Would you like to enjoy an early retirement several decades prior to the usual 60-65 years old in Switzerland?

Then you’ve come to the right blog :)

My personal goal is to stop working at 40 in Switzerland to become financially independent.

What you’ll read below applies equally well if you want to stop working for money at age 30 or 52.

But let’s start at the beginning.

In 2013, I was looking for a way to save money so that we could buy our home in Switzerland with Mrs. MP. Looking on the World Wide Web, I saw that the first step would be to create a budget.

As a geek, I looked for a digital budgeting tool that I could access from my smartphone and laptop. That’s how I discovered YNAB (aka “You Need A Budget”) which brought us from CHF 50'000 to CHF 450'000 of net worth in 6 years.

I spent several evenings on the YNAB forum to find out how to save as much as possible through all the possible and unimaginable budget tips.

In the course of my peregrinations, I came across a member of the forum who said:

“Cool your real estate project. I, on the other hand, am trying to save up to retire at 35.”

“Uh, sorry?!” was my first reaction.

As I was talking with him, he told me about the FIRE (Financial Independence, Retire Early) movement.

It was a turning point in my life. So much so that since 2013, becoming FIRE is my main life goal.

The main idea is that you save a lot via a Mustachian lifestyle. You then invest all this cash in the stock market or real estate. And once you reach the amount you need, you live on the returns of your investments for the rest of your life.

Tempting, isn’t it?

The 4% rule of the Trinity Study (aka FIRE method)

If you’re like me back then, i.e. you’re hooked by the idea to stop having to work for money, the missing piece of the puzzle is:

“But how do I figure out how much money I need to be financially independent? And what about calculating my early retirement date?! Can you tell me MP, please!”

Luckily, people even smarter than me (that’s to say their level! :D) have been working on the subject.

Professors of finance at Trinity University (San Antonio, Texas, USA) have analyzed the subject of the withdrawal rate in someone’s wealth during retirement in their Trinity Study.

This study was popularized with the FIRE movement, and is more commonly known as the “4% Rule” (from its real name “Retirement Savings: Choosing a Withdrawal Rate That Is Sustainable “, by Philip L. Cooley, Carl M. Hubbard and Daniel T. Walz in 1998).

I'm looking forward to going on a hike to Lake Taney in the middle of the week (on a Tuesday morning for instance) when I'll be financially independent when I'm 40 years old in Switzerland

In summary, this Trinity Study explains that, statistically, your wealth invested in the stock market will remain untouched — thanks to the stock market’s steady growth — if you use only 4% of its returns each year to support yourself.

Please note that the Trinity Study only talks about your invested assets. It does not take into account any income from any Swiss AHV/IV/LPP pension system that you may receive in the future.

The idea is that all your invested wealth will earn you 6-8% annually. You subtract from that the inflation of 2-3%, and you live with the remaining 3-4% returns.

If you take my example:

- We’ll need CHF 86'240/year with Mrs. MP to cover our annual expenses

- Our FIRE objective is therefore to reach CHF 2'156'000 of net worth, since 4% of CHF 2'156'000 gives: 0.04 x 2'156'000 = CHF 86'240

If like me you are not a fan of reverse percentage calculations, let’s make a little rule of three (aka cross product) so that you can calculate the amount of money you need for your own financial independence.

The method of “Multiply by 25 your annual expenses”

As we saw above, if you consume 4% of your invested wealth, it will remain untouched according to the Trinity study.

In order to be able to calculate your FIRE amount, we just have to do the following calculation (I’ll use my example):

| FIRE numbers | Percentage |

|---|---|

| ? | 100 |

| 86'240 | 4 |

A simple cross product tells us that to get the value of 100% of our investments, all we have to do is :

? = 86'240 * 100/4

that is: ? = 86'240 x 25

and so: ? = 2'156'000

The 25x method means that to calculate the amount of invested cash you need to be financially independent, all you have to do is :

FIRE amount = Annual expenses x 25

By the time I had this formula, my goal of financial independence became much more concrete. I finally had a target figure to reach in order to become FIRE.

The next question that came to me was: “In how many years will I be able to reach this amount?!”

The FIRE calculator

In the FIRE community, there is a well-known FIRE calculator: the Networthify calculator.

UPDATE 07.11.2024: I’m working on a financial independence calculator prototype specifically for the Swiss. Detailed info in this article.

