Cornèrtrader has recently introduced new fees, and I am now evaluating the option of transferring my shares to DEGIRO 1.

I can already hear you say:

But MP, I thought your favorite online broker was Interactive Brokers, and that you had more than CHF 100'000 in assets with them? Was it a fake news or what?

Don’t worry, I haven’t lied to you :)

All of our securities with Ms. MP are indeed at our favorite broker Interactive Brokers. However, when our toddlers were born, we decided to put money aside for them to use it when they get 20+ years old for useful things (studies, language travel, etc.)

And so, instead of letting this cash rotten at BCV and their crazy positive interest rates, we decided to invest this money.

In order to separate everything, and also for me to test another online broker that I recommend (well, recommended), I had opened an account at the time at Cornèrtrader which was more advantageous than IB for a portfolio below CHF 100'000.

New Cornèrtrader fees

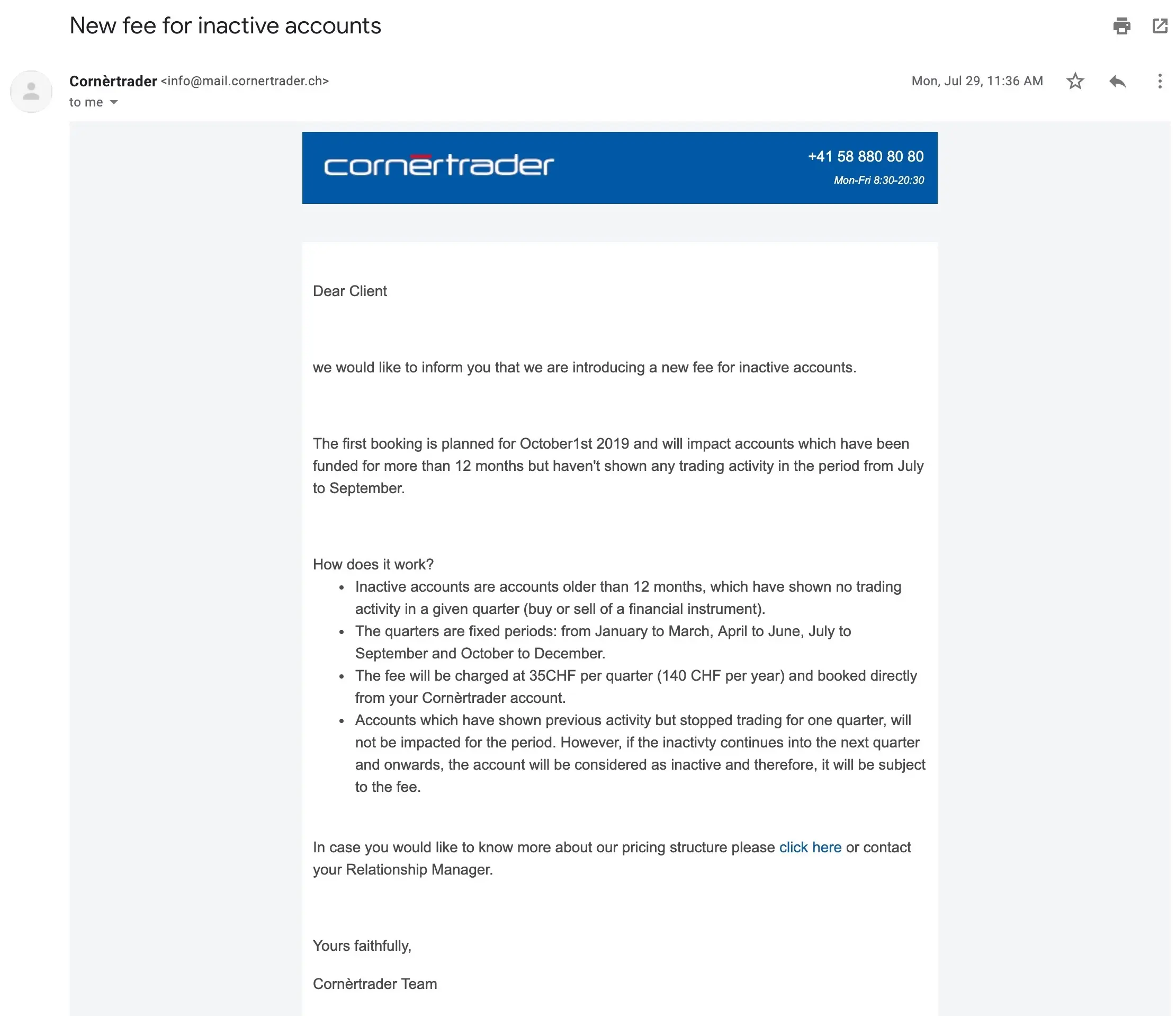

Last July 29th, I received an email from them indicating that they were introducing new account inactivity fees amounting to CHF 35 per quarter:

“But MP, if you supposedly invest every quarter, why do you have a problem with these new fees? They don’t apply to your case, do they?”

I see you’re perceptive today :)

The thing is that we set aside smaller amounts for our children, so we invest less regularly in the stock market to avoid paying too many fees (aka minimum CHF 20 to buy an ETF on the Swiss stock market).

Difference in fees between Cornèrtrader and DEGIRO

Currently, we’re paying commissions of CHF 20 (+ Swiss stamp duty) to purchase the ETF “Vanguard FTSE All-World UCITS” (code name VWRL) from Cornèrtrader. We’re doing about one transaction per year.

With the new Cornèrtrader inactivity fee system, we should either go to a minimum of 4x transactions costing CHF 20 each = CHF 80/year of transaction fees, or if we keep the same purchase rate (i.e. 1 transaction per year), we would end up with 3x CHF 35 (inactivity fees) + CHF 20 (transaction fees to buy the ETF VWRL once a year) = CHF 125 of fees in total…

If you have been following the blog for some time, you probably know that mathematically, the online broker with the lowest fees for a Swiss investor is DEGIRO 1. You also know that I had some concerns about it because it was a newcomer on the market at the end of 2016, and that sometimes they would change their conditions without giving their customers too much advance notice. Nevertheless, in 2019, they are still alive and increasingly present in Switzerland, and apparently the confidence index of the people I talk to seems to be quite high.

Concretely, with DEGIRO as an online broker for the money we invest for our children, our fees would be much lower:

- CHF 0 to buy our favorite global ETF VWRL (as it is part of their list of free ETFs — free as in commission-free)

- 0.10% exchange fee because the free VWRL ETF is the one in EUR (we should be around CHF 1-2 of exchange fee in our case)

- 2.50€ of stock exchange connection fees

- 1€ + 3% of the dividend (maximum 10%), which is equivalent for CHF 100 of dividends to about CHF 4 of additional costs

- Total costs per year with DEGIRO = 2 + 2.50 + 4 = CHF 8.50

The result is clear: DEGIRO 1 wins.

My questions to you

Before I move on, I thought I would ask you the following questions because I saw on the forum that a lot of readers use DEGIRO :

- Do you agree with my statement? Any other opinions?

- Cornèrtrader vs. DEGIRO: did I miss recent events that make you lean more towards one than the other?

- Have you ever transferred securities from one online broker to another? Simple? Complex? - in any case it will allow me to experience it and then document it here :)