In my last article, I explained that I had put money that was technically not mine in a real estate investment in Switzerland.

As you can imagine, that means I’m using what’s called leverage by investing with more money than I have.

I can already hear you saying that I told you to never use that, and that I would never use it myself…

You are so right! :)

But as always, once you understand the mechanics behind what scares you — like investing in the stock market for the first time — the fear gradually fades, making way for a more rational perspective.

This is what happened with my first margin loan at Interactive Brokers.

Back in January 2021

One of the only blogs I still read about the FIRE (Financial Independence, Retire Early) topic is Mr. Money Mustache’s. I think he’s cool because he’s very critical of every topic he writes about, and transparent as I like about his own shortcomings.

He published an article in January about margin loans at Interactive Brokers, which introduced me to a new world of investment possibilities. At first I read it thinking “Ah, interesting that MMM is playing with this, then I archived the article, because it seemed complex and not necessary given my situation”. Then while discussing real estate with a friend, I saw the potential and got back into it.

I then checked out other sites in the field to see what was being practiced in the Mustachian community regarding borrowing money to invest.

How does a margin loan work?

Basically, a margin loan is nothing more than a standard loan where you borrow money from a broker.

If we take an example with my online broker Interactive Brokers (aka IBKR), it goes like this:

- You have CHF 300'000 invested in the stock market at IBKR

- Since they have “the control” on these assets, they allow you to borrow 50% of this amount, i.e. CHF 150'000 (this limit is called “Reg T margin”)

- So let’s say you borrow CHF 150'000 by transferring it from your Interactive account to your bank account

- Three months later, a massive stock market crash hits overnight, reducing your CHF 300'000 investment to CHF 200'000. To comply with Regulation T, Interactive Brokers Switzerland will automatically sell CHF 100'000 of your shares. This adjustment ensures that your remaining assets of CHF 100'000 only support a maximum loan of CHF 50'000. As a Swiss investor, it’s crucial to understand these margin rules and how your brokerage firm manages risk in volatile markets.

N.B. a margin account can quickly become a financial risk. Not only can you lose all your Swiss Francs much faster, but in the event of a major market crash, you could also accumulate debt just as quickly. Managing your IB account wisely is essential to avoid these risks.

On the other hand, if used wisely and with caution, this tool can help you generate cash using borrowed funds.

Choosing the right account type with Interactive Brokers Group is key to managing risk while taking advantage of this feature.

My Mustachian margin loan limit

Reading various articles on the subject, and understanding that it is very unlikely (i.e. it can still happen!) that a stock market crash will divide my assets’ value by 4, I set myself a conservative maximum margin lending limit of 25% of my stock market assets.

That way, the worst that can happen is that I end up with CHF 0 in stock market assets. But no debt.

Is this a dangerous game? Yes, clearly. Can I sleep soundly with this limit? Yes. If that’s not your case, you can close this page and keep your IBKR account in “Cash” mode (i.e. no margin).

What is a margin loan for as a Mustachian?

I, for one, keep this financial tool for the following things:

- It gives me a cushion in case our fantastic car fails overnight, or for any other big unexpected expense, without having to keep a huge pile of cash in the bank that doesn’t earn me anything

- Likewise, I don’t bother to keep a little cash under my elbow to take advantage of the sales during the next stock market crash (unpredictable by nature)

With a margin loan, I can stay fully invested in the stock market at all times, maximizing my investment potential. This allows my money to work even harder for me whenever I buy stocks.

And so it was thanks to this tool that I was able to seize the opportunity to invest in Swiss real estate last summer. A few clicks and I had CHF 70'000 in my Swiss bank account!

This allows me to collect CHF 3'850 per year (7% guaranteed return - the 1.5% loan interest from IBKR) without having to resell any of my ETFs.

How much does an IBKR margin loan cost?

An important point: leverage isn’t free! However, Interactive Brokers offers significantly lower costs compared to other platforms. When choosing the best online broker, it’s crucial to consider interest rates and custody fees but also margin fees, as these can impact your overall returns depending on your strategy (margin or not margin).

Below CHF 90'000, it costs you ~1.5% annual interest. And from CHF 90'000 to CHF 900'000, it’s only ~1%.

