When Mrs. MP and I received our first paychecks, we had to choose a Swiss bank. Except that most Swiss banks are too expensive and believe you are there to serve them, rather than vice versa.

Who says serious banks must have nice offices, free coffee, and shiny Amex cards?

At the time, we got caught up in the slick marketing of one of the two (former!) “big” Swiss banks. You know, the ones with their classy dark blue branding, chic branches, and the nice little coffee during the account opening meeting. They knew how to make you feel important, especially when you came in to open not one checking account, but two accounts with all the bells and whistles, including American Express. The high life.

Except that this little comfort (and ego boost) was costing us CHF 15 per month each, or CHF 180 per year… If you factor in compound interest, we’re talking about potential savings of CHF 2'314 over 10 years!

But once you dive into the FIRE universe, you start to question a lot of things. So I reviewed all the banks using comparison tools and the websites of various banks.

Everything I’m telling you dates back to 2014, and at that time, the offerings were still pretty standard, especially in Switzerland.

A decade later, we are lucky to have much better offers for end customers, i.e., you and me!

When I say better offers, I mean free basic banking packages, rather than unnecessary customer service in branches.

Who is this Swiss bank comparison for?

Before going into detail about my comparison of the best banks in Switzerland, I want to clarify who this article is aimed at:

- You are a Swiss Mustachian

- You want the most efficient banking solution in terms of banking fees

- You want to set up a minimalist banking system with as many services as possible from a single provider (to avoid having to remember lots of cards and logins)

Mustachian banking strategy: simple and effective, so you can focus on the important things in life, such as hiking at the Etang de la Gruère!

If this doesn’t match your vision (because you like to meet with your banker and guide you through your personal finances), then I’d advise you not to waste your time reading any further, as it won’t be right for you.

For everyone else, let’s take a look at the relevant criteria I use to compare the best banks in Switzerland (and I’ll also mention the other, more useless criteria).

What are the important criteria for choosing your online bank in Switzerland?

Here are all the criteria I take into account when choosing my best Swiss bank account:

No basic fees

I don’t want to pay any basic fees to my bank, as they can be passed on to other services with higher added value.

Mobile and digital banking

I mainly use my bank online when I’m on the go or at home. So I want a neo-bank that I can access from my smartphone.

Secure

I keep my salary and savings in my bank account. My neobank must be regulated by FINMA (so that my assets are protected up to CHF 100'000 by esisuisse), store my data in Switzerland, and offer two-factor authentication.

Personal and registered IBAN

Not a shared IBAN like some other neo-banks, where you have to add a special reference for each payment (which is usually not possible for salary payments).

Bank transfers in Switzerland and the eurozone

These must be free of charge, with euro transfers via SEPA.

Low-cost international transfers

I want to be able to send money internationally with optimal exchange rates and little or no fees (and definitely no hidden fees).

Free debit card

To be able to pay in CHF daily without additional fees.

Optimal exchange rate fees

When I pay in foreign currencies, I want the interbank exchange rate without any hidden exchange rate surcharges.

Free ATM withdrawals

To be able to withdraw cash free of charge when I need it.

Free cash deposits

When I sell something on Anibis or elsewhere, I want to be able to deposit cash free of charge.

QR code bill payment

Because scanning a QR code to pay a bill is just so convenient!

eBill support

To automate the receipt and payment of my bills as much as possible.

Pot system or CSV export

I want to be able to use “pot” systems to better manage my budgets, or at least be able to export my transactions to CSV to sync with YNAB.

Download account statements in PDF format

To archive my statements and provide proof to other services if necessary.

Push notifications

I want to receive real-time alerts to track my spending and income.

Mobile payment methods

Compatibility with Apple Pay, Google Pay, Samsung Pay, Garmin Pay, SwatchPAY!, etc.

A dedicated TWINT app

So I can pay without cash even where bank cards are not accepted.

Available in FR / DE / IT

And bonus points if the app is also available in English for my expat readers.

What criteria are NOT important when choosing your online bank?

There are certainly more than the four listed below.

But these four criteria are often the ones that make people choose one bank over another.

