“It depends…” a colleague answered me.

I was digging a little more: “But what does it depend on?”

“Well… it’s complicated, you know… you have to take into account a lot of things like taxes, purchase costs, and the cost of renting for the long term… in short, it depends and it’s not simple.”

Thanks for the evasive answer.

And I’m not talking to you about other situations such as:

- My old uncle who used to certify that being a landlord was better than being a tenant, because my rent wouldn’t go out the window every month

- My father used to tell me that investing in stone was one of the safest things to do

- My banker or insurance company confirmed my father’s statements, so that I would take out a mortgage at his place, so that he could receive his famous year-end bonus to pay for his Porsche

In fact, none of them were able to give me a concrete answer. And that drove me crazy! For a Cartesian mind like me, I couldn’t believe that there wasn’t a calculator that could tell me whether it was better to buy an apartment in Switzerland (or a house), or to rent it.

The worst thing is that I only found the answer to this question after buying our own home.

In the end, the one who was right was my colleague.

The other opinions I received were only beliefs or assertions out of pure self-interest.

“But then MP, what does it depend on?!” can I hear you mumbling behind your screen.

“It depends on what, for God’s sake!?”

Well, that depends on your personal situation; i.e., the cost of your current rent, the cost of what you would buy instead, and finally what you would do with the difference between these two expenses’ items.

Common thinking suggests that once you own your home, the “rent” you pay pays off your mortgage rather than going up in smoke every month. But what the common wisdom forgets is that there is a plethora of extra costs when you own your home:

- Amortization (what we just described—i.e., paying off your mortgage)

- The interest on your mortgage debt—because banks and insurance companies don’t lend cash for free…

- The charges and maintenance costs of your property (which, when you are a tenant, are mostly paid by the landlord)

- Possible renovations on the long run

Calculating two scenarios between tenant and landlord on this basis is a bit complex, but feasible.

Except that there is another variable to take into account: the opportunity cost. By being a homeowner, you will have equity to bring to obtain your mortgage (at least 20% of the total value of the property) as well as notary fees. This money, if you remain a tenant, could be invested (on the stock exchange for instance) and potentially earn you more than if you put it in stone.

So yes, the answer to “Should I buy or rent in Switzerland?” is definitely “It depends!”

I had to wait 6 years of blogging to find a definitive answer to this problem. Indeed, at the beginning of 2020, I got in touch with the founder of Moneyland.ch for an interview on his website about the FIRE (Financial Independence, Retire Early) movement. And while discussing, he told me that they had a very detailed and free (!) automatic calculator to know the answer to the famous question “Buy or rent in Switzerland?” while taking into account your personal situation.

So I suggest you that we take two concrete examples so that you understand the calculation method. Because in the end, it’s not that complicated.

That way, afterwards, you will be able to compute your own case, and make an informed choice.

Concrete example #1: should Julia and Steven buy or rent in Olten?

Julia and Steven rent a 4.5-room apartment of 107 square meters in Olten with their two children. They pay CHF 2,015 per month in rent, including charges—which is not much in 2020, but they have been living in the same apartment for four years. They would like to buy a 4.5-room apartment in a residential area of Olten. They have found one which is listed at the price of CHF 770,000.

