Ah, the pillar 3a… what a great tool for Swiss tax optimisation, and completely legal!

But the question I’m regularly asked is which is the best 3a pillar for a Swiss Mustachian?

I’m going to answer that question in this article, starting with a brief introduction to the world of the Swiss pension system and the pillar 3a in particular, just in case you’re just starting out in life (and so that you don’t get taken in by those pesky insurers like I did in the past!)

Role of the pillar 3a in the Swiss pension system?

Switzerland’s pension system consists of a three pillar system, and was introduced gradually over time by the federal government. The first pillar, financed by the State, was created in 1948. The second pillar, financed by employers, was added in 1985. Finally, the third pillar, a private pension provision, based on individual savings, was introduced in the 1970s.

The 1st pillar (or AVS pension) is compulsory in Switzerland if you live or work there. It corresponds to the AVS contributions you have paid (i.e. the money you have paid in) from the age of 20 until you reach retirement. It is used to guarantee the minimum living standard for everyone.

The 2nd pillar (or LPP pension) is the money you put aside via your pension fund when you work in Switzerland, aka occupational pension provision. It is automatically deducted from your annual salary. This kind of occupational pension is also compulsory from the moment you start work. It is used to guarantee the “usual” standard of living" once you reach your retirement.

The 3rd pillar (or 3a pillar) is an optional, personal, voluntary private pension provision. Generally speaking, the 1st and 2nd pillars are not enough to provide you with a full pension. The pillar 3a therefore allows you to put some money in the piggy bank until your 65th birthday (i.e. after the legal “retirement” age) to fill potential pension gaps, and have a sufficient retirement planning.

Is the pillar 3a pension fund actually useful?

So, from a purely technical point of view, the 3a private pension provision will not be mega-useful for us Mustachians trying to achieve early retirement from the age of 40 in Switzerland.

After all, you save a lot more than the CHF 7'000 or so a year that you can put aside via your pillar 3a pension fund.

But the pillar 3a has one significant advantage: you can deduct your contributions from your tax bill.

On average, that saves you around 1'000 Swiss Francs of tax burden each year!

Personally, I wouldn’t pass on that offer!

Maximum pillar 3a amount for 2025 (to reduce taxable income)

In 2025, the pillar 3a ceiling will be CHF 7'258 for employees who are affiliated with a pension fund. Self-employed persons who are not affiliated with a pension fund may contribute a maximum of CHF 36'288 (but no more than 20% of taxable income) and also enjoy such tax incentives.

Maximum 3a pillar amount in 2025: CHF 7'258 per year

This maximum 3a pension fund amount is defined and announced annually by the Federal Council at the end of the year.

What type of third pillar should a Mustachian choose?

As a reminder, on this blog, we want to be able to put our savings to work while we sleep.

That way, we can live off the returns on our savings.

So the money saved in a 3a pillar should also be working as hard as possible.

The first piece of good news is that you can invest the money in your third pillar on the stock market.

The second piece of excellent news is that there is no longer a limit on the percentage of your 3a pillar that can be invested in stocks and shares (previously, in the 2010s, it was a maximum of 45% in stocks and shares, but that’s in the past!)

Any supporter of the FIRE movement in Switzerland will therefore be looking for a 3a pillar with the following characteristics:

- 100% in global equities

You want to be able to invest the maximum amount of the third pillar in 100% global equities (meaning that you would be covering the whole world to have an optimum risk/return ratio thanks to a broad diversification of the companies in which you invest) - Passive investments

You want passively invested funds that beat actively managed funds over the long term (over 10 years or more, which is our minimum investment horizon here) as has been proven time and again by economic papers - No sustainable funds (ESG or other)

You don’t want ESG-type funds for two reasons: firstly, these assets are less diversified (and therefore riskier), and secondly, these supposedly sustainable funds don’t change much (cf. the economic papers that demonstrate this factually) - The best return

You want the pillar 3a with the best return, once all costs are included. Because at the end of the day, that’s the goal: returns!

IMPORTANT REMINDER: never start a 3a pillar with an insurance company!!!

As long as I’m blogging, I’ll keep telling you: NEVER start a 3a with an insurance company, also known as 3rd pillar mixed insurance, or third pillar life insurance.

It’s the worst (legal) scam in Switzerland!