Except that they can come with additional costs that you can do without.

Pointless criterion 1: a bank with a physical location

This criterion was important to me in the past, but with the advent of digital banking, banks have redundant systems that ensure availability rates close to 100%.

So I prefer to use my alternative of having a primary bank and a secondary backup bank. Both can be digital and 100% online, which suits me fine.

Pointless criterion 2: tools you don’t need

Whether it’s sophisticated dashboards or artificial intelligence assistants, I don’t need any of that for my bank. I just want to be able to receive money and do my banking stuff.

Then, for all my budget management, I use YNAB (or you can do this via a spreadsheet or one of these other methods).

So I prefer that my bank use this cash to keep its fees minimal instead.

Pointless criterion 3: attractive interest rates

As a Mustachian, you want to put your money to work somewhere other than standard banks, particularly in the stock market, where the growth potential is much better.

And if you’re looking for the best savings account to store money for the longer term, then I recommend checking out my guide to finding the best bank savings account here.

Pointless criterion 4: cutting-edge marketing

When I say marketing, I mean the negative side of it, such as:

- Sponsoring major soccer teams

- Free coffee in branches

- (Supposedly independent) advisors available to help me with my personal finances (and sell me their products…)

Instead, I prefer an efficient and frugal bank that offers products so good that word of mouth does their marketing for them.

Candidates for the title of best Swiss bank in 2026 (for a Swiss Mustachian)

After hours of research and compiling bank fees, here are the candidates for my ranking of the best online banks:

- Bank WIR

- neon

- ZKB (Zürcher Kantonalbank)

- Zak

- Yuh

- Migros Bank

- Revolut

- N26

- Alpian

- UBS

- Swissquote Banking

- Raiffeisen Memberplus

Here are the logos of these banks:

If you don’t see the online bank you’re looking for, send me an email, as I may have missed a new mobile neobank!

Comparison of the best banks in Switzerland

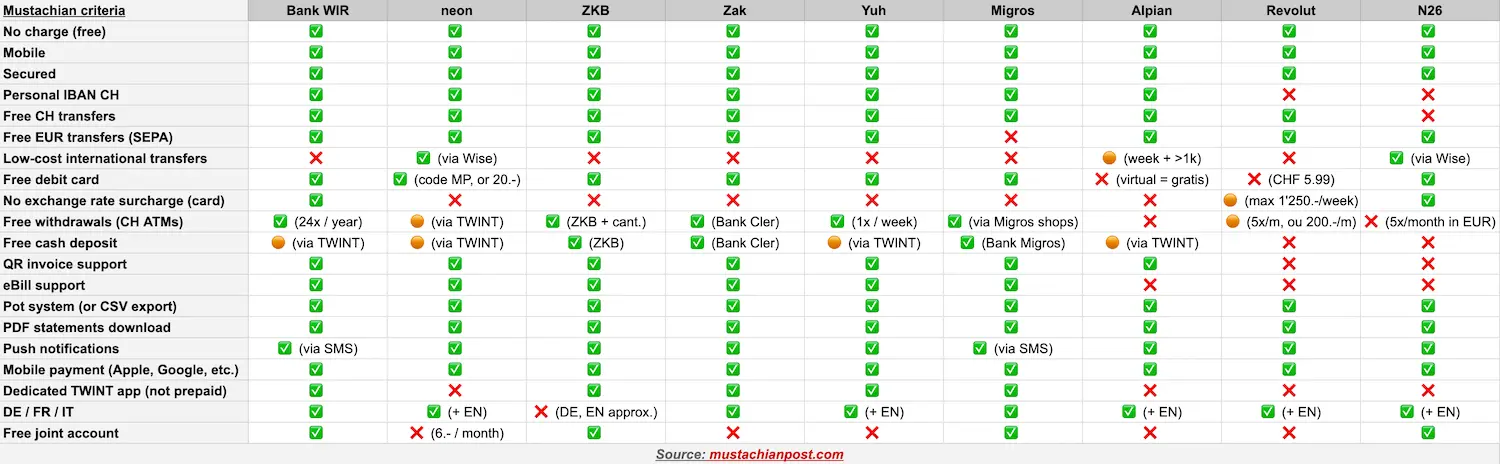

Without further ado, here is a summary of my analysis of the best Mustachian bank in Switzerland:

Which online bank to choose in Switzerland: my choice for 2026

Bank WIR got it right with the launch of its Bankpaket top. It’s the best bank for a Mustachian, whether it’s for a private account or a joint account.

