UPDATE 13.01.2022

Click on the following links to see my updated comparison of the “Best Swiss credit card as of today”, as well as the “Best Swiss bank as of today”.

We’ve been using the same credit card for five years.

At the time, I noticed that travel hacking didn’t work in Switzerland, so I went back to the credit card with the lowest fees, and offering the most cashback.

This credit card is the Cumulus-Mastercard 1.

I do not review all existing credit cards here because they are all less advantageous except the Coop Supercard credit card if you shop there (see Moneyland for more infos).

Cumulus-Mastercard, the advantages

The first big advantage of the Cumulus-Mastercard is that it is free. Zero CHF of fees per year. And we can have several of them linked to the same account (our case with Mrs. MP), and this, too, for free.

In addition to that, Migros offers a cashback program:

- CHF 1 spent at Migros gives you 1 Cumulus point

- CHF 3 spent outside Migros generates 1 Cumulus point

Then, these points are translated into cashback at a 1% rate. So for 500 points, it gives you CHF 5 that you can spend in any Migros Group store: Migros supermarkets, Migros specialty markets (melectronics, SportXX, Outdoor by SportXX, Do it + Garden, Micasa, Interio) and their online stores, Migros partners, VOI and Bio Alnatura supermarkets as well as Migros restaurants and takeaways.

The last advantage not to be forgotten is the travel insurance which reimburses up to CHF 50'000 per person per event (all details in this document in French, or that one in German).

It is only valid if you pay at least 51% of the trip with the Cumulus-Mastercard.

Cumulus-Mastercard, the disadvantages

Despite this offer, which is by far the best in Switzerland compared to those of the usual banks, this credit card is still subject to the “Mastercard law” which requires you to pay a 1.5% fee on any transaction made abroad or in a foreign currency!

And that’s not to mention the inflated exchange rate used by Cembra (the bank that provides the Cumulus credit card), which makes you end around 2% in total fees!

I am not even talking about the 3.75% withdrawal fee at the ATMs in Switzerland or abroad (with a minimum of CHF 5 and CHF 10 respectively…).

I enclose their fees’ summary in this PDF file in French, or that one in German.

In addition to being expensive, it is also painful on the budget level because you have the information of the price actually paid on a deferred basis.

Before the end of last year, you had to wait for the monthly invoice or log on to your Cembra e-banking several days after the transaction. For a few months now, they have had a mobile app that makes it easier to track information in YNAB rather than going on your laptop in Cembra’s not user-friendly interface.

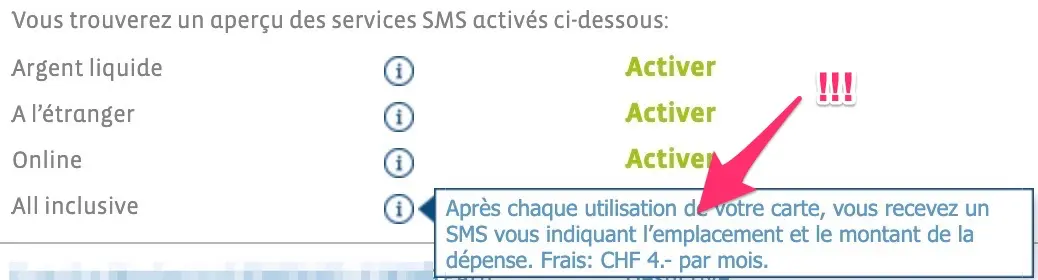

As Mrs MP forgot to enter a transaction in YNAB sometimes, I even came to the point of activating the SMS option at CHF 4 (!) to be alerted of each expense and have a YNAB that reflects reality in real time…

Revolut enters the scene

Several of you have asked me for my opinion on Revolut. I was only moderately interested beforehand because they didn’t offer an IBAN in CHF, which meant that we had to pay a fee to top up the account (their system is similar to prepay).

Except that this changed in December 2018, and Revolut has finally made an IBAN in CHF available to its Swiss customers!

So I seriously wondered if it was worth changing. The main point was to know if I was consuming that much in foreign currency and abroad, and to compare the gain via Revolut compared to Cumulus’ cashback program.

I took the Cembra invoices of my Cumulus-Mastercard over the past 12 months and counted the total spent in foreign currency: CHF 16'792. This made me about CHF 251.88 of transaction costs (at 1.5%), not taking into account the exchange rate inflated to the max by Cembra.

Over the same period, I had won CHF 220 in Cumulus cashback. And this is true in total, not only for spending abroad.

Because if we only take expenses abroad, it makes us only CHF 55.40 of cashback (CHF 16'792 x 0.0033, because CHF 3 spent outside of Migros gives 1 Cumulus point which is worth CHF 0.01, so 1/3 * CHF 0.01 = 0.0033).

The decision was quickly made. We opened a Revolut account!

