UPDATE 04.11.2020

I have (again!) updated my Swiss credit card strategy to include the Swisscard Cashback credit card. All the info is in this article.

“Hey Frugalisto, do you really think our beloved MP will accept your offer to have four Swiss bank cards in his wallet?!”

“For sure! Do I need to remind you, dear Minimalismo, that the MP brain we’re responsible for always leans towards the side with the most cashback and the least fees?!”

“I’ll give you this point Frugalisto, but be a little serious for once! Four cards! I’m sure his minimalist side will take over and I’m gonna beat you this time!”

“What do you bet?”

“A year’s worth of cashback from the Cumulus Mastercard of MP!”

“Deal :) See you at the end of the article. Get your Swiss credit card ready, bro!”

The above dialogue took place in my brain when I read that Revolut announced new fees as early as August 12, 2020, and then Neon announced a new partnership with Wise, formerly TransferWise at the end of June, and that Zak explained in early July its willingness to compete with Neon on fees for payments abroad.

I wasn’t planning to write again an article about credit card comparison in Switzerland in 2020, but only to update the one of 2019 explaining that I kept the same strategy:

- Zak’s free Maestro Card for CHF withdrawals at the ATM and for payment at certain places that only accept the Maestro (long live the Vaud countryside :D)

- Cumulus-Mastercard for all my expenses in CHF in order to earn as much cashback as possible in Cumulus points (about CHF 200-300 per year for my part)

- Revolut Card for all my foreign currency transactions to get the best possible exchange rate in Switzerland

It was not counting on COVID-19, which pushed Revolut into its financial retrenchment, since they make a major part of their cash flow through people who travel. Except, because of COVID, people don’t travel anymore. As a result, Revolut has to find solutions to remain (become?) profitable.

Revolut has therefore announced that from 12.08.2020, free foreign exchange transactions will be capped at CHF 1'250 per month, instead of around CHF 6'000 per month previously.

For someone who stays in Switzerland all year round, and just orders from time to time in USD or EUR on the internet, it’s not going to make much difference. But for us, the MP family, who are often in Europe for holidays or real estate business (not to mention our travels across the Atlantic), it’s a big difference. Clearly, we risk to exceeding the foreign currency transaction limit of CHF 1'250 at least once or twice a year.

This is a problem because above this limit, Revolut adds an additional fee of 0.5% of the transaction amount.

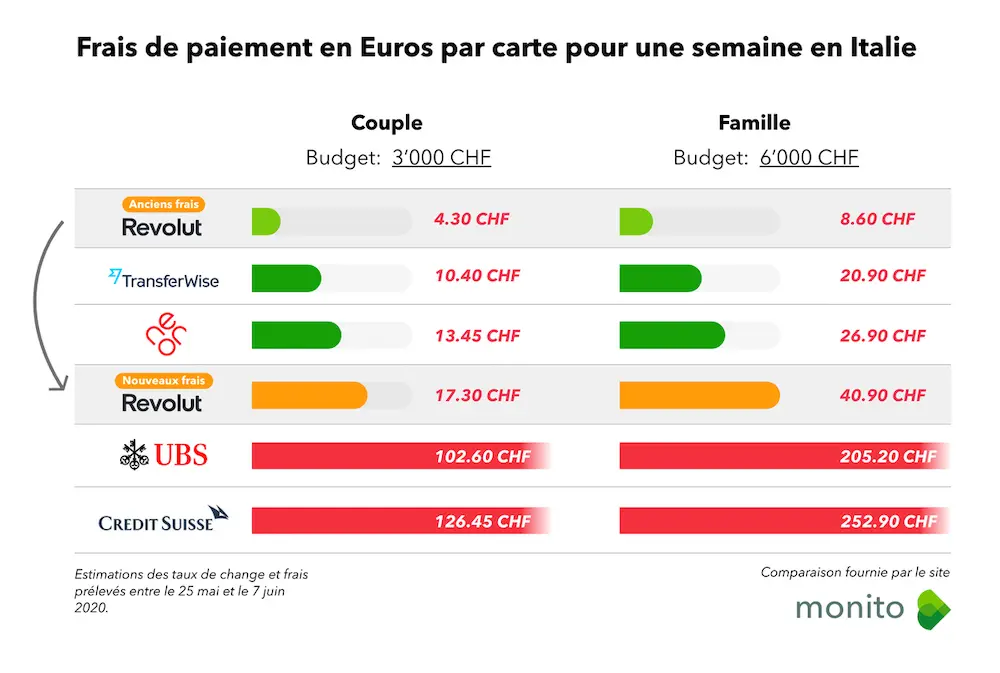

Our friends at Monito.com (comparison site for international money transfer services, made in Switzerland please, in Lausanne moreover) sums up the situation well with this infographic that speaks for itself when you spend more than CHF 1'250 in foreign currency:

© Monito: The Wise, formerly TransferWise app becomes the most advantageous in the sector, ahead of the Swiss neobank Neon

In addition to these fee changes at Revolut came the partnership between Neon and Wise, formerly TransferWise, and the elimination of foreign transaction fees at Zak.