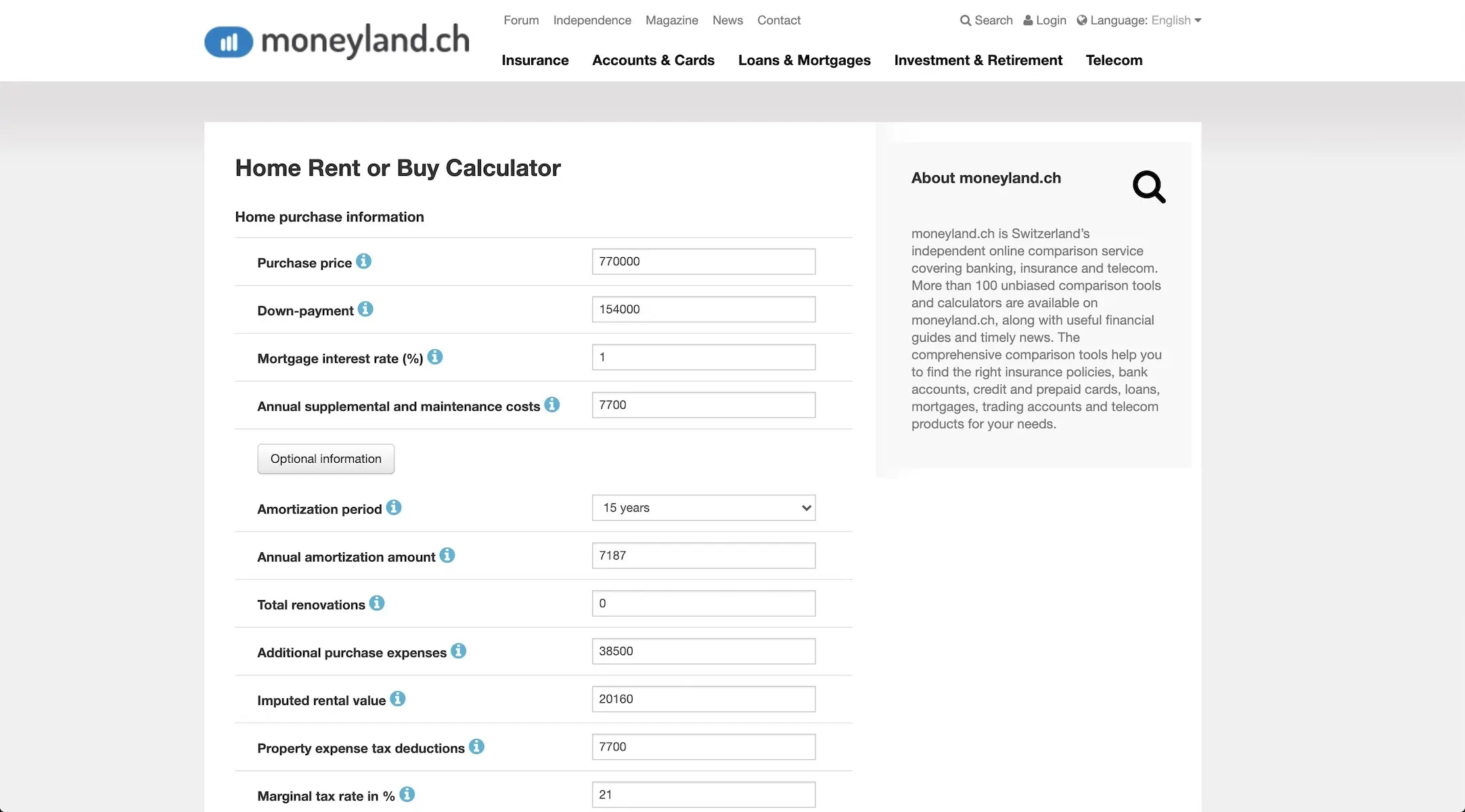

To find out whether it is better for them to continue renting or buying, they prepare all the data to be inserted in the Moneyland.ch form, starting with information about their potential purchase:

- Purchase price: that’s easy, it’s CHF 770'000

- Down payment: idem, they know that they have the 20% (minimum required by the law currently in force) at their disposal, i.e., CHF 154'000

