This 12th anniversary of the blog has a very special flavour, because, as I wrote to you in September in my article “Financial independence in Switzerland: the final stretch (90%)”, we’re going to reach FIRE status during the year if all goes well.

Also, I’m talking to more and more readers about their journey towards their own financial independence, which helps me make my journey even more concrete, and I love that.

All this means that, even after 12 years of blogging, I’m even more motivated than ever at the idea of embarking on another year of writing and sharing.

The FIRE Mustachian Post blog in 60 seconds

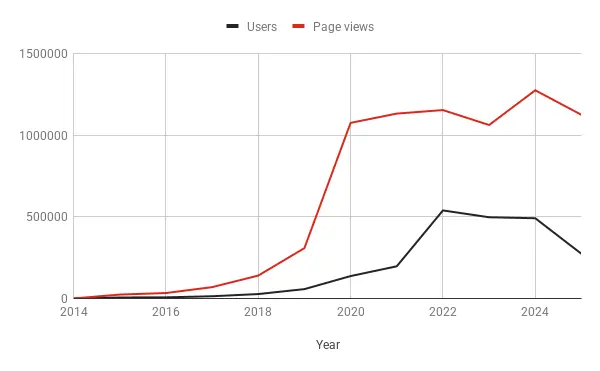

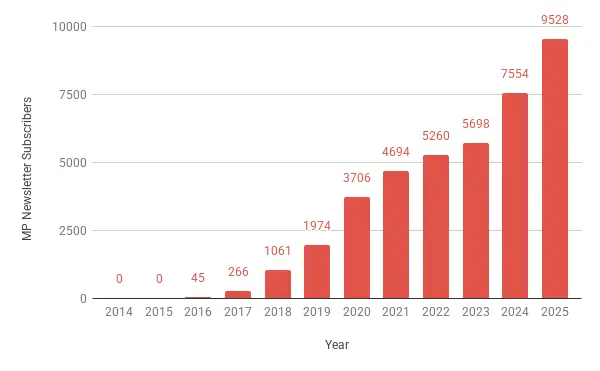

Mustachian Post is a Swiss FIRE blog launched in 2014, which today accumulates over a million page views a year and nearly 10,000 subscribers.

In figures, here’s how it looks:

- 12 years of existence (2014-2026)

- 49 articles published in 2025

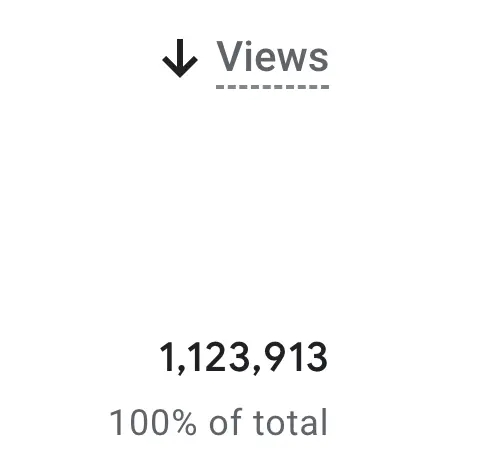

- 1'123'913 page views in 2025

- 9,564 newsletter subscribers in total

- 65% open rate for each newsletter

- 3,519 books sold in total (bestseller, that’s it!)

- Focus 2026: public launch of FI Planner

12 years of FIRE blogging in Switzerland: what really matters

Why I’ve always preferred transparency

Whether we’re talking about my net worth and monthly savings rate, or the amount of the blog’s income, I’ve always wanted to be as transparent as possible on the blog.

Why is that?

Because it makes everything more tangible, and more inspiring.

I was talking about this with one of my reader buddies who asked me:

But Marc, aren’t you afraid of making people jealous? And that some people won’t come back to your blog after reading such and such an article with crazy figures?

I retorted:

Are you jealous when you read these figures?

He replied:

Oh no, clearly not. On the contrary, it inspires and motivates me to talk to another Swiss entrepreneur who thinks the same way I do!