As a result, I had to update my Swiss credit card strategy for 2020.

For a long time, I hesitated between two Swiss credit card strategies: the frugal strategy or the minimalist strategy.

Before introducing them to you, I quickly remind you my criteria for choosing a credit card as a Swiss Mustachian. Because some new readers are perhaps not yet clear. In 6 points, the best Swiss credit card for me should:

- Be able to withdraw CHF cash free of charge from ATMs, and pay even in small shops that only accept the Maestro card

- Be free for life (no annual fee)

- Maximize the CHF cashback I can earn on my purchases

- Have zero fees for purchases in CHF

- Use the interbank exchange rate (i.e. the exchange value of a currency in a transaction between two banks, also known as the “real market rate”) without any exchange rate mark-up

- Have the lowest transaction fees when paying in another currency (ideally none)

As a reminder, I am optimizing my Swiss credit card strategy because, compared to any average Swiss who has a credit card from one of these “big banks”, it allows me to save on annual fees (around CHF 100-150/year), on foreign currency transaction fees and on exchange rate markup (around CHF 400/year for us who have a lot of them!). And I’m not even talking about the CHF 200-300/year that I earn extra in cashback. So the impact of my strategy is at its highest point CHF 850/year more in my pocket, i.e. CHF 12'574 per decade.

So let’s see which two Swiss credit card strategies I recommend.

Frugal credit card strategy in Switzerland for 2020

From 12.08.2020, the date on which Revolut will introduce its new fees, the optimal strategy for earning maximum cashback in CHF and paying the lowest bank fees is:

- Zak’s free Maestro card for ATM withdrawals and to pay at certain places that only accept the Maestro (long live the Vaud countryside :D)

- Cumulus-Mastercard for all my expenses in CHF in order to earn as many Cumulus points as possible in cashback (about CHF 200-300 per year for my part, at a rate of CHF 1 for every CHF 1 spent in Migros stores, and CHF 0.33 for every CHF 1 spent elsewhere than at Migros)

- Revolut Card for all my transactions in foreign currencies to get the best possible exchange rate in Switzerland, up to a maximum of CHF 1'250 per month (else, afterwards the fees are too expensive)

- Wise, formerly TransferWise Card for all my foreign currency transactions for when I have exceeded the CHF 1'250 limit of my Revolut above

To illustrate what it looks like on each platform, here are some concrete screenshots:

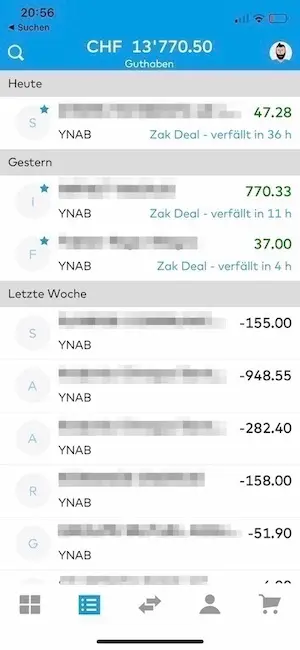

Zak Maestro card

ATM withdrawals and other payments in CHF via my Maestro Zak card appear like this in the Zak mobile app