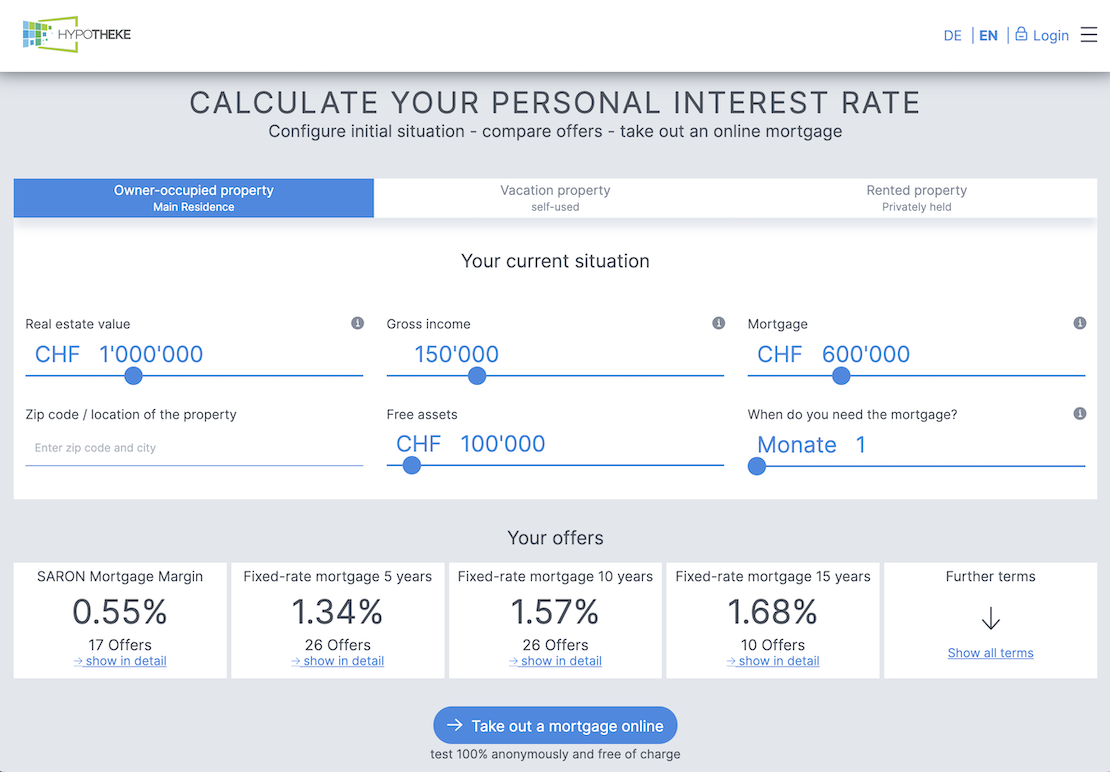

- Mortgage interests in %: they are thinking of taking out a 10-year mortgage to start, in order to secure their rent over the long term. The rate they’ve been told so far averaged 1%

- Annual supplemental and maintenance costs: they put 1% of the value of the property as is customary in the field, i.e., CHF 7'700

- Amortization period: in Switzerland, a mortgage is divided into two parts. The first mortgage amounts to 66% of the total price of the property (i.e., CHF 508'200 in our example), and the second mortgage corresponds to the rest of the amount (CHF 770'000 - CHF 154'000 - CHF 508'200 = CHF 107'800). This amount of the second mortgage must be repaid within a maximum of 15 years. However, there are ways of getting around this rule by means of indirect amortization via the filling of a pillar 3a which will be used to repay the mortgage on the date of your retirement (the real one, i.e., 65 years to date, not your FIRE early retirement). As for our couple, they decide to repay this second mortgage over 15 years, i.e., CHF 107'800/15 = CHF 7'187 per year

- Total renovations: the cost of renovations if the property you bought needs renovations. This is not the case for our couple who buy a new property

- Additional purchase expenses: this corresponds to one-off costs such as notary fees, transfer tax (a tax on the transfer of a property title from one person to another), land registry entry (writing in a register that you are the owner of the plot in question from now on). In total, Julia and Steven get away with a bill to be paid with their own cash (in addition to their own down payment) of 5% of the total sale price, i.e., CHF 38'500