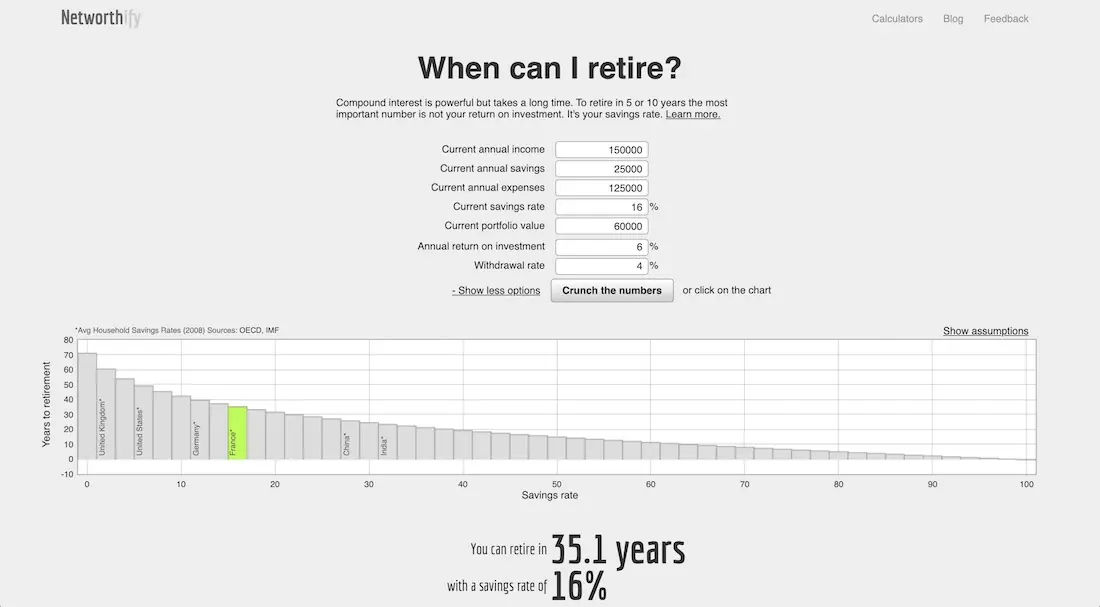

This latter allows you to enter the following information:

- Current annual income

- Current annual savings

- Current annual expenses — this amount is calculated automatically if you fill in the 2 fields above

- Current savings rate — this amount is also calculated automatically if you fill in the fields above

- Current portfolio value — to 0 by default, but if you have CHF 50'000 already invested for example, then you can add them in this field

- Annual return on investment — you can be conservative with 3-5%, or more optimistic with 6-8%, which allows you to calculate different scenarios

- Withdrawal rate — you can put 4% as the initial rule we’ve seen, or a bit less (see the controversies on the 4% rule below)

Then click on “Crunch the numbers” and the magic of the calculator will tell you in how many years you can retire early :) You can then play with the numbers to see what impact more savings would have on the number of years you have left to work for money.

Let’s take two concrete examples:

- 1/ The Swiss Lambda family earns CHF 150'000 in total per year and spends CHF 125'000 per year. At the beginning of their adventure towards financial independence, they have an initial capital of CHF 60'000 in their investment account

This gives us the following table:

