- 🙂 Banina, Aargau

- 😀 Judit, Vaud

- 😡 Migoo, Vernayaz, Valais

- 🙁 SP, Grisons

- 🙂 Ivan, Freienbach, Schwyz

- 😕 Brixton, Promasens, Fribourg

- 🙂/😕 Jürgen, canton of St. Gall

- 🙂 Alexis, La Neuveville, Bern

- 😶 Frank, Sion, Valais

- 🙂 Marti, Assens, Vaud

- 😀 Stefan, Nyon, Vaud

- MP conclusion about MoneyPark for your mortgage in Switzerland

Hey MP, what do you think about MoneyPark for a new mortgage or a renewal?

So, listen, at the time when they were still called DL, I went to see them about our real estate purchase in Switzerland. But as I had already been to several banks myself before, the advisor told me that it was better to continue my research alone. Because the risk was that my files would be presented twice to the same institution, but not necessarily to the same person, and that could create duplication and other confusion.

So I never used them myself. But the appointment I had at the time had pleased me in terms of the consultant’s skills.

And since I’ll have to renew my Swiss mortgage in a few years, I’m already starting to prepare the ground. And rather than keeping all this valuable information to myself, I thought I’d ask the readers of the blog if they had any feedback, and turn it into a consolidated article. I’ll share my opinion on Moneypark at the end of the article.

UPDATE 28.11.2024: I’ve written a comprehensive article to help you find the best mortgage in Switzerland.

🙂 Banina, Aargau

Real estate

My purchase concerns a 200 m2 house in Aargau for CHF 750'000 without notary fees.

Mortgage via MoneyPark

This was a new mortgage, taken in November 2016.

The costs of MoneyPark were CHF 0, without using special offers like neon or others.

I took a 10 year fixed term Swiss mortgage (MoneyPark did not recommend LIBOR/SARON). The final mortgage rate obtained was 1.05%, while the average Swiss mortgage rate was about 1.9% at the time.

My mortgage is in 2 installments over 10 years each.

Finally, MoneyPark proposed me only one offer (the most advantageous).

Financing

I took out my 2nd and 3rd pillars for the purchase.

And I chose an indirect amortization via a pillar 3a linked to a life insurance (this was the condition of Allianz Suisse).

My mortgage lender was Allianz Suisse.

Since we signed our contract for the mortgage in 2016, I can’t really say if the costs MoneyPark charges were the same as today.

I know that the broker for our house had an agreement with MoneyPark, and for that they did not charge us a fee.

But we also asked MoneyPark if we should pay them for their services. And they said “No” because they get a commission from Allianz Suisse for bringing in new customers. So we figured that was the way their business model worked.

It might be worth asking MoneyPark how it works today. I’m pretty sure they still get a commission for referring new customers.

😀 Judit, Vaud

Real estate

I bought two apartments in two times, respectively of 135 m2 and 115 m2, in the canton of Vaud.

Mortgage via MoneyPark

Each time it was new mortgages. My purchases were made in June 2015 and January 2021.

I got a preferential price of only CHF 500 at MoneyPark thanks to my company (Nestlé).

Concerning the setup, a bit complex, it was done via 8 (!) different tranches for each purchase, but essentially in fixed rate over 10 years (MoneyPark did not advise me LIBOR/SARON).

The final mortgage rates obtained were 1.87% and 0.97% (market rates were quite similar).

And MoneyPark offered us only one mortgage offer each time, the most advantageous one.

Financing

I withdrew my 2nd pillar for the purchases.

For the amortization, I chose the indirect amortization via a pillar 3a linked to a life insurance. For both apartments. Despite your advice, I preferred to choose life insurance for my husband as well, because if something happens to one or the other, one person will not be able to pay the mortgages for both properties. After long reflections and debates with our financial advisor, I chose the PAX pillar 3a solution from Crédit Agricole next bank.

In the end, I recommend MoneyPark one hundred percent, because they are a very trustworthy and professional team. The cost of their services will save you a lot of work, and you will probably get better conditions than if you went to the banks yourself.