If you also want to open one, you can click on the image below and you will get your card for free (instead of CHF 6.99).

Opening the Revolut account in less than 1 minute

Rather than a series of screenshots, I found you a video showing the complete process of creating a Revolut account in less than 60 seconds:

Personally, I did this from my bed on a Friday night at 10:30pm once I had finished my calculations. It changes from the appointment at the bank on Monday morning that makes you lose half a day of work!

Advantages of Revolut

The first major advantage is about the purchases abroad or in foreign currency. First of all, there are no fees. And secondly, the exchange rate applied is the interbank rate (i.e. the rate at which banks exchange money, which is the lowest available on the market) without any extra cost if you pay during the week. If you pay on weekends when the stock markets are closed, then there is a 0.5% surcharge applied by Revolut to protect them from fluctuations.

You will find the detailed information in Revolut’s FAQ.

Two concrete examples where I asked the merchant to divide the bill in two:

- Payment of 78.37€

- With my Cumulus Mastercard: CHF 92.28

- With my Revolut card: CHF 89.07

- Payment of $134.40

- With my Cumulus Mastercard: CHF 139.34

- With my Revolut card: CHF 134.41

I let you compute with your usage, but for me the winner is Revolut!

On the other hand, the alternative to the 0.5% weekend fee is to change cash in the week in the currency in which you are going to spend. It works as if you had as many wallets as currencies on your Revolut account. That’s a great concept!

In addition you can set up automatic actions like for example “Change me 1'000€ if the exchange rate drops below 1€ = CHF 1.10”.

The second advantage is the instant notification on your mobile phone (via the Revolut mobile app). And when I say instantaneous, it means that often I get it in advance compared to the payment terminal that still writes “Payment in progress”!

It’s really cool for three reasons:

- When I am abroad, I know exactly how much I have spent in CHF - the conversion is done directly and the final amount is shown immediately

- When my wife uses my secondary card, I am notified directly and I can enter it into YNAB (this mode of operation suits us well) without having to pay CHF 4 to Cembra for notifications via SMS…

- Your account in YNAB is therefore always up to date because the Revolut app is always up to date in terms of balance, there is no delay as with the Cumulus Mastercard (which has a delta of several days…)

The third advantage is the top-up of your Revolut card. I have read in a lot of places that it takes a while via an IBAN transfer with your bank (from several hours to 1-2 days). On my side, the only thing I tested was the top-up via my Cumulus-Mastercard credit card.

For one thing, it’s free. And two, it’s instantaneous again. And I can use the cash on my Revolut in the second that follows.

Anecdote: Mrs. MP was supposed to make a substantial payment last week. She’s texting me. I launch the app, top up CHF 2'000 in less than 10 seconds. I’m telling her it’s okay. Her reaction: “Huh? Already?!”

The fourth advantage is that I can benefit from the cashback of my Cumulus-Mastercard when I use it to top up my Revolut. So it’s the best of both worlds!

And I was about to forget the fifth advantage: you can withdraw money for free up to 200€/month at any ATM worldwide!

Disadvantages of Revolut

So far, the disadvantages I have found with Revolut are:

- Some sites like Apple (the only case I’ve had so far) do not accept my card because they consider it to come from the United Kingdom and not from Switzerland

- Another site refused me because it’s a prepaid card (I think it was DigitalOcean)

- There is no option to mark a transaction as “Checked” (useful to know what went into YNAB). So I use the Revolut option to “Hide a transaction” every time I enter it into YNAB. Apparently to make all transactions reappear you have to log out and then re-log into the app. Not very practical but it’s all fine like that for the moment

- I don’t have a personal IBAN as I would with N26 (an article will follow regarding this new bank), so when I want to receive money I have to use a unique Swiss Revolut IBAN with an additional code so that it knows that it is for my account

Conclusion: what is the best credit card in Switzerland in 2019?

To make it short:

- If you spend only CHF and only in Switzerland, then the Cumulus-Mastercard is the best choice because no fees and a cashback program (N.B. cashback money can only be spent in Migros group stores)

- If you regularly spend in foreign currencies and abroad (via the web or when travelling), then go for Revolut (see picture below to get your card for free instead of paying CHF 6.99 for shipping). It’s fantastic, really!

- If you want to take advantage of Cumulus cashback and the zero fees of Revolut, then take both and top up your Revolut account via your Cumulus Mastercard 💥

And you, which credit card do you use in Switzerland and abroad?!

Note: for those who follow well, you will have noticed the new Swisscard Cashback credit card which seems advantageous at first sight because it offers a 1% cashback with Amex. The problem is precisely that 1/ the Amex is not accepted everywhere in Switzerland, and 2/ that we cannot make a Revolut top-up with an Amex… bummer!

And their VISA/Mastercard only gets you 0.2% cashback compared to 0.33% with the Cumulus-Mastercard.

This affiliation link allows us to earn CHF 15 each! ↩︎