“Hi MP,

For the record, I’m a young man, soon to be 32, married, we have a 2 year old boy and we live in Geneva (OMG the rent!)

When I left school 14 years ago, I joined a local bank, and have been there ever since.

In the last few years, I’ve been dealing with mandates that were completely outside of client advice, and following a merger between offices, I had the opportunity to join a back-office team where I got my feet wet in the fascinating field of accounting. It was a good timing since at the same time, I discovered YNAB, what a treat!

As they say: “Shoemakers are often the worst shod…” First of all, the unconsciousness of youth made me open (much too) late a 3rd pillar, and it took me many more years before I took the step to invest it in funds (half of it… via the bank where I work… one tends to remain “secure”).

From a family budget point of view, my wife had a complicated start in her professional life (employer not paying several salaries, some periods of unemployment here and there). We had a few years with credit cards loaded to the brim (paying the installments as much as possible, and especially interests!), as well as a consumer credit to finish the last expenses of our wedding (it is now, by writing these lines, that I realize with big astonished eyes, by which crazy period we went through!)

The arrival of our son was the trigger: we did not want to live on credit anymore. Fortunately, in our troubles, we had a certain monthly savings rigor in order to foresee the important annual payments (thanks to my mom for teaching me that). So we dipped into it, paid off all the debts, and finally found a much less stressful end of the month. Subconsciously, we had been using YNAB rules 2 and 3… that’s when we started using the app for regular budget tracking (and credit card coverage management!!!)

I find myself stuck though, when I have the ability to easily open a securities account for investments. But today, I don’t detect in my budget an amount of savings that could be allocated to it (one shot or regularly)…

What do you recommend in this kind of situation?”

What a journey! First of all, congratulations on getting out of credit card debt and getting your finances under control before your first child was born!

Next, I’ll answer your question in two parts.

1. Strategy: define the why, and the how will follow

As is often the case, the secret is simple — but you still have to take action!

Here’s what you need to define — together with your partner:

- The purpose of the savings (that you want to invest)

- The exact amount of savings you want to achieve

Indeed, when you saw the heresy of paying interest on a credit card, you unconsciously created a goal with a precise amount, and, as if by a miracle, you were able to reach it with your wife.

Define the why, and the how will follow.

While for many years you didn’t care about all that cash you were paying in the wind.

As the saying goes: “Define the why, and the how will follow.”

A good example is my FIRE (Financial Independence, Retire Early) goal: “I want to have CHF 2'156'000 in net worth by age 40 to be financially independent.”

Compare that with the following counter-example: “I’m going to start saving a little each month, because one day I’d like to stop working before the official retirement date if I can.”

You get the idea.

And let’s be clear: my savings goal is very ambitious, but it works just as well with smaller amounts like the need to change your car for about CHF 8'000, or the desire to buy a house in the country with its necessary CHF 200'000 deposit.

2. Tactic: Pay yourself first

Now that the strategy is laid out, you’re going to have to put it into practice.

Your goal is to save money every month, no matter what, to reach your monthly savings goal.

The important part of the above sentence is the “no matter what”.

For that, I’m not re-inventing the wheel, and recommend the method described in the book “Rich Dad Poor Dad”: pay yourself first.

In short, if you don’t pay yourself first, then you will always come last after your bills, taxes, unplanned outings with friends, etc.

Because as Robert Kiyosaki asks in his book, you’ll freak out more if it’s taxes that are chasing you, or if it’s your remorse for not saving? Well, we agree, taxes are scarier. And that’s the power of his method. If you pay yourself first, and you’re CHF 100 short of paying your taxes, you’ll do whatever it takes (additional hours at your job, side gig) to come up with the money. Whereas if you had paid your taxes first, and you were CHF 100 short of your savings goal, 99 times out of 100, you would say to yourself that it’s not that of a big deal, and would make excuses like it’s not easy, life is hard in Switzerland, and blah blah blah…

This tactic is unbeatable.

For the application, you will need two (free!) bank accounts. I recommend Zak and neon, as explained in this article (with my blog’s promo codes allowing you to earn CHF 25 and CHF 10 respectively).

