Silvan, a long-time reader (we became great buddies), sent me this email the other day:

If you are reading this blog, chances are your situation is similar to his:

- You’re a stock market investor whose base currency is CHF (aka the currency you use in your country — and therefore also the currency which you make transfers, transactions and value your investments)

- You invest in a global ETF listed in USD (like the VT ETF!) because it’s the best way to diversify your investment portfolio

- You run a passive investment strategy via ETFs (instead of an active one where you have fun trying to outsmart the market by buying/selling stocks) — because like me, you can’t predict the future!

Except that, this type of profile carries a risk… linked to the impact of currency fluctuations.

But don’t worry, we’re not here to scare you. On the contrary, in this article, we’ll look at the concept of currency hedging, its purpose, and its advantages and disadvantages.

And, as usual, at the end of the article, I’ll explain what I do for my own ETF portfolio as a Swiss investor.

What are currency fluctuation risks?

Currency fluctuation risk refers to the danger that the value of a currency may change over time, positively or negatively affecting the value of your investments or international transactions.

Let’s take an example.

Let’s assume that you invest in the VT ETF in US dollars (USD) and that your base currency is the Swiss Franc (CHF).

Simply put, you buy your VT ETF at USD 95. At the moment of purchase, 1 CHF equals 0.88 USD (fictitious example, not representative of the current exchange rate). So, to buy a VT ETF, you’ll pay CHF 107.95.

To calculate how much you're going to have to pay in CHF to get a certain number of USD (or any other currency), here's how you calculate it:

- Take the USD amount you want to convert into Swiss Francs. In this case, it's 95 USD

- Divide the USD amount by the exchange rate (= 0.88, so for 0.88 USD you get 1 CHF) to get the equivalent value in Swiss Francs

- So in our example, this gives: 95 USD / 0.88 USD/CHF = 107.95 CHF

6 months later, you decide to sell your ETF, because it’s now worth 120 USD instead of 95 USD when you bought it 🎉

If the exchange rate were still the same (1 CHF = 0.88 USD), then you would have made CHF 136.36 (120 USD / 0.88 USD/CHF).

Not bad at all, you earned CHF 28.41 (= 136.36 — 107.95).

BUT, let’s imagine that over the past 6 months, the exchange rate is no longer 1 CHF = 0.88 USD, but 1 CHF = 1.45 USD.

Suddenly, after 6 months, if you sold your VT ETF (bought at USD 95 and now worth USD 120), you’d only get CHF 82.76 for it (= 120 USD / 1.45 USD/CHF).

Ouch!

In this new scenario, where the USD/CHF exchange rate has fluctuated, we see that you’re left with CHF 82.76 instead of your initial CHF 107.95 invested. And this is despite the fact that the value of the VT ETF itself has risen…

Basically, the exchange rate fluctuation ate up your profits…

What’s worse, you lost money!

So this is when you ask yourself: How do you hedge the exchange rate risk? :D

What is currency hedging?

Currency hedging is a way of protecting yourself against fluctuations in exchange rates between different currencies.

In simple terms: you can buy a kind of insurance that guarantees the exchange rate (CHF/USD in our case) at a date in the future.

In our example above, if you had used a currency hedge, you would have received the entire profit, i.e. CHF 28.41 (purchase price = 107.95, and sold price = 136.36).

How does currency hedging work?

Technically, there are three ways to ensure a fixed exchange rate between two dates:

- A forward contract

- A call option

- or structured products

Let’s take a short detour and let me explain what these are since this is all gibberish - even for me!

A forward contract is an agreement that allows you to fix a specific exchange rate in advance (up to 12 months in the future). So if today you decide to lock in a rate of 1 CHF / 0.88 USD for 6 months from now, then you'll be guaranteed to complete your transaction at that exchange rate in 6 months' time.

“Hmmmm, that’s a cool solution MP!” I hear you saying to yourself.

But wait a moment! Nothing is free in life… what do you expect :)

Let’s first continue with the other definitions:

A call option gives you the right, but not the obligation (that's the difference with a forward contract), to buy or sell a currency at an agreed price on a future date. And depending on currency fluctuations, you can use this option to buy or sell the currency at the agreed price.

