I know this topic has been treated again and again but I was still having questions, even after reading other bloggers’ posts. Questions about Switzerland specificities but also about more general concerns.

I then discussed with other financial mates about these questions and here is my take on how to calculate your net worth.

Mathematic formula

Your net worth corresponds to the CHF value at a time T of everything you own, minus everything you borrow.

The resulting value is the wealth you can claim to be your own.

What do you own?

1/ The first point is to take into account all the cash you have stored in every of your checking and saving accounts. Don’t forget your bank accounts opened abroad in case you have any. Same for cash you hide under your matress (even though it would be a great financial mistake).

2/ As a wise investor, I assume you’re making money on the stock and bond markets, aren’t you? So all of your invested stash is to be considered as an asset.

3/ The next point is the money you have accumulated in your 2nd pillar. I take the current value of it which is named in French “Prestations en cas de sortie”.

You can withdraw this money before the retirement legal age if:

- You leave Switzerland to live in another country

- You start your own company

- You buy your primary home (still valid as of this writing, but they talk about dropping this possibility…)

Depending on the country you live in, it might not be a good idea to take into account your pension fund as it depends too much on the government laws that rule it.

In Switzerland, the 2nd pillar being funded fully by the employer and the employee, I’m in favor of taking into account its current value as it is money you contractually own.

4/ The other asset to take into account is the CHF you’ve invested into one or more 3rd pillar account(s). Simply ask your bank or insurance to give you the surrender value.

As the conditions to withdraw this money are the same as with the 2nd pillar, I think it’s a good idea to consider that for the computing of your net worth.

5/ The value of your home(s) - if you’re lucky to own one or more.

6/ In case you’re renting your current home, there is another hidden amount of CHF that can be found in your rental guarantee deposited in a bank account. This has to be added to your net worth total too.

And while we are at it, please don’t get fooled by these insane rental guarantee companies such as the “famous” SwissCaution which makes millions on your back. In case you don’t know this system: you basically pay a yearly fee equivalent to 6% of your three months rent warranty and you don’t have to give the cash to your property management.

7/ Any other assets you are ready to sell right now can be considered as potential cash to increase your net worth value. Being a Mustachian, you shouldn’t have anything in this category as you don’t bother with clutter in your life!

What do you borrow?

1/ Let’s start with the first conceivable loan in our Mustachian realm: mortgage. This number must contains the amount you owe the bank, including the interests.

2/ Credit card also needs to be considered when you compute your net worth as it is some minus you will have to pay with your next month bill.

Red zone below. Be careful!

3/ Credit card debt anyone? There is a huge difference between point 2 and point 3 as the 2nd is basically consuming money which is in your bank account.

While this very point is an emergency to be reimbursed as soon as possible due to the huge interests you are paying for every single month!

4/ Car loan/leasing is also something to be considered as you drive something which is not your own property. I won’t detail this point as it’s such a nonsense in itself, and nobody reading this blog has one, so why talk about it?!?

And before you ask, no, your car isn’t an asset! It probably the thing that depreciate the most on Earth these days!

5/ Any other loan you try to put under the carpet need anyway to be substracted!

Special YNABer Q/A

As a huge fan of YNAB, I was wondering whether I should take into account my cash cushion and also my savings for planned expenses into my net worth calculation.

The answer is simple: your net worth is all your money at a time T. Which means that for once, you’re allowed not to think in budget, but in banks accounts. Compute the sum, and there you go!

MP net worth update

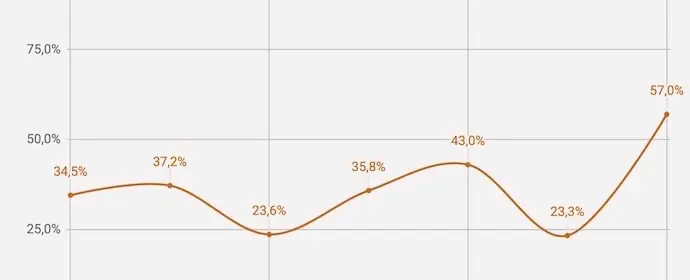

After clarifying all the points above, I computed all our numbers and there is a breaking news: we are over CHF 100'000!!!

It such a great feeling to see where we stand only a few years after we started our journey towards early retirement. I hope the next hundred of thousands will be that easy to collect!

To know the exact amount of our stash, I let you check this net worth dedicated page to get the most recent figures.

What about you?!?

In case you’re living in Switzerland, I would love to exchange on the topic as people tend to have very different opinions on the topic - mainly on the pension fund. Please use the comments section to explain us how you compute your numbers!

By the way, I’m surprised I didn’t see yet your figure on the most famous net worth tracker on Earth. Where are you?