I have some reassuring news about DEGIRO to share with you.

DEGIRO and BaFin context

Over a year ago in September 2022, I learned that BaFin (Germany’s financial regulator) was issuing additional capital requirements to the group owning DEGIRO (flatexDEGIRO Bank AG and flatexDEGIRO AG).

Then, in March 2023, BaFin announced the following in a publication:

On February 17th, 2023, the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht — BaFin) ordered flatexDEGIRO Bank AG to take measures to ensure that the institution has an appropriate business organization in the areas of risk management and money laundering prevention, and to limit the risks.

To ensure the proper organization of activities in the area of risk management, BaFin ordered flatexDEGIRO Bank AG to remedy several serious shortcomings, particularly in its internal controls, its supervisory reporting system, and in the area of money laundering prevention.

To monitor the implementation of the risk management system, BaFin ordered a special commissioner according to section 45c (1) in conjunction with paragraph (2) of the KWG.

Due to this context, on February 7, 2023, BaFin issued a final and binding administrative order imposing a fine of 1'050'000 euros for flatexDEGIRO Bank AG.

The fine is based on a breach of obligations under section 130 (1) of the breaches of administrative regulations (Ordnungswidrigkeitengesetz — OWiG) in conjunction with offenses punishable by a fine under the KWG and the European Capital Requirements Regulation (CRR).

When I did my research, I found that this was not alarming.

On the contrary, it proves that the financial system has learned (a little ^^) from its past mistakes.

But nevertheless…

Having my children’s entire ETF portfolio with DEGIRO myself, I was following the news closely (as I announced to you in my newsletter).

In December 2022, the signals sent by DEGIRO were good with an extension of its management via senior profiles, as well as organizational changes at the head of the internal control, risk management and regulatory reporting departments.

News from BaFin and DEGIRO dated September 29, 2023

Last September, BaFin’s special commissioner reassessed DEGIRO’s situation (as required by law).

As a result. BaFin “approved the reapplication of credit risk mitigation techniques for DEGIRO’s margin loans with immediate effect.”

A bit of gibberish for me…

But reading DEGIRO’s press release, the header reads:

- Increase in CET1 ratio to over 27 % following BaFin approval of the reapplication of credit risk mitigation techniques for the DEGIRO margin.

- Decrease in the Group’s risk-weighted assets by around 450 million euros

- Solid capital structure opens up new opportunities as part of the ongoing financial planning process

The most important thing in this text for me is the CET1 ratio, which is over 27%.

I didn’t know its meaning until today ^^

As defined by Investopedia:

Common Equity Tier 1 (CET1) is a component of Tier 1 capital that consists primarily of common shares held by a bank or other financial institution. CET1 is a capital measure that was introduced in 2014 as a precautionary measure to protect the economy from a financial crisis, largely in the context of the European banking system. All eurozone banks are expected to meet the minimum requirements of the CET1 ratio for their risk-weighted assets (RWAs), as defined by financial regulators.

In the event of a crisis, capital is first drawn from Tier 1.

CET1 is nothing more than an acronym for “solvency ratio” for banks.

The DEGIRO press release continues:

On this basis, the flatexDEGIRO group’s Common Equity Tier 1 (CET1) ratio should increase to over 27% compared with a regulatory CET1 ratio of around 15,4%, resulting in a regulatory capital surplus of around 100 million euros.

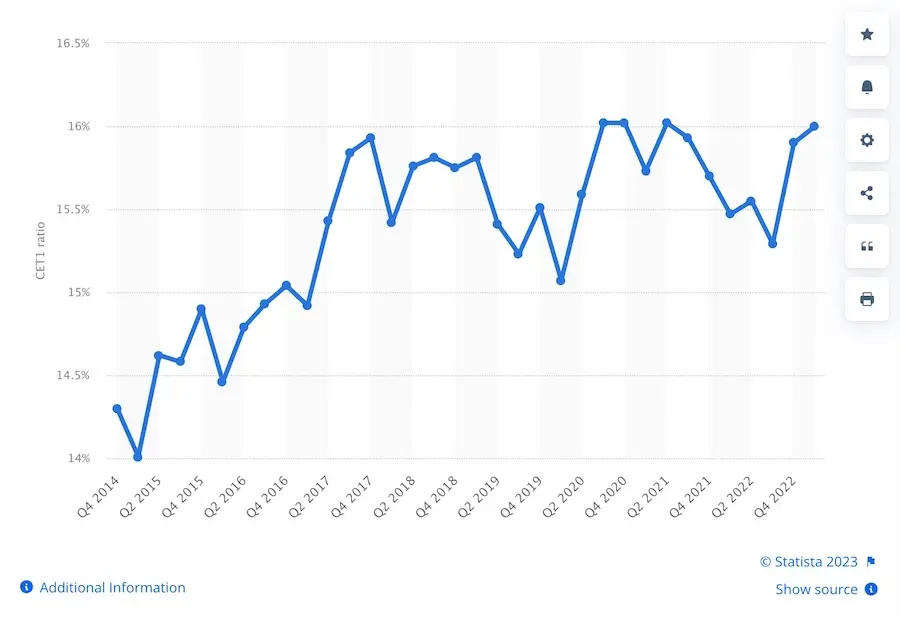

These figures are verified by what I found as another source of statistics online:

What do you think of all this?

DEGIRO has grown very fast over the years 2018-2022.

They have prioritized the focus on a simple, clear, and effective product for their customer. And, in my opinion, they’ve left a bit out with the administrative paperwork control.

This BaFin intervention proves that the German system of financial auditing of investment institutions works.

DEGIRO took it seriously, resolving the major problems in less than 12 months. Both in terms of staffing and cash reserves.

As discussed with BaFin, they still have 12 months to deal with the final points for improvement named by the Commissioner. This is in line with the original timetable and the agreement reached with BaFin.

Conclusion

So I’ll continue to keep an eye on them doing their homework ;)

In the meantime, I’m staying with DEGIRO for my kids’ investment portfolio.

FAQ

Is DEGIRO secure?

Yes, DEGIRO is safe thanks to asset segregation. Any ETFs you buy are stored by DEGIRO in a separate legal entity, so that they are not accessible to DEGIRO’s creditors, even if DEGIRO were declared bankrupt. This serves to protect clients’ investments.

Does the DEGIRO Custody account still exist?

Yes, the Custody account still exists for customers who selected it at the time. Nowadays, DEGIRO no longer offers the Custody option to new customers to optimize their fees as much as possible. This means that your assets (ETFs or other equities) can be loaned out.

Don’t worry about it, because DEGIRO covers these share loans in the event of borrower default. The only risk is therefore if DEGIRO and the defaulter go bankrupt at the same time. I consider this risk to be minimal.

As proof, I myself use this stock lending system by Interactive Brokers (cf. my review after one year via this link). And I use it knowingly, as IBKR offers the option of having a “custody” account (i.e. without securities lending by default).

Nevertheless, I think it’s a shame that DEGIRO has stopped offering a custody account. Even if I understand their strategy of wanting to optimize their fees as much as possible, knowing that they (compared to other banks) pass on most of these savings to their end customers in the form of a very competitive offer.

What is BaFin?

BaFin is Germany’s federal financial supervisory authority. It is an independent institution that regulates German finance. It reports directly to the German Federal Ministry of Finance. BaFin is the equivalent of FINMA in Switzerland.

Who is FINMA?

FINMA is the Swiss Federal Financial Market Supervisory Authority. FINMA is the Swiss equivalent of BaFin in Germany.