FYI, if you want to buy it's called a "call option" and if you want to sell, it's called a "put option".

And finally, the last definition of the day (aw man, are we back in high school? ^^):

Structured products are more complex financial instruments that combine different hedging strategies. For example, a structured product might be designed to protect you against a fall in the U.S. dollar, while allowing you to profit from an eventual rise. These products are complex and difficult to understand (even for me), so we won't go into more detail here.

Now that we’ve finished the finance lesson, let’s get back on track :D

Let me first remind you of one of our goals here on the blog: to invest in the stock market in no more than 30 minutes per quarter.

We don’t want to spend our precious time on trading platforms (life’s better than that!) buying forward contracts!

And we’re (also) a bit lazy ^^

So clearly, we’re not going to play around with hedging the exchange rate risk of our ETFs!

And it seems we’re not the only ones, since the financial world has already anticipated the need for hedged ETFs.

So when you see “hedged” in the name of an ETF, it means that it incorporates a currency hedge.

Concretely:

A “hedged” ETF automatically manages the risk of exchange-rate fluctuations for you via (in most cases) forward contracts.

So now, the million-dollar question: Is it worth taking a hedged ETF vs. a non-hedged ETF?

Should I buy a hedged ETF as a Swiss investor?

When you read my explanations above, you think that you clearly need to hedge against currency risk.

Because you don’t want to see all your stock market profits reduced to zero when you convert your USD back into CHF…

At least, that’s what I told myself in 2013 when I started investing in the stock market…

Except that I was wrong :D

Because, like all good insurance, they’re never free!

We’re talking about an additional 3% (in 2023) in insurance costs… so on a portfolio of CHF 500'000, that equals an extra CHF 15'000 per year!

So, yes, it’s not cheap. But if it gives you a 6% return, for example, it’s still worth it.

Then I looked up what the economic research papers had to say.

