UPDATE 11.11.2020

You will find an in-depth (and without filter!) interview with the Daubasses team by following this link.

UPDATE 27.03.2025

I’ve stopped investing in my Daubasses portfolio to date, but I still recommend it. My two personal reasons are listed in this article.

While discussing investments with several readers last year, I realized that my cash was working for an expected return of 6-8% over the long short term with my ETFs, compared to their investments in value which were returning between 10-20%.

So I started googling to try to find more info on the web, but all the sites and blogs I found were either too clickbait or too superficial. So I stayed with my investments in ETFs and real estate for a good part of 2019…

All this until I spoke with two members of the Team MP who recommended me a book and a reference value investing blog respectively.

But before I tell you the details of my journey, let’s start at the beginning.

Value investing, yes, but instead of what?

Until mid-2019, my strategy was to invest in the stock market via ETFs. As a reminder, an ETF is an “Exchange-Traded Fund”. In other words, it’s a fund that you can buy on the stock exchange, just like a normal share.

For stock market beginners: a fund allows you to answer the following problem: “I want to buy stocks from all over the world to be highly diversified, but I don’t want to buy them one by one.” So when you buy a share of this fund, you automatically own shares in each of the companies the fund invests in.

One of the criticisms of this approach is that we do not know too much about the thousands of companies in which we invest.

But we do know (well, we do hope) from historical data, confirmed by Mr. Warren Buffett himself, that it is an approach that will beat an actively managed portfolio in 75% of cases (i.e. portfolios built by financial advisors who try to beat market indices).

As you can see, it’s a very passive type of investing, and that was my goal. Because in the end I only spent 30 minutes per quarter re-injecting my savings into 3 ETFs (see my article on how to build a Bogleheads portfolio with only 3 ETFs for more information).

With this kind of ETF portfolio, I want to achieve 6-8% return over the long term (i.e. 10-15+ years).

What is value investing?

Value investing is an investment strategy that involves selecting stocks that appear to be trading at a lower price than their intrinsic value (also called book value).

Compared to a portfolio of ETFs, which often includes thousands of companies, a value portfolio consists of approximately 30 companies.

The purpose is twofold:

- 30 only because you have to follow the accounting, finances, and other board meetings very closely

- And at least 30 because you want to diversify in order to have the statistics on your side (i.e. you don’t win every time but when you win, it’s more than your potential losses, in order to make a positive gain in the long run)

Value investing is an investment strategy that involves selecting stocks that appear to be trading at less than their intrinsic value.

A concrete example of value investing

Imagine that the Tesla brand (the manufacturer of electric cars) is unstable, and that its flagship model the Tesla Model S has an Argus value defined by Eurotax Switzerland (representing the stock market in our example) that varies between CHF 5'000 and CHF 60'000 depending on the daily mood of buyers and sellers.

You who know about batteries and large touch screens for electric cars, you have knowledge that even if the Tesla brand were to close tomorrow, you could resell all the spare parts of this model for CHF 50'000. That’s the intrinsic value, which is completely uncorrelated to the market price or to what the brand does (like burning cash by sending rockets with cars in them :)).

Then, in case your estimate of CHF 50'000 is too optimistic, you take a safety margin (one of the key principles coming from Benjamin Graham, founding father of value investing) of 30%, i.e. you agree to buy this vehicle when it is at CHF 35'000 (= 50'000 - (30% x 50'000)). The goal is that you don’t make a loss if you ever screwed up in your calculations for the resale of spare parts. In the worst case you should be able to sell everything for CHF 35'000.

And then, Wednesday morning when you arrive at work, a colleague says: “God, Tesla are really not doing good… even my neighbour offered me his Tesla Model S this morning for CHF 30'000 because he’s afraid it’s not worth anything when he wants to change it in 3 months…”

What would you do?

Personally, I take the neighbor’s phone number and tell him that I buy his car that night with cash.