😡 Migoo, Vernayaz, Valais

Real estate

I bought a house of 170 m2 in Vernayaz in Valais. The purchase price without notary fees was CHF 820'000 + CHF 25'000 for the installation of solar panels.

Mortgage via MoneyPark

So it was for a new mortgage. My purchase took place in September 2021. I paid the services of MoneyPark CHF 490 through the partner offer of the Swiss neobank neon.

But finally, I did not take out my mortgage through MoneyPark… I’ll share all the details below.

The mortgage I got through a private contact was at 1.05%, compared to 1.11% with the only better offer MoneyPark could provide me — all from the same bank!

Financing

I withdrew all my Swiss 3rd pillar, and I had to insist on withdrawing part of my 2nd pillar, and pledging the rest in order to reduce the monthly cost for a small impact on my retirement.

Full details of my MoneyPark experience

So I am a brand new Swiss home owner. I contacted Moneypark to get my mortgage and my experience was pretty bad overall.

There were 4 phases with them:

Phase 1

February 2021: contact to estimate the amount of the property I could afford. Good contact and I learned a lot from my advisor.

Phase 2

September 2021: we found the property of our dreams. I contact again MoneyPark so that it confirms to the real estate agent that the property was well in the budget. There too, they were very efficient and in less than 24 hours the property was definitely reserved with the real estate agent. It was afterwards that things started to go wrong.

Phase 3

Still in September 2021: for the search of mortgage, I specify him well that I would not like to make a mixed life insurance for the pillar 3a of indirect amortization (I reread page 302 of your book several times!) I also came in with a very specific amortization plan (a mix of Pillar 3a and direct amortization). The advisor was not very responsive from that point on. She strongly insisted on the benefits of mixed life insurance… Then she found me a mortgage. It was a relief, because our financial capacity was only 35% and few institutions accept such a high rate. The conditions of her Swiss mortgage proposal were:

- Fixed rate of 1.11% for 10 years

- Bank fees: CHF 500

- Obligation to move my accounts with the institution

- All this while insisting on the offers of 3a mixed for the amortization plan (with a rate of 1.5%…)

Since this is a big topic, I also contacted my girlfriend’s cousin who works in real estate. She also found me a mortgage, better than the one from Monepark, with the following conditions:

- Fixed rate of 1.05% over 10 years

- Application fee of CHF 250

- No obligation to move the accounts

- I make my amortization plan as I wish, and the bank has 3a pillars that allow me to invest 35% of the funds

I would like to point out that these 2 offers are from the same bank (!), namely, the Cantonal Bank of Valais.

And you see the 1.11% rate? Well the 0.01%, in my opinion, is the bonus for MoneyPark…

Phase 4

So, clearly, I choose the cousin’s offer. When I told MoneyPark that I didn’t choose their offer, the advisor told me that I would have to pay penalties (WTF!). I sent her back the terms of the contract, and she finally decided not to enter into a conflict with me. To this day I still haven’t received the basic fee invoice either (50% off by going through neon).

So much for my experience. I will also publish a more detailed article on my blog jefaisconstuire.ch (in French), but clearly my experience will have more impact on your blog :) (thanks again for the latter by the way!)

🙁 SP, Grisons

I do have experience with Moneypark. And I have never concluded with them for the following reasons:

- The fee they asked for was CHF 250 (they offered a 50% discount, normally it would have cost CHF 500)

- The decisive reason was however that, according to the contract, you are obliged to take MoneyPark’s offer if it is the best one, otherwise you have to pay them a contractual compensation of CHF 2500, which is huge!

🙂 Ivan, Freienbach, Schwyz

Real estate

I bought a 120 m2 apartment in Freienbach in the canton of Schwyz. The selling price without notary fees was CHF 1'190'000.

Mortgage via MoneyPark

The mortgage taken was a new one (i.e. not a renewal). It was in April 2020. And I paid about CHF 2'000 in fees to MoneyPark (I did not use any promotional offer).