So my answer was:

That’s it! That’s exactly why I’m so transparent: to inspire readers. To bring them value. And the advantage of this strategy is that those who stay (like you) are the people I want to talk to and who inspire me in turn, because transparency naturally speaks to certain profiles!

What still motivates me after more than a decade?

I’ve also had other readers ask me about my motivation for continuing to write after so many years.

I could sum it up for you in a testimonial I received recently:

Tristan's FIRE testimonial, with the increase in his net worth (what makes me happy is that I get several like this every month!)

Clearly, in addition to writing out of passion and the fact that it’s my side-business (the selfish side of things, that is), what’s most pleasing is to see the concrete impact my articles have on readers. I often share those feedbacks with Mrs. MP, to help me realize that, yes, I’m the one who’s being written to!

So, in theory, we’re in for another good dozen years at least :)

What I’ve learned from this, if you want to set up a blog like this too

There are two main guiding principles that got me where I am today:

- Quality: add value to others, sincerely, and it will be returned to you a hundredfold.

- Consistency: publish regularly. If one week you don’t make it, that’s okay, you’ll pick up your pace the next week. And you never give up.

And I speak from experience when, in 2015 (a year after I started), I had very little feedback on my blogposts (whether via comments or email)… it was a bit like a long desert crossing. But I told myself that I had to keep at it, that I had to write my articles one after the other, and that inevitably at some point, word-of-mouth would kick in if I followed my two guiding principles.

The result? In 2026, I find myself with over a million views a year, and almost 10,000 people who receive an email from me every Thursday to help them achieve their own financial independence in Switzerland.

So yes, there’s certainly a bit of survivorship bias and a bit of luck in terms of timing (arriving at the right moment with the blog in the FIRE topic), but without these two guiding principles, whatever happens, I wouldn’t be here writing these lines.

Mustachian Post blog 2025 review (projects and products)

My book “Free by 40 in Switzerland”

In 2025, my book “Free by 40 in Switzerland” became a bestseller in Switzerland. Even if it’s just an ego-flattering number, it feels good.

To mark the occasion, I’ve discreetly updated the cover:

And like every year, what makes me even happier than a “National Bestseller” banner is this kind of feedback from readers:

Investment programs (in the stock market and real estate)

After releasing version 2 of my programs in 2024, I mainly added various FAQ items and provided support to several participants in “Personalized” mode:

If you are interested, the links to the latest version of the program are here:

- Beginner’s program for investing in the stock market in Switzerland

- Rental real estate investing program in Switzerland

- France rental real estate investing program (from Switzerland)

[New for 2025]: Interactive Brokers and Saxo Bank Challenge

I had almost forgotten that it was in 2025, but I also launched two free challenges for the online trading platforms Interactive Brokers (IBKR) and Saxo Bank.

Indeed, many readers are not yet investing, not because they lack conviction, but because they are afraid of making a mistake or feeling lost when faced with these trading platforms.

To alleviate this dual stress (tools + money), I have created two free gradual exposure challenges, based on Interactive Brokers and Saxo Bank demo accounts, with daily micro-tasks to familiarize yourself without risking a penny.

If you too want to finally take the plunge, you can sign up for the IBKR challenge, the Saxo challenge, or both. The first email will arrive immediately after you sign up.

Interactive Brokers Challenge:

Saxo Bank Challenge:

Private newsletter “Club MP”

I don’t talk much about this part of the project, even though it plays an important role.