And to finish the story: 7 months later, the market having returned more rational, I see that the Tesla Model S on AutoScout24 sells for around CHF 50'000. So I put an ad, and the next day it’s sold.

As a result, in 7 months, I realize a gain of almost 43%.

Does that sound too good to be true? I was thinking too that it couldn’t be. But it is, thanks (or because?) to people’s irrationality and emotionality, supply and demand actually generate such price variations on the stock market.

How to start value investing?

The summary of my value investing experience in one sentence: I read a book that allowed me to understand the basics of value investing, and then I focused on a website that has a paid newsletter in order to take action while being accompanied.

Value investing book: “Rule One Investing”

Thanks again to you @Andrew for getting me on the right track by advising me to read the book “Rule #1” by Phil Town.

This book is very practical. It’s a sort of A-Z value investing guide for finding “value” companies to invest in.

And the cool thing is that all the economic jargon is illustrated very simply via an example of a lemonade stand that Phil takes throughout the book whenever there is a complex financial concept to explain.

In addition to this book, there are two books that are a bit like the bible of value investing because written by Benjamin Graham himself, namely The Intelligent Investor and Security Analysis.

To have started (and not finished because boring) reading “The Intelligent Investor”, I can only recommend you the Phil Town book to get a good overview of what value investing is all about. And then move on to Benjamin Graham’s if you want to delve deeper into the subject.

If I had to summarize this book “Rule One Investing” in a few key points, I’d explain it to you as follow:

- Make a list of all the fields and industries you understand

- Find all the companies corresponding to these criteria that are listed on the stock exchange (there are online tools for that, don’t worry)

- Then analyzes their financial reports to keep only those that have a moat (read “competitive advantage”) big enough not to get knocked out in the years to come. This is the very interesting part because you have all the mathematical calculations explained very simply

- Analyze the company’s management to make sure they align their interests with yours as an investor in their company

- Calculate the price at which you agree to buy the stock of such a company, including the famous “safety margin” of 50% in case you’re wrong in your calculations, and also because it’s impossible to predict the future

The last principle of the list, the “margin of safety”, is a key element also put forward by Warren Buffett in his famous expression :

Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1. Warren Buffett

To answer the question you’re asking yourself, “But then MP, I read a book, I apply it to the letter, and boom, I get 10-20% return?!”

My answer: “Yes and no.” (the kind of answer I hate myself!)

Yes, because I applied the method myself by choosing a company matching all the criteria (which I then followed without buying to test the process). This company was therefore offered by Mr. Market at US$200 back in 2019. And on the day I write this article, Mr. Market woke up (i.e. the stockbrokers investing like at the casino) and now values it at US$315… So we are talking of a return of about 57.5%!

And another yes because Phil even offers a paid service to do all the calculations in his book automatically: ruleoneinvesting.com.

The other part of my answer is: no because the method given by Phil Town proposes to follow market movements and buy and sell very regularly to satisfy Warren Buffett’s rule of never losing money. And in my case above, I would have sold and bought back the shares one or even several dozens of times until today.

The problem I see with that is related to the tax situation in Switzerland. As a reminder, you are not taxed on capital gains as a private investor. On the other hand, there is a criterion that makes the taxes consider you as a professional investor who does not play with the Phil Town method: the holding period of a security must be a minimum of 6 months.

So I didn’t get into value investing through this book. For one, because I was afraid of being taxed on capital gains, and two, because I felt the need to be more accompanied at the beginning.

My reference value investing blog: Les Daubasses!

Following this book, I remembered that Julianek (our moderator of the MP forum) had talked about net-net investments. So we discussed a lot, and he even gave me a very detailed introduction to the subject which complemented Phil Town’s book (thanks again @Julianek!).

He also mentioned to me a site that he used to follow in the past (when he started like me) and that he always considered as one of the most reliable (and understandable by the “normal people”) resources: Daubasses.com. Sort of a “Value investing for beginners” guide.