I chose a 10-year fixed rate mortgage with a mortgage rate of 0.79% (MoneyPark did not recommend LIBOR/SARON). At the time, the market average was about 1.10%.

MoneyPark offered me two deals, and I chose the one I thought was the best.

Financing

I opted for a 50-50 split between direct and indirect amortization. As for the indirect amortization, I started with a pillar 3a linked to a life insurance with SwissLife.

The financial institution with which we took our mortgage is the pension fund ALSA PK.

In the end, I was satisfied with MoneyPark. They were competent and available.

😕 Brixton, Promasens, Fribourg

Real estate

I am in the middle of renewing my mortgage. For me it’s a bit different, because now I left Switzerland to settle abroad. And I have a lot of problems to find a bank that is willing to renew my mortgage. I contacted MoneyPark and HypoPlus from Comparis. HypoPlus had better offers if I stayed in Switzerland.

The Swiss property we are talking about is a 78 m2 apartment in Promasens in the canton of Fribourg. I paid it CHF 350'000 excluding notary fees.

Mortgage via MoneyPark

It was for a renewal in October 2021 that I contacted MoneyPark.

I didn’t pay them because we couldn’t find a solution.

My application was for a 10 year fixed rate mortgage. MoneyPark’s mortgage rate quote was ~1%, and Comparis’ HypoPlus quoted me 0.80%.

Financing

In the end, I intend to go towards the proposal of HypoPlus of Comparis which recommends me the Banque du Léman (with which I am currently in discussion).

🙂/😕 Jürgen, canton of St. Gall

Real estate

I bought a 120 m2 house in the canton of St. Gallen with a mortgage of over CHF 400'000.

Mortgage via MoneyPark

It was a Swiss mortgage renewal in my case. It was in January 2018. I paid about CHF 200 to CHF 400 in one-time fees to MoneyPark.

I wanted a 10 year fixed rate mortgage. MoneyPark did not recommend a LIBOR/SARON mortgage.

Finally, the mortgage rate I got was 1.5%. It was a very competitive offer for the time. It was for a 10 year single tranche mortgage (MoneyPark did not recommend LIBOR/SARON).

I asked MoneyPark for several variations (annual refund, easy cancellation, etc.). In the end, I chose the model recommended by MoneyPark (more details below).

Financing

I did not withdraw my 2nd pillar or my 3a pillar.

For the amortization, MoneyPark convinced me to sign 3 contracts: 1 for the mortgage, 1 for a life insurance contract, and 1 for a household and private life insurance. This combination of 3 contracts allowed me to obtain this attractive rate.

We signed with Allianz Suisse.

In conclusion, my experience with MoneyPark was mixed:

- Pros: very competitive mortgage rates… The variant I had requested was provided, but not so interesting in terms of mortgage rate

- Cons: the combination of several contracts was revealed at the end of the signing process. It was “forbidden” by contract to discuss individually with “my” banks with the MoneyPark offer in hand (understandable…)