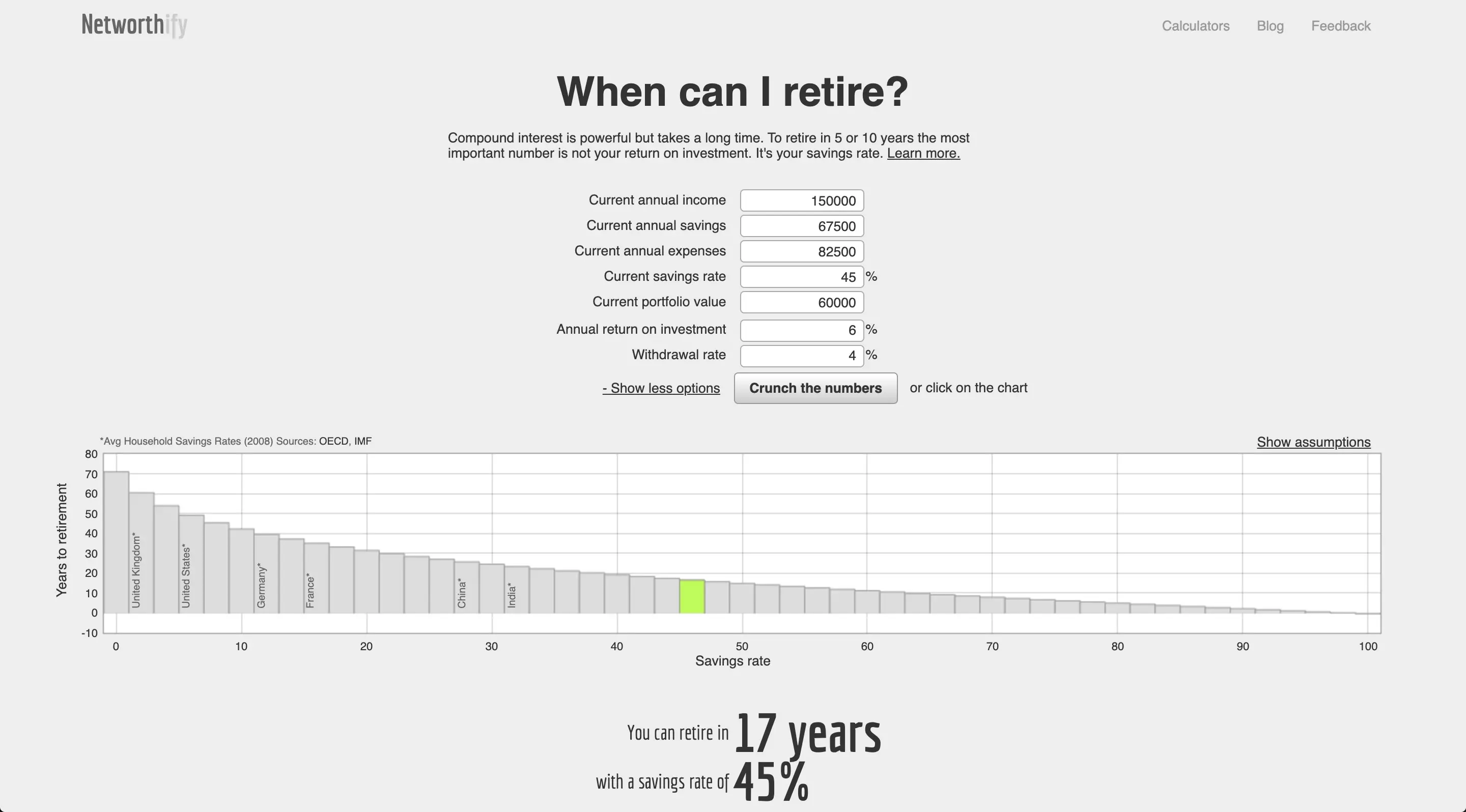

- 2/ And on the other hand, we have the Swiss Frugal family who also earn a total of CHF 150'000 per year, and also have CHF 60'000 invested at the start of their FIRE adventure. The only difference is that they have a frugal lifestyle and spend only CHF 82'500 per year. Result of the races:

FIRE calculation of early retirement / financial independence of the Swiss Frugal family, who have learned how to spend less

Starting from the same starting point in terms of income and net worth, the two families do not end up at the same point of arrival… :

- The Swiss Lambda family will be able to “early” retire in 35.1 years

- The Swiss Frugal family will be able to reach financial independence in just 17 years

That 18-year difference is huge, especially when you think it’s mostly due to little optimizations that create that gap.

Table “Years to Retirement / Savings Rate”

Once you have understood the mechanism of the FIRE calculation using the 4% rule and the 25x annual expenses method, you understand the interest of calculating your savings rate each month. And work on increasing it continuously if you want to achieve financial independence as soon as possible.

To motivate yourself, I advise you to print this table “Number of years until retirement/Savings rate” and hang it somewhere you won’t be able to miss it:

| Savings rate | Years until retirement |

|---|---|

| 0% | 90 |

| 2% | 84.7 |

| 4% | 70.4 |

| 6% | 62 |

| 8% | 56 |

| 10% | 51.4 |

| 12% | 47.5 |

| 14% | 44.3 |

| 16% | 41.5 |

| 18% | 39 |

| 20% | 36.7 |

| 22% | 34.7 |

| 24% | 32.8 |

| 26% | 31.1 |

| 28% | 29.5 |

| 30% | 28 |

| 32% | 26.6 |

| 34% | 25.2 |

| 36% | 24 |

| 38% | 22.8 |

| 40% | 21.6 |

| 42% | 20.6 |

| 44% | 19.5 |

| 46% | 18.5 |

| 48% | 17.5 |

| 50% | 16.6 |

| 52% | 15.7 |

| 54% | 14.9 |

| 56% | 14 |

| 58% | 13.2 |

| 60% | 12.4 |

| 62% | 11.7 |

| 64% | 10.9 |

| 66% | 10.2 |

| 68% | 9.5 |

| 70% | 8.8 |

| 72% | 8.1 |

| 74% | 7.5 |

| 76% | 6.8 |

| 78% | 6.2 |

| 80% | 5.6 |

| 82% | 5 |

| 84% | 4.4 |

| 86% | 3.8 |

| 88% | 3.2 |

| 90% | 2.7 |

| 92% | 2.1 |

| 94% | 1.6 |

| 96% | 1 |

| 98% | 0.5 |

| 100% | 0 |

I find this FIRE table very inspiring. It makes you realize that you are the one who has your future in your hands. Every expense you decide to optimize or not to make has a direct impact on your savings rate, and therefore on how many years you have left to work for money.

