“No, I don’t want to give pocket money to our children.” I said to Mrs. MP a few months ago.

She replied: “Really? I had some when I was young, and I thought it was a cool way to learn how to manage my money, and to make me responsible. I would go out and buy candy, and I understood that I couldn’t buy more than the money I had.”

“Yeah, but I think it’s getting them used to have money without doing anything… I’m not a big fan of that…”

“Hmmm… OK, well think about it, but I’m really keen that we do it,” concluded Mrs. MP.

We were at an impasse, and no decision had been made about the pocket money for children.

I though about writing a “Ask the readers” article to get your opinions.

But, as is often the case, I started with Google first.

Breaking through my limiting beliefs of financial education for children

I’ve read several interesting articles on how to teach a child to use a budget.

Fun fact: I learned along the way that Swiss Germans start to educate their children about money earlier than Swiss French speakers… And also that children in the German part of Switzerland get more pocket money allowance than the French part.

But above all, the more I read, the more I had to do some introspection in order to accept that my parents might not have done everything right… And that giving pocket money may not be seen as easy money. And that on the contrary, it can be a great tool to put your children on the right track, and also to learn to talk about it without taboos from a young age.

One sentence in particular finally convinced me that I had to revise my copy.

It comes from the “Budget-conseil Suisse association”: “Only when you have money at hand do you learn to manage it.”

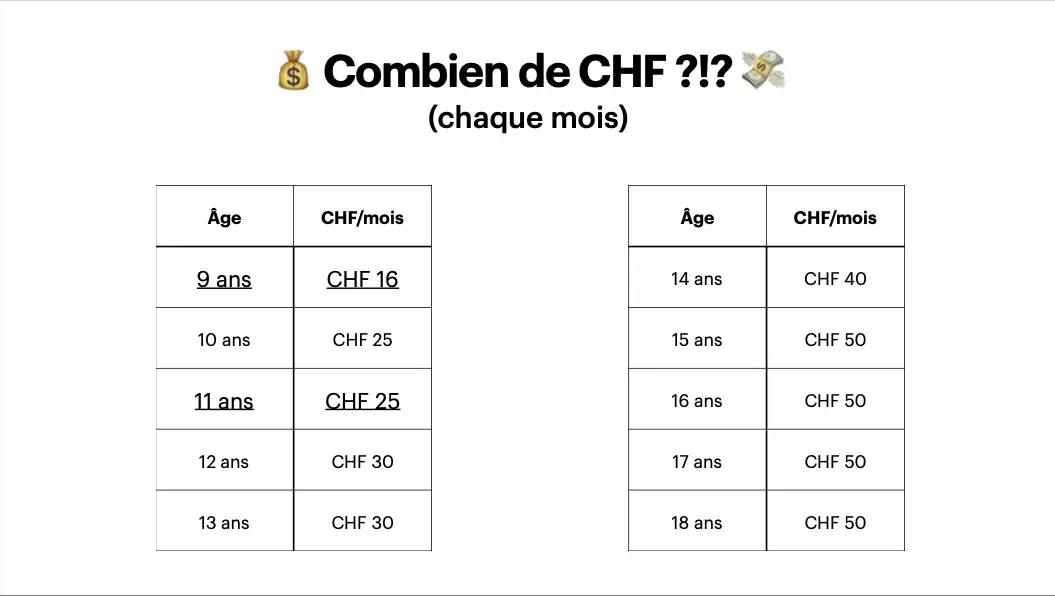

How much pocket money in Switzerland?

Once I understood the purpose of pocket money, my Mustachian brain immediately went into overdrive thinking: “Uh huh, but now we’ll have to get some more cash out of our budget!”

But how much, concretely?

That’s how I came across the recommendations of “Budget-conseil Suisse”:

| Age of child | CHF per month |

|---|---|

| 6 | CHF 4 |

| 7 | CHF 8 |

| 8 | CHF 12 |

| 9 | CHF 16 |

| 10 | CHF 25 |

| 11 | CHF 25 |

| 12 | CHF 30 |

| 13 | CHF 30 |

| 14 | CHF 40 |

| 15 | CHF 50 |

| 16 | CHF 50 |

| 17 | CHF 50 |

| 18 | CHF 50 |

I also learned an important educational element: not to use the restriction of pocket money as a punishment. Pro Juventute explains it well: “Usually, children show two types of reactions: either they don’t care because the amount of pocket money is not high, they don’t need it for the necessities of life, and they may be saving most of it anyway. Or because they only change their behavior out of fear and not out of discernment, which only reinforces the power relationships between parents and children. Neither of which is favorable.”