And the best part is that it only takes you 5 minutes online to get such a loan. No forms or bank advisors to satisfy. The process is as easy as pie, and fully automated.

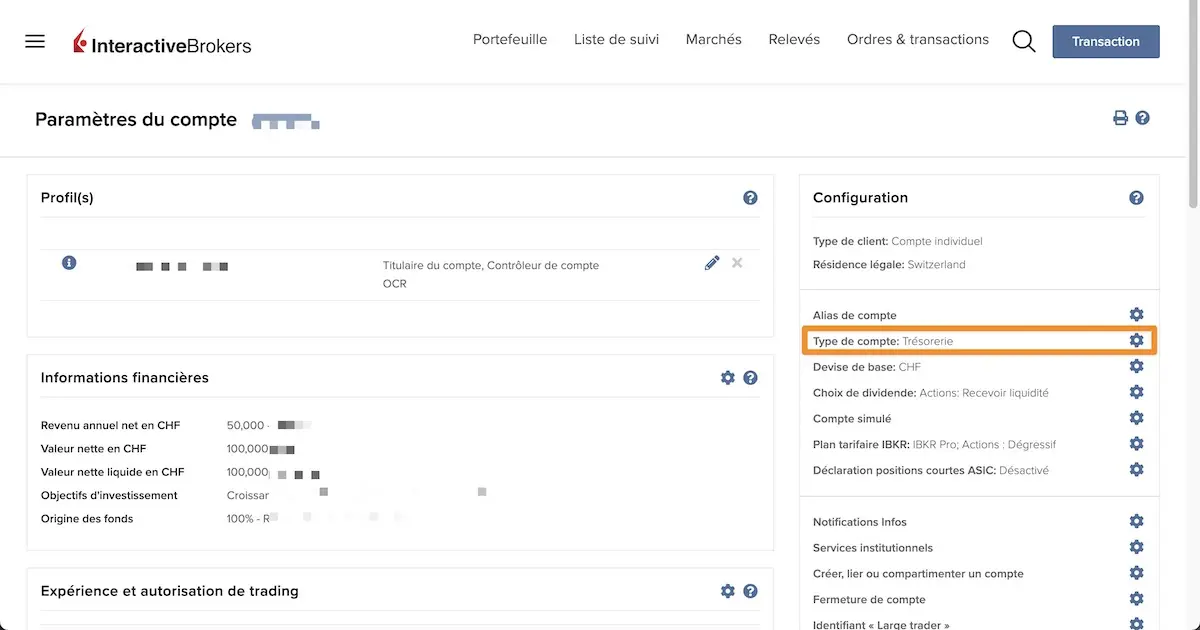

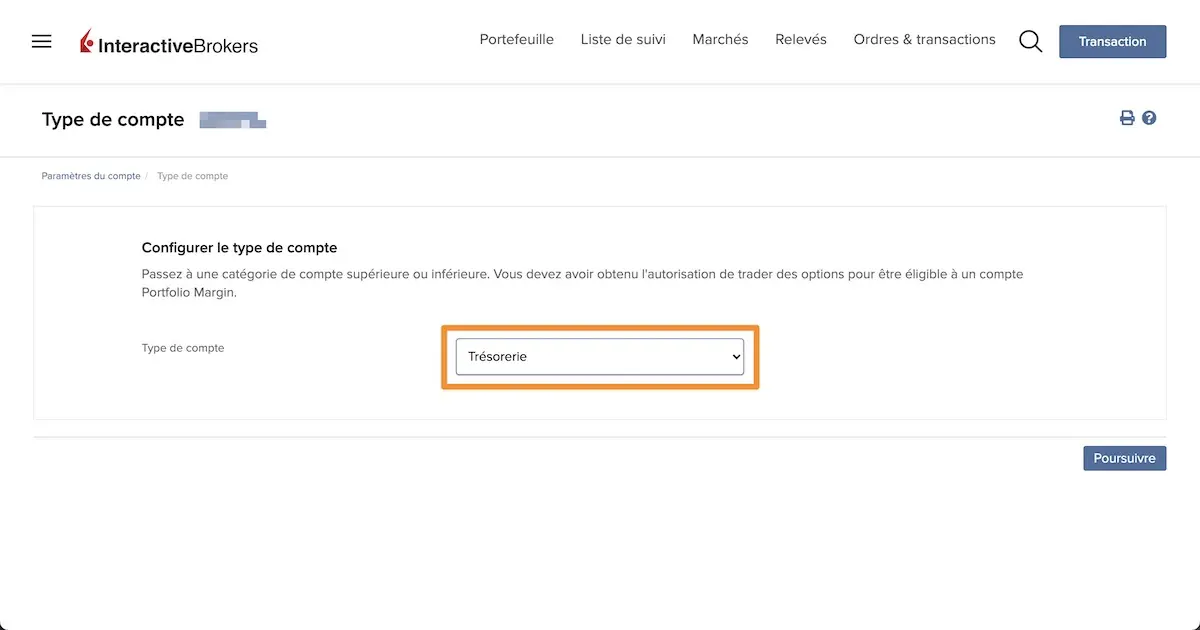

