For the last three years, I knew that I could still scrape a few dozen francs a year from my Swiss car insurance policy.

But that meant canceling the old car insurance and taking out the new one. I had almost crossed the line, but by the time I talked to my insurer, he had conveniently found a way to increase my bonus. So, between that and my laziness, I didn’t apply what I was preaching… namely frugalism and constant optimization…

But fortunately, in September 2019, a reader pointed out to me that the new insurer I was looking at was even more advantageous than I thought… and he literally challenged me not to be complacent and to apply my own advice! A good kick in the a** is what I needed! And it’s also why I love my blog with the interactions it provides me. Because yes, I do need a booster shot once in a while!

Except that by the time I put an uppercut on my laziness for good, it was already October 2, 2019… and my Helvetia policy at the time stipulated that “the annual contractual deadline was 31.12 of each year and effectively cancellable 3 months in advance, so the next possibility of cancellation of my motor vehicle policy was December 31, 2020, so I had to notify them no later than September 30, 2020”…

So I played the stupid guy and wrote to my insurer, Helvetia, asking what the procedure for cancellation was. And that’s when he answered the quote from my contract in quotation marks above… but I hadn’t said my last word!

I replied that I was indeed two days late, but that since I was planning to switch to the Smile Direct car insurance that the Helvetia Group had recently acquired, I was finally remaining a client of their group.

And it worked. I was entitled to an “exceptional” favour and was able to terminate my Helvetia car insurance contract on 31.12.2019 and switch to Smile Direct as of 01.01.2020. Phew!

In the end, for the same insurance cover (and the same level of guarantee since it is the same group behind it!), our new contract enabled us to go from an annual bill of CHF 474.50 at Helvetia to CHF 323.30 at Smile Direct.

Results: CHF 151.20 of savings per year. In other words, it’s as if in 10 years’ time someone would come to me and say: “Oh by the way, you had a good idea for changing car insurance 10 years ago. Thanks to the fact that you invested those savings and the magic of compound interest, here’s CHF 2'253 for you!”

Knowing that it only cost me an e-mail cancellation to Helvetia + a simple and quick form to fill in (all online!) at Smile Direct, I don’t know about you, but I’m a taker in such case!

Who’s Smile Direct by the way?

Smile Direct is a bit like the Zak or Neon of car insurance (and not only! — because they offer all the other “standard” insurances). I make this analogy because, although Smile Direct exists since 1994 (!) with at the time a revolutionary concept of selling insurance by phone, they have been able to go digital since 1999 during the internet boom by drastically simplifying all the administrative steps necessary to take out a Swiss car insurance.

Proof of this is: I did everything from the comfort of my bed on my iPhone one evening last October! And apart from the insurance certificate that I received by mail to put in our car, all the rest of the paperwork was simply sent to us by email. Welcome to 2020!

Fast forward to 2014 when Smile Direct has been taken over by the Helvetia Group. And from what I’ve seen, the latter is using Smile Direct to meet the demand of minimalist and efficient people like you and me, people who don’t want jibber-jabber and useless paperwork. Not an idiotic acquisition I find from Helvetia.

Now it’s your turn to act (with a CHF 100 bonus!)

Just like the kick in the butt I took a year ago, I plan to do the same with you with this article :)

Initially, I wasn’t planning to publish this blogpost until September, since uno, that would have forced you to act and not postpone the change until the next day since the deadline was imminent, and secondly, because I do have a book to finish by the end of August!

But plans are made to be changed, as they say.

At the beginning of July, Neon announced that they were becoming the first Swiss “bancassurance” provider. This means that you can take out your insurance directly via your Neon bank account, thanks to a partnership with… Smile Direct!