- Imputed rental value: this is a fictitious taxable income that corresponds to the rental income that a landlord could receive if he were to rent out his property, in order to maintain a social Swiss tax system between tenants and landlords. We take it into account in our calculation because this amount will change Julia and Steven’s taxation. A simple method often used by tax specialists to calculate the rental value is to take an approximate rent that we multiply by 12 and then by 70%. For example, for our two lovebirds: CHF 2'400 × 12 × 70% = CHF 20'160

- Property expense tax deductions: these are real estate expenses that are deductible from income, such as maintenance costs (repairs or renovations that do not generate capital gains), operating costs (heating, electricity, water, home maintenance) and management fees (the costs of a company managing a co-ownership building, for example). As advised by their banker, our future owners expect 1% of the selling price, i.e., CHF 7'700 per year

- Marginal tax rate in %: this is the amount of tax you pay per unit of CHF 1'000 in addition to your taxable income (see [1] below for the calculation method). Julia and Steven are at 21% for this rate

- Annual property value increase as a %: it corresponds to the increase in the value of your property over the years. Experts (like Mathieu!) agree that on average the value of a property in Switzerland increases by 1 to 1.5% per year. Our lovers have chosen to enter 1.25% in the calculator

Our couple then continues to fill in the information concerning their current rental:

- Net monthly rent (without charges): CHF 1'815

- Charges per year: CHF 200 × 12 = CHF 2'400

- Investment yield rate in %: this investment corresponds to the value of the equity capital and purchase costs that would be invested elsewhere than in the property (for example on the stock exchange) if our couple remained tenants—this will be used to calculate the famous opportunity cost. Since Steven is a seasoned investor, he plans to earn an annualized return of 6% because he knows how to achieve it

And finally, they still have to select the time frame for the evaluation. They choose to take 25 years because they know they want to stay in Olten at least until their children enter the workforce.