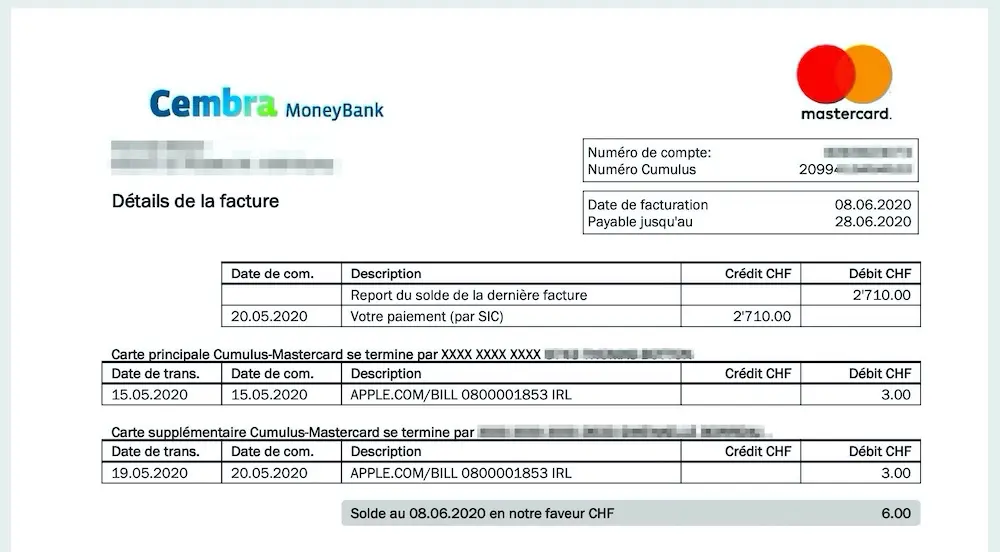

Cumulus-Mastercard credit card

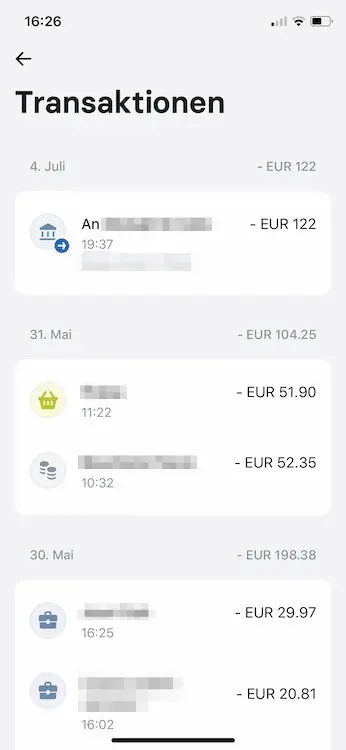

Revolut debit card

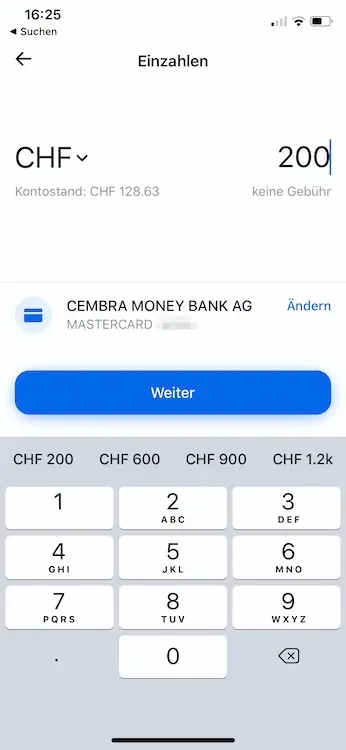

Top-up in CHF of my Revolut card from my Cumulus Mastercard (N.B. these top-ups don’t generate any more cashback on the Cumulus side, so use your Cumulus Mastercard credit card for your CHF expenses, and not your Revolut):

Top-up in CHF of my Revolut card from my Cumulus Mastercard (N.B. these top-ups don't generate any more cashback on the Cumulus side, so use your Cumulus Mastercard credit card for your CHF expenses, and not your Revolut)

Top-up in CHF of my Revolut card from my Cumulus Mastercard (N.B. these top-ups don't generate any more cashback on the Cumulus side, so use your Cumulus Mastercard credit card for your CHF expenses, and not your Revolut)

Top-up in CHF of my Revolut card from my Cumulus Mastercard (N.B. these top-ups don't generate any more cashback on the Cumulus side, so use your Cumulus Mastercard credit card for your CHF expenses, and not your Revolut)

Top-up in CHF of my Revolut card from my Cumulus Mastercard (N.B. these top-ups don't generate any more cashback on the Cumulus side, so use your Cumulus Mastercard credit card for your CHF expenses, and not your Revolut)

One wallet per currency on my Revolut account:

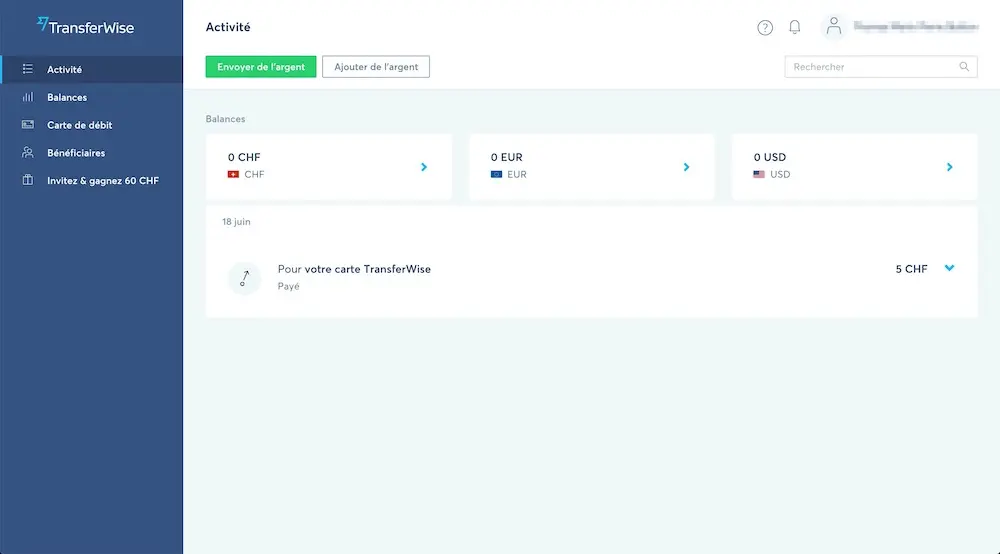

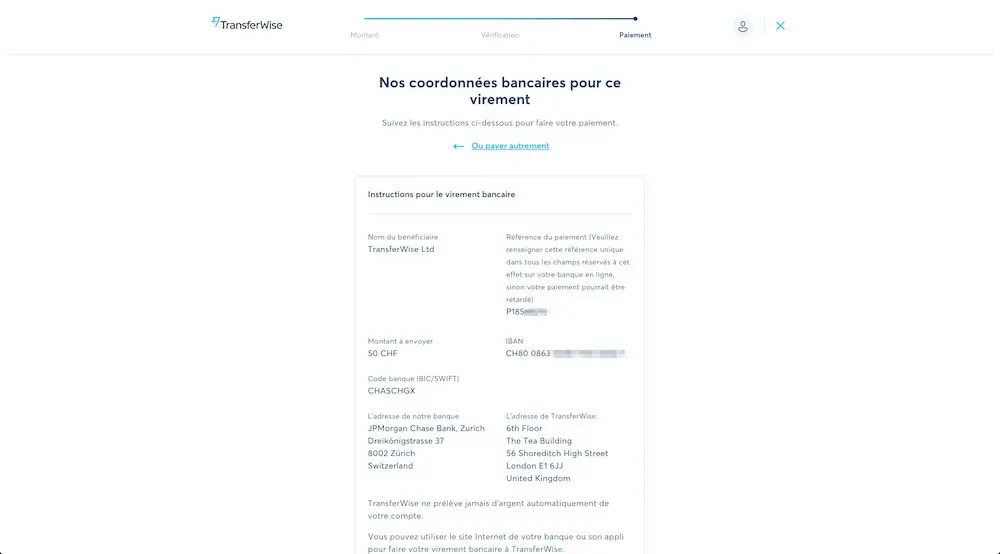

Wise, formerly TransferWise debit card

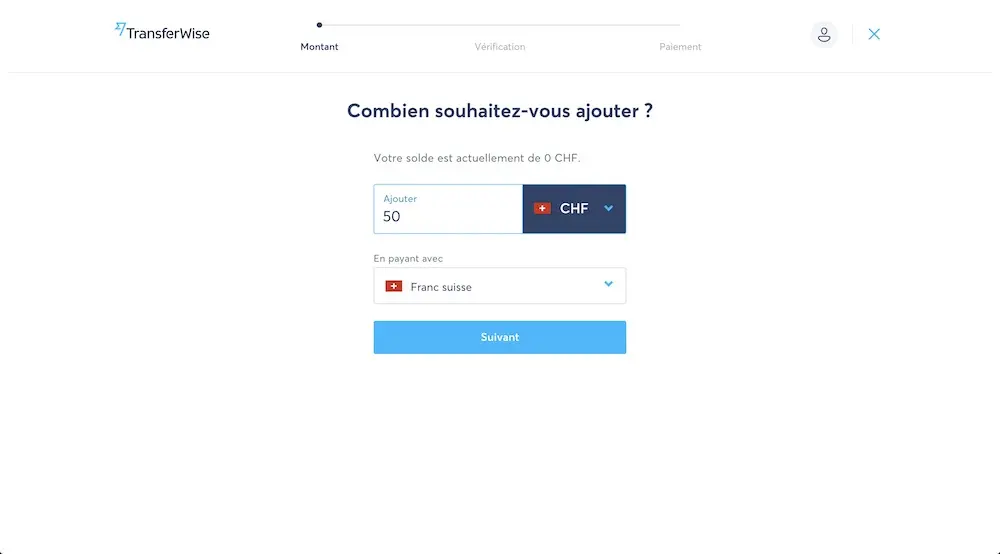

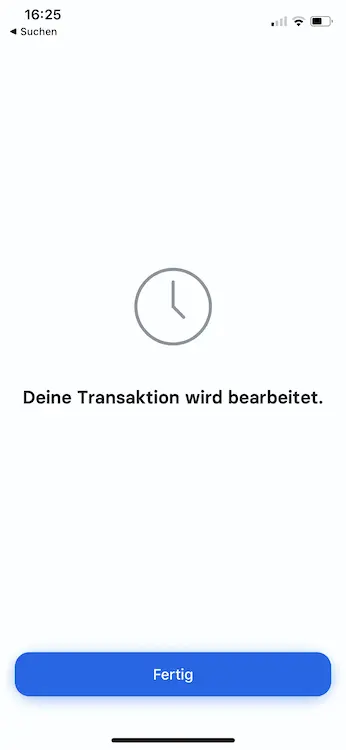

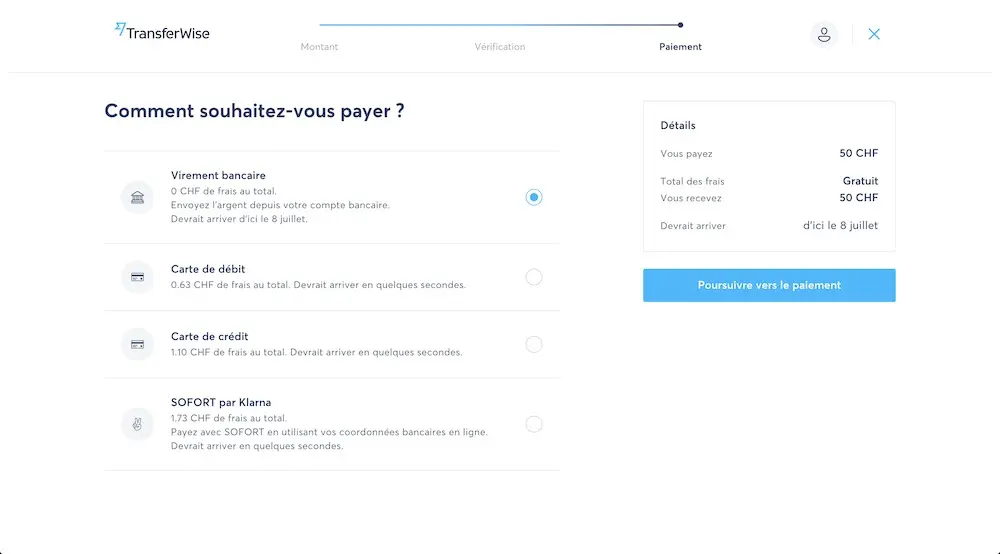

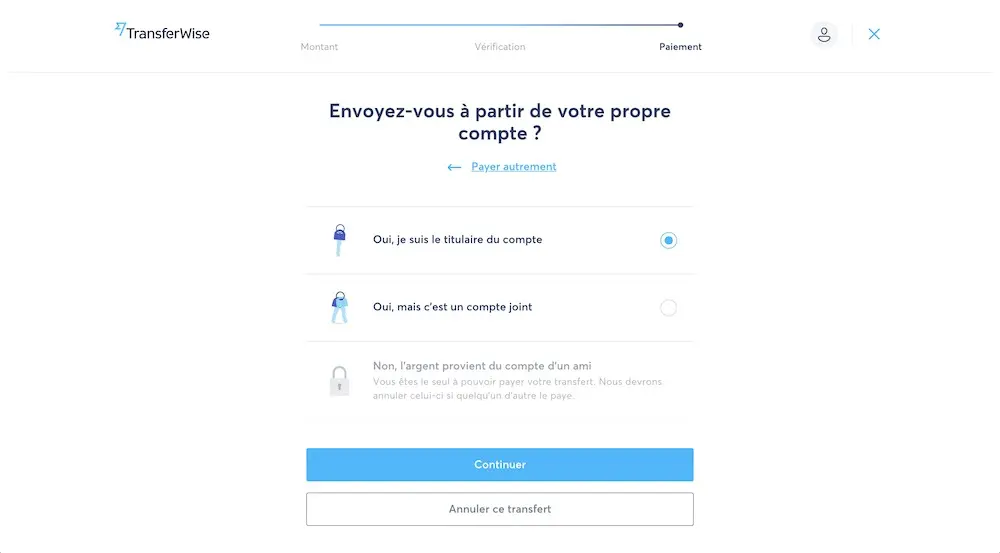

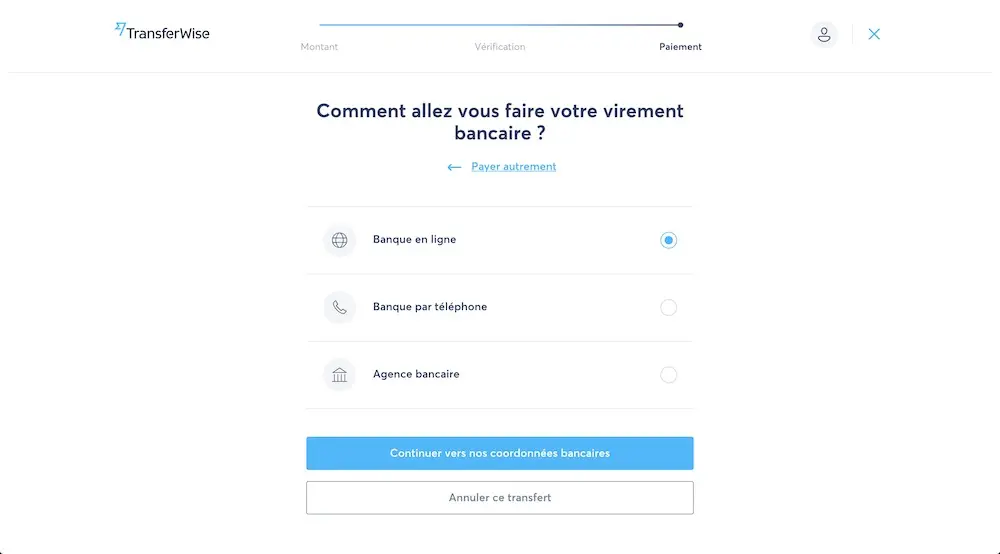

Choice of payment method for my Wise, formerly TransferWise account top-up: via bank transfer because it's free (other options are subject to a fee)

Choice of payment method for my Wise, formerly TransferWise account top-up: via bank transfer because it's free (other options are subject to a fee) (bis)

Choice of payment method for my Wise, formerly TransferWise account top-up: via bank transfer because it's free (other options are subject to a fee) (tris)

The company Wise, formerly TransferWise has therefore made its entry into the ranking of the best Swiss credit cards.

