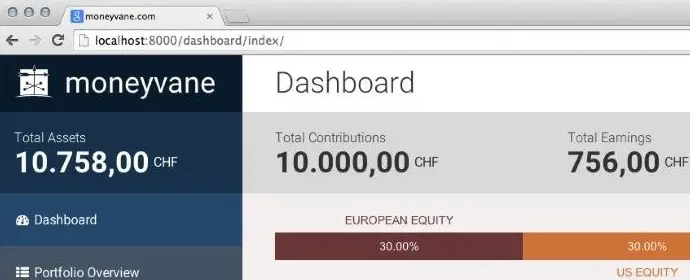

Today is the day of our first interview! And what an interview! None other than the CEO of MoneyVane.com kindly accepted to answer and reveal some exclusive infos about his new online service! Many thanks to you Bartosz.

Before we start, you are maybe wondering what’s this MoneyVane about?

In one sentence, it’s basically the Swiss equivalent of Betterment, the famous US-based low-fees investment tool.

If you trade in Switzerland, you’re either stuck with your expensive bank solution, or stuck with a service a bit-less-expensive like Swissquote. Either way, you are stuck and paying too much fees!!!

Thankfully, a guy named Bartosz Burclaf got the guts to fight all the Swiss banking regulations, raise funds, and be ready to launch very soon the Mustachian’s best friend investment tool!

Because he’s kind of a Mustachian himself, he will reveal you exclusive infos on how his great online service will work.

Hi Bartosz! You know, you’re realizing my own dream by doing what I don’t have time to build: Betterment-like in Switzerland, by Swiss people! Congrats and thanks! What a nice Christmas present you offer us!

Hi MP. Thanks for the invitation.

In Europe (end especially in Switzerland) it is not as simple as it seems. We were struggling a lot with regulations, external brokerage etc.

I am happy though that thanks to interested people – like yourself – we can keep the work going, so thank you :)

My first question then. Your project could have been mine as I’m so sure it will take off quick and big. As you were first, I’m left with investing into your company. Can I? What’s the Business Angel entry level ticket price?

I am afraid that we are currently closing the first round of funding already. Entry level is minimum 50k CHF. But if you or one of your readers is willing to invest, ping me and we would see what we can do.

Thanks. Will keep you posted on this one as I have other <a href=/blog/revealing-my-financial-goals/" target="_blank">investment priorities at the moment. Next question: in your last mail, you talked about a private beta. What are the steps and requirements to get in?!?

For the private beta, we will most probably require an initial investment of 12k as we still depend on an external broker :(

We can accept investments of as low as 5k CHF but only with more aggressive profiles as otherwise the fees would devour your earnings.

For the production version, we will have an offering giving probably the first 15k for free,

so that we avoid this cliff and you will be able to start with as low as 5k.

As soon as we will prove the market, we will boot up the process of getting our own securities dealer license (we will register with much higher capitalisation) and then we will be able to waive every fee which is currently forced on us by the broker.

You caught my interest here. You mean that up to 15k, there won’t be any fees - or what?

Yes that’s the idea - we are working on amounts, so that it makes sense from the business perspective.

On top of that, as we cannot afford a huge marketing campaign, we want to introduce a referral programme which will manage additional 5k CHF for free for each referred user who will fund his account with MoneyVane with the minimal required amount.

This free 5k will be for both of users, so 5k for the person who referred and 5k for the referee.

Just to picture it. You start an account with 15k managed for free. You refer 3 friends. So in total, all of you will have is 15k managed for free + 3*5k for free for referrals = a total of 30k managed for free!!!

That’s awesome. I can’t wait to move my money from Swissquote to MoneyVane!!! And thanks for the info about the referral program; I forgot to ask about it.

It looks incredible to me! Readers, be ready to have a referral link on this blog as soon as the service is live ;)

So what about security. As I will entrust you a lot of my money, could you give us more details about what’s written on your website: “Your investment is protected up to 500'000 CHF.” How does this protection works? Insurance?

This is a generic SiPC guarantee for the cash equivalents which will reside on your account.

This activates in case of bank’s bankruptcy or broker miscarriage.

Please be advised that on your account we will only store ca. 5% of liquid assets. Rest will be invested and it is like your property (you have all ownership certificates).

This guarantee will of course not protect you from market downfalls etc.

Regarding our misconduct, i.e. if our system would malfunction, we are finalising a separate insurance for up to 3M CHF per incident.

Thanks for the clarifications. I think we are safe on this one. Still on the “where is my money topic”, can you tell me a bit more about this sentence: “Your assets are deposited on an account registered on your name at a third party custodian bank.” What’s the name of the bank?

We are working with Interactive Brokers in Zug. They are cooperating with hundreds of banks all around the world, but your account will be stored in Frankfurt at the CitiBank.

Fair enough. Back on the investing topic itself.

Reading http://moneyvane.com/, you say things like “We build your portfolio, we invest for you and our platform makes sure that your investments are properly rebalanced and cost-efficient.” Can you confirm us that “we” means a machine. Like not a human doing some active investment right? All the way passive as we Mustachians love it, isn’t it?

All the way passive - yes.

You reassured them, thanks! So how can we start?

Basically, as soon as we will be live, all what you will have to do in order to start investing is to follow these 5 simple steps:

- You answer few questions so that we can establish your risk appetite.

- We propose a portfolio based on your input (you can still adjust later on).

- If you are happy with your portfolio, you sign up for the service.

- We are required by the law to verify your data. Once everything is OK, we will start an account for you with a broker.

- You fund the account and we start investing! That’s it!

Whoa, pretty straightforward! Can I adjust by choosing the ETFs I want? Even if not aligned with your proposed portfolio?

Currently we do not support this as we are putting tons of effort to analyse and build the investment strategy so that it is as low cost as possible, risk-adjusted and tax-efficient - i.e. Switzerland has a very peculiar law regarding equity income, so it is better to trust us not to loose too much on taxes.

Interesting. Can’t wait to get the private beta invitation mail!!!

While we all wait for the golive, can you tell us more about your company?

I started executing the idea on November 2013, but the company was officially registered in April this year.

We currently have 6 people working on the project. We aim to cover the whole Swiss market, so don’t worry, Romandy will be part of it ;)

Thanks Bartosz for your time.

All Swiss Mustachians are now checking their mailbox hourly to see whether they are invited to the private beta!

I’ll make sure to do a proper review of MoneyVane once I played with it.

Good luck with the final pre-golive tasks.

Thanks, let’s keep in touch once we have it live!

UPDATE 08.12.2014

Breaking news from Bartosz today: expected golive date of moneyvane.com is planned early 2015! Looking forward to it!!!