We used to have a short-term view of our investments with securities focused only on Switzerland, hedged for some. There was reasoning behind it, but I was waiting for the moment we could invest like true Mustachians. We are now ready to get back into the stock market game. For real. For the long run.

Last month, I successfully chose my cheap online-broker, the first step of investing the Mustachian way.

This month, my challenge is to build a well diversified ETF portfolio with the lowest fees and taxes possible, the second step of investing the Mustachian way.

Which portfolio strategy for a Mustachian?

I think I already talked about the buy-and-hold strategy on this blog, but I will repeat it to be sure it’s been heard. You are not smarter than anyone, neither am I. We can’t beat the market. The only path that can grow our stash on the long run is to follow a buy-and-hold strategy.

“Can you summarize it quickly MP?”, you ask. Sure thing! You buy. You hold for the long run. That’s it. You never sell during market downturns. You never frenetically buy stocks of the latest trendy Silicon Valley startup. You buy. You hold.

What kind of ETF should I buy as a Swiss investor?

“I got that MP, thanks. But what kind of ETFs should I buy in such a portfolio, then?”, you wonder with impatience.

Here we have to pause for a moment to remind ourselves something. Something that yielded me to an ever-growing stash during last years. This something is: seek for Grandpa advice.

Seek for Grandpa advice. That is how I call it. For every unknown topic you faced during you childhood, you would go to your grandpa to siphon the best advices from his wise brain. You are (and will always be) a child compared to someone else. Any question you may have today has already been answered yesterday by a Grandpa.

In this article, Grandpa is called John C. (Jack) Bogle. He is American. This long-ago-retired man taught me that the best buy-and-hold strategy is one that is KISS. One portfolio with only 3 ETFs.

Not any ETF, though. Like Grandma’s recipes, there are specific ingredients to use to get a good cake: 1 international stocks ETF for the diversification (with as many companies as there are grains in a sugar box), 1 home-currency stocks ETF in case all currencies get crazy for a decade, and 1 home bonds ETF for the safety margin.

I hear some of you at the back of the classroom who shout at me “Hey MP, you’re an ignoramus, true Mustachians invest into Vanguard mutual funds, not into your ETF stuff!”

Let me reply to you here so it’s written elsewhere than in the Community: Vanguard mutual funds that are recommended in US boglehead-portfolio aren’t available to non-US residents as of the day I write this blogpost. The best equivalent that one European can find is to go the ETF way.

How should I allocate ETFs in my Switzerland-tailored portfolio?

About the cake ingredients’ quantity, Grandma relies on Grandpa’s allocation recommandation: the bonds percentage should represent your age (i.e. you’re 31, then 31% of bonds), and the stocks get the remaining part (i.e. 69% in our example).

For the stocks ETFs part, he says to go for a 50-50 split — although that’s true for US investors, that a bit too biased for other countries such as Switzerland when you compare countries financial weight. I’m more in favor to allocate 55% for the world (which already includes about 3% of Swiss large-caps), and to have 15% for Swiss stocks.

When Grandma continues to cook such cakes, you can be sure that Grandpa will live a wealthy life until he dies!

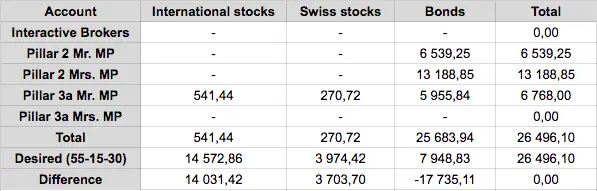

Before I forget, my Swiss Grandpa tells me to precise that you should include your second and third pillars money when you compute your percentage numbers into your fancy spreasheet (seen how cool Grandpa is?! He knows about spreadsheets!)

He advices to consider second pillars as bonds. For third pillars, it depends on which one you got; for instance my preferred one would translate in my spreadsheet as 55% of bonds, 22% of Swiss stocks, and 23% of international stocks.