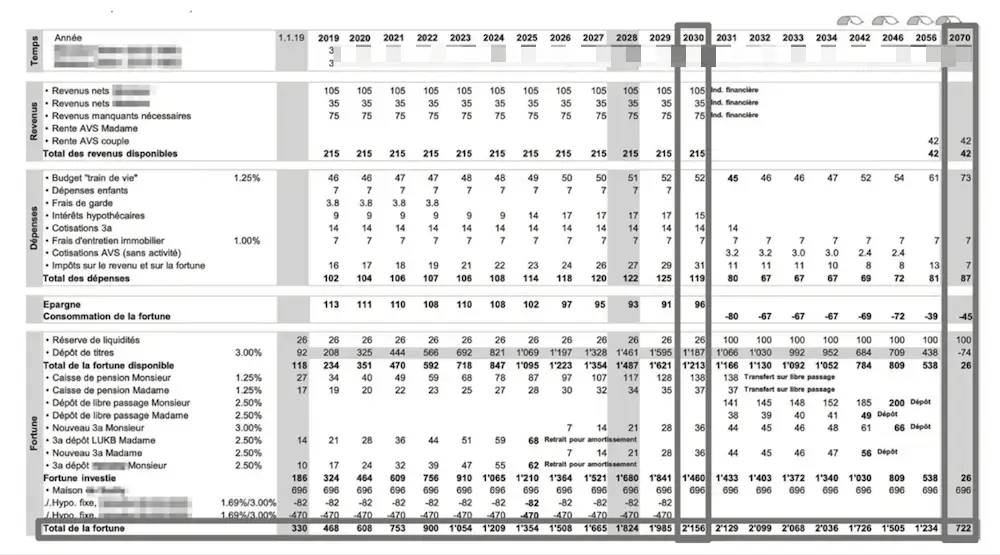

In the private newsletter “Club MP” (subscription), I share more raw and immediate information than on the blog. In particular, I documented the purchase of my second rental property in Switzerland, as well as each of my stock market moves.

I also publish the complete evolution of my net worth, with figures to back it up, without any filters or anything.

Here’s an example so you can see if you’re interested:

By the way, a big thank you to everyone who supports my projects through this “Club MP”, and for the quality of the discussions we have behind the scenes. 🙂

YouTube channel and alternative formats

In 2025, I didn’t post many videos on my YouTube channel MP.

However, I did release one from the previous year that was very important to me, featuring Fabienne and Benoît from Novo-monde. Their journey is truly inspiring, they are very down-to-earth, and I greatly enjoyed our conversation. I have fond memories of it.

There was also another interview that I wanted to publish as a video, with Jean-Pierre Danthine, an internationally renowned economist and former vice president of the Swiss National Bank (SNB). In the end, it took the form of a written transcript. The format has changed, but the content remains, in my opinion, particularly rich and interesting. Here is the link if you are interested: Interview with Jean-Pierre Danthine, former SNB Vice-President.

More generally, my need to remain anonymous makes the video format less natural for me. I will probably continue to publish videos in the future, in line with what I have done so far, but without making it a priority.

And then, very practically speaking, video takes a lot of time: preparation, recording, editing, publishing… In 2025, between other projects and time constraints, I simply couldn’t produce as much as I would have liked.

FIRE blog statistics after 12 years

Traffic and page views

Number of page views on the Mustachian Post blog: part of the decline in page views (-12%) is linked to changes in search habits (answers directly via AI tools such as Claude)

Both the number of page views and the number of visitors to the Mustachian Post blog declined in 2025, mainly due to the arrival of ChatGPT and similar technologies

Newsletter: growth and open rates

27% growth in the number of subscribers to my newsletter (while maintaining a very high open rate of 65.4%)

Frequency and volume of publication

49 articles published on my Mustachian Post blog: an impressive record, as in 2020, which also explains the other growth figures (there's no secret to it ;))

Forum Mustachian Post

The Swiss FIRE community continues to grow, with as many posts, visits, and page views as ever. I would like to take this opportunity to thank our moderators: Julianek, Dr.PI, and dbu

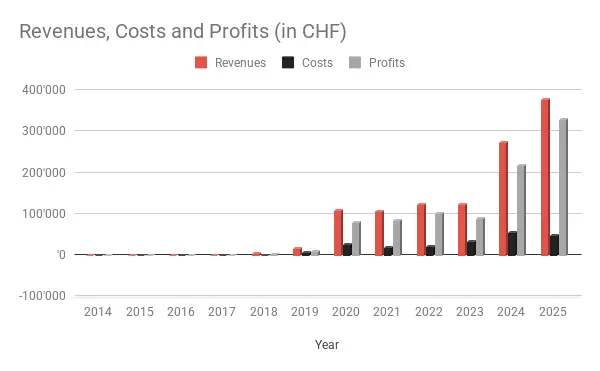

Mustachian Post blog income and expenses

I can only be grateful for the success of what I once called “my little pet project”, which gradually turned into a fine entrepreneurial adventure. After all, you don’t get something for nothing, when I see how many hours I spend on it in the mornings (“5am club”!) and at weekends.