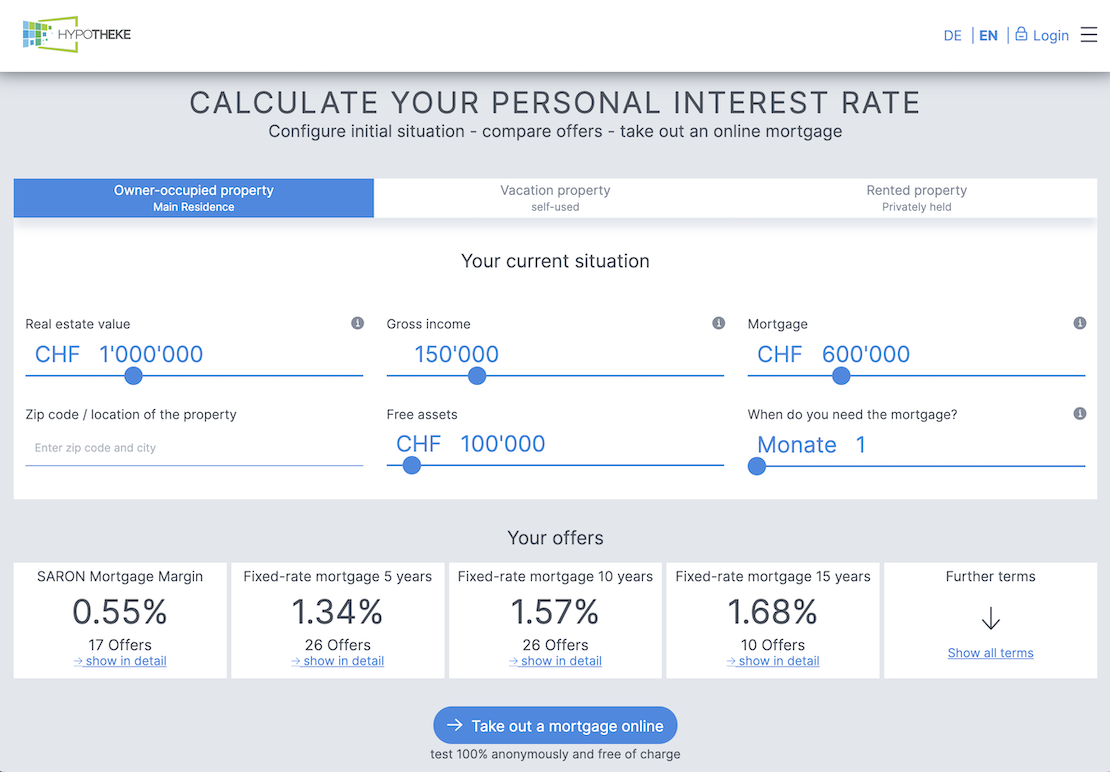

Based on this experience, if I had to go through this process again today, I would rather go to a “pure” credit comparison service (HypoPlus, hypotheke.ch, …) and focus more on the options I really want to have. Because at the end of the day, you’re trading convenience with long-term contracts, vs. more work for constant renewals with short-term contracts.

🙂 Alexis, La Neuveville, Bern

Real estate

I bought an apartment (based on plans) in a PPE for a delivery planned during this summer 2022. It is 120 m2, located in La Neuveville (canton of Bern), and cost me CHF 850'000 excluding notary fees.

Mortgage via MoneyPark

So, it was for a new mortgage that I used MoneyPark last September 2021. I paid a fixed fee of CHF 980 (I did not use any promotional offer).

My goal was to find a 10 year fixed rate mortgage. MoneyPark did not recommend LIBOR/SARON.

I got a mortgage rate of 1.06% through MoneyPark. The average market mortgage rate was 1% at the time.

MoneyPark proposed me 3 offers.

Financing

I only pledged my 2nd pillar for CHF 40'000 for this acquisition. And I took an indirect amortization via a pillar 3b contract with Allianz, linked to a life insurance. And I took out my mortgage with Raiffeisen.

I had no choice in putting together the file for the 3b pillar, so that it would be viable from a death risk point of view!

The Allianz product is Balance Invest, and the periodic premium is split in 2:

- 60% on the manager’s fund, which I know will have no return

- 40% on the Pictet Swiss Equities fund, which is an ETF on Swiss stocks that will allow me to “catch up” with the underperformance of the Allianz fund thanks to a quality fund that has a very interesting average return. The magic of compound interest will do the rest!

I am aware that this life insurance is the negative point of the financial package by the fact that I am bound, but the long term calculation and the tax advantages by the pledge of my LPP (which allows me to keep everything I have acquired to date for retirement and tax savings), and no need to touch my pillars 3a have a strong impact; this package will also allow me to acquire a second property or a larger main residence at maturity in 5 or 10 years, while retaining this property.

In the end, I found a very good service and support from DL MoneyPark Neuchâtel. It was a time saver, because they go where the file will pass, and negotiate for you at the bank.

