It’s time again to compare health insurance plans to see if we’ll switch or not this year to maximize our frugal spending.

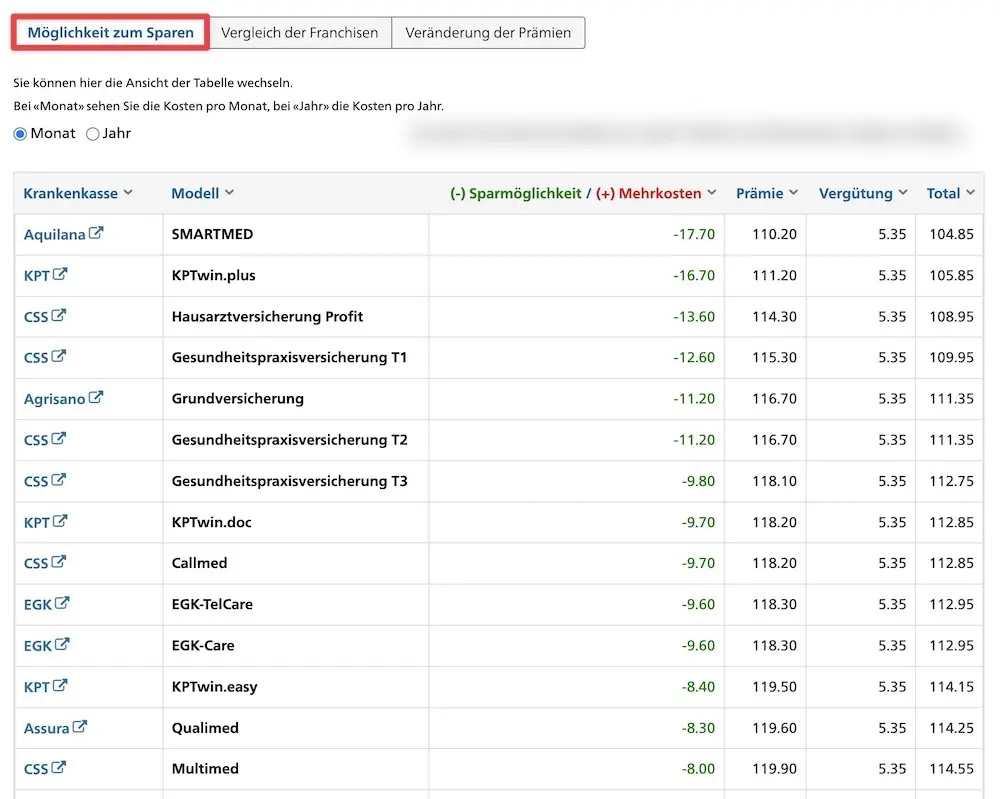

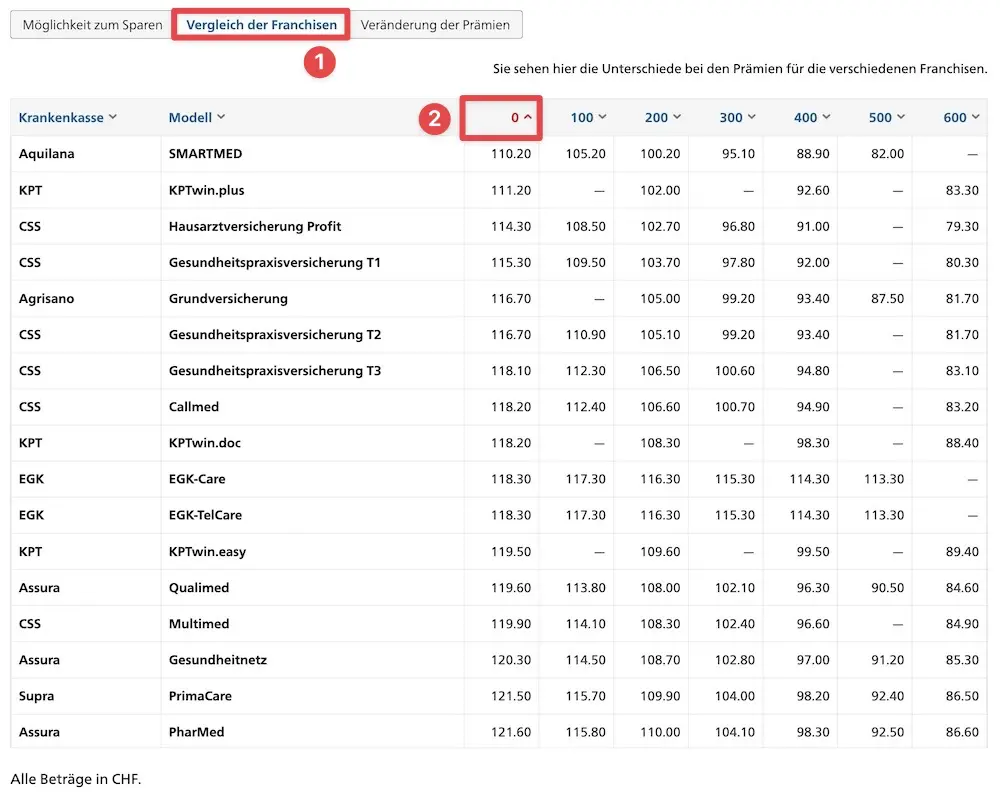

As usual, I used the best health insurance comparison tool in Switzerland on the official website of the Swiss Confederation “Priminfo” (and not Comparis or anything else that puts sponsored items in between results that you can quickly get screwed over).

