As you know, I am in the process of acquiring my first rental property in Switzerland.

We therefore asked ourselves the question with Mrs MP to hold this property directly through our own names, or via a Swiss company (LLC or Ltd).

Knowing that we wish to acquire more than one, and that we think on the long term (i.e. until the inheritance to our children), we said to ourselves that the simplest would be to create a company which holds all our buildings in Switzerland.

That way, the day we are no longer around, we will only have to divide the shares of a company between our children, rather than having to divide the properties.

So we decided to go for a Swiss company formation.

As usual, I documented all the steps of the company formation process, with the idea to make a guide for the blog ;)

N.B. my experience of company formation is based on the canton of Vaud, even if the steps and main principles are the same for all Switzerland.

What type of company to create in Switzerland?

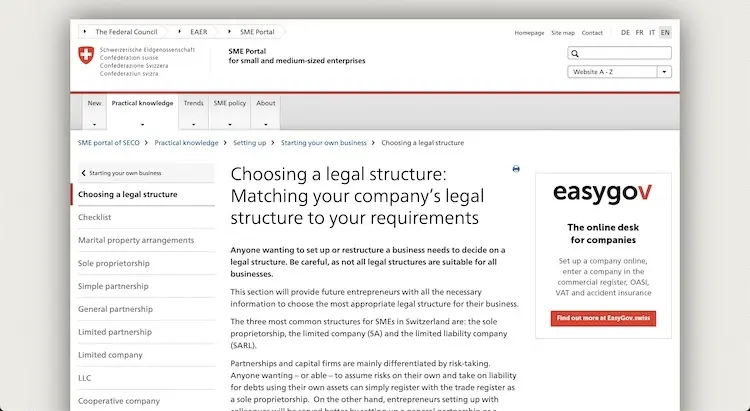

The type of company is called the legal form. The 4 most common types of Swiss legal entities are: the sole proprietorship, the general partnership, the limited liability company (LLC), and the corporation (Ltd). The main differentiating factor is whether you are liable for unlimited or limited liability.

The SME portal for small and medium-sized enterprises of the Confederation is full of useful information as an entrepreneur

To put it simply, with the sole proprietorship and the general partnership, the partners are jointly and unlimitedly liable for any problem with the said structure, especially at the financial level.

Whereas with the limited liability company and the corporation, the liability of the partners is limited to the amount of the share capital (respectively a minimum share capital of CHF 20'000 for the LLC and a minimum share capital of CHF 100'000 for the Ltd).

For Mrs MP and me, future entrepreneurs in the making, it was clear that we wanted to create one of those two limited liability companies’ structure.

We then had to choose between the two Swiss legal entities that are the LLC and the Ltd (aka joint stock company).

The 3 main differentiating elements for us were:

| Limited Liability Company | Corporation | |

|---|---|---|

| Minimum share capital | CHF 20'000 | CHF 100'000 |

| Commercial Register | All partners appear | Only the administrator appears |

| Legitimacy (perceived) | + | +++ |

In the end, we chose to found a joint stock company (aka Ltd).

We were going to need more than CHF 100'000 of equity for our first building anyway.

And, even if it’s only a matter of perception, it’s reassuring to banks and entrepreneurs when you come with a Ltd, as you had to put CHF 100'000 on the table when you founded it.

Company formation via notary or via online service?

Once you have chosen your legal form, you have to take action.

For our first company (LLC for the activities of the blog), we had gone through a notary for the company formation.

Apart from a lot of papers to sign, there wasn’t much to do. Well, OK, we still had to know what to put in the statutes, and also how to send all that to the trade register.

But then, we had already been through it, and we felt less newbie than the first time.

So I started looking into doing it online to save time.

And, to my good (big!) surprise, there are services to create your company in Switzerland entirely online (all automated or with advice from a lawyer if needed).

The two most serious sites for me were: startups.ch and entreprendre.ch.

Then, you know me, as a frugalist, I started to make a small comparison of the costs of creating a company for each of the solutions (including comparison with several notaries around).

I specify that to be fair, each line includes the foundation part (definition of the statutes) and the notarial authentication of signature. The costs of the commercial register are separate (not included in the table below), with a direct invoice in your name (in the canton of Vaud, for a Ltd., you should account for between CHF 500 and CHF 600).