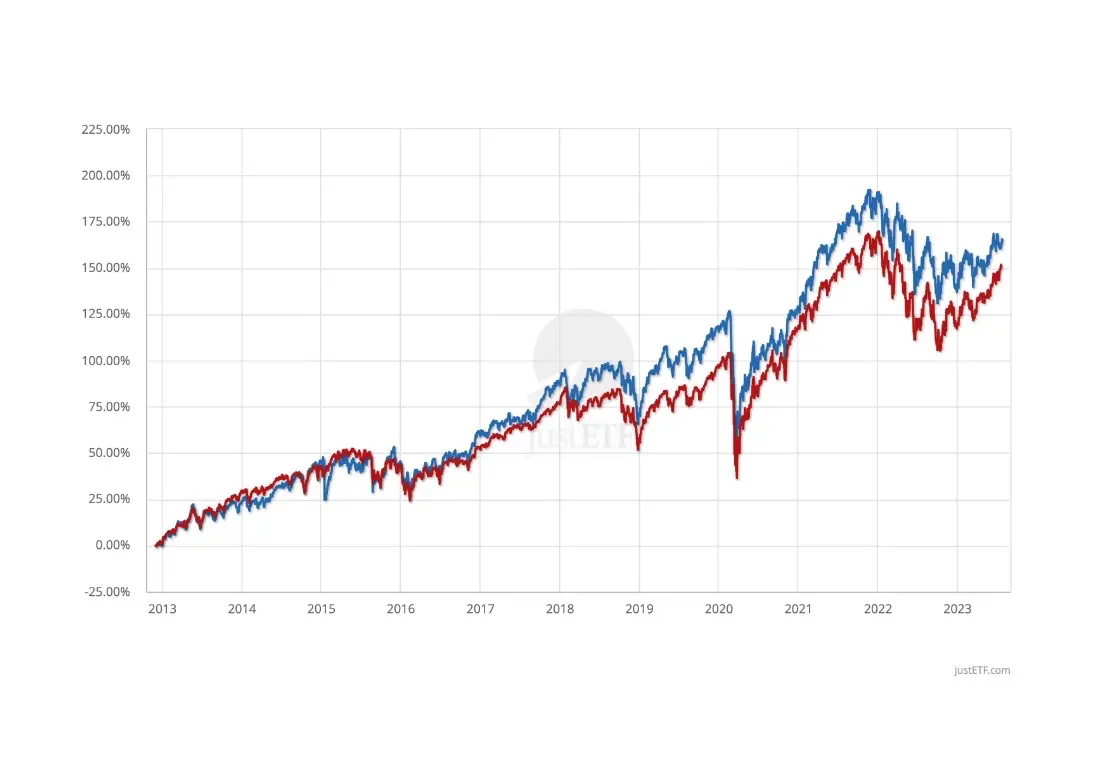

To keep things short: for a Swiss investor (CHF as a base currency) who invests over the long term in a global ETF (ETF VT for example), there is no evidence that a currency hedging strategy would improve returns or reduce risk. STILL, there is also no evidence that it would have a negative impact 1 2 3

On the contrary, one thing is certain, by not hedging your investments against currency risk, you benefit from additional currency diversification (as each company in your global ETF is active in its own currency).

So, in the specific case of a long-term investment in global ETFs, I prefer ETFs that are not hedged against currency risk (aka ETFs that don’t have the keyword “hedged” in their name)

Hmmm… MP… you got my attention! Why in this particular case? Are there any other cases?

Of course, there are! Remember, we all want to be FIRE on this blog. This means that part of our investments are placed in a long-term global ETF, for returns.

Then, when you become FIRE, you’ll have another part of your investments placed in bonds or other investment vehicles with stable returns (but lower than global equities).

Why?

Well, quite simply so that you can benefit from passive income in CHF to finance your early retirement :)

The moment when currency hedging can be useful…

When I’m FIRE, I’ll be consuming my wealth - rather than accumulating it as I am now in the pre-FIRE period.

That will be the time to adapt my hedging strategy.

Let’s imagine two scenarios.

Scenario 1:

- Global stocks and bonds

- I’m comfortable with currency exchange rate fluctuations (i.e. we’re always ready to adapt our lifestyle downwards when necessary): so we’ll stay entirely “non-hedged”

Scenario 2:

- The currency fluctuations are too stressful, I don’t sleep well because of it.

- In this case, I’m thinking of keeping my global stocks unhedged, then:

- a/ Either increase my CHF bond holdings

- b/ Or, if CHF bonds, don’t yield anything, invest in USD bonds and hedge them against the currency fluctuation risk 4

- c/ But if we find ourselves in a negative interest environment (which was the case between 2015 and 2022), then I’ll certainly opt for:

- Increasing my shareholding in CHF on the one hand

- And on the other hand, buy a hedged global equity ETF

And anyway, in terms of portfolio allocation, I’ll be following my Bogleheads strategy according to my age as detailed in this article

And as always, I’ll stick to my currency hedging strategy without changing one bit throughout my FIRE retirement, regardless of the financial news.

Because it’s precisely by becoming an “active management” investor (aka when the human brain full of behavioral biases gets involved!) that I’ll be taking far too much risk in relation to potential returns.

Summary of advantages and disadvantages of currency hedging

Advantages of currency hedging (i.e. hedged ETFs)

- Protection against fluctuations: Due to hedging, you protect yourself against changes in the value of foreign currencies relative to your own. This can prevent you from losing money if a foreign currency falls in value. It’s like a shield that protects you against market shocks over the long term.

- Stability of “fixed” returns (fixed-term): When hedging, you make the returns on your fixed investment (bonds and also stock dividends) even more stable by eliminating the impact of currency fluctuations. So it’s easier for you to predict exactly how much you’re going to earn.

Disadvantages of currency hedging (i.e. non-hedged ETFs)

- Additional costs: Hedging can be expensive. You have to pay fees for currency-forward contracts or options. These fees can eat into your profits (by around 3% in 2023). On a portfolio of CHF 500'000, the fees are around CHF 15'000 per year!

- Missing out on opportunities: If the exchange rate moves in your favor, hedging can prevent you from benefiting from the rise in foreign currency. So you risk missing out on potential earnings.