Reminder health insurance choice of the MP family until 2023

Readers who have been following the blog for a long time know that we have been with Assura for several years now.

Then, in 2022, we switched to KPT, which had become the cheapest insurance for 2023.

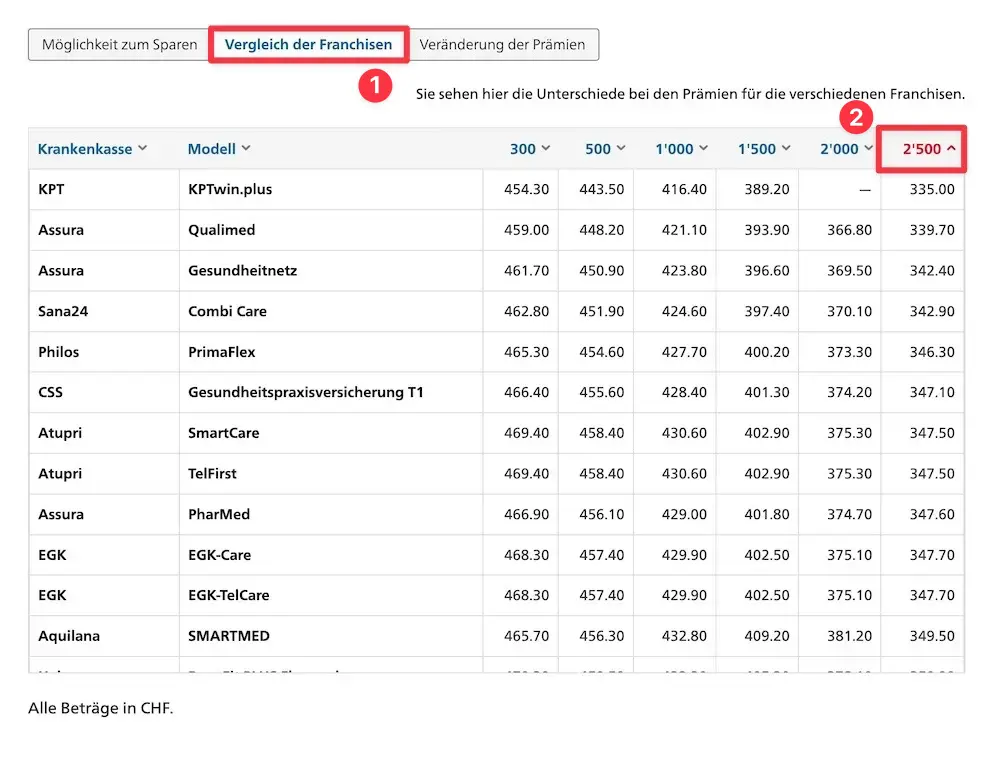

This was the most frugal option we could find with our search criteria, namely:

- Mr MP and Mrs MP: deductible of CHF 2'500, family doctor model (to be able to choose our family doctor and not have him imposed on us)

- Children MP: deductible of CHF 0, family doctor model also

Since the beginning of 2023, we paid the following monthly health insurance premiums with KPT:

- Mr MP: CHF 270.90

- Mrs MP: CHF 270.90

- Kid MP 1: CHF 87.40

- Kid MP 2: CHF 87.40

- Total health insurance in 2023: CHF 716.60/month

Using health insurance comparison tool priminfo

So I went to enter my info and that of Mrs. MP and the kids on the official federal “Priminfo” website to compare health insurance premiums:

Verdict health insurance choice 2024 MP family

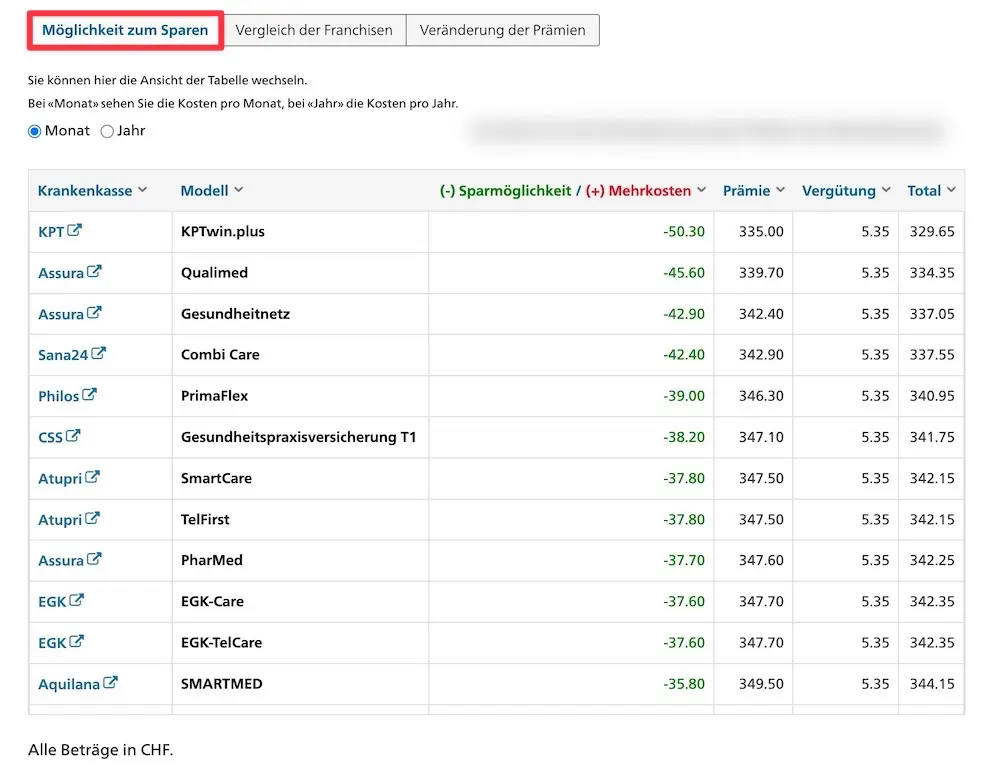

The result of the comparison was less obvious than the previous year:

- 👎 CPTwin.plus: does not give us a free choice of family doctor

- 👎 Assura Qualimed: it could have done the job. In fact, we almost took it. The one restriction we don’t really like is having to go through BetterDoc for all specialist referrals (cardiology, cardiac and vascular surgery, orthopedics, hand surgery, neurosurgery, gastroenterology, visceral surgery, urology), rather than being advised by our family doctor who has known us all our lives

- 👎 Assura Care network: does not give us a free choice of family doctor

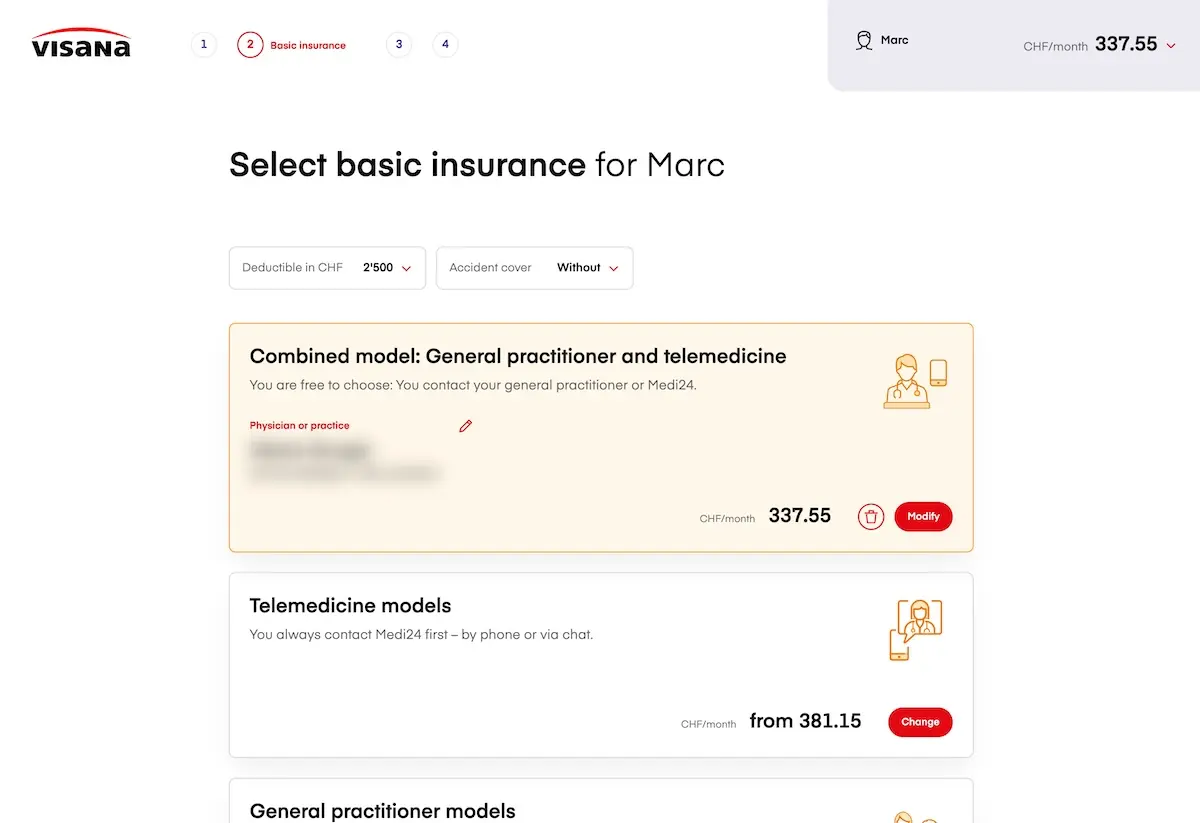

- ✅ Visana Family doctor and telemedicine: we opted for this basic insurance, as there are no restrictions on specialist referrals. If there had been more than a few Swiss francs’ difference with Assura Qualimed, we would have chosen Assura.

Visana (Sana24) becomes the most frugal insurance for Mrs MP and myself in 2024.