I’ve been ripped off myself (twice 🤬).

I’ll explain why — and above all how — to close your pillar 3a life insurance in this detailed article.

And if you’re lucky enough to be tied to your 3a pillar life or survivors insurance because of your mortgage: check out my article on how I managed to terminate these two long-standing liabilities early!

Candidates for the best third pillar in 2025 (private pension provision)

Until the end of 2017, only a few banks offered to invest the money in your 3a pillar on the stock market at fairly reasonable fees.

I had even gone so far as to open a 3a pillar account with Lucerne Cantonal Bank to take advantage of the best pillar 3a in Switzerland…

But a certain VIAC came along and kicked the banks and insurance companies in the teeth for the fees they were charging their customers.

The result has been the creation of a number of competing fintechs that are finally competing because of the right criteria to satisfy their customers: maximum returns for minimum fees.

So, to date, here are the Swiss third pillar offers worth considering in 2025:

Invest 100% of your pillar 3a in global stocks

Here’s how much you can invest in your 3a pillar via each of these financial institutions:

- VIAC: 99%

- finpension: 99%

- BLKB: 99%

- True Wealth: 99%

- frankly: 95%

- Selma: 97%

- Descartes: 99%

As a reminder, I want as much of my money as possible invested in my pillar 3a to work for me. And 2 to 5% more invested over decades quickly makes a big difference!

My top 7 quickly turn into a top 5:

- VIAC

- finpension

- BLKB

- True Wealth

- Descartes

All pillar 3a institutions invest a maximum of 99% of your savings in stocks and keep 1% in cash to debit their fees.

Third pillar with the best return (fees included)

Since I started the blog, I’ve been far too worried about fees, and far too little about returns.