This account offers the best banking services for a Mustachian:

- 100% free

- Available as a private account, as well as a joint account, free of charge!

- Debit card with no exchange rate surcharges (their single card is all you need for all your expenses)

- Has all the features you need to manage your day-to-day banking in Switzerland

- Available in all Swiss languages

The only three things we would ask them to improve are:

- Integrate a solution like Wise (but/and you can use it alongside if necessary)

- Have everything in one app, without needing to download the additional free debiX+ mobile app from SIX to receive push notifications from your Debit Mastercard. It’s not a big deal, but I think there could only be one app in total.

- Translate their entire app and website into English (for expat readers who are just arriving) — but as a lifelong Mustachian learner who values effort, it’s a good reason to master German, French, or Italian!

Bank WIR with its Bankpaket top package has been our new bank at the MP family since 2025. It’s the bank I recommend to everyone I know since the start of the year.

You will find a detailed guide on the Bankpaket top package (private account and joint account) at this link.

Secondary bank: Yuh (or neon free)

Neon is no longer my choice for the best Swiss bank account since May 2025. On that date, they added a +0.35% surcharge on foreign currency transactions with the neon debit card (unless you pay CHF 20 per year with the “neon plus” plan). In comparison, with the Bankpaket top from Bank WIR, there is no additional exchange margin. It’s sad that neon had to make this change to be profitable, because I really like neon, and their integration with Wise is super convenient!

But as I mentioned earlier, I like to have a secondary bank account in case there is a problem with my main bank.

To date, I recommend Yuh as the best secondary Swiss bank account for emergencies. You can find all the details of my choice in this detailed review of Yuh.

In the MP family, out of emotional attachment and to avoid closing and reopening an account (since Yuh and neon are very similar), we decided to keep our neon free account and the associated debit card.

We therefore have a neon free account in Mrs. MP’s name and one in my name. We closed our joint neon duo account when we switched to the Bankpaket top from Bank WIR.

(N.B. the app may not show the bonus straight away, but it will be taken into account; I have checked with their support team)

Other secondary online bank options

Each neo bank listed below is, in my opinion, equivalent to neon for my purposes: a backup bank account for my day-to-day transactions in Swiss francs only (including QR invoices).

I have added my notes for each institution so that you can choose the account that best suits your situation.

