I’m currently evaluating savings accounts in Switzerland…

Yeah, yeah, I know, it’s not really my style as I invest all my money in the stock market!

Yet I regularly receive requests from readers, like this recent one from Axelle:

Hi MP, thanks for everything you do with your blog! In my case, I can’t invest yet as I’m going to buy a property within 2-3 years ;) so I was wondering what savings account you would recommend for putting my deposit savings into (currently around CHF 100'000) in the meantime?

Axelle also told me that she didn’t want to put her cash into bonds or other stock market investments as she hasn’t done it before and isn’t ready yet 😅

My automatic reaction, as a personal finance geek, was to turn to Moneyland to see what they said.

And to my surprise, as a guy who still lives in the negative rate era, there’s been quite a bit of movement in recent years at Swiss banks!

Special thanks to the Swiss National Bank (SNB) for having played around with the key interest rate several times :)

Important note

I wrote this article at the end of 2024, and by January 2025 it was already out of date. Indeed, banks change their savings account rates almost every week or month.

So instead of having an article listing THE best savings account, I’ve turned it into an article explaining my process for finding the best savings account in Switzerland at any given time.

Criteria for choosing the best savings account in Switzerland

If I were in Axelle’s situation (as was the case from 2013 to 2016), then I would use the following criteria in order to choose the best savings account:

- The best guaranteed interest rate (for as long as possible)

- Zero opening and closing fees

- The maximum authorized amount corresponds to at least the amount of my deposit (or is larger)

- The amount of the single annual withdrawal is as high as possible

- Bank available in my language (and region, if not online)

My process to compare savings accounts (2025 rankings)