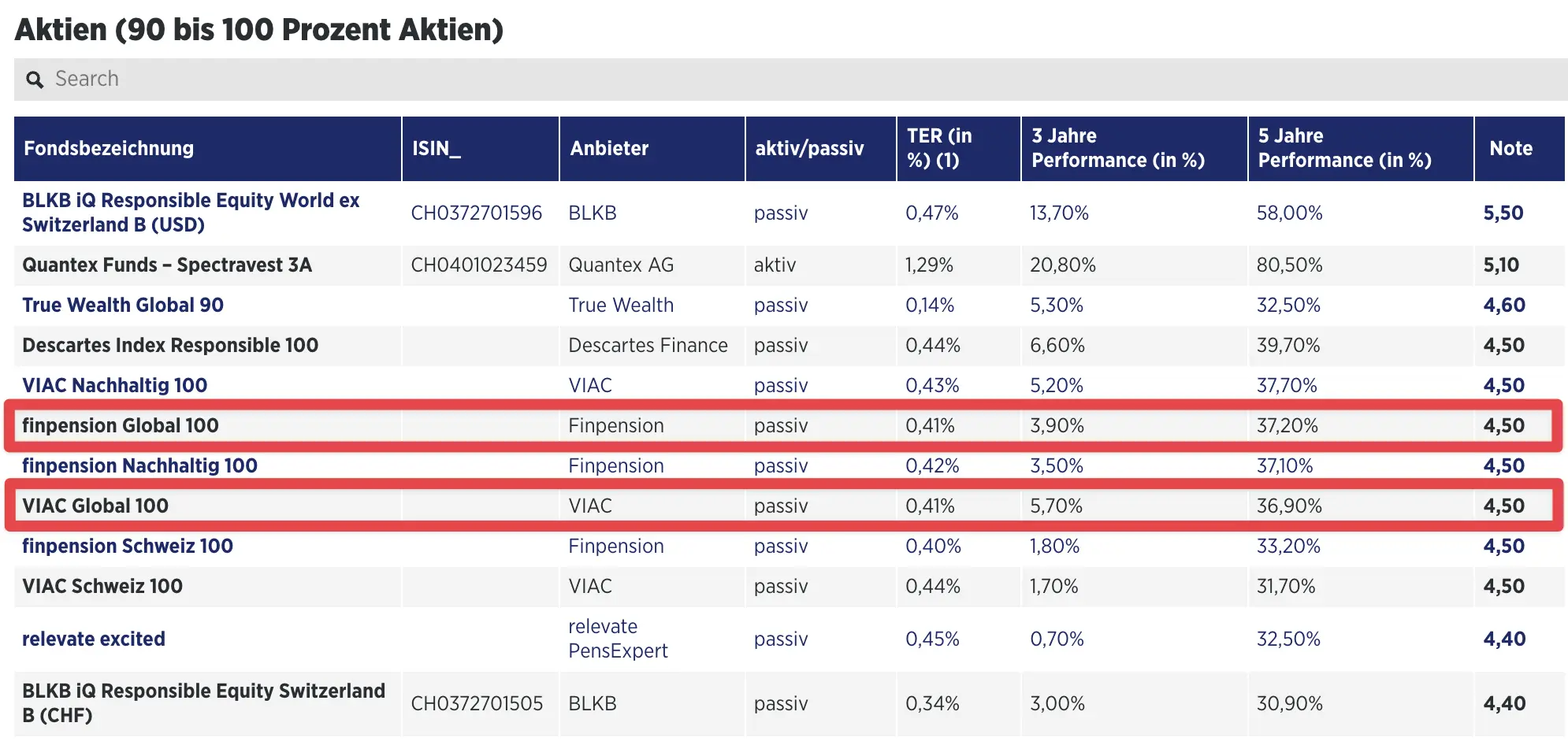

That was until I came across the Handelszeitung’s (a Swiss German business magazine) great pillar 3a comparison — compiled by the Haute École de Gestion de Fribourg.

Every year around the end of November, they publish a comparison of each of the 3rd pillars according to its return, including all fees.

The ranking of the best 3a pillars which invest 100% in global stocks is undisputable:

Score: the performance and risks over one, three, and five years including fees which were weighted and converted into a score. Products less than five years old were given a worse score due to their short track record. Funds with less than a three-year track record were excluded.

Fees: The performance was measured after deducting fees. For institutional funds, a custody fee of 0.3 percent per annum has been considered, which is usually included in the fund fee for retail products. For retail funds, which are not available for purchase without a custody fee, this has been considered when presenting performance.

Reference index: to properly assess the risk profile of each fund, it has been compared to the corresponding reference index based on its stock share.

(source: Handelszeitung)

My first comment: We certainly didn’t screw up with the top 5 I mentioned earlier, since they’re all in the Handelszeitung’s list of the best third pillars (100% invested).

Next, here are the other comments I made myself while reading this list from top to bottom:

- BLKB iQ Responsible Equity World ex Switzerland B (USD): I don’t take it into account because of its lack of diversity, as it is a “responsible” fund that excludes certain companies.

- Quantex Funds - Spectravest 3A: I didn’t have this 3a fund on my radar, because the fees were too high and it was actively managed. Nevertheless, I visited their site, and I really like their teams’ approach (see Quantex’s description as well as their philosophy. On the contrary, they don’t have a mobile app or digital solution. Well anyways, active management is a showstopper for me in the long run)

- True Wealth Global 90: good score, but they only invest 90% of my cash in equities (and the remaining 10% in REITs, which is too much real estate for me), and I’m asking for at least 99%. Nevertheless, I’m keeping them on my radar for next year ;)

- Descartes Index Responsible 100: “responsible” fund, not diversified enough and not necessarily more impactful. We skip it

- VIAC Sustainable 100: same as above

- finpension Global 100 et VIAC Global 100: unsurprisingly, we find VIAC and finpension pulling at each other’s heels with the same score this year!

- finpension Sustainable 100: same as the point for VIAC Sustainable

- finpension Switzerland 100: I don’t take it into account because it is invested in Swiss equities only, and I want diversification with global equities

- VIAC Switzerland 100: same as previous point

I’ll stop there because after that, the score drops again. And we’ve got enough candidates for our pillar 3a!

The editors at Handelszeitung came to the same conclusion as I did:

Over a longer period of five years, pension funds with a higher equity component tend to achieve a higher absolute return than defensive products.

But few of them manage to beat the market. Passively managed funds generally achieve a better return than actively managed funds. They are also cheaper.

finpension and VIAC, the best 3a pillars in 2025

finpension and VIAC are the Swiss fintech companies that were created to give the old, fee-ridden pillar 3a world a big kick in the teeth.

They both exist since 2015 and have added a lot to their product range.