Here is the result:

| Create a Ltd. company via: | Costs |

|---|---|

| Entreprendre.ch | CHF 490 |

| Startups.ch | CHF 549 |

| Notary Montreux | CHF 2'550 |

| Notary Yverdon | CHF 3'200 |

| Notary Echallens | CHF 3'500 |

So we were very motivated to go with entreprendre.ch.

I called them and explained that we wanted to create our company in Switzerland, to do real estate. The last part of my sentence cut short our conversation: entreprendre.ch does not create companies for holding real estate…

I could already see myself having to go through a notary and pay double the registration fee… but I thought I would call startups.ch anyway to see if they had the same limitations.

And no! They agreed AND were used to startups active in the real estate field.

On the other hand, we had to choose their “Business Pack” in order to have a phone conversation with a lawyer to define our legal entity statutes correctly, and to make sure that everything would be in order at the time of the company registration in the commercial register.

Here is my updated comparison of the costs to create a business in Switzerland in the real estate field:

| Create a Ltd. business via: | Costs |

|---|---|

| Entreprendre.ch | n/a |

| Startups.ch | CHF 928 (CHF 899 of bussiness pack + CHF 29 signature authentication) |

| Notary Montreux | CHF 2'550 |

| Notary Yverdon | CHF 3'200 |

| Notary Echallens | CHF 3'500 |

So we decided to found our Swiss company with startups.ch, saving over CHF 2'500 compared to the most expensive notary!

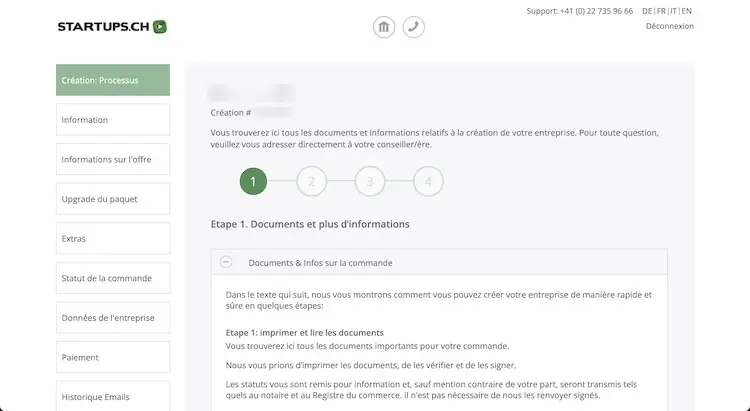

Opening a company in Switzerland via Startups.ch (in 8 steps)

We chose to open a Ltd. in Switzerland via Startups.ch, but it’s almost the same process to open a LLC (except that the limited liability company requires you to bring “only” CHF 20'000 of minimum share capital).

All the steps are very well explained on startups.ch with help bubbles wherever needed.

Also, startups.ch is available in French, German, English, and Italian.

Step 1: Calculate your offer (for either your limited liability company or your corporation)

The process of the startups.ch website starts with the calculation of your offer for your new legal entity.

A picture is worth a thousand words, so here are the screens in a few slides:

Step 2: Enter the data of your Swiss business

Then the interesting part begins :)

This is where you have to choose your legal name (aka the name of your business). You also have to define in your legal entity’s statutes what kind of activity your company will practice (also called “goal”).

As everything is well explained on startups.ch, I’ll quickly list the other elements you need to consider:

- Registered office of the business (aka head office address)

- Amount of the share capital and the amount paid up

- Number and nominal value of shares

- Voting rights, general meeting

- Members of the board of directors, auditors

- Form of publication of the corporation

And the slides that go with it so that you can see the whole process:

Congratulations when you get to the end of this part, because it’s the one that takes the longest!

Step 3: Contact with a legal expert

Within 24-48 hours, you will be contacted by a startups.ch lawyer.

Her goal is to verify and provide you with advice on the statutes for your Swiss business. And you can see that they are experts directly, because they ask you very pertinent questions about

- your business model

- your activity

- the reason of your project

- all the specificities related to real estate, such as whether all the funds come from people on Swiss soil (and not via European countries or others) — because otherwise it raises additional checks on money laundering

- the expected amount of annual turnover to know if you have to submit a VAT registration, and then pay the VAT

- etc.