😶 Frank, Sion, Valais

Real estate

I bought an old house of 200 m2 in Sion in the canton of Valais. I paid CHF 1'950'000 excluding notary fees.

Mortgage via MoneyPark

The purchase took place in April 2020. I needed a new mortgage at that time.

I consulted MoneyPark, but I did not go with them in the end, because my bank (Credit Suisse) offered me a better deal. MoneyPark, if I remember correctly, put me in touch with BKB (Berner Kantonalbank) which had a good proposal (the only one presented by MoneyPark by the way), but not as good as CS. It’s obvious that it’s much easier to deal with people who know you — i.e. Credit Suisse in my case — and that’s probably the reason why the proposal was better from the beginning of the discussion. And so I didn’t pay any fees to MoneyPark.

Concerning the CS mortgage itself, I took a 10-year fixed tranche, and another 5-year fixed tranche. Credit Suisse offered me a contract at 0.69% for the 10-year fixed rate mortgage, and 0.67 for the 5-year fixed rate mortgage. In comparison, the market mortgage rates were between 0.80% and 1.00%.

Financing

I have not withdrawn my 2nd pillar or my 3a pillar. And I am paying off my mortgage directly by making an annual payment.

If I had one piece of advice to give to anyone who is starting to buy a property in Switzerland, it would be to look around the market, not to be older than 50 or 55, and never to be retired ;) Your ability to repay is judged by your income (and its regularity).

🙂 Marti, Assens, Vaud

Real estate

Ten years ago, I bought a 115 m2 condominium in Assens (Vaud). The purchase price doesn’t mean much anymore, because the market has gone up a lot in 10 years. But for those who are curious, I paid CHF 710'000 for this apartment in 2012.

Mortgage via MoneyPark

I am in the process of renewing my mortgage, and I am thinking of choosing MoneyPark but nothing is signed yet.

Their fees are normally CHF 490, but thanks for the info, I just signed up at neon, and I’m going to ask for the 50% discount at MoneyPark! Thanks for the tip, I owe you a pizza on this one :)

I’m thinking of going with a 10 year fixed rate mortgage. I already had a 1st free interview with them, and they are not pushing SARON. I was the one who asked, but they don’t advise it in my case. On the other hand, they give me an update on the pension plan (which is very good) and suggest tax optimization with a linked life insurance, or BVG buyouts (in my case, it will be without).

For now, the mortgage rate proposed by MoneyPark is 0.94% over 10 years, with pledge of my existing 3a pillars, and maximum amortization indirectly via a bank 3a pillar. In comparison, for a fixed mortgage over 10 years, UBS offers me 1.30% and Raiffeisen 1.24% (you know those who drive a Porsche ^^). VZ offers me 1.10% and about 0.70% in SARON.

I am still in discussion with them now, but the decision will be made very soon as I have to renew my mortgage in 2022.

Financing

As mentioned above, I am not withdrawing my 2nd or 3rd pillar for this renewal. On the other hand, I have to pledge my 3a pillars. But well, it’s better than in 2012 when I was entitled to the whole thing… pillar 3a linked to a life insurance. I know, it’s not good, but you didn’t have your blog back then… But the goal is to blow up the linked life insurance once the mortgage renewal is done. I had signed (and am still under their contract) with UBS in 2012…

😀 Stefan, Nyon, Vaud

Real estate

I bought a newly built apartment in a PPE in Nyon in the canton of Vaud. The apartment is a 3.5 which is about 100 m2, with 16 m2 of balcony. I paid CHF 945'000.

Mortgage via MoneyPark

This was our very first purchase, therefore our very first mortgage. We used MoneyPark from May 2020 (contract signed with Moneypark) to May 2021 (invoice received from Moneypark). We moved into our new apartment in May 2021, which was also the month our mortgage started. We paid MoneyPark CHF 980 including VAT. This amount includes about 30 to 40 emails and/or phone conversations with my advisor, and 3 or 4 meetings of about 1 hour each.