As for expenses, they are increasing proportionately (notably due to the printing costs of my book), but I’ve managed to keep them well under control, thanks to AI automation that saves me time and money.

Ethics, independence and business model

Since 2020, I’ve taken the time to reiterate my position on a central issue: the link between profit and ethics.

My aim has never been to “make cash at any price” with the blog, at the risk of losing readers’ trust. And I know this all the more because I’m the first to unsubscribe when I feel that a piece of content is becoming biased towards money.

Especially since, as time goes by and my blog grows, the opportunities are always bigger in terms of profits. I mean, I think I could have reached 500kCHF by 2025 if I’d accepted all the affiliate offers. But that would be very short-sighted, because I think that by 2026 (OK, let’s say 2027) I wouldn’t have had any loyal readers, and the site would have become an “ad bar” like so many others… no thanks!

Why I refuse sponsored articles

Because every week I receive requests for sponsored articles. I’ve always refused.

On the one hand, because such content is rarely relevant to Switzerland (casino gambling in the US, articles sponsored by dubious European services), and on the other, because they inevitably skew the message. The day an article is paid for, the line between information and marketing becomes blurred, and that’s precisely what I want to avoid.

Affiliations, transparency and trust

When I use affiliate links, I always mention them explicitly. If I forget, I’m counting on you, dear reader, to let me know.

I’ve also always refused exclusivity clauses proposed by certain banks or platforms. My comparisons (such as the best Swiss bank) are only of value if they remain honest, even if this means earning less commission.

And I’m not even talking about the idea of reselling the e-mail addresses of newsletter subscribers: NEVER!

Recommend only what I use

Finally, I’ve always followed a guideline that makes all my decisions easier: I only recommend financial tools and services that I use myself, on a regular basis.

Above all, I never try to impose my choices. When a reader tells me that he prefers to stay with Raiffeisen because it makes sense for his family with the free museums, I respect that decision. After all, it’s these exchanges that fuel my own thinking.

Outlook for 2026

Increasingly useful articles for Swiss readers

My first focus for 2026 will be to provide you with increasingly high-quality articles. Both in terms of the subjects I cover, and the way I write.

Then, my second focus will be to guarantee an article every Thursday, with perhaps a 2 to 5 week break between summer and the Christmas vacations.

