an individual IBKR account to a joint account

I’m going to answer questions about my experience with Interactive Brokers Group customer support below. I’ve also outlined the key steps to follow if you want to switch from an individual Interactive Brokers account type to a joint account.

- Open your new IBKR joint account (in the same way as you open an individual account — full tutorial here)

- Configure the trading permissions in the same way as your individual account so that the transfer can be made (i.e. US ETFs, the countries where you want to buy stocks, like Switzerland for example, margin account, and stock yield enhancement program)

- Request a manual internal transfer (full or partial) from your individual account (number ABC) to your new joint account (number XYZ), and explain the reason

- Complete the Letter Of Authority or LOA document (by the individual account holder) that the support department will send you, physically sign it, scan the doc, upload it to the IBKR secure messaging service and attach proof of identity

- Call Interactive Brokers client support (Interactive Brokers number in Switzerland on their website in the “Support” section) in order to confirm your request to them verbally and provide the ticket number (two-level security to avoid an ill-intentioned transfer)

- Await approval then confirmation of the transfer

- Enjoy your new joint account with Interactive Brokers Switzerland!

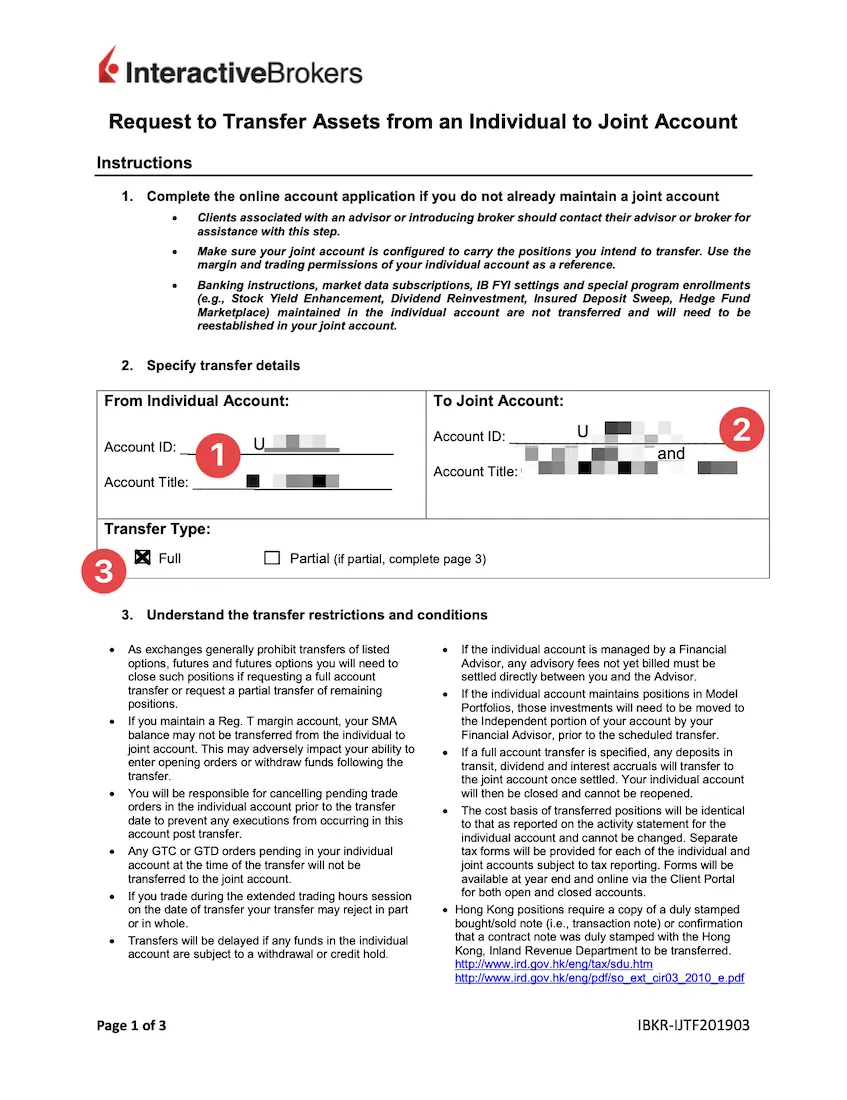

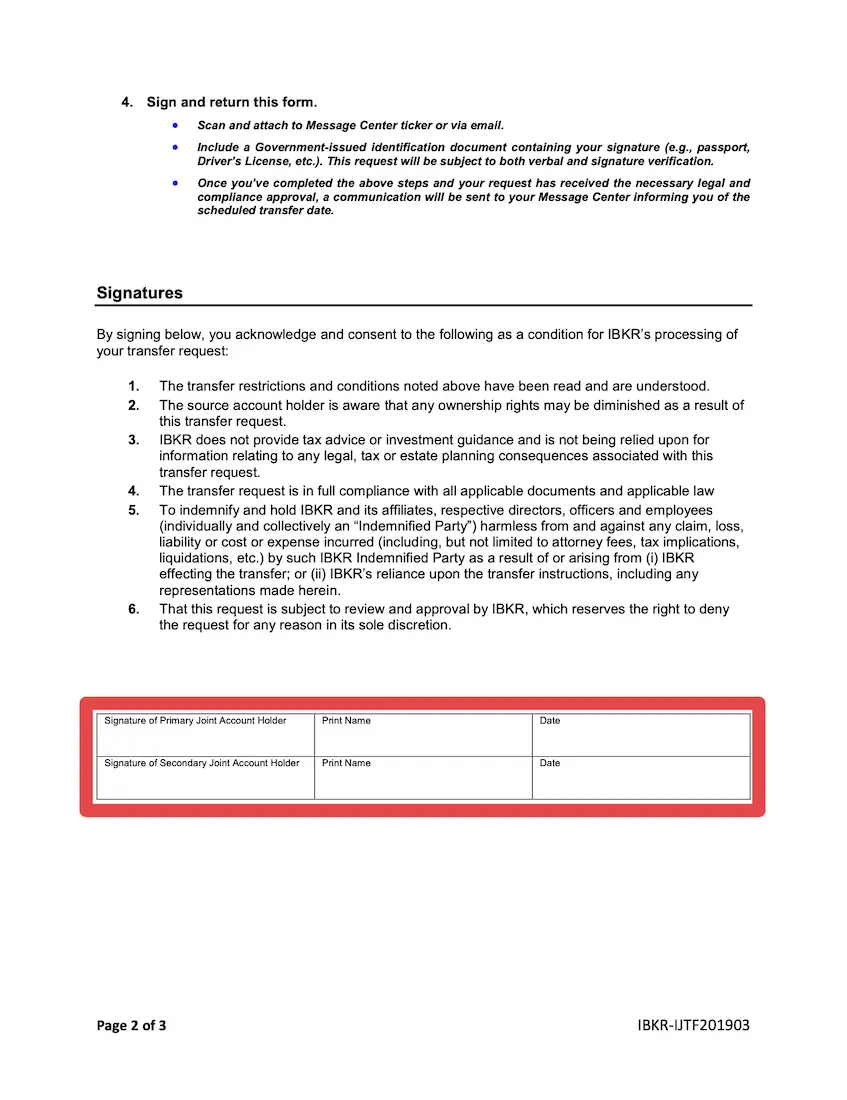

Below is the above-mentioned LOA:

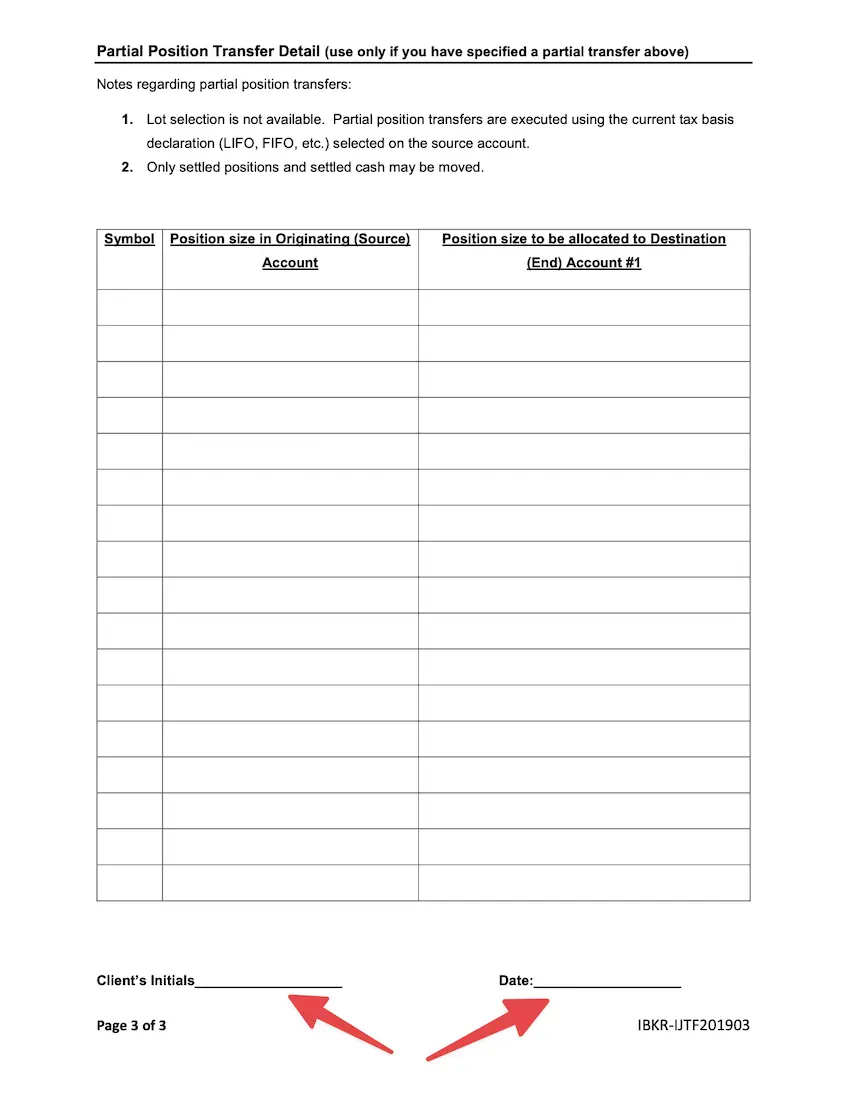

Add your initials and the date (I leave the table empty as I want to transfer ALL my holdings into the new IBKR joint account)