Mrs. Mp and I have ten 3a pillars at VIAC and finpension (no, no, you aren’t mistaken: we have ten 3rd pillars, read the FAQ section below to understand why).

And so finpension and VIAC maintain joint 1st place as best pillar 3a for Mustachian.

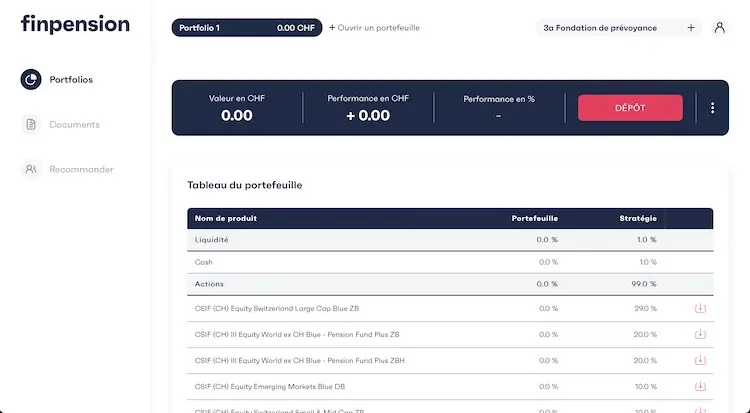

Details about finpension 3a

finpension joined the pillar 3a market later than VIAC.

Indeed, they started their adventure in 2015. But they started with the 1st and 2nd pillars - giving institutions a good kick in the pants too!

Nevertheless, their 3a pillar offer is no worse. Quite the contrary!

Every year, finpension and VIAC battle it out for a first and second place on the podium :)

You can find my detailed review of finpension 3a by following this link.

The finpension promo code below gives you a fee credit of 25 Swiss francs (provided you transfer or deposit at least CHF 1'000 within the first 12 months after creating your finpension account).

===> MUSTBC <===

Finpension security via formal identification

Until recently, finpension offered to carry out your formal identification (the legal KYC process aka “Know Your Customer”) when you withdrew your 3a assets (or vested benefits account).

As they have the status of a foundation, this was perfectly legal.

Except that it seemed a bit odd to be able to create a third pillar account with the name “Donald Duck” and for it to work without any problems… jokes aside, imagine if you had used a typo in your surname or first name… the problems would have come later, when you wanted to withdraw money from your private pension plan!

Finpension finally corrected the situation in April 2023.

So now you can opt for formal identification when you open your 3rd pillar — which I strongly recommend.

And this security element is now identical between finpension and VIAC (i.e. no longer a differentiating element).

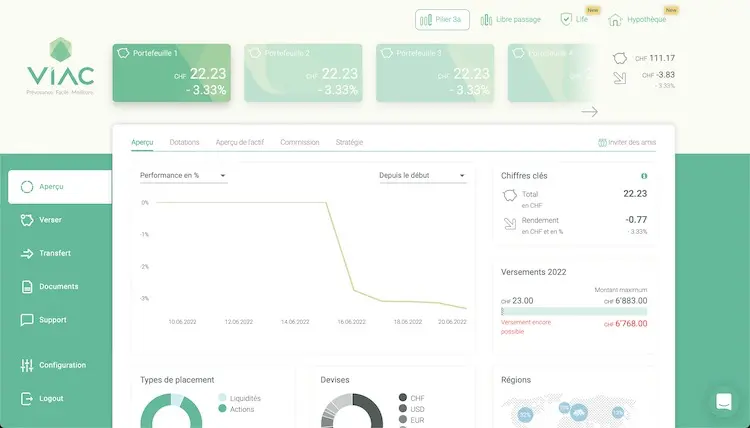

Details about VIAC 3a

VIAC is the fintech that shook up the 3rd pillar market first, when it launched its 3a in 2017.

You can find my detailed review of VIAC 3a by following this link.

The VIAC promo code below gives you free management of your first CHF 2'000 in pension balance on your 3a pension account – and it's valid for life!

===> 3aMust <===

I also wanted to make a few clarifications regarding VIAC:

VIAC and the currency exchange margin

I regularly get the question as to whether VIAC is better than finpension when it comes to currency exchange.