- Additional diversification reduction: With a global ETF, you diversify into thousands of companies, AND ALSO into a plethora of currencies, thanks to companies doing business themselves all over the world. With hedging, you lose this additional diversification.

Conclusion

Throughout this article, we’ve assumed that you’re a long-term investor (minimum 8-10 years). And that you primarily invest in a USD-denominated global ETF (such as my favorite VT ETF). The final assumption, is that your base currency is the Swiss Franc (i.e. the currency in which you earn, spend, and invest your money).

Also, one of your goals is to become FIRE. And once you’ve achieved that goal, you’ll be living your early retirement using CHF (and not USD).

To the question “Is it worth taking out a currency hedge”, we’ve seen that no economic paper gives a clear YES or a firm NO.

And that’s understandable when you think about it, because just as our MP Forum Julianek says: “It would be next to impossible to hedge it correctly (with companies weight in the index changing regularly, and business performance in each region of the world changing every day)…”

My strategy will therefore depend on each of the two phases of my FIRE life.

During my wealth accumulation age (i.e. before becoming FIRE):

- I will remain entirely unhedged

And during my wealth consumption phase (i.e. once I become FIRE), I’ll have two possible scenarios:

- 1/ Exchange rate fluctuations don’t keep me up at night

- We’ll remain entirely unhedged for both our stocks and bonds

- 2/ Exchange rate fluctuations stress me too much

- I’ll keep my global equities unhedged

- Depending on the global financial context at the time:

- a/ I’ll increase my CHF bond holding

- b/ If CHF bonds yield nothing, I’ll invest in USD bonds, hedging them against currency fluctuation risk 4

- c/ If we find ourselves in a negative interest environment (like between 2015 and 2022), then I’ll increase my share of CHF stocks on the one hand, and buy a hedged global ETF on the other

How about you, would you hedge or non-hedge the currency risk?

PS: all that being said, a bigger risk that is often overlooked as an investor is taxes on the profits of your US ETFs, as you have more to lose if you don’t do the right thing declaring your tax situation correctly in order to recover your anticipated taxes. I recommend reading my complete tax guide for Swiss investors.

FAQ

Is hedging counted in TER (Total Expense Ratio)?

Currency hedging is only partially included in the TER. There are certainly more management fees, which make these hedged ETFs more expensive. But the actual costs of the assets (futures or options) used to hedge currency risk is not included in the TER.

In concrete terms, interest rate variations on these futures or options are not included in the TER. This can be very confusing when you only compare the TER between a non-hedged and a hedged ETF. So be wary to not only take this TER info into consideration.

Is currency hedging against underlying assets or ETF’s base currency?

Hedged ETFs are protected against the ETF base currency fluctuations, and not against each underlying ETF assets’ currency fluctuations. So if you buy an hedged ETF in USD, the ETF provider will take a forward contract for the total value of all assets included in the ETF at once.

What are hedging costs of an ETF?

As of 2023, hedging costs of an ETF are about 2-3%. It means 2-3% additional costs compared to the same non hedged ETF. As said above, all costs of hedging an ETF are not reflected entirely in its TER. (source: ZKB article).

Is it really a good idea to diversify your investments via a global ETF?

When you’re investing for the long term (8+ years), diversification is your best ally for increasing expected returns, while reducing the volatility of your investments. Scientific papers in applied financial economics all come to this same conclusion.

In particular, the paper International Diversification Works (Eventually) explains that:

International diversification is beneficial in the long term, because the sawtooth curve observed on the markets, which is a short-term phenomenon, does not tend to collapse over the long term, and each country’s long-term economic performance is the main determinant of long-term returns.

Shouldn’t I choose a Swiss stock ETF only? That way, I won’t even need to hedge my currency risk.

The trading currency doesn’t really matter. The currency that matters the most is the one in which your ETF companies do business - and even more importantly, the currency of their revenues.