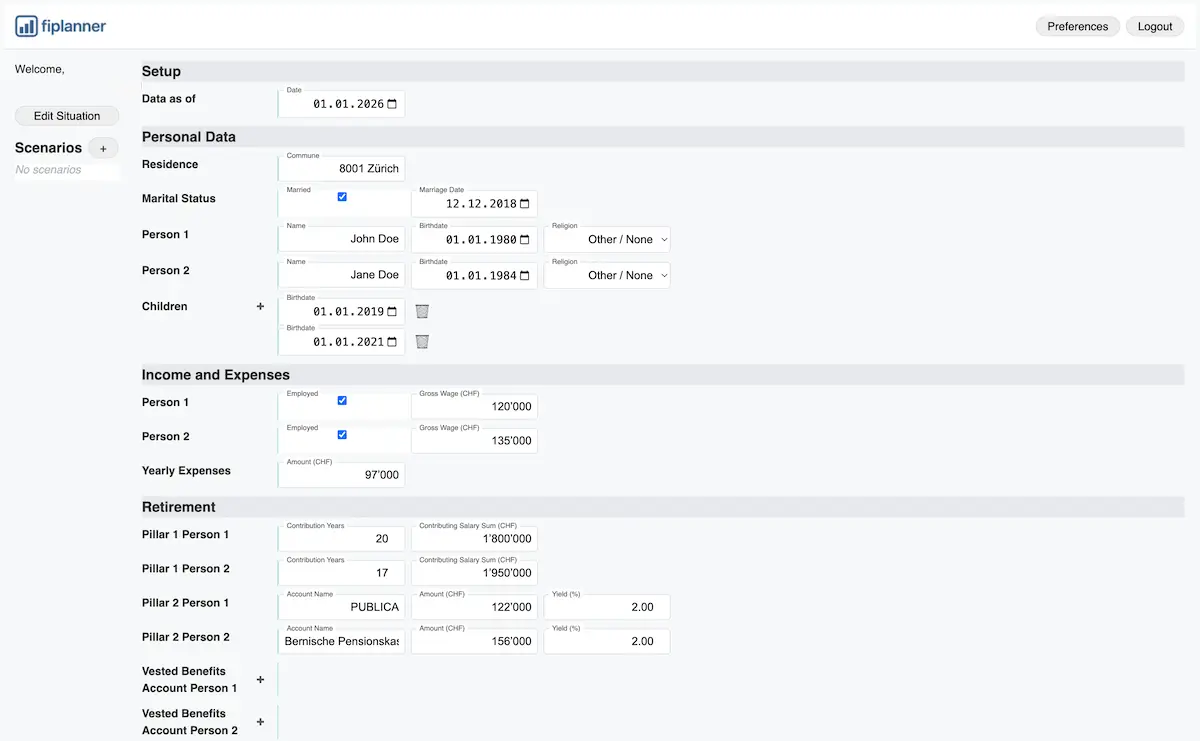

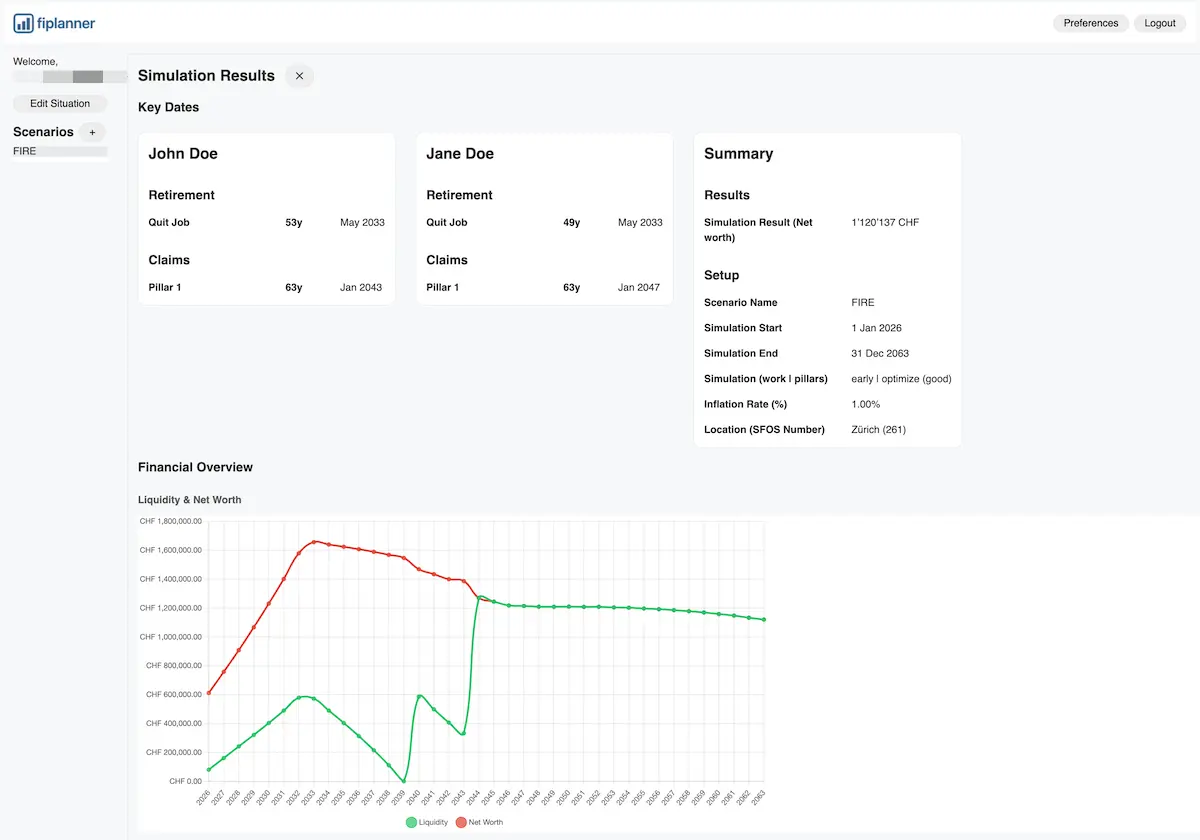

Public launch of FI Planner

Another big moment of 2026 is going to be the public launch of our fiplanner.ch service, our Swiss financial independence tool to calculate your FIRE date.

Patrik and I are very excited that as many people as possible can benefit from it. I’ll tell you more about it in the next chapter.

FI Planner: the project I’m focusing on for 2026

Why a Swiss FI Planner was needed

Initially, the idea was born out of a very personal frustration with the common use of the 4% rule to find out how much one can be financially independent. This rule is still relevant to get an initial idea, as the order of magnitude it provides is generally correct, and I myself continue to use it as a benchmark, even today with FI Planner.

In Switzerland, on the other hand, it is often applied as a final decision-making tool, without taking into account the essential structural elements of the Swiss system, such as AHV, the second pillar, capital withdrawals or taxation, which evolves according to life stage.

In fact, that’s why I went to VZ for 10 hours of consulting on a simulation specific to my situation, about a decade ago.

Except that in practice, the closer I get to financial independence, the greater the need for precision. With my updated data ;)

Because at this stage, a simple approximation becomes psychologically insufficient, even if it’s correct on average. Of course, no tool can eliminate the mathematical uncertainty of future returns; FI Planner is no exception.

So I tried to build my own calculator on Excel, but it was tedious… and I ran out of time, so I never finished it…