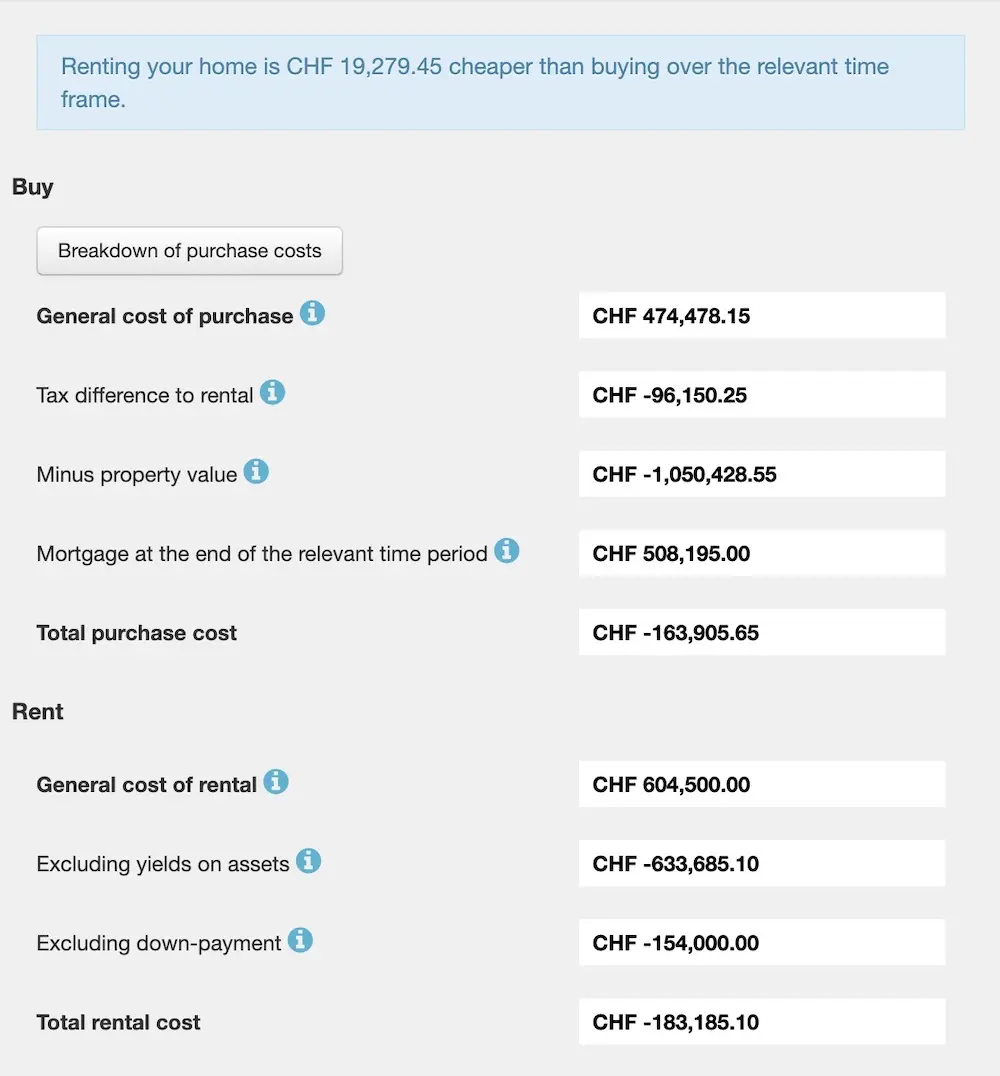

The result on Moneyland.ch is surprising compared to what Julia and Steven had heard before…

“Buy” option

- General purchase costs (sum of interest costs, maintenance charges and expenses, amortization, renovation costs and acquisition costs over the total valuation period): CHF -474'478.15

- Tax difference to rental: CHF +96'150.25, which corresponds to a tax advantage that will be deducted from the purchase costs in the sum below

- Minus property value at the end of 25 years: CHF +1'050'428.55

- Mortgage at the end of the relevant period: (corresponds to the remaining 1st mortgage due): CHF -508'195.00

- Grand total of the “Buy” option if the property is resold after 25 years: CHF +163'905.65 (= 1'050'428.55 + 96'150.25 - 508'195.00 - 474'478.15)

“Rent” option

- General rental costs: CHF -604'500.00

- Deduction of profit on equity capital: CHF +633'685.10—corresponds to the so-called opportunity cost, i.e., the interest earned on down payment and purchase costs if the money is invested instead of being used to finance a purchase

- Down payment deducted: CHF +154'000.00 (the amount of equity, which is used to generate the profit in the line above)

- Grand total of the “Rent” option for 25 years: CHF +183'185.10 (= 154'000.00 + 633'685.10 - 604'500.00)

Conclusion of the Moneyland.ch calculator: for the evaluation period, renting is more favorable than buying for an amount of CHF 19'279.45.

By playing with the calculator, the couple also realizes that the more they increase the retention period of their property, the more interesting the rental becomes, for example:

- Over 30 years, it’s more interesting to rent because it brings in CHF 123'477.60

- Over 40 years, renting brings in CHF 567'905.45

On the other hand, under 24 years of retention, the “Buy” option is the most interesting:

- Over 15 years only, the purchase is more favorable by CHF 47'753.50

- Over 20 years, the purchase is CHF 33'178.45 more favorable

As you will have understood, buying or renting in Switzerland depends on a lot of criteria to be taken into account. The most important and difficult to evaluate is the length of time you can stay in the same place.

For a “minimal” difference regarding the total amount invested, our couple prefers to buy because they will be able to have a property that suits them to start their family. Also, they do not wish to be at the mercy of their landlord who might decide one day to stop their lease.