They also ask you if you intend to have employees in order to foresee questions related to social insurance system, unemployment insurance, as well as disability insurance. Fortunately, we don’t plan to have employees, and we will distribute any profits to ourselves via dividends or other means. Well, first, we’ll reinvest as much as we can, and when we’re FIREd (Financial Independence, Retire Early), then we’ll get dividends!

Step 4: Receive, verify, and sign the documents

In the same week following the call with the lawyer, we received the documents via mail.

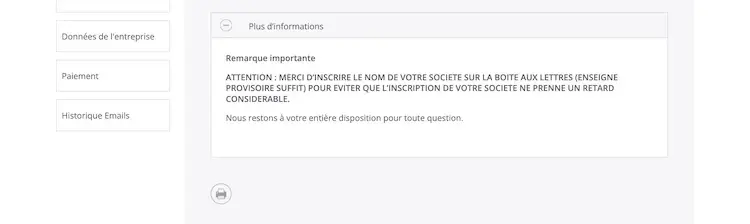

Small aside about the mail by the way.

Startups.ch even wrote the sentence in CAPITAL LETTERS because many clients were experiencing a considerable delay: you must write the name of your future business on the mailbox located at the head office address. Otherwise, the mail from startups.ch will not reach you!

We just had to print everything, sign, add our initials, and send all the documents back via registered mail to Geneva to startups.ch.

The instructions were very clear, and on top of that you get an email notification at each step to tell you that your file has progressed. I was blown away by the quality of the service!

Step 5: Open your capital deposit bank account

At this stage of your project, you will have to open a Swiss corporate bank account.

And this, at the cheapest Swiss bank for companies, of course!

To date (and as in 2020 when I founded my first LLC), Migros bank is still the most frugal bank for a corporate account in Switzerland.

You can verify this on moneyland.ch.

Pro tip: you have to take into account the one-time fee for the capital deposit account AND the long-term recurring account maintenance fee. Because UBS and Credit Suisse are smart, and lower the one-time fee as much as possible, but charge you in the long run with recurring fees.

While Migros Bank does charge you one-time fees of 0.5% of the paid-in capital (min. CHF 300, max. CHF 2000), i.e. CHF 500 for CHF 100'000 of capital, but after that, it’s CHF 3/month in account management fees.

What is a capital deposit account?

A capital deposit account in Switzerland is a bank account created when a Swiss company is registered in the commercial register. It allows the deposit of the share capital on a blocked account, so that the notary (from startups.ch) can proceed with the company registration in the commercial register.

The whole process of creating a bank account for a Swiss business goes like this:

- Creation of the capital deposit account

- You send the registration certificate of your bank to your notary (to prove that you have deposited your capital)

- The notary registers your company in the Swiss commercial register

- The trade register of your Swiss canton does its job so that you become an official entrepreneur

- You receive your registration certificate that your company exists in the Commercial Register

- You send this paper to your bank

- Your bank proceeds to the creation of your company current account

- It releases the funds to transfer your capital from the capital deposit account to your current account

- You can do whatever you want with the money of your capital (i.e. the amount is not blocked anymore)

And so, as I was saying: the best Swiss corporate bank is Migros Bank.

Once you have sent your capital deposit account certificate to startups.ch, the process continues with the next phase.

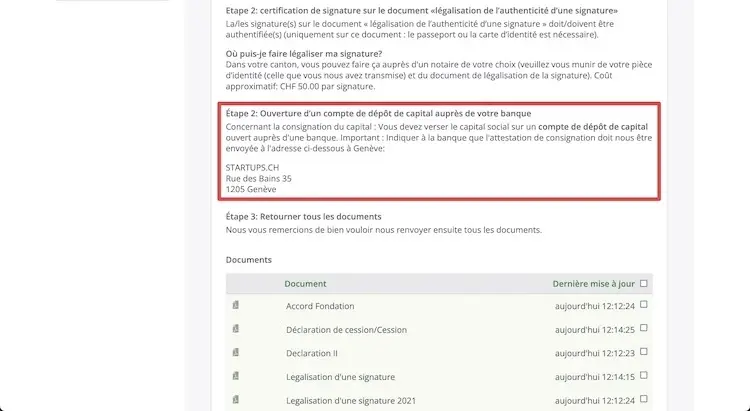

Note on startups.ch explaining that you have to create your capital deposit account in order to be registered in the Swiss trade register

Step 6: Authenticate your signature (online!)