So that’s what I (and many other readers of this blog) were missing: a tool designed from the outset for the Swiss context, enabling us to rely on a tried and tested calculation model, rather than a rough transposition of models designed for different pension and tax systems. This dimension is largely psychological, but it is central to the FIRE movement, as taking early retirement means wanting to be sure of not running out of money due to hasty or approximate calculations.

Where FI Planner stands today

We started discussions with Patrik, my co-founder, in the early summer of 2024, and then it all came together:

- Q2 2024: oh, we have the same idea! Would we get along well on such a joint venture? Come on, let’s give it a try!

- Q3 2024: Prototyping

- Q4 2024: Testing the proto myself (🤯, so good, and addictive!)

- Q1 2025: Onboarding of the first 3 customers (Early Adopters)

- Q2 2025: Onboarding of 15 other customers (Early Adopters)

- Q3 2025: Creation of web application (thanks again to Patrik!)

- Q4 2025: Early Adopters switch to web application

- Q1 2026: Finalization of the payment module so that everything is automated from A-Z

12-month target

Our goal with FI Planner by the end of 2026 is to have 100 repeat customers, happy and motivated to have finally found their financial independence planning guide in Switzerland.

And this in a 100% automated way (which is not the case at present, as we still have to manage payments manually in particular).

Talk to you in a year ;)

Would you like to be kept up to date with FI Planner news?

We’ve created a dedicated waitlist and newsletter for those who want to stay in touch with FI Planner’s development (including when we open the doors to waitlist subscribers, on a first-come, first-served basis).

You can sign up directly via our FI Planner website.

Thank you

And I still have to thank you, because everything I’ve just explained wouldn’t make sense without you, dear blog reader.

Whether you’ve been following me since early 2014 or more recently, a big THANK YOU from the bottom of my heart.

Last updated: January 20, 2026