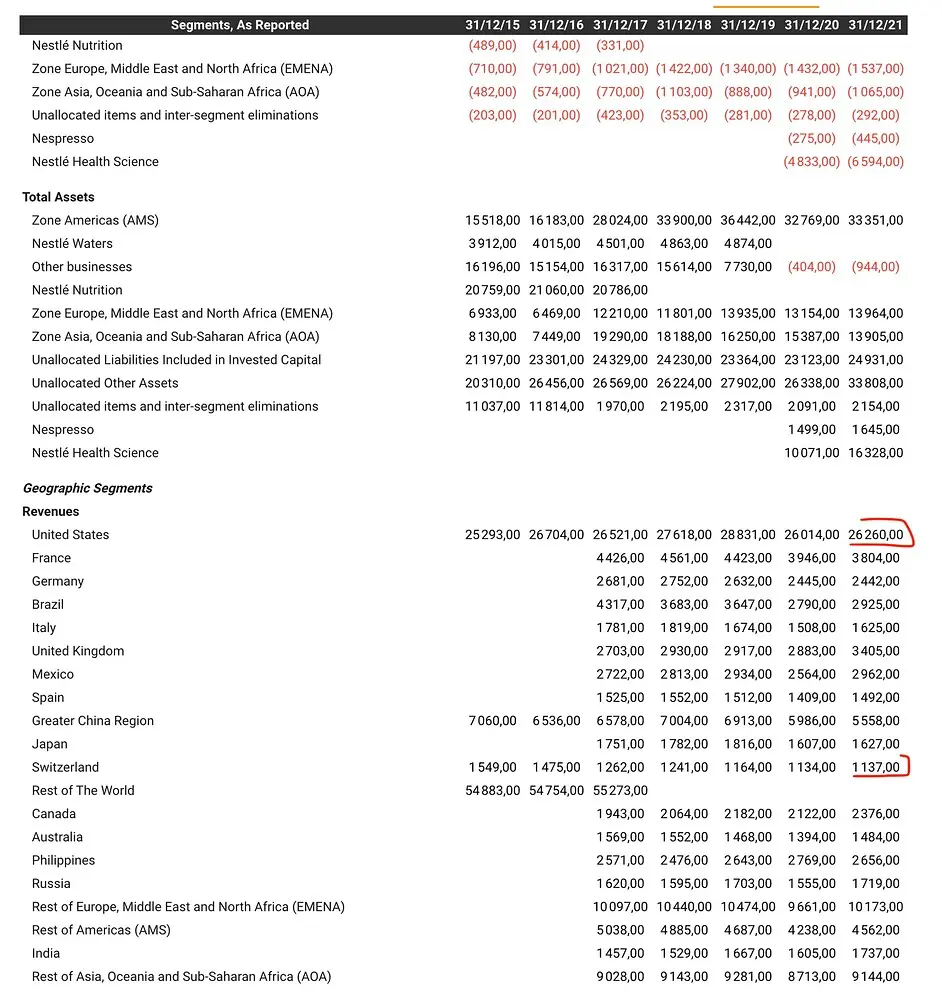

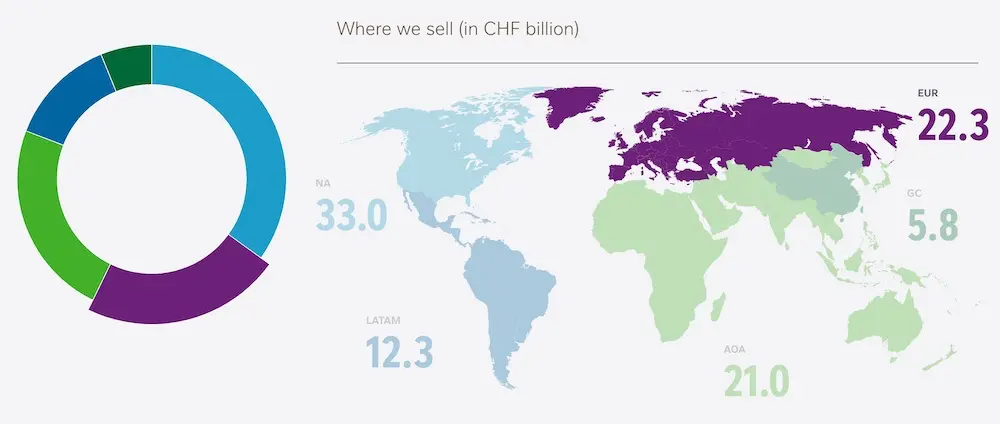

Let’s take an example (thanks again, Julianek, for the images you provided in the forum) with the company Nestlé:

As a beginner investor, you might think you’re putting all your eggs in Nestlé because you want shares in CHF to not be exposed to the risk of exchange rate fluctuations.