The controversies of the 4% rule

I can already hear the Internet naysayers and trolls screming: “Hey but no MP, the 4% rule doesn’t work! No way! Blah, blah, blah, blah, blah…”

My answer?

“Yes, I know, but, no, you’re wrong!”

Yes, I know that the 4% rule of the “Trinity Study” was made almost twenty years ago, with 30 years of retirement as the basis for calculation, and not 50-60 years of years spent in retirement as is envisaged in the FIRE community.

As my blogging buddy The Poor Swiss recently calculated in his article (see here), it would be wiser to take 3.5% of your total invested wealth as the amount to count on for your annual expenses (i.e. transforming the annual expenses multiplier from x25 to x28.5).

Another very reputable colleague in our Swiss FIRE community is the Canadian Ben Félix. In his latest video on the 4% rule of the FIRE movement, he mentions Vanguard’s paper which recommends a more pragmatic approach. Namely to adapt the spending percentage of the total portfolio between 2.5% and 5% depending on how the market is doing. This is done in order to prevent the value of the portfolio from falling.

When I answer “No, you’re wrong!” to naysayers, my argument is this:

- The purpose of the 4% rule (and the resulting FIRE 25x method) is to provide a rough estimate of the objective to be achieved.

- If your FIRE target is between CHF 2 million and 2.5 million, that’s not a problem for me. Because once you have learnt how to reach 2 million, I can assure you that you will have the necessary mindset and skills to earn an additional half a million.

- The advantage of being Mustachian is that frugalism is in our genes for the rest of our lives. So, armed with this advantage, we won’t have trouble reducing our expenses to 2.5% as Vanguard recommends in times of crisis. And no, it’s not deprivation, it’s adaptation, Mr. Grumpy!

- Similarly, another advantage of Mustachianism is that we have understood the foundations of “true happiness that lasts”. The latter is not found in the consumption of goods for ephemeral pleasures, but in the accomplishment and mastery of a passion/work/craft (note for the FIRE police of the Internet: when I say passion, work, or craft, I am talking about non-mandatory activities). And the best thing in all this, these activities often create value. So in addition to making us happy, they bring us additional cash to our 4% early retirement allowance.

- In the same vein as point 4 above, if the stock market and the entire financial world were to collapse, our skills acquired during the practice of our various passions as well as our sharp frugalism would allow us to survive such an ordeal without having to consume our entire fortune.

- This 4% rule can also be seen as conservative in a sense because it does not take into account the Swiss pillar pension system (AHV, BVG, Pillar 3a) at all. In other words, any pension or capital you receive will be added on top of the returns on your investments on the stock market.

- And finally, and this is important to understand, the 4% rule is intended to keep your initial capital untouched, living only on the returns it generates. Except that if, like Mrs. MP and me, you don’t plan to intentionally leave an inheritance (should I say a silver spoon!) to your children and loved ones, then you can afford to tap into your initial capital. For yes, oh unworthy parents that we are, we intend to instill to our kids that they are the ones who will have to create their own wealth. And if, by chance, they still have a few CHF of our fortune left, then that will be an unexpected bonus.

Summary

The 4% rule to calculate your FIRE date is a good rough estimation.

What I advise is not to get too lost in micro-calculations to the nearest tenth of a percent. And rather to put this energy into building up your frugality muscle, and finding ways to increase your income regularly.

To find out how much CHF you need to become a FIRE, simply multiply your annual expenses by 25.

Then, you can calculate in how many years you can early retire by inserting your figures in the Networthify FIRE calculator.

UPDATE 07.11.2024: and if you want Swiss precision in your calculation of financial independence, I recommend that you read my article about my “FI Planner” prototype.

Exercise

In order not to draw only inspiration from this article, I suggest the following exercise to take action:

- Calculate your annual expenses (roughly speaking at first, don’t spend weeks on it)

- Apply the FIRE method of 25x your annual expenses to know the amount you need in order to reach financial freedom

- Share your amount in the comments (don’t worry, we don’t judge in the Team MP, we’re here to help each other)

- Have fun with the calculator to see how many years it will take you to reach this amount

- Go ahead and create your first budget to increase your savings rate as much as possible