The Mustachian rule for pocket money in Switzerland

In addition to these recommendations, as a good Mustachian, I will obviously add the following rule of the game:

Pay yourself first, with 50% of any income you receive.

That is, any money they are paid should be divided in two: one part directly into the savings account, and the other part to do whatever they want.

Fast-forward to last September

As we had told our children over the summer that we were thinking about whether or not to give them pocket money, they kept asking us if it was YES or NO…

For my part, I had finally broken through my educational glass ceiling… and announced to Mrs. MP that she was right… (ah the little squabbles of who will have the last word ;))

“Is pocket money good or bad?” — I nowadays think it’s a good personal financial tool.

As a personal finance geek, I had already imagined opening a bank account for each of our children, with the option of a Maestro card.

The idea behind it was to train our kids to the principle that paying by card is one of the best ways to have money worries because everything is virtual. And that the best way to deal with it is to be confronted with it while being accompanied by your parents.

Especially because nowadays, with online shopping and COVID (bouuuh cash is dirty), we are often forced to pay by card.

Except that… Mrs. MP has put her feet up against the wall! For her, it was cash or nothing.

Because she too had her own beliefs linked to her own upbringing.

The key to any couple that lasts being communication, we discussed it quite a bit. And after I explained to her my point of view concerning the danger of the “virtual” effect of banking cards, she also changed her mind. Even though she thinks that the feeling of having cash is cooler. But since the kids will be able to withdraw money at the ATM, she was fine with it in the end.

But before I could tell the kids the good news about their future pocket money, I had to find the most frugal and Mustachian Swiss bank for children!

Which free Swiss bank for children under 10 with debit card?

My first instinct was to check if Zak or Neon, my two favorite free banks in Switzerland, offered accounts for such young children. But unfortunately, they didn’t… (if you ever read this dear product departments of these banks, it would be super helpful to us Mustachians!)

That’s how I found myself comparing the offers of the classic banks… oh joy!

The choice quickly narrowed down due to the age of the last MP kid being under 10 years old. The interesting offers were from none other than… UBS, Credit Suisse, and BCV…

I was not thrilled with the idea of having to go back to one of these banks… but then again, financial education for children in Switzerland is priceless!

After a careful inspection of each product sheet, BCV proved to be the most advantageous with its 100% free Juniors formula including:

- 1x Junior checking account

- 1x Junior savings account

- 1x Maestro card

- E-banking access

For those of you who have been following me for a long time, I had to learn to separate the personal problems from the BCV business itself (see this article for the juicy details).

So we made an appointment at a local BCV branch to open our toddlers’ two Junior formulas. And after having signed about ten forms each (no joke!), their accounts were opened!

Even if I prefer digital banking to open a bank account, I thought it was cool to do it in a branch because of the “solemn” aspect of the moment when our kids pass a milestone in terms of autonomy — only fools don’t change their mind!

But I’ve already told my kids that they’ll go to a Swiss neo-bank as soon as they’re old enough to do so — and that at that point, they can do it from their bedroom, in less than 5 minutes!

Slides to announce pocket money to kids!

You’re getting to know me by now.

I had already done this slides’ thingy to Mrs. MP when I wanted us to put our whole financial life together.

So I did the same thing to properly present the concept of Swiss pocket money to our kids, so they would take it seriously, vs. just explaining it to them off the cuff between two game sessions on their Switch.

They are in French but Deepl is there for German and English speakers.

Our first interesting money talks with the kids

As we went through these slides, one of my MP kids asked us: “But what can we use our savings for and when?!”

We then were able to explain to them the concept of saving up for something bigger like a crazy new freestyle scooter, or a trip, or anything else. In order not to confuse them too much about the Swiss standard, we didn’t (yet!) tell them about FIRE (Financial Independence, Retire Early) :) one thing at a time.

Another question that showed me the power of financial education via pocket money was: “But what if I don’t spend all my half of the allowance? What happens? Do I lose the money or do I keep it for the next month?” To which I replied that of course he kept it, and we didn’t cut his allowance the next month! But that a smart thing to do was to always spend less than you earn, and put it in the savings account if there was any left at the end of the month.

I’m frankly impressed with how our kids have taken to it, and accepted this 50% “Pay yourself first” rule.

It is the most valuable gift they can be given for their entire future lives — far more than any inheritance could ever do.

So there you have it, I’m looking forward to sharing with you the next part of the MP kids’ adventures with money. The next step will be to get them to invest in the stock market!

But in the meantime, I’m interested to know how you manage your kids’ pocket money and financial education in Switzerland? Do you give any? If so, how much and how? And how do you teach them to manage it?