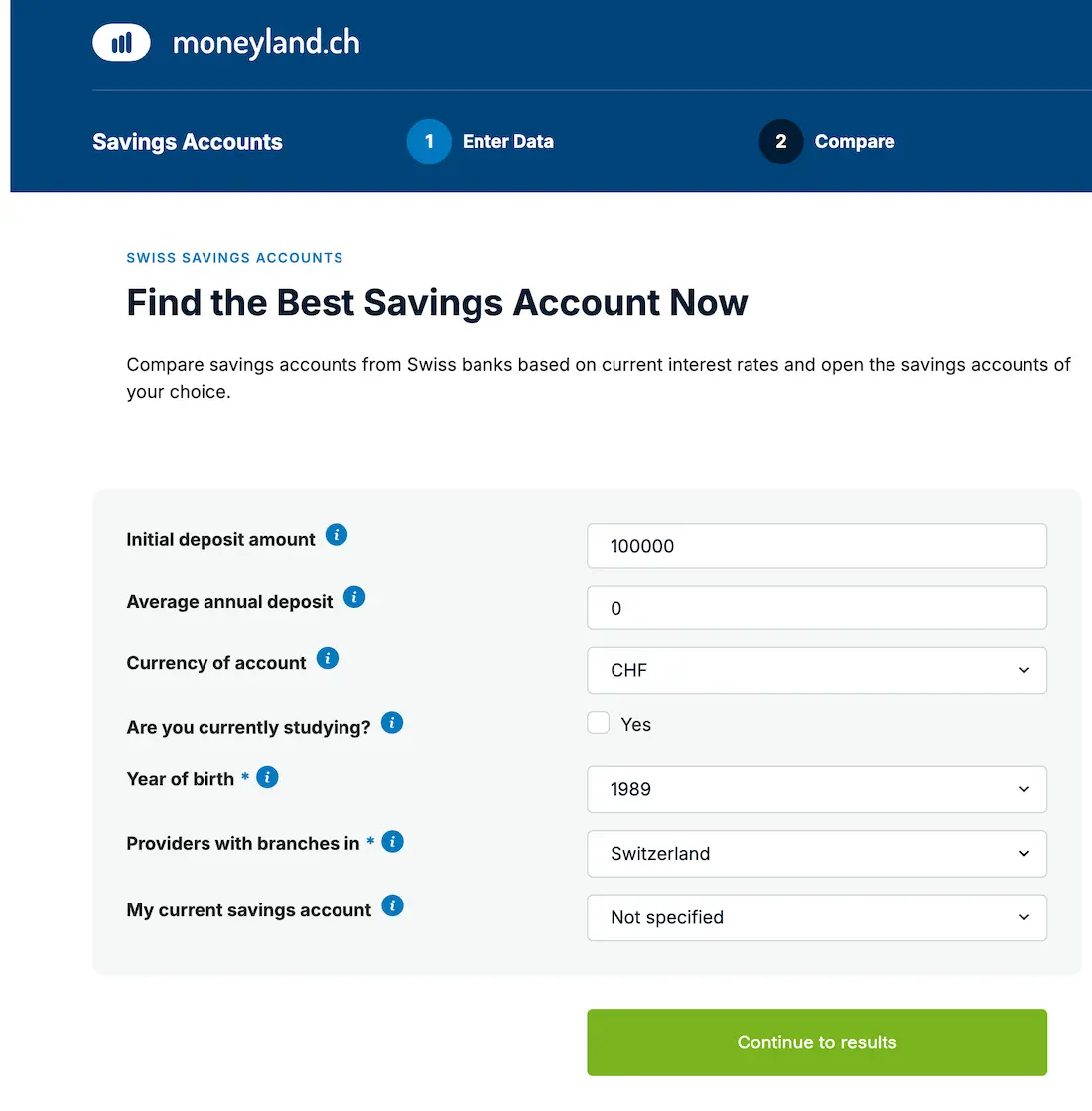

I’m using the case I’ve heard most often: a deposit of 100'000 Swiss francs.

Then, my 1st step is to query Moneyland’s database of savings account options:

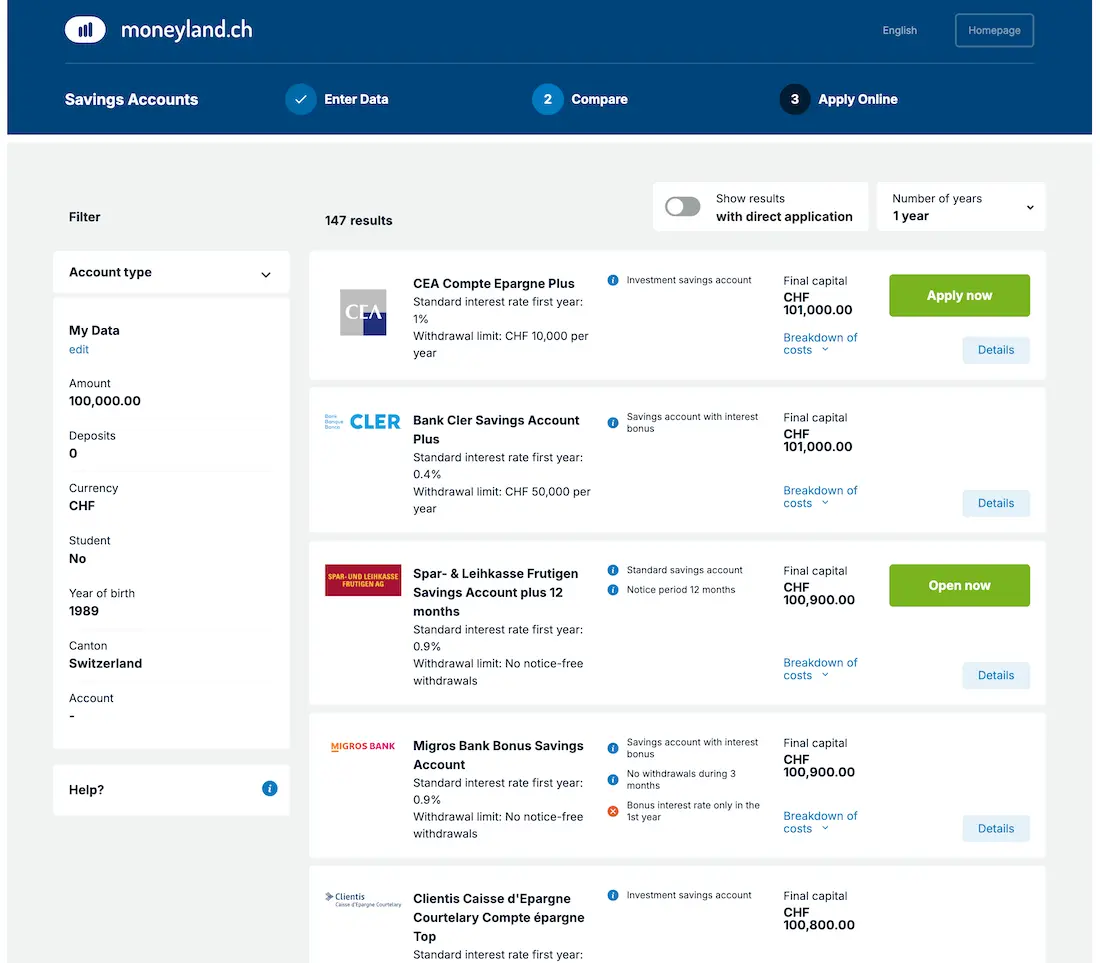

My 2nd step is to choose the account with the best guaranteed interest rate (i.e. the first in the list below).

And my 3rd step is to check the conditions on the bank’s website directly, to see if it covers points 2 to 5 presented in the previous section.

Every time I look at this Moneyland ranking, I notice that none of the large other banks or any of the cantonal banks appear in this ranking. Interesting with respect to their strategies.

Raiffeisen and Cembra savings accounts

After surveying the readers of the blog, I mention (and recommend) that you also take a look at the Raiffeisen banks in your area. As the latter regularly offer good savings account options.

There’s also Cembra, which in the past has offered two interesting savings accounts. Yet, their rates are not guaranteed for any period of time. They can therefore change from one day to the next.

A point about savings accounts without withdrawal restrictions

Once Axelle gets closer to her goal of saving for her primary home, she’ll certainly want more flexibility when it comes to withdrawal options.

In any case, that was my experience as a future homeowner at the time.

In such a case, the ranking of the best interest rate for an unrestricted savings account (often as a standard private account actually, with free withdrawals), I recommend you take a look at these banks in particular:

- Alpian

- Central Bank of Liechtenstein (wiLLBe)

- Radicant

- Yuh

- Interactive Brokers (cash account IBKR Pro)

- neon (bank account, via the “Spaces”)

A point about medium term notes

Without using exchange-traded bonds, there is also the option of medium-term notes for storing your savings.

They are still stocks but issued by a bank, with a guaranteed interest rate. The difference with the savings accounts listed below is that you can’t break your contract before the end of the deposit period.

If I were Axelle, I would look into that option if I was sure that I wouldn’t need my money to buy my main home for X years.

Otherwise, that would be a barrier if a less expensive real estate opportunity came up sooner than expected.

That is why, personally, I would rather choose a savings account.

FAQ about savings bank accounts in Switzerland

Is the money I deposit in a savings account protected?

Yes, just like with your current private account, the money deposited in your savings account is protected in Switzerland by the deposit guarantee up to CHF 100'000 per person and per bank.

Conclusion

Historically, if you’re from French-speaking Switzerland, the best savings account has often been at the Caisse d’épargne d’Aubonne.

If you’re not, or you want a Swiss bank with branches everywhere, or you want the best withdrawal conditions, then I recommend you follow Moneyland’s ranking to find the best interest rate for your own situation..

And what would you choose as a short-term solution for putting your savings away?

Photo credit: pexels.com