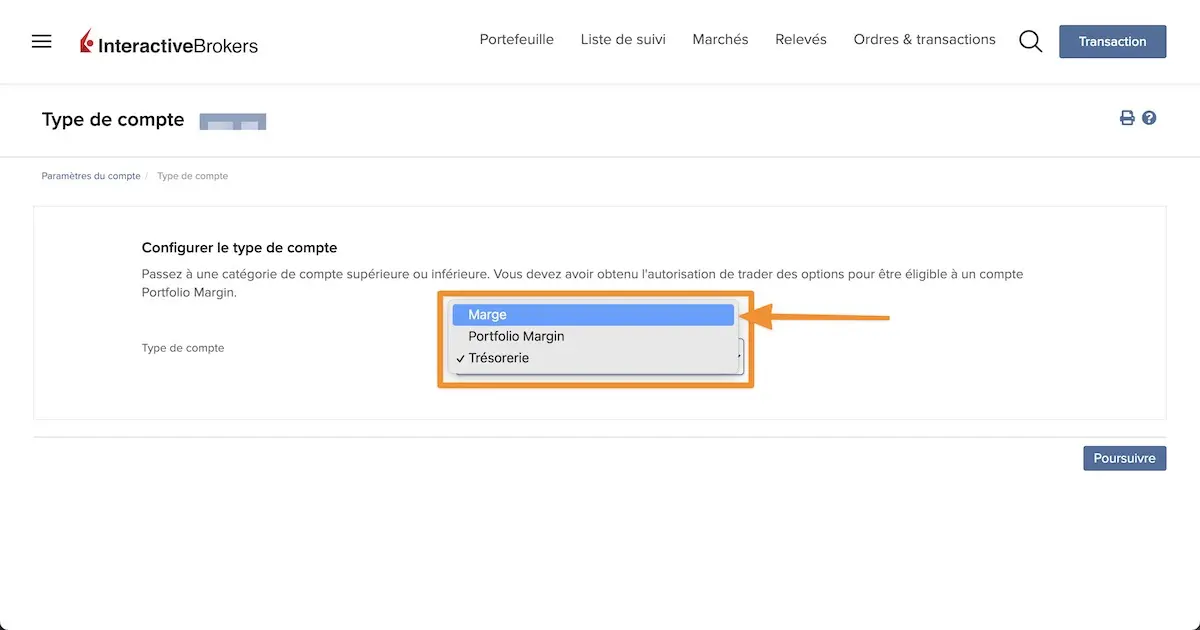

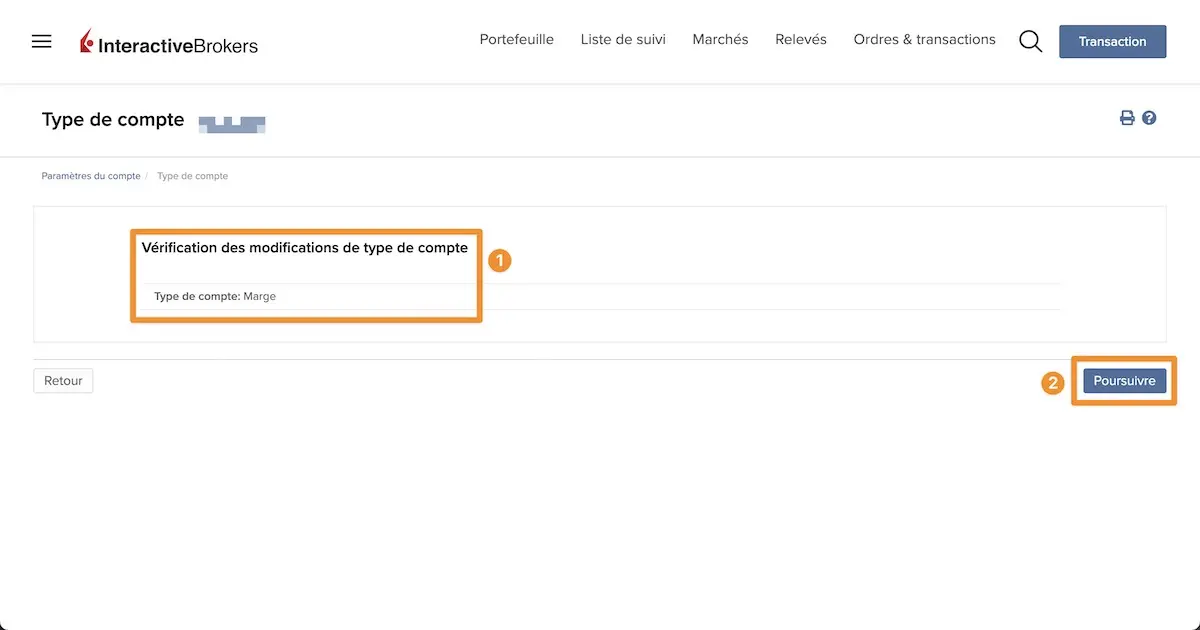

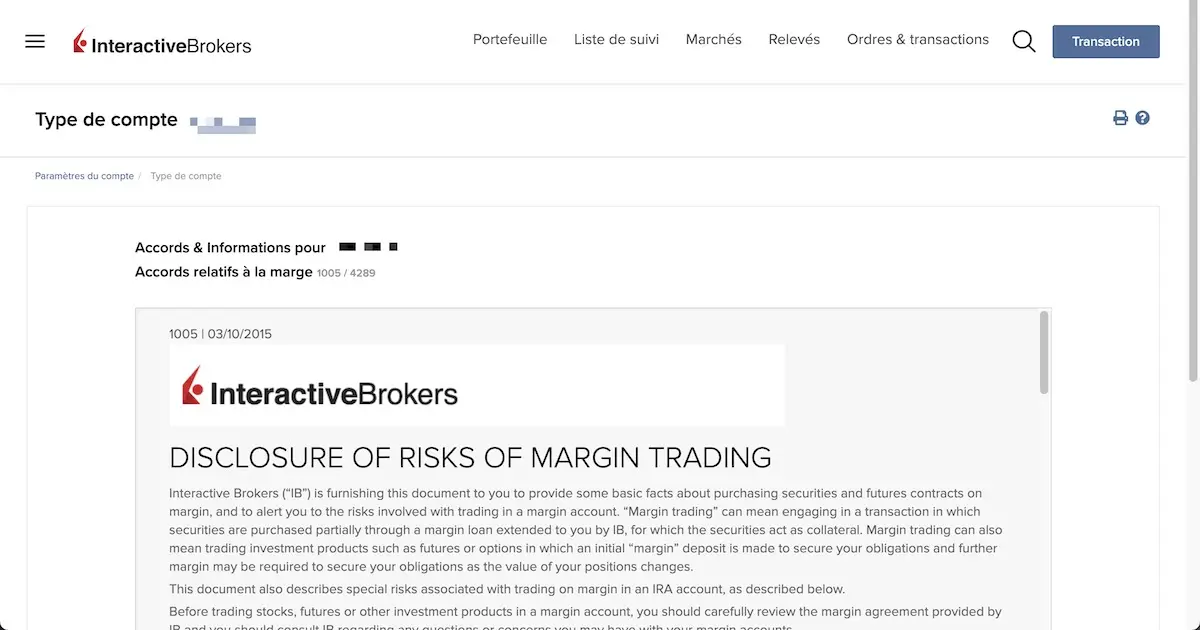

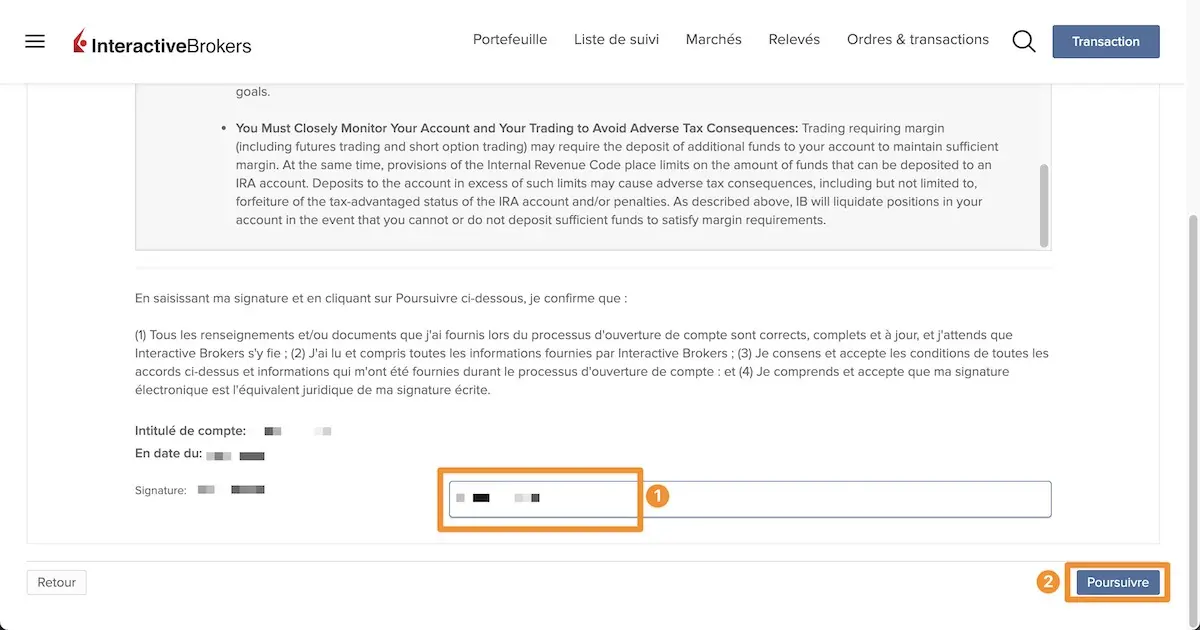

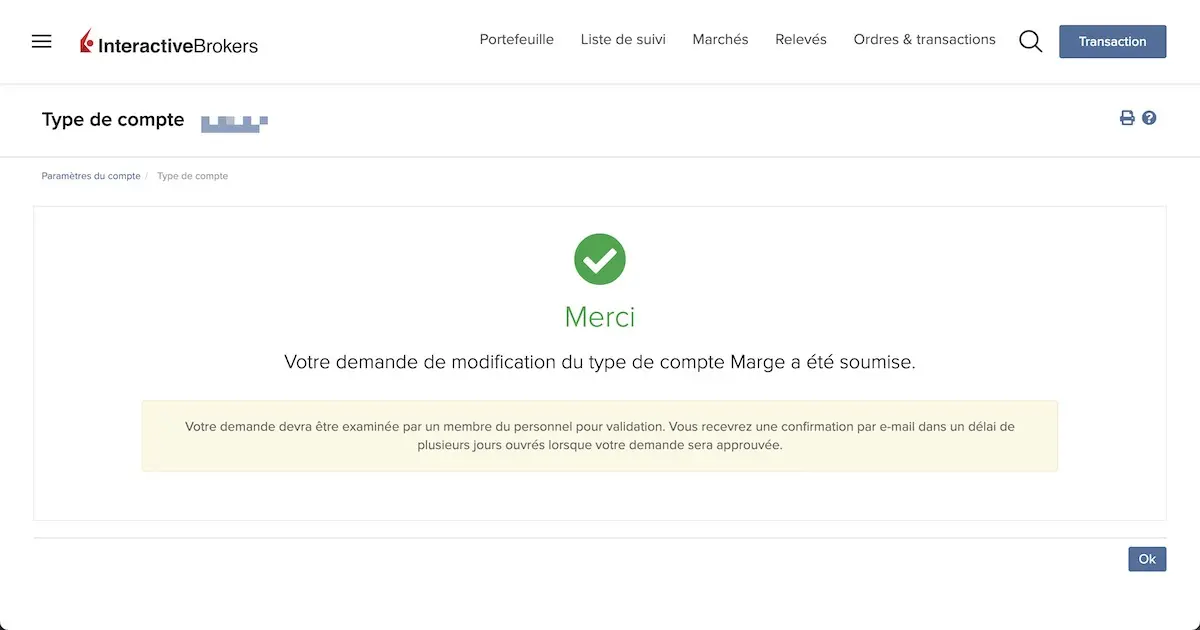

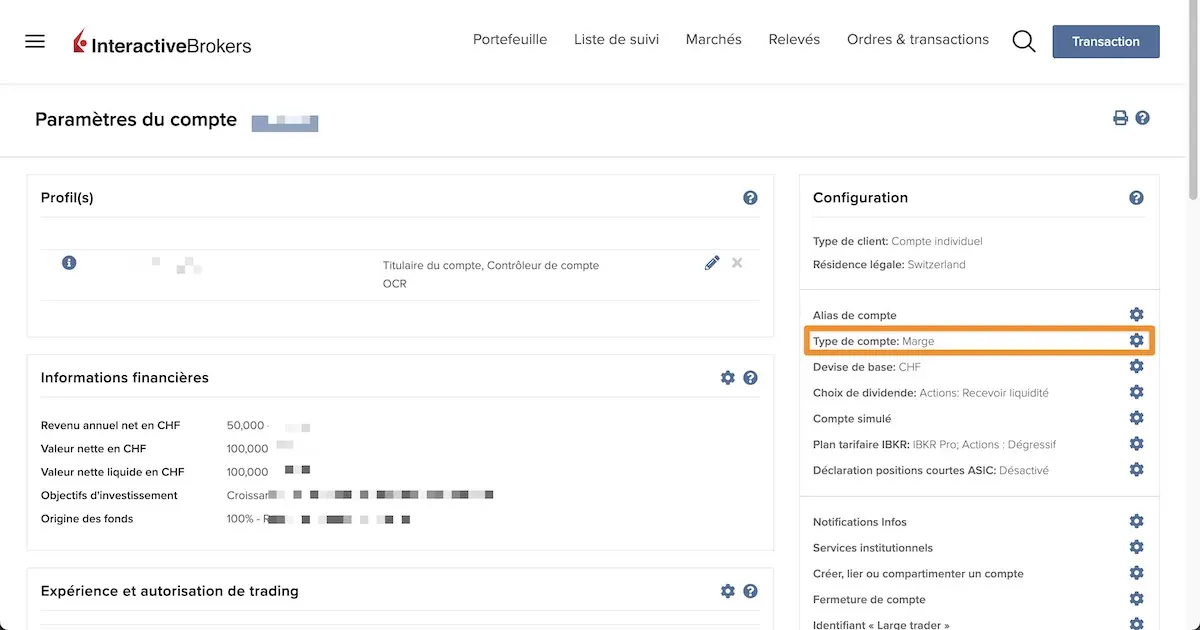

How do you switch a Cash account into a Margin account at Interactive Brokers?

And here’s how you can turn your Interactive Brokers account into a cash provider for opportunities one can’t miss:

Then I simply made a withdrawal from IBKR to my Swiss private bank account. The funds were available the very next day.

And this is how my margin loan appears in IBKR:

For the Swiss and European investors reading this — who know more about margin lending than I do — is my plan completely flawed? Would you suggest a different approach? I’d love to hear your thoughts and answer questions constructively, as we always do on this blog!

PS: I’m telling you one last time that you really need to understand what you’re doing before you start such adventures with your money. It’s said!