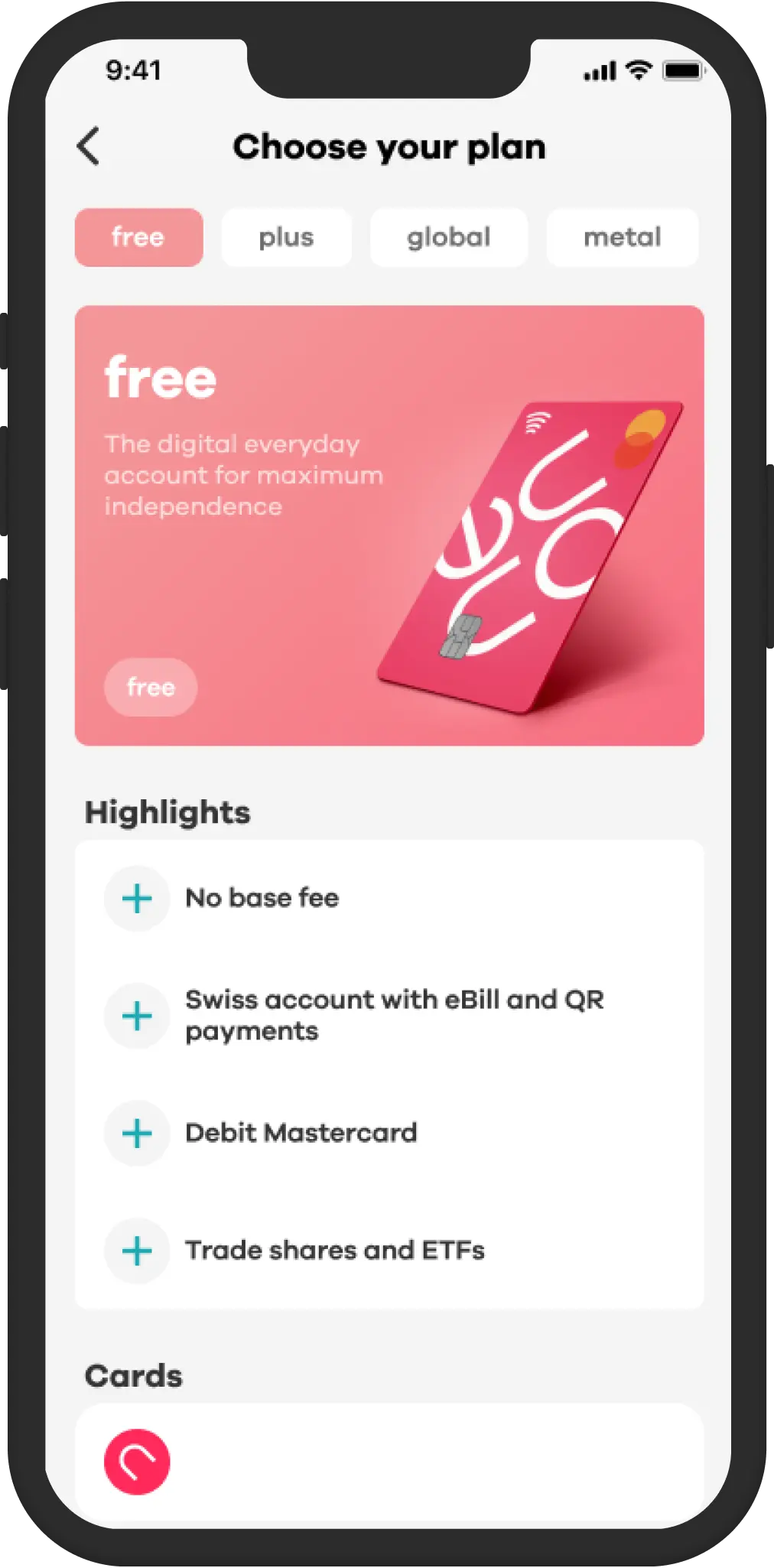

Yuh review

The neo bank Yuh was born out of a project between Swissquote and PostFinance. Your bank account is held by Swissquote, which is regulated by FINMA (guaranteeing the protection of your assets up to CHF 100'000).

Yuh competes well with neon as a solution with no annual fees. For basic use as a secondary Swiss bank, it can do the job — as long as you don’t use it for foreign currency payments.

If I weren’t emotionally attached to neon, I might choose Yuh as my backup bank account — which is also available in English for expats.

Migros Bank review

Migros Bank is a traditional bank that stands out as one of the most affordable, thanks to its free account management. With a physical presence through its branches, it fully plays its role as an “official” bank. It also offers free domestic payments and transfers, as well as a dedicated TWINT mobile app.

Like Yuh, I would choose Migros Bank as my second bank account if I weren’t attached to neon.

Alpian review

Alpian is a Swiss bank licensed by FINMA that entered the market in 2022. It targets a more premium clientele (similar to a digital private bank), offering personalized wealth management services.

This may be an attractive option if the following points are not important to you, such as being able to:

- Get the best final exchange rate, with zero surcharges on all your foreign payments

- Withdraw cash free of charge from ATMs in Switzerland (at least a few times a month)

- Benefit from a free joint account

- Use TWINT normally (not via TWINT Prepaid)

For my part, as a Mustachian, I don’t use Alpian as my primary bank, but it could serve as a secondary bank in the same way as neon.