Talking about spreadsheets, mine is below so you have a real-life example:

All credits on 'how to structure an allocation spreadsheet' goes to this Bogleheads wiki page: https://www.bogleheads.org/wiki/Using_a_spreadsheet_to_maintain_a_portfolio

Which properties to analyze when choosing your ETF?

With Grandpa Jack advice in mind, it was so much easier to narrow down the huge list of available ETFs. I used justetf.com to do this filtering.

Still, I was left with more than one item each time. In order for you to be autonomous, I will share my own recipe on how I compare and choose the best ETF.

TER

The TER stands for Total Expense Ratio, meaning the total costs of a security. In other words, how much of your money the ETF will eat up due to various fees.

As a Mustachian, I consider the range 0-0.15% amazing, 0.16-0.30% very interesting, and 0.31-0.40% okayish if what’s tracked interests me and the returns are good. Above 0.40% I usually disregard.

When you choose a security, you shouldn’t use TER as the single property to assess. You have to include the next criteria in your analysis to get a reliable evaluation.

Returns

The second criteria is historical returns of an ETF. After all, why would we, Mustachians, invest into the stock market if it wasn’t for getting returns!?

I look at three things: returns since one year to see how it goes currently, average returns since the existence of the fund to see overall performance, and the returns for each year since inception to check what’s the trend.

As a comparison benchmark, I use the 4-8% returns bracket which is what we, long-term investors, expect from our stocks’ investments.

Fund volume

For the size of the fund, I always try to choose the ones which are >500 millions, if not >1 billion. The smaller a fund is, the riskier it is that it gets closed or merged, which implies that you respectively may have to sell at an inappropriate time, or pay more fees.

You can find a risk-assessment color range on any security detail view which indicates whether a fund volume is risky when between 0 and 100 millions, okayish between 101 and 499 millions, or fine above 500 millions.

Trade volume

I use this value to check the liquidity of an ETF. The very popular ones get millions of trade per day. The rule of thumb with this trade volume value is that the higher it is, the most liquid a fund is.

It’ll be important for you when you’ll need to sell at FI stage, because the more liquid a fund is, the more you can be confident to sell at a good price thanks to a tight bid-ask spread ratio.

My three-ETFs Mustachian portfolio for 2017

Many of you waited for my selection to be released. I am glad to offer you this Christmas present in advance:

International stocks ETF: Vanguard Total World Stock ETF (VT)

This ETF is very diversified (7'627 companies including small-, mid-, and large-caps), and has: a low TER of 0.14%, about 4.5% of average returns since inception, a fund volume of 8.8 millions USD, a monthly trading volume of around 600'000, and the possibility to optimize US taxes.

I will invest up to CHF 60'000 maximum into this ETF because afterwards, the US estate law makes your heirs lose 40% of the amount invested into this fund. I will then switch to the Ireland based ETF Vanguard FTSE All-World UCITS (another option could be iShares Core MSCI World UCITS with its larger fund volume, but I prefer Vanguard that tracks the FTSE index, as it includes emerging markets).Swiss home-bias stocks ETF: UBS ETF (CH) SMIM (CHF) A-dis

This UBS tracker includes the 30 largest and most liquid Swiss mid-cap companies (large-cap being already covered by my International ETF), and has: an acceptable TER of 0.25%, about 13.5% of average returns, a fund volume of CHF 618 millions, and a daily trading volume of 4'293.

I also looked at UBS ETF (CH) SPI Mid (CHF) A-dis which is more diversified with 80 companies, but the fund volume of CHF 78 millions is too low for me.Swiss bonds ETF: iShares Swiss Domestic Government Bond 3-7 (CH)

This mid-term bond has: a 0.15% TER, 1-2% returns, a fund volume of CHF 418 millions, and a daily trading volume of 842 — my current allocation will allow me to wait to invest into this one, which is a good news looking at the bad period that Swiss bonds face these days.

What ETF portfolio did you build to ensure a bright FIRE (Financial Independence, Retire Early) future?

N.B. I’m not a financial advisor so you won’t be able to sue me if you loose all your stash when investing on the stock market. What I share here is my experience, not financial advices.