We ended up choosing a 10 year fixed rate mortgage at 0.92%, in one tranche. Since mortgage rates are low, the consultant recommended a fixed term loan rather than LIBOR/SARON, which I agreed to without reservation.

At the time we set the rate at 0.92%, the average market mortgage rate (10-year fixed term) was between 1 and 1.1% (as indicated on the “Bon à Savoir” website).

The cool thing is that we got several offers from MoneyPark:

- The first operation consisted in guaranteeing the reservation of our future apartment at a rate of 1.45% (with the BCV). Our advisor assured us that he could find a better rate if we gave him more time

- The second contract was at 1.22% (with BCF if I remember correctly)

- Then my wife signed an open-ended contract, and BCV offered us a third contract at 1.10%

- Then we had an agreement with the Basel SoBa bank in January 2021 at 0.92%, but we had to start paying the interest and amortization in May 2021 at the latest. At the time we didn’t know if we would be able to move into our new apartment in May (because of COVID, the property developer told us that they were at least 3 months behind, and that we could move in between May and September 2021). We signed with Baloise and took an option to secure the loan at 0.92% + 0.06% (to secure the rate until May 2022) = 0.98% in case we couldn’t move in May and would have to move in September at the earliest (this was a better deal than starting to pay the loan and amortization too early + our actual rent)

- 3 weeks after signing a loan at 0.98%, the real estate developer told us we could move in May (and sh**… we had just gotten a loan at a cost of 0.06% for CHF 780'000 mortgage = CHF 4'680 on a 10 year loan). A quick call to the Moneypark advisor and 2 hours later, he confirmed that Baloise Bank removed the 0.06% to secure the rate, which brought the mortgage rate down to 0.92% :)

Financing

At the time, we did not have a 3rd pillar, and we did not withdraw our 2nd pillar. There is however a pledge of CHF 35'000 on my 2nd pillar in case we could not pay our amortizations. The bank also asked for a life insurance of minimum CHF 120'000 for me, so that my wife could keep the apartment with her salary.

We therefore chose an indirect amortization strategy via the 3rd pillar of La Baloise for an amount of CHF 10'500 / year. The maximum remaining amount of about CHF 3'266 (6'883 x 2) was invested in a 3rd pillar VIAC. I refused to sign a pillar 3a linked to a life insurance, because I was not comfortable with the products. I took a private life insurance with La Vaudoise which costs about CHF 350 / year to cover CHF 200'000 in case of death.

If you are interested, here are the details of our amortization:

- Half of the amortization is stored as cash without investment (i.e. pure savings). We can change the strategy whenever we want, but since this was a first, we felt more comfortable as it is

- The other half is in a Bâloise investment fund “LPP-Mix 25 plus R”, i.e. with 25% in shares, and the rest in real estate, bonds and alternative investments. There are options with more shares, but within the framework of an indirect amortization with the bank, it was not possible to do more than the 25% in shares in our case

The bank issuing our mortgage is the SoBa Bâloise Bank.

If I were to give a friend advice about MoneyPark today, I would say that when we decided to buy our apartment, we knew that our financial resources were good but far from excellent. We had the 20% (+ 5% for other expenses) required for the purchase of our new home, and a combined salary of CHF 190'000 gross (which was more than enough). However, at the time, my wife was on a fixed-term contract, and the banks refused to take her salary into account. My own bank (BCV) accepted a loan of CHF 650'000… so we had a gap of at least CHF 100'000.

Since we needed to secure the apartment we wanted on short notice (we didn’t have much time for this, and we didn’t have a loan confirmation at the time), a colleague of mine recommended his own counselor at Moneypark whom I called. After reviewing our resources, the advisor told me that he was able to find the required loan based on my salary alone, but at a bad rate (he quoted me a rate between 1.4 and 1.5% at the time). However, he was confident that he could find a better loan if we gave him more time (we had 1 year to find better conditions). In less than a week, in order to secure our reservation with the real estate developer, our Moneypark advisor was able to find a first confirmation loan with BCV (funny enough it was with BCV…). He then found more interesting conditions with other banks and we were able to buy our apartment at a good rate (we finally took a loan of CHF 780'000 at 0.92%).