(With the code MUSTCH, you are entitled to a free physical debit card (worth CHF 60) after making a non-blocked deposit of CHF 500 (and the card must be requested by the customer via the chat in the mobile app). This code also entitles you to up to CHF 60 in fee credit on investments.)

Zak review

Zak and neon are two excellent Swiss mobile banking options, perfectly suited as secondary banks. They offer very similar services and are equally good for everyday use, especially as a backup solution in case your main online bank goes down.

The only real difference is for expats: unlike neon, Zak does not offer its app or website in English. If you are not comfortable with German, French, or Italian, neon is clearly the better choice for you.

(I’ve also negotiated CHF 25 welcome cash for you if you use the code “Y06JPR” during the account opening process.)

ZKB Banking review

ZKB Banking, the free offering from the Zurich Cantonal Bank, includes a free account, a free debit card, a dedicated TWINT mobile app, and standard e-banking services. It’s a solid option, but with high fees for foreign currency payments (1.25% compared to 0.35% at neon) — not really a problem for a backup bank.

That said, ZKB Banking is only available in German. So if you’re fluent in Swiss German, ZKB and neon (“free” plan) are equally good options as a secondary bank. But for everyone else — French speakers, Italian speakers, or English-speaking expats (as an English version exists, but is poorly translated) — neon remains the best choice thanks to its multilingual mobile app.

UBS key4 banking Pure review

UBS reacted to the Swiss neo-banks’ offers in 2025 with their “UBS key4 banking Pure” package. This offer for individuals includes a personal account and a savings account, as well as a prepaid card and a debit card. However, the two disadvantages of this banking solution are: no joint account, and a Mastercard exchange rate surcharge of 0.5%.

For use in Switzerland only (not abroad or on foreign currency sites, nor in EUR, as SEPA payments are not free), UBS is equivalent to the other mobile banks presented in this “secondary bank” section. With the advantage of being available in English in addition to the other Swiss languages.

Open a UBS key4 banking Pure account >

Swissquote Banking Light review

The Swiss online broker Swissquote offers a banking solution with a personal account and a debit card (Mastercard). Nevertheless, this Swiss account is not as good as all its competitors for several reasons:

- Swissquote Virtual Debit Mastercard is free, but the physical debit card is not

- No free ATM withdrawals (even in Switzerland, you have to pay)

- 0.95% exchange rate surcharge for payments in currencies other than the Swiss franc (CHF)

- No joint account

- SEPA transfers in EUR are not free

For all these reasons, I do not recommend Swissquote Banking Light, even as a secondary bank.

Raiffeisen Memberplus review (Associate private account)

Raiffeisen offers a member account for CHF 4 per month, plus a one-time membership fee ranging from CHF 200 to CHF 500, depending on the local cooperative.

If you are passionate about museums and cultural activities, it could definitely be worth it thanks to the MemberPlus program, which includes a Swiss Museum Pass for you and up to three children under the age of 16.

As always, I recommend doing the math to see if this package is worthwhile for your daily use of your Raiffeisen account, or if it’s better to pay for cultural services separately.

It’s worth noting a few limitations of the member account, including high exchange fees for payments in foreign currencies and no option for joint accounts, as far as I know (because the membership share is registered to one person, with only one person per share).

Radicant review

The neobank Radicant ceased all operations in November 2025. They will recommend a way out to all their customers. All customer assets are protected (i.e., no money is lost).

Notes on Revolut and N26

Although Revolut and N26 offer innovative banking solutions, they are not suitable for everyday use in Switzerland.

For example, neither bank offers a personal IBAN in CHF.

With Revolut, you have a shared Swiss IBAN, which often causes problems when receiving your monthly salary (because you have to specify special information in the “Message to recipient” section, and this is not always possible with automated salary payment systems).

As for N26, their IBAN is denominated in euros, so it’s not ideal for living in Swiss francs.

And you have the same kind of limitations with the lack of eBill or TWINT.

Finally, Revolut and N26 do not have a banking license in Switzerland, which may be a deal-breaker for some.