Once you have two bank accounts, here’s what you do:

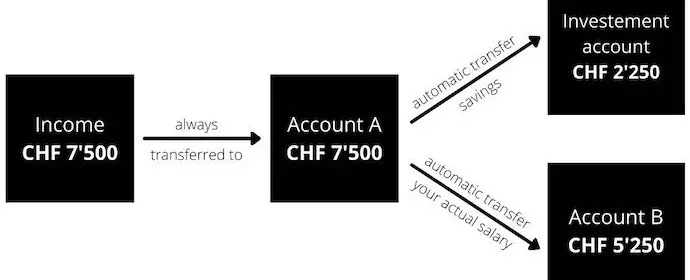

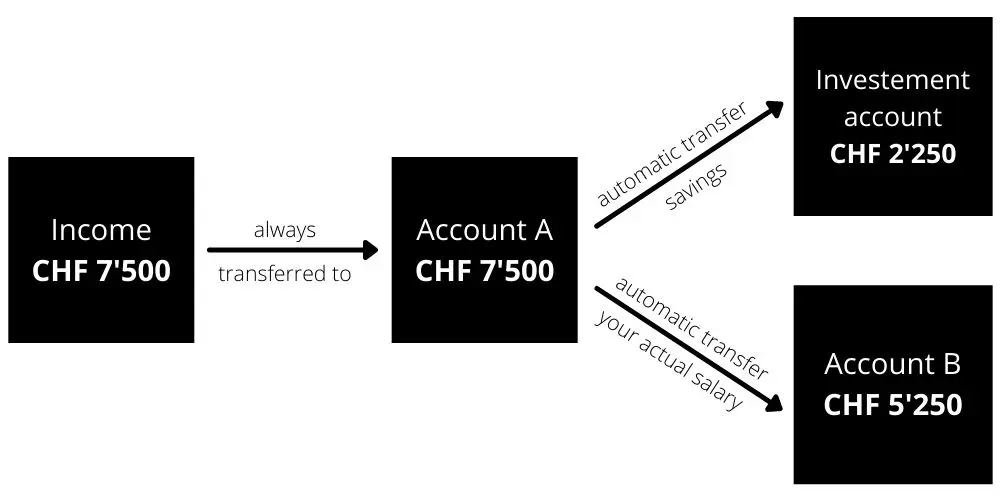

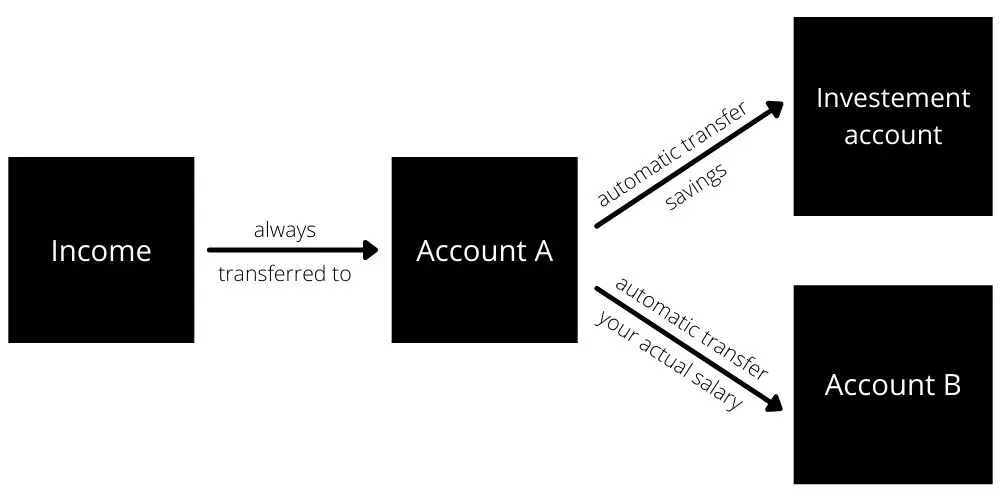

- You send your salary to your Swiss bank account A

- You create a standing order to send your savings amount to your investment account

- You create another automatic transfer to send the rest of your salary to your bank account B

- Once all this is in place, you will give access to your bank account A and your investment account to someone you trust (best friend, mother, father, etc.), and not keep them yourself. The idea being that you are put off by the idea of having to ask permission to access your accounts to a third person. And that you’d rather eat pasta for a week than have to tell someone else that you’re not meeting your savings goal

- And so, as you will have understood, your Swiss bank account B is your account for all your expenses, other than your savings

- It is therefore on this bank account B that you will create a reserve of a few thousand francs, in order to face unforeseen events, and never have to ask for access to your account A

Your actual salary is the one you see on your account B (the other accounts being 'invisible' to you)

And the same diagram with concrete amounts in CHF:

This method is great if you don’t manage to save money, because you don’t see the cash available in your bank account A, and you don’t have easy access to it at all.

And you, what’s your unbeatable method for saving money every month?

How to transfer DEGIRO to Interactive Brokers …

Should I invest in specialized ETFs? (fintech ETF,...