Except that, if you take a closer look, you’ll only see that Nestlé only does 1-2% (!) of its business in Switzerland… while a third of its business takes place… in USD in North America! Thanks for the focus on CHF :)

To drive the point home, if you look at the list of revenues by country, you’ll also notice that by buying a Nestlé share, you’ll be more exposed to the Indian rupee than to the Swiss franc ;)

And the same goes for Novartis or Roche.

Does the listing currency of an ETF matter?

The listing currency of a global equity ETF is of little importance, compared with the currencies in which the ETF companies do business. On the other hand, the listing currency for a bond (or bond ETF) is essential, as this type of asset guarantees predetermined and expected cash flows.

That’s why, in conclusion to this article, I recommend currency hedging the non-Swiss bonds first (if this risk of exchange rate fluctuation keeps you awake at night, of course).

What does “a strong US dollar” (or “a weak US dollar”) mean concretely?

A strong US dollar (USD) means that the value of the USD is rising against other currencies, including the CHF. It means you need less USD to buy one unit of another currency like CHF.

For example: let’s say you have an exchange rate of 1 USD = 0.85 CHF as a starting point. If the US dollar strengthens, the exchange rate could rise to 1 USD = 0.95 CHF, for example. This signifies that each US dollar is now worth more in terms of CHF, and it takes fewer US dollars to buy one Swiss Franc.

And on the contrary, if we say that the USD is weakening against the CHF, it means that with the same number of US dollars, you’ll get less CHF. For example, we say that the USD has weakened when one day we’re at 1 USD = 0.85 CHF, and the next day we’re at 1 USD = 0.70 CHF.

References

“However, this did not translate into superior absolute or risk-adjusted performance, and Hedged ETFs underperformed all other asset categories (with the exception of Commodities index ETF DBC). The absolute and risk-adjusted performance of Hedged Mutual Funds was similar to that of Hedged ETFs. Based on these findings investors would have been better off with index fund ETFs."

Source: Kanuri, S. (2016). Hedged ETFs - Do They Add Value? Financial Services Review, 25, 181. ↩︎“We find that the mean returns and standard deviations of global portfolios with hedged currencies during the 15-year period 1988-2002 were approximately equal to those of portfolios with unhedged currencies."

Source: Statman, Meir & Fisher, Kenneth. (2003). Hedging Currencies with Hindsight and Regret. SSRN Electronic Journal. 10.2139/ssrn.428741 ↩︎“The literature on the convenience of currency hedging of international portfolio investments has not reached a final verdict. There are arguments for (Perold and Schulman [Perold, A.F. and Schulman, E.C. (1988). The free lunch in currency hedging: implications for investment policy and performance standards, Financial Analysts Journal, May/June Vol. 44, No. 3: 45–52]) and against (Froot [Froot, K. (1993). Currency hedging over long horizons. NBER Working Paper 4355.] and Campbell et al. [Campbell, J.Y., Viceira, L.M., and White, J.S. (2003). Foreign currency for long-term investors. The Economic Journal, Volume 113, Number 486, (March), pp. C1–C25(1)])."

Source: Walker, E. (2008). Strategic currency hedging and global portfolio investments upside down. Journal of Business Research, 61, 657-668. https://doi.org/10.1016/J.JBUSRES.2007.06.041 ↩︎“We find developed markets (DM) fixed-income instruments should generally be fully FX hedged. […] When it comes to multi-asset investing, hedge ratio optimality also becomes a function of cross-asset correlations, which leads to interesting trade-offs."

Source: Iborra, R., & Chabane, I. (2020). Strategic Currency Hedging in Multi-Asset Portfolios. , 29, 31 - 57. https://doi.org/10.3905/joi.2020.1.141 ↩︎ ↩︎