Conclusion: Best Swiss bank account

When asked, “Which bank offers the best Mustachian bank account in Switzerland?”, I would answer that Bank WIR comes out on top with its Bankpaket top without hesitation. This applies to both private and joint accounts!

Our salaries get deposited every month into it.

And I pay all of our invoices (eBill for the win!) and do our domestic bank transfers in CHF via the Bank WIR app.

I use the WIR Debit Mastercard in Switzerland to withdraw money at ATMs, and to pay in shops when credit cards aren’t accepted (see my credit card strategy in this article.

Abroad, the Bank WIR’s credit card is the single one I need for all purchases in foreign currencies.

And for online payments, I use it also for foreign currency payments (else I use another credit card when paying online in CHF).

Mrs MP and I switched to this bank after spending the last few years with neon. However, we remain attached to this neobank and have our backup bank accounts there.

And you, which Swiss bank do you use to receive your salary and carry out your daily banking transactions?

FAQ

Which banks offer a “pots” or “categories” system similar to Zak’s?

A pot system allows you to divide your money into several virtual “sub-accounts” to better organize, track, and achieve your spending or savings goals.

The following banks offer this system:

- Zak (with the “Pots” system)

- neon (with the “Spaces” system)

- Yuh (with the “Savings Goals” system)

Online banks: checklist for switching banks

I remember when I switched banks for the first time, I was pretty stressed out. I was afraid that a payment would go through while my old bank account was empty, that I would forget to notify an organization that wanted to transfer money to me, or that I would have to reconfigure all my eBills manually…

As well as being stressful, it can seem daunting… but in fact, with a little preparation, it’s really easy to do. And above all, it’s definitely worth it if you want to save on bank fees.

And I know what I’m talking about! Since embarking on my journey toward financial independence, I’ve changed bank accounts five times: I started with Credit Suisse, then BCV, Zak, neon, and finally Bank WIR.

So here’s my checklist for changing bank accounts in Switzerland to make sure the transition goes smoothly:

1. 📲 Open your new bank account

- Download the app or go to your new bank’s website

- Complete the account opening process (identity, supporting documents, etc.)

- Receive your debit or credit card if applicable

2. 🧾 Take stock before switching banks

- Make a note of all your standing orders, including their execution date and frequency (on paper or screenshot, whichever you prefer)

- List any transfers that are still pending

- Review your transactions from the last 3 to 6 months (via YNAB or your online banking) to identify who has transferred money to you — and who you will need to notify of the account change

- Make a note of all the eBills you are signed up for

3. 💸 During the first month after switching banks

- Leave some money in your old account to cover any outstanding payments

- Transfer your salary to the new account

- Pro tip: if you’re in a relationship, transfer only one salary first, just to be on the safe side in case you forget payments on your former account

💳 4. Activate and use your new card

- Make all your everyday payments with your new card (e.g., Debit Mastercard or Visa Debit Card)

🔁 5. Transfer your standing orders and direct debits

- Stop any standing orders on your old account, then set them up again on your new one

- Go through any pending transfers one by one: set them up again in your new app, then delete them from your old one

👀 6. Keep an eye on your accounts

- Check both e-banking accounts every 1-2 days for a few weeks

- Or activate push notifications so you don’t miss anything

📨 7. Update your information with service providers

- Notify your insurance companies (basic and supplementary) of your new IBAN, especially if they reimburse you directly to your account

📂 8. Transfer all your eBills and documents

- Transfer all your eBills to your new bank (log out of your current bank and log back in to your new bank — this will keep all your eBill information safe while you switch!)

- Check if there are any important e-documents (invoices, statements, etc.) stored only on your old e-banking account and download them for your records

✅ 9. Close your Swiss bank account

- Check one last time that everything has been transferred: standing orders, upcoming transfers, eBills

- Close your old Swiss bank account!

- And enjoy the moment when you finally stop financing your banker’s Porsche 😎

By following this checklist, you can switch banks without stress. And you’ll enjoy the benefits of your new banking solution sooner, whether it’s 100% digital or a mix of branches. It’s also a good opportunity to clean up your finances ;)