UPDATE 19.09.2024: under founder and former CEO Thomas Peterffy, the process has been simplified since I wrote the article. Swiss and European investors can now do a digital signature of the Letter Of Authority and that’s it. No downloading, printing and all that. Thanks to the reader Javier for pointing it out.

Conclusion

When I read IBKR’s first two responses, I thought it was going to be a battle to transfer the individual account into a new IBKR joint account.

And in fact, it was a piece of cake, as everything is done for you by IBKR’s client support.

The only small hassle is having to redefine the same trading parameters in your joint account, but by having two web navigators open side by side, you can easily copy all that from your old individual account.

So anyway, that’s done! We can die in peace :D

What about you? Have you taken out a joint account with Interactive Brokers Switzerland?

FAQ Interactive Brokers manual internal transfer

How long does an account transfer take with Interactive Brokers Switzerland?

To be on the safe side, plan for about 1 to 1.5 months for the process. In my case, I sent my first message at the beginning of November, and the transfer was completed by the end of January. However, I delayed responding to some of their messages in December because I was busy with the blog. Plus, there was a two-week break over the Christmas holidays, which also slowed things down.

Is the IBKR Switzerland account transfer free?

Yes, transferring an account with IBKR Switzerland is completely free. This is a big advantage, considering that the process involves manual identity verification for the new joint account. However, since you continue to be a client, it makes sense that no custody fees or extra charges apply. This keeps your investment in Swiss Francs as efficient as possible.

Is it possible to transfer a margin?

Yes, it’s possible to transfer the margin from your individual account to your Interactive Brokers joint account. It seemed complicated to me (in my head, as in the end it’s only figures in a computer ^^). Nevertheless, IBKR support say that you have to wait for them to fully review your request in order to confirm whether it’s possible.

For me, I ended up with a negative balance in CHF on our new IBKR joint account. So it works :)

Does IBKR Switzerland sell and buy back your stocks, or is it really a straight title transfer?

As IBKR support told me: “Please note that IBKR transfers the positions as they are in the source account to the destination account and does not close or open positions.”

What do you mean by the “same trading permissions”?

At the time of the transfer, I still held my Daubasses portfolio stocks. They are from different countries like Japan, Canada, Germany, etc. Except that in order to hold these kinds of stocks, when I opened my individual Interactive Brokers account, I had to request permission to trade securities from these countries.

That’s why I had to make the same (automated) request on my new IB joint account so that the transfer could be done.

As stated by the Interactive Broker’s support department:

Please note that the destination account does not have the necessary authorizations (JPY stocks, CAD stocks, EUR stocks - France, Germany, Spain and Netherlands) to hold the source account positions. Please request the necessary trading authorizations on the destination account. To request the required trading authorizations on the destination account, connect to the client portal, go to the menu and select Parameters > Account parameters. Click on the Configure icon (cog wheel) for “Experience and trading authorizations”, make the appropriate selections and complete the online steps.

Is there any other information to consider during an IBKR account transfer?

When I received approval for the transfer of my individual account to my new joint account, I was sent a list of points to note.

I’ve picked out the most useful ones for you:

- Submitting a transfer request is not a guarantee that we will process.

- We will be unable to complete the transfer if the source account holds futures, futures options or equity or index options positions, unless the account registrations are identical.

- If clients would like IBKR to CONSIDER transferring option positions, they will need to obtain a letter from a reputable U.S. attorney opining on the implications of the transfer as related to CBOE rule 6.7(a).

- If clients would like IBKR to CONSIDER transferring commodity positions, they will need to obtain a letter from a reputable U.S. attorney opining on the implications of the transfer as related to CME rule 853.

- If approval for the transfer of these positions is NOT granted, any positions will need to be removed from the source account or otherwise omitted from the request, prior to the execution of the transfer.

- For FULL ACCOUNT transfers - The source account will be slated for closure and will not be able to be used again once the transfer is complete. Any deposits, transfers, postings, etc., will automatically sweep to the new account and cannot be moved back.

- Market data subscriptions will not transfer and may not terminate on the source account if applicable.

- Stock Yield permissions, loans and borrows will not transfer.

- Depending upon the circumstances, open orders on the source account may not automatically be canceled and should be reviewed.

- Once final approval has been received, these requests can be queued for overnight processing on a best efforts basis.

- Wire instructions on the source account will not move to the destination account. They must be reentered on the destination account if they do not already exist there.

- Any deposits or transfers to the source account will automatically sweep to the destination account.

- Kindly review your GTC orders as some may not have canceled on the old account and now will be on place on the new account.