One point that I clarify from the outset: the website is only in French, but that’s not a problem. If you’re really serious and want to value invest, I recommend you the translation tool Deepl (available as a desktop application too) which is 100x better than Google Translate (I use it for all my professional needs and for the blog too).

To prove it to you, here is an example of translation of the Daubasses website from French to English and from French to German.

Les Daubasses is the perfect website for any value investing beginner. Rational, humble, jargon-free, established since 2008, and above all with returns that many bankers and financial advisers are jealous about. The gem in terms of pragmatic and down-to-earth investments! MP

The two sections to read first are : The Philosophy of the Daubasses and the the guided tour of the Daubasses’ blog.

I recommend them to every member of the Team MP who writes to me asking where to start with value investing.

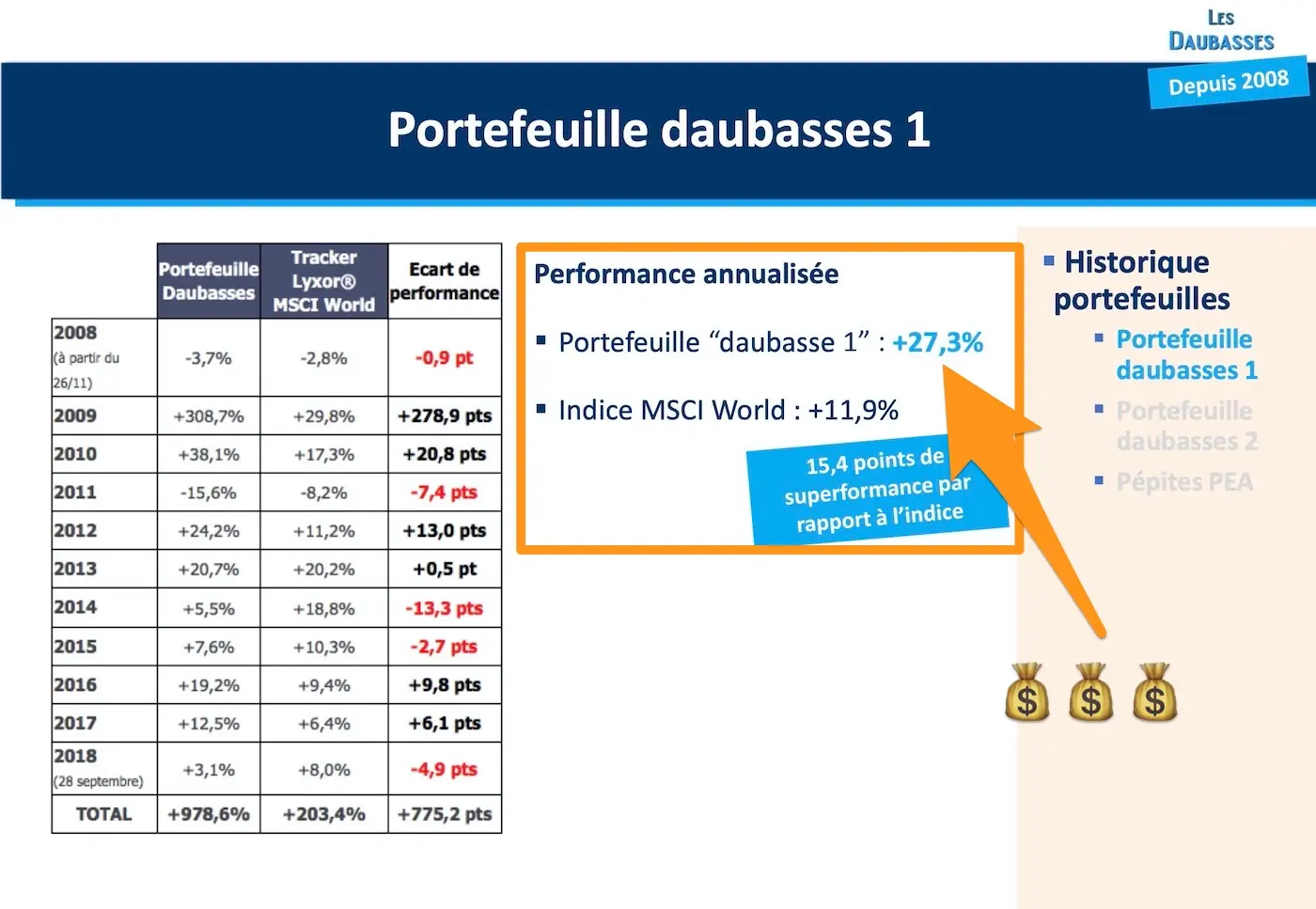

Their website Daubasses.com was launched in 2008, just before the last stock market crash. And their no.1 value investment portfolio nevertheless achieved an annualized return of 27.3% compared to the MSCI World benchmark, which made “only” 11.9% over the same decade (2008-2018).

Once I read all this, I was as convinced as I was with the book “Rule One Investing” because it’s rational.

Except I always had this fear of going in it alone.

And that’s when the Daubasses came to my rescue with their paid newsletter. At first I said to myself: “119€ a year, really? I’m trying to eliminate as much investment fees as possible, I’m not gonna spend more than a hundred bucks a year to figure out what and when to buy/sell.”

Except that a month later, I still hadn’t started investing in “value” stocks…

So I subscribed to their newsletter for a year. And I never have regretted this investment.

It’s great to have the buy and sell alerts so I don’t have to hustle the market every morning. And it’s also great to have a real portfolio (they invest themselves in what they stand for) of 30 “value” companies.

But most of all, what’s great is the educational, jargon-free financial side of each of their monthly newsletters where they explain their value investing formula step by step. I’m learning tons and feel more and more confident about buying my own daubasses (i.e. not part of the newsletter’s reference portfolio) in the coming months.

