Lately, I receive more and more emails from readers who want to know if closing their 3a pillar life insurance is a good financial decision, in order to stop the hemorrhage that this type of financial product creates in their savings. Instead, they want to invest their retirement money in an optimal pillar 3a such as the VIAC Global 100 (our favorite among Mustachians).

But all of them hesitate when they see that they will lose thousands or tens of thousands of CHF by closing their pillar 3a life insurance…

Having been a victim of this rip-off (sorry, can’t call it anything else!) twice… I can only understand their upset and questioning.

It always starts like that:

Hi MP! I have a question regarding my life insurance policy with Helvetia. It is a guarantee plan, linked/restricted pension (pillar 3a). I started investing CHF 6'768 per year since 2016, and the contract ends in 2051. Part of the contract is invested in incomprehensible derivatives, but at least it’s not all sitting in a savings account earning nothing.

The guarantee in case of life amounts to CHF 173'020. According to your advice, I asked what the surrender value would be and this is what they told me: “Surrender value = CHF 15'378.87, and the credit balance of the cash account = CHF 564.00 (total payment in case of surrender: CHF 15'942.87)”

Since I have already paid CHF 40'608, that would mean that I would lose more than half of the amount invested… so I wonder if it’s really worth closing this 3a pillar, and transferring the surrender value to a VIAC pillar 3a account with the Global 100 strategy. What do you think?

And my answer is always the same: trust only the math and the data, and definitely not your human aversion to losing money.

Keep your pillar 3a life insurance?

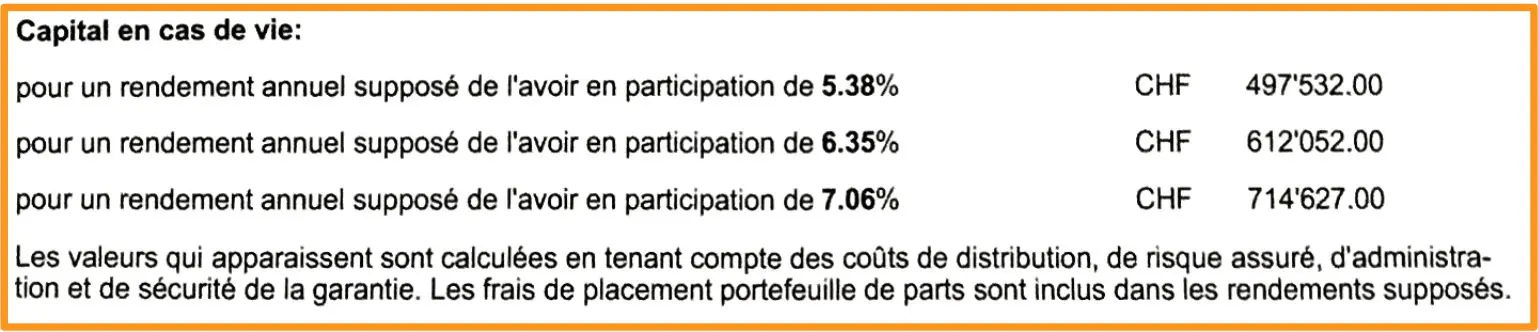

Luckily, the insurance company of the reader above provided him with a document showing different possible scenarios of the surrender value of his 3a pillar life insurance at term (i.e. in 2051):

- Guaranteed minimum: CHF 173'020

- With a return of 5.38%: CHF 497'532

- With a return of 6.35%: CHF 612'052

- With a return of 7.06%: CHF 714'627

I specify that these figures are valid as long as the pillar 3a life insurance premium of CHF 6'768 is paid every year until 2051.

Or change to a VIAC pillar 3a invested in a Global 100 strategy?

The other option of our reader is to terminate his Helvetia contract, recover only the surrender value, and invest this amount (as well as all future premiums) in a VIAC pillar 3a invested in global ETFs (via the VIAC Global 100 strategy).

If we put the numbers down, we get:

- End of 2021

- Withdrawal of the Helvetia pillar 3a surrender value of CHF 15'942.87 (i.e. a loss of CHF 24'665.13, as CHF 40'608 - CHF 15'942.87)

- Termination of the Helvetia pillar 3a

- Beginning of 2022

- Opening of the third pillar 3a at VIAC

- Transfer of the surrender value of CHF 15'942.87 to VIAC

- Annual payment of CHF 6'768 from 2022 to 2051

I put all this data into my “Compound Interest Calculation” spreadsheet, and here’s what comes out with the same stock market returns as the Helvetia pillar 3a simulation:

- Guaranteed minimum: CHF 0 [1]

- With a return of 5.38%: CHF 797'074

- With a return of 6.35%: CHF 1'002'005

- With a return of 7.06%: CHF 1'188'489

[1] If you really have CHF 0 left in 2051, you’ll have other things to worry about, like a World War III, and nothing will go right. In that case, I don’t think your 3a will be a big concern. In a more balanced world where you would have saved CHF 212'214.87 (15'942.87 + 6'768 x 29), and where you would retire in 2051 in the middle of the biggest stock market crash of the 21st century, one could imagine that your 3rd pillar VIAC would be worth only half or even a quarter (in the worst case) of your invested amount, i.e. about CHF 111'000 (if divided by 2), or CHF 53'000 in the worst case scenario divided by 4.

The first time I realized what a rip-off a pillar 3a life insurance is... (photo credit: Andrea Piacquadio from Pexels)

Conclusion

The answer to the question “to terminate my pillar 3a life insurance or not” is clear to me by looking at this table:

| Data as of 2051 | Pillar 3a life insurance Helvetia | Pillar 3a VIAC Global 100 | Difference if VIAC choice |

|---|---|---|---|

| Guaranteed | CHF 173'020 | CHF 0 (or rather CHF 53'054) | -CHF 119'966 |

| Performance 5.38% | CHF 497'532 | CHF 797'074 | +CHF 299'542 |

| Performance 6.35% | CHF 612'052 | CHF 1'002'005 | +CHF 389'953 |

| Performance 7.06% | CHF 714'627 | CHF 1'188'489 | +CHF 473'862 |

If I were the reader who sent me the above e-mail, I would switch to VIAC with a pillar 3a invested in the Global 100 strategy and terminate my Helvetia pillar 3a “Guarantee Plan - Linked Pension” with a big smile.

I would like to clarify an important point: I would take this decision because my risk profile is quite high, and I can sleep very well with all my 3rd pillar invested at 100% in the stock market. This knowing that in the worst case I could always count on my 1st and 2nd pillar, and especially (!), on my ability to bounce back and generate new income.

And I can understand that this is not the case for everyone, and that some people need more guarantees regarding their private savings for their retirement.

And you, have you ever been ripped off by taking a mixed pillar 3a linked to life insurance? If so, what will you do after reading this article?

Header photo credit: Mikhail Nilov from Pexels