Without the help of this advisor, we would not have bought the apartment we now live in (and I must say that we do not regret our choice at all). For people with limited financial resources or little time, going through a broker is a great help to explore. As far as I am concerned, I totally recommend the services of DL Moneypark in Nyon.

MP conclusion about MoneyPark for your mortgage in Switzerland

Pillar 3a linked to a life insurance? No, thanks!

If we do the math, we have 11 feedbacks. Of the 11, 2 did not take out a mortgage with MoneyPark. And so, out of the remaining 9 who received a proposal, 6 of them were offered a mixed pillar 3a linked to a life insurance.

Let’s be clear, paying for convenience is TOTALLY OK with me. Even though I’m often on the DIY side of things as a Mustachian, I can understand and sometimes do pay for convenience when I want to put my time and effort elsewhere. But, and this is a big BUT, paying for a service (in this case, MoneyPark’s research fees) AND receiving (or even being forced to receive) such crappy products as 3a pillars linked to life insurance: NO THANKS!

Again, this is only my personal opinion, and surely each MoneyPark advisor is different (the proof is with the last advisor in Nyon), but in most of the examples, we end up with pillar 3a linked to a life insurance…

Based on this alone, I would not recommend MoneyPark to a Mustachian.

MoneyPark’s independence

Even if I trust people by default, the fact that Helvetia owns 70% of MoneyPark’s capital bothers me regarding their independence… Because at the end of the day, the interests of both companies are directed by one and the same group behind.

This is a second warning that makes me not recommend MoneyPark.

Cool analysis MP, but what do you recommend about MoneyPark?

The day I have to renew our mortgage in Switzerland, I will do it this way:

- Define a clear and precise plan (like Migoo above)

- Use online tools as independent as possible such as hypotheke.ch or HypoPlus to get an idea of the market, and potentially contact some institutions following the results

- Go to financial institutions I know through my personal network — while choosing at least 3 entities: a big bank like UBS or Credit Suisse, a local bank like BCV or Raiffeisen, and an “outsider” bank like Crédit Agricole Next Bank, Migros Bank, Banque Cler, or this kind of institution. The goal is to make the competition work here

- Compare everything, and sign on MY terms (N.B. because I would finally have the opportunity to do so, whereas when we signed the first time we were rather short on initial capital, a bit like the situation of Stefan from Nyon

And yeah, of course, I would definitely NOT sign up for a pillar 3a life insurance policy, no matter what!

I would only recommend MoneyPark if…

…you are in the same situation as Stefan from Nyon above: you don’t want to miss out on your dream property, and your file is borderline. The only thing you have to take care of is to force your MoneyPark advisor to accept YOUR financing plan with, for sure, NO mixed pillar 3a linked to a life insurance, and at most a life insurance alone (which is much cheaper in the long run than those mixed pillars 3a linked to a life insurance!!!)

Another important point

One of the readers contacted me following my request for feedback. She told me that she had to pay an exit fee when she wanted to change her Swiss mortgage provider. And she had no choice, because it was written into her original contract. In her case, we’re talking about CHF 500, so that’s something I’ll pay attention to. Because when you sign for 10 years, you don’t necessarily look at this kind of small amount (wrong!), but I’m sure it’s easily negotiable.

You work at MoneyPark?

Although I am very critical about MoneyPark, I am still an open-minded person. So if there are one or more advisors who are readers of the blog, and who have a mindset in line with us Swiss Mustachians, then I’m interested to know more if you can adapt your strategy easily without having any problems with your management (by favoring LIBOR/SARON which is historically the most advantageous, or by proposing fixed mortgages with a minimum of life insurance, and especially not linked to a pillar 3a :)).

If this is your case, you can contact me by replying to any email received via my newsletter.

What about you?

What is your experience with MoneyPark and/or any solution to find your first mortgage or renew your mortgage in Switzerland?

You can share it with us via the comments section below (or by return email).