And, first time for us, the children’s health insurance for 2024 will be different from ours, as they change their health insurance for CSS in 2024!

That’s what we’re talking about in numbers, monthly:

- KPT MP family 2024: CHF 716.60

- Visana + CSS MP family 2024: CHF 893.00

- Difference = CHF 176.40 more to pay each month!

That’s quite a slap in the face compared with last year… we’re talking about a 25% increase 💸

But if we’d stayed with KPT, we’d have paid CHF 1'005 for the whole MP family, or CHF 112 more a month!

So, by switching health insurance in 2024, we’re talking about annual savings of CHF 1'344 (= 112 x 12).

And over 10 years, by investing this amount in the stock market via my favorite broker Interactive Brokers, that will make us CHF 19'877 more in our pocket!!!

All this for the small effort of sending a registered letter to cancel my KPT health insurance, and filling in a small form to take out our health insurance with Visana and CSS for 2024!

All that for about 1h15 of work, so we got a good return in the end!

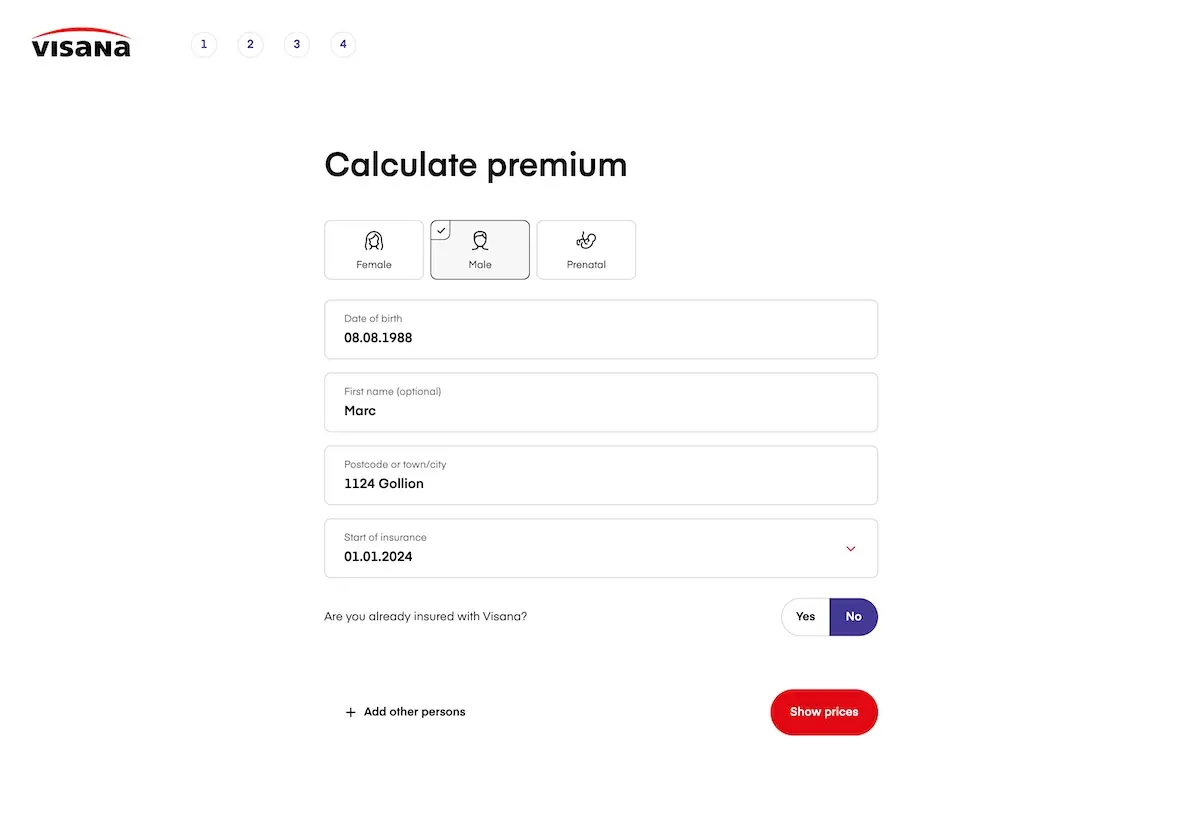

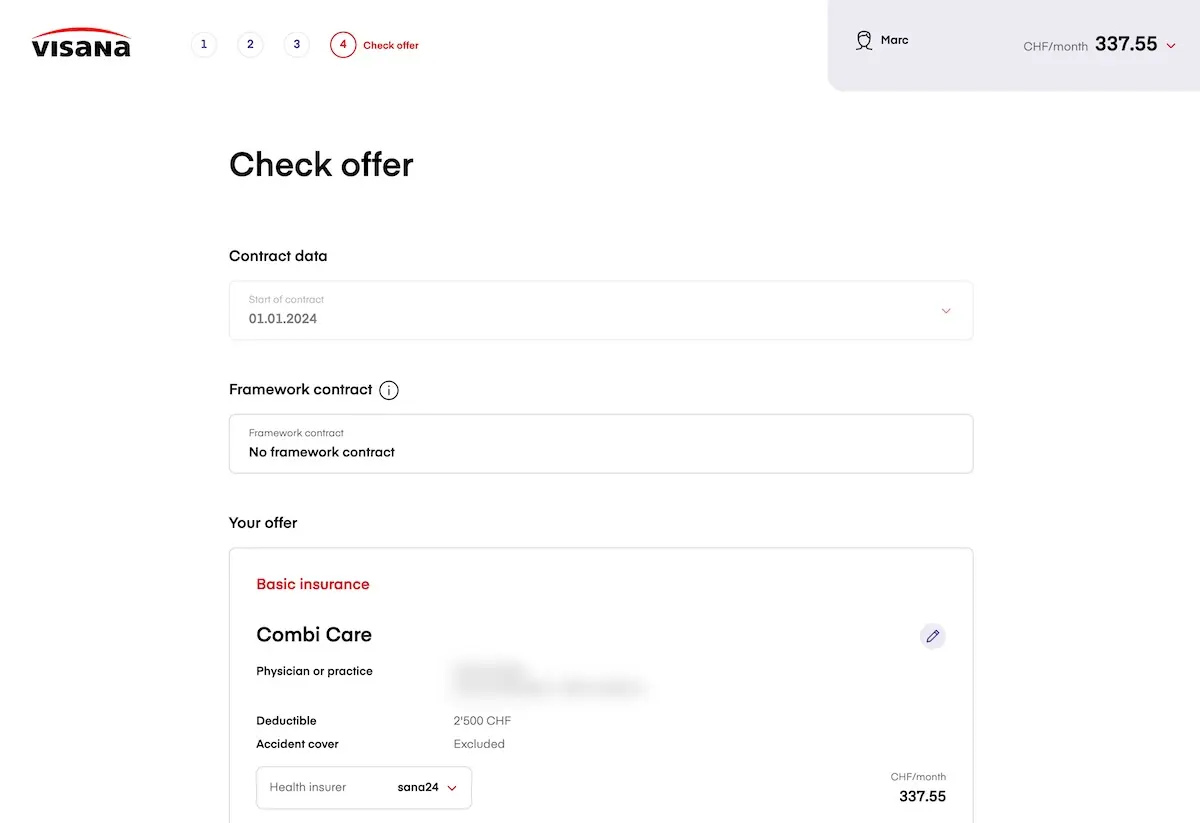

Account creation at Visana

If you also decide to take out your KVG/LAMal health insurance with Visana, I’ve made a few screenshots of their registration process (pretty well done):

And the last step:

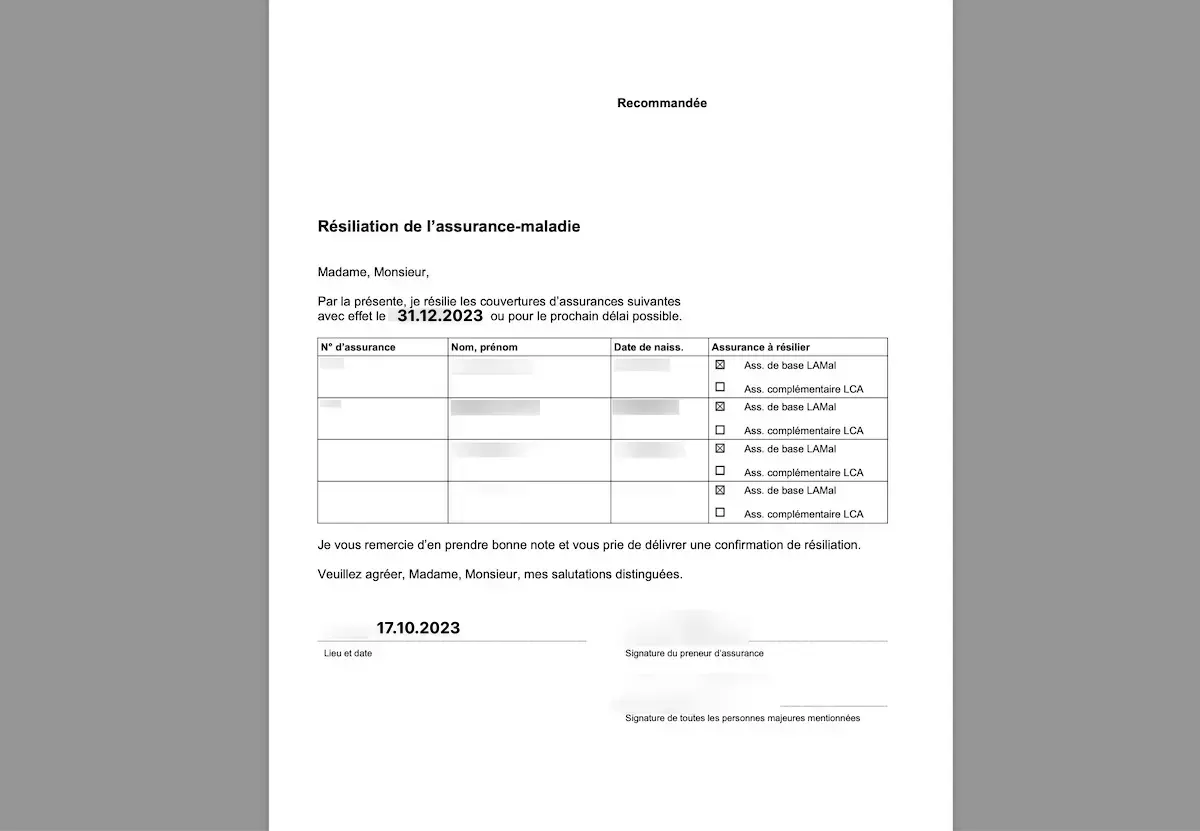

Sample letter to cancel KVG/LAMal health insurance

If you also want to cancel your KVG/LAMal health insurance (no matter if KPT, Assura or other), here is a standard insurance letter that you just have to fill in, sign and send by registered mail to your health insurance before 30.11.2023:

Download sample cancellation letter for health insurance (in French) >

Download sample cancellation letter for health insurance (in German) >

I must insist that you send this letter on time, otherwise your request to cancel your basic insurance will not be considered…

Conclusion

It feels weird to go through all these health insurance changes again… I’m borderline happy because I feel like I’m back in 2013 when I was optimizing all my contracts to become the Mustachian that I am today :)

And a little note about KPT and Assura: even though I’ve cancelled with them, I can confirm that it’s only because of the health insurance premium, because it’s always gone well and I’ve always been very satisfied.

And you, are you cancelling your KVG/LAMal health insurance this year? If so, with whom? With the family doctor insurance model or another? And also, do you have any opinion on Visana and CSS?