That’s when I thought to myself: “We are in a nice country after all!

For 29 Swiss francs (paid directly to startups.ch), you can get a notarization of your signature. Online!

It literally took me 1 minute and 49 seconds of Zoom call! (you can also choose via WhatsApp if you prefer)

The notary of startups.ch (based in St. Gallen) calls you.

He tells you that the call is being recorded for legal record purposes.

Then he asks you a few questions to verify that it is you and the right business.

After that, he asks you to put your passport next to your head to verify your identity. Next, he shows you the documents you signed to confirm that it’s really you.

And then… that’s it!

He congratulates you because you have just finalized your company, and everything will now go to the Commercial Registry. And he wishes you a good day!

All this, in 1 minute and 49 seconds!

Step 7: Company registration in the Trade Register

This is finally the longest step, thanks to the Swiss public institutions…

The company registration in the Swiss commercial register takes on average 2-3 weeks.

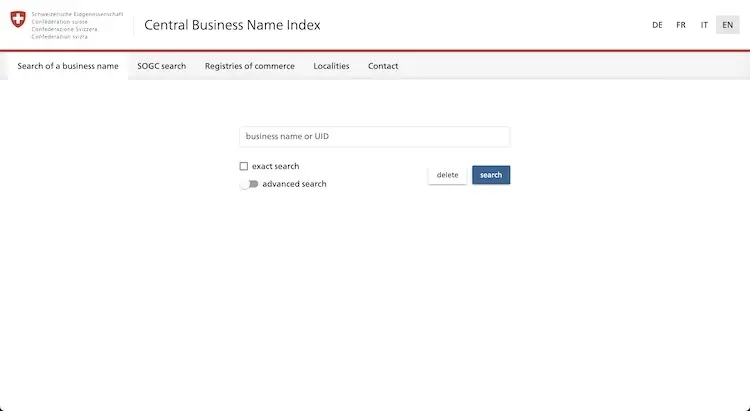

You don’t have to do anything but wait. You can find the expected date of company registration in the dashboard of startups.ch (just so you don’t do like me and check on zefix.ch every 5 minutes if there was any movement!)

Step 8: Company registered — dance like no one is watching!!!

Never forget the dance of joy!

Because you just entered the inner circle of business founders!

Choosing your fiduciary for the accounting

After all these steps, you will have to think about the choice of your fiduciary to do your annual account closing. And potentially to do your accounting and your tax return if you wish to delegate these tasks.

To give you an order of magnitude, because the estimation depends on your turnover, it costs me between 1'000 and 2'000 Swiss francs per year for the accounting, the annual closing of accounts, and the tax declaration (via registering with the Federal Tax Administration).

Summary of the costs of creating a business in Switzerland (canton of Vaud)

To create my company in Switzerland (a Ltd.) with startups.ch, I paid a total of:

- CHF 899 of “Business Pack” at startups.ch

- CHF 29 of signature authentication fees

- CHF 640 of registration fee into the trade register

- CHF 500 one-time fee for my capital deposit account at the Migros Bank

- TOTAL = CHF 2'068

Conclusion

I am looking forward to starting this new business venture with Mrs. MP! We have quite a few projects together as a couple, but this one will have a special flavor because it’s for our own business.

I hope this guide will inspire you to start one or more businesses of your own!

Next step: I’ll keep you posted on the progress of our Swiss rental property investment soon :)

Bonus: startups.ch promo code

Startups.ch is one of those modern online companies, so they offer a referral program. As usual, I wouldn’t talk about it if I hadn’t used their service myself to create my business.

And since I’m very satisfied with it, I share my referral code with you if you want to launch your own business:

8TUSXVQQ

It allows you to get a discount of CHF 50 when ordering a limited liability Swiss company formation (LLC or Ltd) via startups.ch.

Enjoy!

Small lexicon of companies in Switzerlan:

- LLC = Sàrl (in French) = GmbH (in German)

- Ltd = SA (in French) = AG (in German)

FAQ

Startups.ch or EasyGov, which one should you choose?

I chose Startups.ch because with EasyGov, you still have to go through a traditional notary. Notaries are not online AND cost more.