This latter is well known to Swiss Mustachians because before Revolut offered a Swiss IBAN, people used Wise, formerly TransferWise (which offers a Swiss IBAN) to top up their Revolut account at a lower cost compared to an expensive direct transfer between a Swiss bank and Revolut’s foreign IBAN.

Here is a video explaining the Wise, formerly TransferWise service:

The question you may be asking yourself is why don’t I use Zak or Neon instead of Revolut and Wise, formerly TransferWise to have less cards to manage?

As you can see on the graph, there is no discussion about using Revolut up to CHF 1'250, but the question does arise for any amount above that.

The answer lies in the exchange rate used by Wise, formerly TransferWise, Zak, and Neon. Because the devil is in the details: each one uses its own exchange rate.

Wise, formerly TransferWise uses the real time exchange rate like the one you find on Google when you search for the EUR-CHF exchange rate for example. And they add to this a small fee that is transparently displayed on their app and site. So it’s like trading live on your Interactive Brokers account.

As for Zak and Neon, they use a once-a-day exchange rate that is on average a bit higher than the live exchange rate (to cover the risk of a huge fluctuation between two days):

- Zak uses the exchange rate set by the Cornèr Bank (not publicly available on the web, I had to call them to compare the results below)

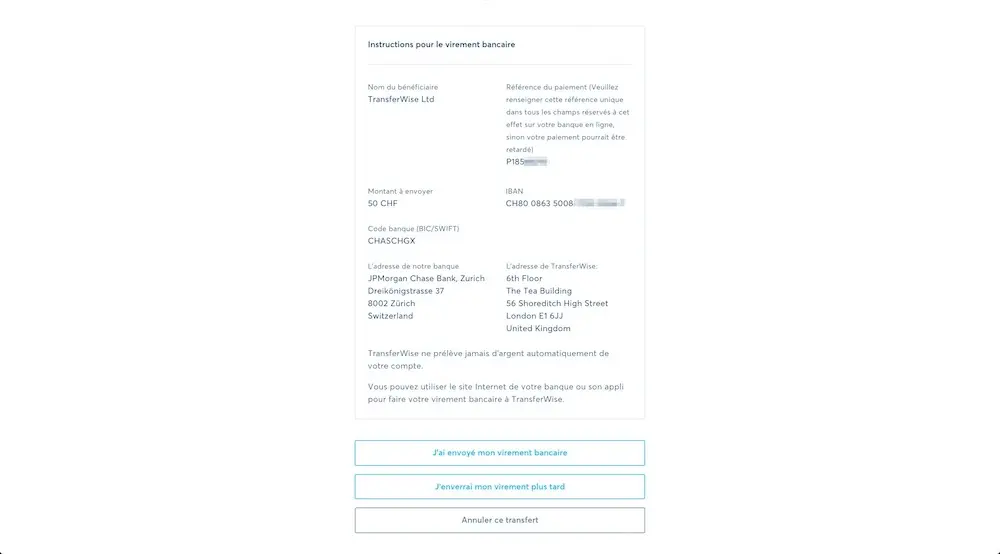

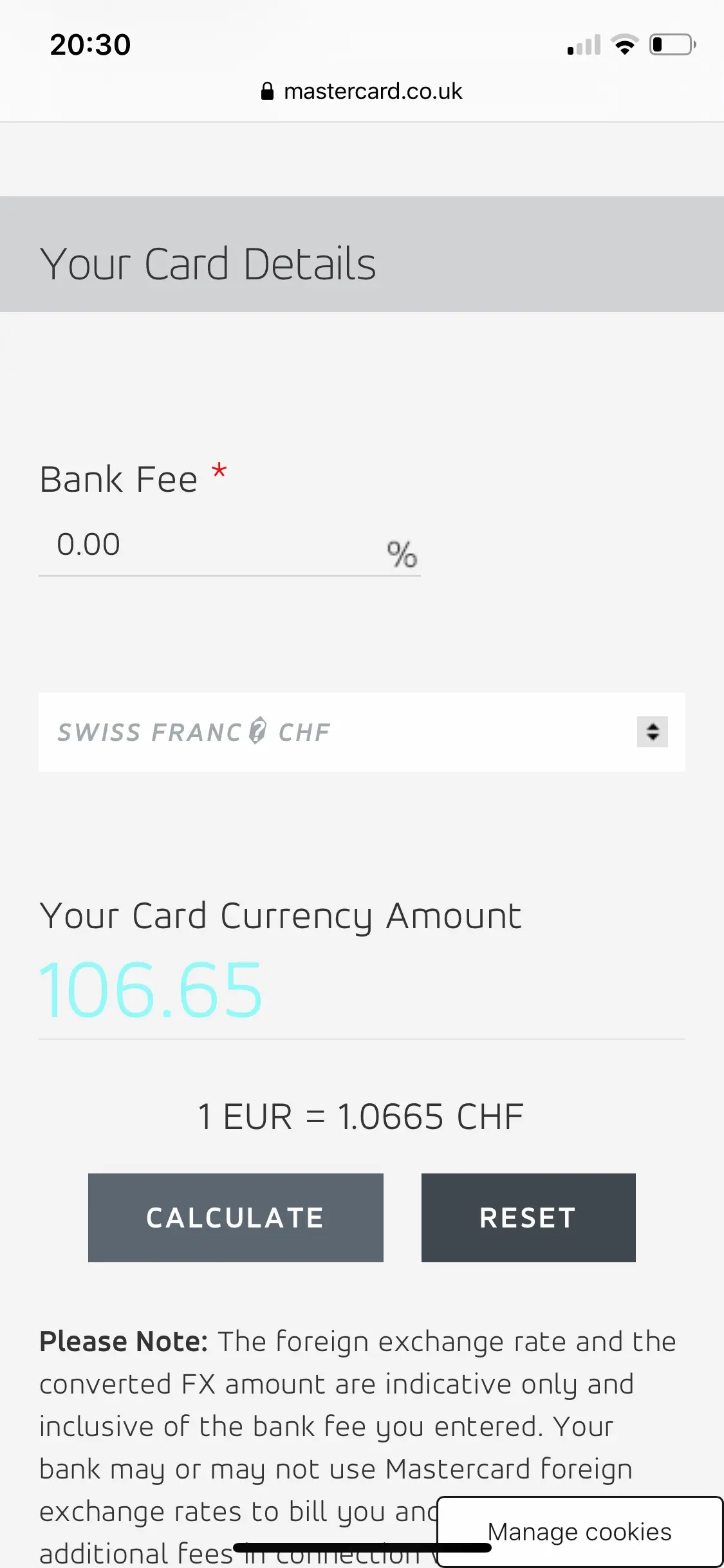

- And Neon uses the exchange rate defined by Mastercard (see the currency converter on the Mastercard site)

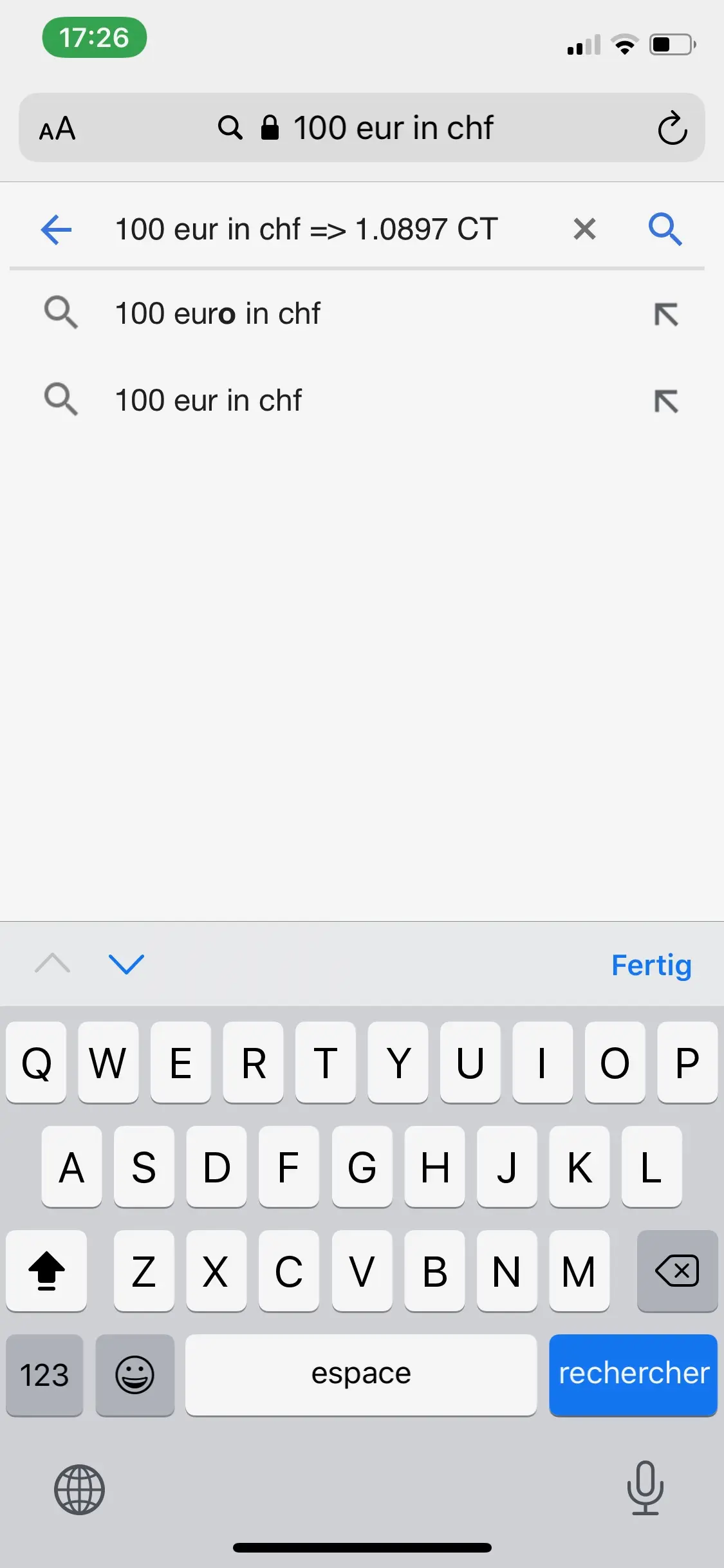

To give you a very concrete example that proves that Wise, formerly TransferWise is the best option, I simulated a payment of 100 euros and here is the result in CHF:

Exchange rate applied by Zak (obtained by phoning Cornèr Bank to find out their exchange rate of the day — I wrote it down in Safari when I had the guy on the phone, hence the weird screenshot)

As you can see, Wise, formerly TransferWise is the cheapest since it follows the live exchange rate, followed by the Mastercard exchange rate used by Neon, and then the Cornèr Bank exchange rate used by Zak.

Let us now turn to the minimalist Swiss credit card strategy in 2020.

Minimalist credit card strategy in Switzerland for 2020

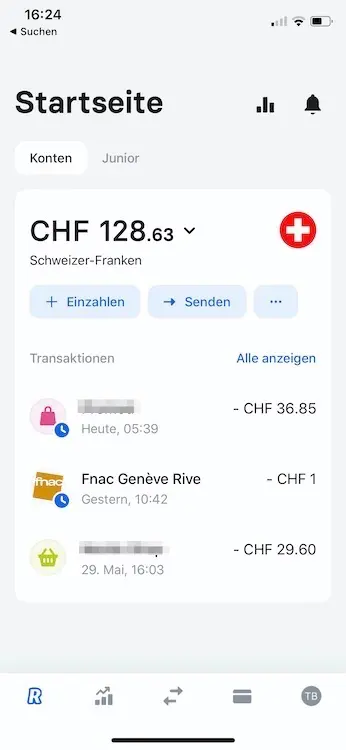

If your Minimalismo brain side is stronger than your Frugalisto side, then you would definitely prefer to have only one Swiss credit card in your wallet instead of four (or even zero with Zak’s virtual card), even if you have to lose between CHF 200 and CHF 300 in cashback per year and pay an exchange rate a bit higher than necessary (knowing that Neon seems more advantageous than Zak according to my tests).

Your solution will be to choose either the virtual Visa prepaid card of Zak or the Mastercard of the mobile bank Neon depending on which Swiss bank you have chosen (see my complete analysis of these two banks here).

Indeed, in both cases:

- It’s free for life (no annual fee), as is the account of each of these neobanks

- It has zero fees for purchases in CHF

- It uses the interbank exchange rate of Cornèr Bank (Zak) or Mastercard (Neon) without any markup (N.B. Cornèr Bank defines its exchange rate internally on a daily basis, and the Mastercard interbank exchange rate is defined daily at 3 p.m. Swiss time, compared to Revolut or Wise, formerly TransferWise which uses the live “real market rate” with the option of being able to convert currencies at the “best time”)

- It has no transaction fees when paying in another currency

(Reminder for new readers: I have negotiated respectively CHF 25 (Zak) and CHF 10 (Neon) of welcome cash if you follow my procedure for the opening of your account at these neobanks).

Be careful, though, before you let Minimalismo convince you. Because you have to make a conscious choice with this minimalist strategy:

- You won’t get a Maestro card if you go with Neon

- You won’t have a multi-currency account (i.e. as if you had as many virtual wallets as you have currencies) to exchange money when you see that the CHF-EUR rate is super advantageous today but you are only going on holiday in a week… Which is something you can do with Revolut or Wise, formerly TransferWise

A short note also on the fact that Neon offers a service for sending money abroad in other currencies based on Wise, formerly TransferWise. It’s very convenient for the minimalist you are, but you should know that they add a 0.4% “convenience fee” (and they are right because it’s very convenient and they don’t hide it at all compared to other financial institutions, but it’s not Mustachian enough for me).

Conclusion

The best credit card strategy in Switzerland for a Mustachian is therefore clear: the frugal strategy wins out in 2020.

“Hey Minimalismo, where are you going? Come back here, you owe me CHF 300! I told you I’d get MP’s brain on my side!”

If you still don’t have all the accounts and credit cards listed in my strategy, then you can use the links below which will allow the blog to earn a small commission without it making any difference to you (you’ll even earn a few CHF depending on the current offers). Thank you in advance for this.

And you, what Swiss credit card strategy do you use in 2020? (don’t hesitate to tell me via the comments below if I miscalculated something too!).

1. Bank Cler Zak Maestro card

2. Cumulus Mastercard credit card

(make sure you follow the link above if you want to get the associated Cumulus points bonus, and once on the form don’t change page otherwise their system seems quite capricious… :))

3. Revolut card

4. Wise, formerly TransferWise multi-currency debit card