Afterwards, we can also note that their example is biased (our case was the same), because their current rent corresponds to a less attractive property (less recent and less well located) than the one they would like to buy; so if they wanted to have the same type of property they want to buy, their rent would in fact be CHF 2'450/month (compared to CHF 2'015 currently), so the purchase could in fact become a potential opportunity?

If you are in a similar situation, think about comparing apples with apples as they say ;)

Concrete example #2: should Barbara and Henri buy or rent in Nyon?

Barbara and Henri live in a 4.5-room apartment of 110 square meters in Nyon with their two children. They pay CHF 2'700 of rent per month, charges included. They are interested in a 4.5-room apartment in a popular residential area of Nyon which is priced at CHF 1'175'000.

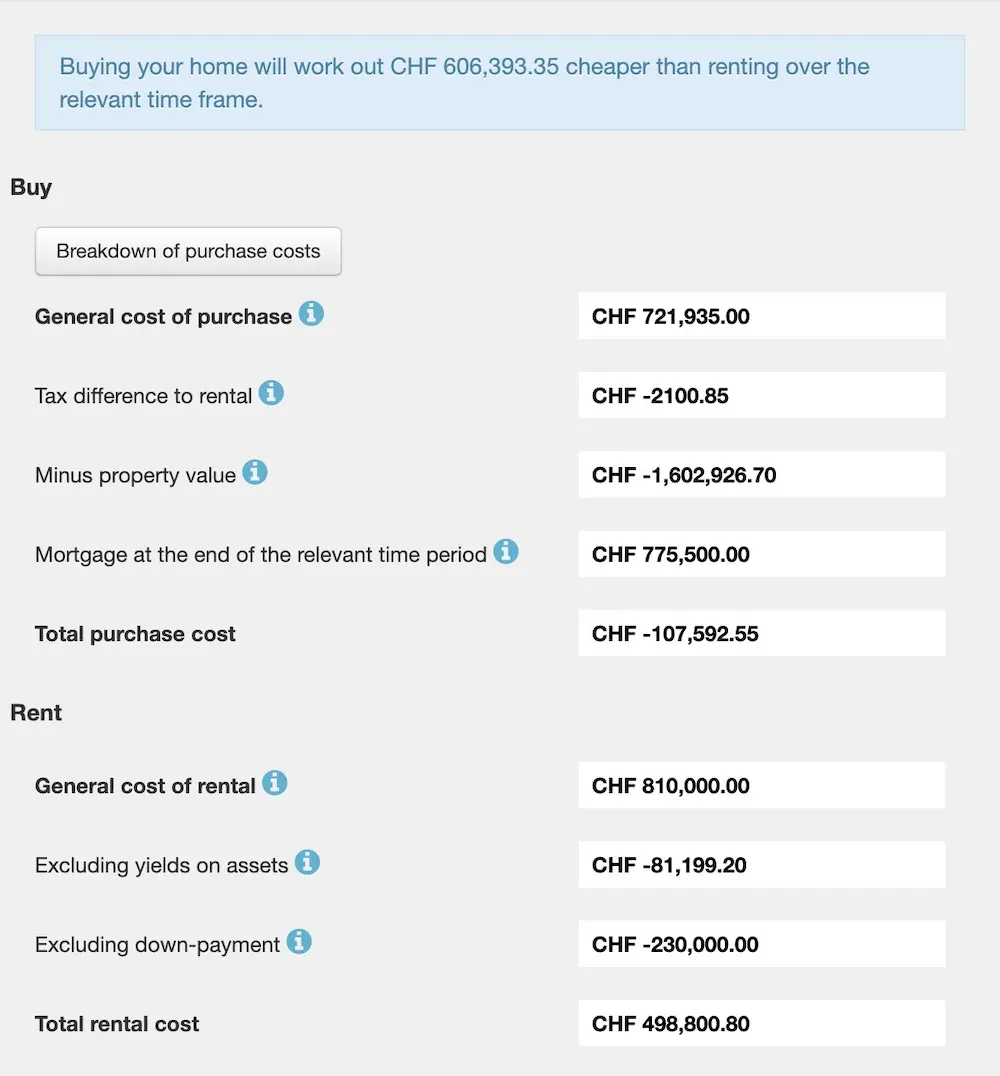

Let’s see what their calculations show:

- Purchase price: CHF 1'175'000

- Down payment: CHF 230'000

- Mortgage interest in %: 1%

- Annual supplemental and maintenance costs: CHF 11'500

- Amortization period: 15 years

- Amortization per year: CHF 11'300

- Total renovations: CHF 0

- Additional purchase expenses: CHF 57'500

- Imputed rental value: CHF 22'680

- Property expense tax deductions: CHF 11'500

- Marginal tax rate in %: 23

- Annual property value increase as a %: 1.25%

- Net monthly rent: CHF 2'500

- Charges per year: CHF 2'400

- Investment yield rate in %: 1%—this value is a key component. Indeed, Barbara and Henri do not know how to invest in the stock market. They prefer to play it safe with an investment guaranteed at 1% over 10 years by their banker (and his Porsche!)

- Time frame for the comparison: 25 years

Result of the calculator: with their data, the purchase is more favorable than the rental for an amount of CHF 606'393.35

Indeed, the appreciation of the property will be greater than the gains they will make through their investment via the bank.

Conclusion

The first and most important thing to remember from this blogpost is that the math never lies. So yes, to the question “Buying or renting an apartment in Lausanne?”, the answer is “It depends.” But it depends on personal data that are easily found, that give you a clear and precise result.

The second most important element of this article is that, apart from the obvious variables such as the price of the property in Switzerland and the price of the Swiss rent, the most impacting variables in the decision “to buy or rent in Switzerland” are the length of time you will live in the same property, and your ability to earn a decent return on your stock market investments.

Afterwards, apart from the mathematical result, there is no single truth, because there are many other parameters. What if you don’t want to risk being dislodged from your rented apartment in Zurich by your current landlord in 10 years time? Or, what if you love to renovate old constructions and are frustrated by renting a house in Switzerland because you can’t do anything about it? Or what if you decide to move abroad in 8 years and don’t want to stay for 25 years in the same place as planned?

On the other hand, there is a golden rule: you must make your own simulations before making any important decision to rent or buy in Switzerland over the next 20-30 years, because the effects add up very quickly with such amounts — we are talking about dozens or even hundreds of thousands of CHF more in your pocket!

And of course, as a frugalist, the potential savings on both sides have to be invested properly, like Julia and Steven.

And you, did you buy or rent? What does the Moneyland.ch calculator say for your situation? Did you already know the result? Surprised? Or not?

P.S.: I am thinking of making a series based on this article, as there are so many different examples as there are readers. Don’t hesitate to send me all your data via email if you’re hesitating between buying or renting in Switzerland, so that we can make an article about it on the blog and get the opinion of the MP community.

[1] How do I calculate my marginal tax rate?

To obtain your marginal tax rate, simply go to the online tax calculator for your canton. Enter your personal details (including whether you are married, with or without children, etc.) and your current taxable income and then enter the amount of tax you have to pay according to the calculator. You repeat this via the online tax calculator for the direct federal tax portion.

Then repeat these two calculations with your new taxable income, for example, if your salary is increased by CHF 1'000.

Finally, calculate the rate using the following formula: (new tax - current tax) / (new taxable income - old taxable income) = marginal tax rate.

With a concrete example, this gives:

- Current income = CHF 100'000/year

- Current taxes = CHF 20'000/year

- New income = CHF 105'000/year

- New taxes = CHF 22'000/year

- Marginal tax rate = 40% (because (CHF 22'000 - CHF 20'000) / (CHF 105'000 - CHF 100'000) = 0.4)

Net worth and savings rate update September 2020 …

Net worth and savings rate update August 2020 CHF...