As usual, I’ll let you make up your own mind by reading the two sections of their site mentioned above which are like a value investing crash course.

Team MP promo offer: 3 months free subscription Daubasses.com

In addition to assiduously following all the content published by the Daubasses team (there are four of them behind this project), I’ve contacted them by email to find out more about who they are and co.

And I also took the opportunity to negotiate something for you. And it’s exclusively for members of the MP Team!

This Daubasses.com promotion consists of 3 free months in addition to the 12 months for which you subscribe. So you save 30€ if you decide to go for it :)

This offer is only valid until 29.02.2020.

The rules of the Daubasses.com special offer work like this:

- You must be a new subscriber to the paid Daubasses.com newsletter

- You wish to subscribe for 1 year (it doesn’t work with the 2 and 3 year abo)

- In order for them to activate the 3 months free subscription, once you have subscribed for 1 year via their website, you must send an email to contact [at] daubasses.com AND with me in copy (contact [at] mustachianpost.com) with the title “OFFER-MP” and a content like “Thank you Daubasses team for your 3 months free offer! You rock :)”

Change of MP portfolio allocation?

I’m going to see in 2020 how these value investments look. But in principle, I’m aiming for an equity portfolio split 50-50 between ETFs and value stocks.

Since June last year I have invested around CHF 16'000 in 18 different companies (many of them in Japan) for a return so far of +5.69% (the return on this portfolio no. 2 of the Daubasses that I have been following since mid-2019 is +12% since they launched it in October 2018).

But the most important thing is the potential of the portfolio, i.e. how much we would earn if the market valued all our companies correctly (i.e. at their intrinsic value). And to date the portfolio no. 2 of the Daubasses is at a weighted average potential of +171.6%.

In any case, I plan to document my new portfolio strategy in a future article this winter still.

And you, are you already into value investing? If so, what resources are you using?

Note: many thanks to the 3 new patrons @Coralie, @Andrei, and @Oogie for their blog sponsorship via Patreon. We’re getting close to hit the first goal to secure the hosting part of both the blog and the forum, I’m so thankful.