And to celebrate the launch, here’s what Neon offers if you take out your Smile Direct insurance via the procedure below:

- CHF 100 bonus for a new Smile Direct car insurance policy

- CHF 50 bonus for a new motorcycle insurance

- CHF 50 bonus for household insurance

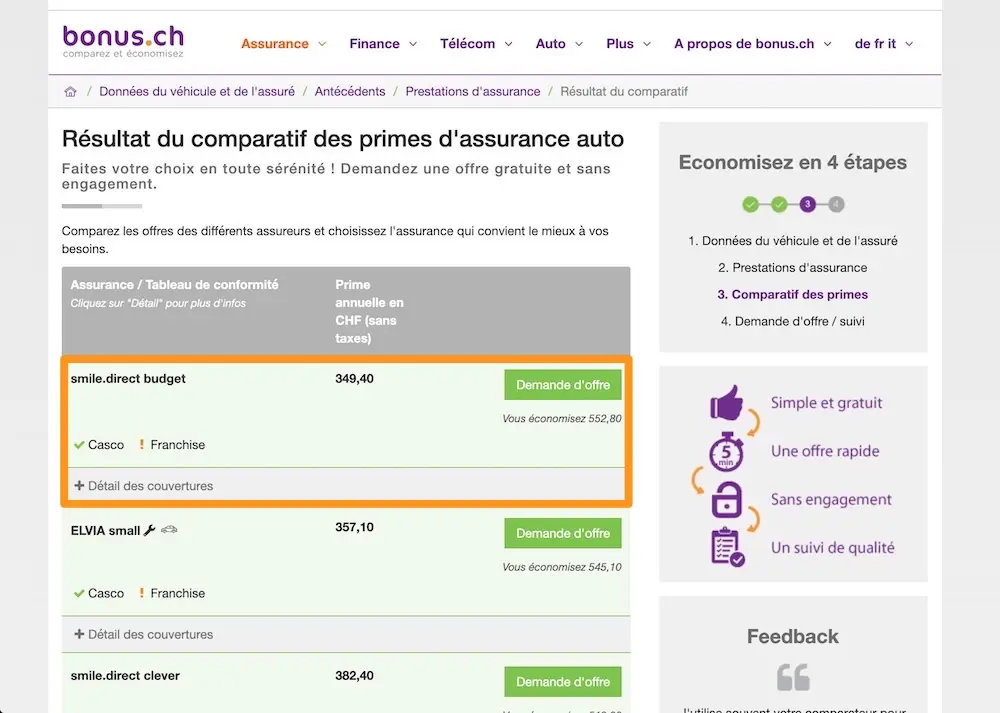

My Swiss car insurance comparison tests on the online comparator of bonus.ch, here with a Skoda Octavia Combi as an example

Bonuses are paid in cash (!) into your Neon account as soon as you have paid your first invoice at Smile Direct.

And these bonuses are in addition to the fact that Smile Direct is the cheapest Swiss car insurance according to my numerous Bonus.ch simulations with different vehicles ;)

I could have waited until September for this article as planned, but the introductory offer seems to be limited in time (until the end of the summer, or at best until the end of the year).

How do I get the Neon/Smile Direct bonus?

In order to get your bonus cash, you have to subscribe to Smile Direct through this web link in German, or this one in French.

And if you want to be nice and support the blog (without changing anything to your bonus or your new cheap car insurance premium), Neon agreed to share a small part of their reward with the blog.

In order to track this properly, they asked me that after filling out the form above, you send me an email to let me know what insurance you have taken out (car, motorcycle, household, or a combination of these). And that’s it!

Exercise

- Go to this Bonus.ch link of Swiss car insurance comparison

- Enter the make, model, and year of your car

- See if Smile Direct is the cheapest in your case, which could save you several thousand CHF per decade

- Make sure that your car insurance details are the most optimal (at the time this tip and this other one saved me several hundred francs more per year!)

- If your answer is yes to point 3, cancel your current car insurance immediately and follow the link above to subscribe to Smile Direct

- If you want to support the blog without it costing you anything, send me an e-mail as soon as it’s done

- BONUS: write in the comments below how much you will save with these few clicks!

PS: and while you’re at it, if you haven’t yet changed that non-frugal car you own, it might be time to get started!!! That’s why I’ve compiled a list of the best frugal cars used by various FIRE bloggers around the world.

Net worth and savings rate update June 2020 CHF …

Mathieu makes CHF 1'000/month of additional income...