VIAC talks about a 0.75% basic currency exchange fee on its site, whereas finpension highlights its 0% exchange fee (in reality, it’s around 0.05%).

However, as explained in this FAQ VIAC article, the latter optimises exchange transactions globally across all its customers’ accounts. As a result: VIAC exchange rate fees are on average less than 0.05% for all strategies.

In short, VIAC and finpension are both the best with their minimalist margins on currency exchange.

VIAC and withholding tax

Again, I am often told that finpension is better than VIAC on this point as well, because finpension emphasises the fact that they invest in funds (and not in ETFs). This means that they don’t have to pay withholding tax in advance and is, therefore, more advantageous for us investors.

But VIAC uses the same index fund (and not ETFs) from Crédit Suisse (as you can see here on the factsheet for VIAC’s Global 100 strategy).

So finpension and VIAC are equal in this aspect, as they are both fully tax-optimised (at least for standard strategies, as for customised strategies, they go through ETFs).

VIAC fee cap

The fee cap of 0.44% is applied first, then an additional allocation is deducted on top.

Let’s take the example of the VIAC Global 100 strategy:

- No fee cap: 99% invested x management fee of 0.52% = effective management fee 0.5044%

- With CHF 50'000 invested, this gives us: 0.5044% x 50'000 = CHF 252.20 basic fee

- Thanks to the fee cap, we must reduce the calculation basis so that the effective management fee corresponds exactly to 0.44%, so: 0.52% x 0.44%/0.52% x 50'000 = CHF 220.00 in fees

- This means that the new calculation basis (thanks to the fee cap) is as if the fees were calculated on 84.6% of shares (and not 99%), because 0.44%/0.52% = 84.6%

- Therefore, the adjusted calculation basis thanks to the fee cap is CHF 42'307 (= CHF 50'000 x 84.6%)

- If, in addition, an allowance is added thanks to the invitation of friends, this calculation basis is further reduced. For example: (CHF 42'307 — CHF 7'500) / 50'000 x 0.52% = 0.36%

- Then you will only pay 0.36% in fees

VIAC or finpension in 2025, which 3a pillar should I choose?

For me, the 3rd pillars of VIAC and finpension are on an equal footing, with the best returns you can find for a 3rd pillar. In other words: it is the 3a that will give you the most cash in your pocket when you withdraw your assets.

Reasons for choosing the VIAC 3rd pillar

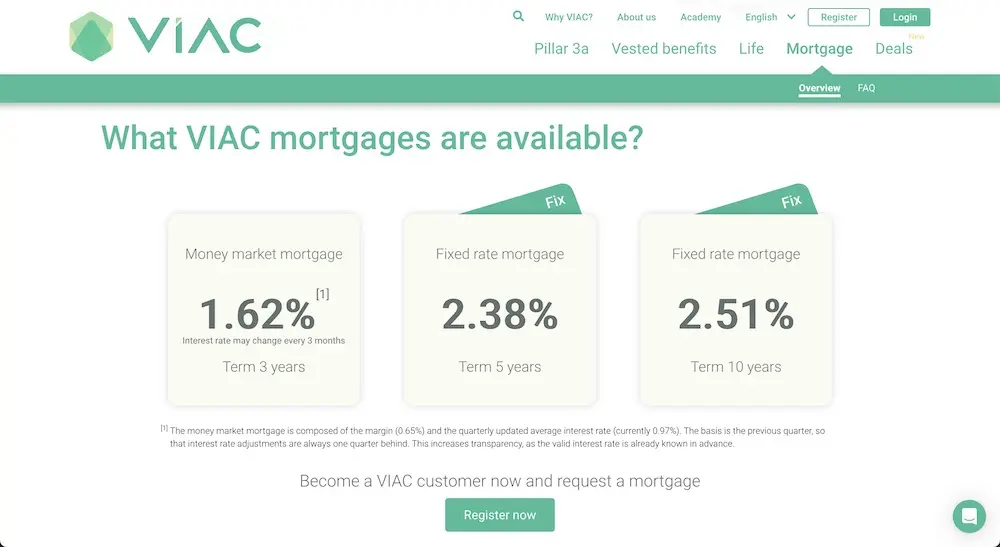

VIAC offers certain advantages:

- Attractiveness

VIAC does everything possible to optimize the attractiveness of its products by reinvesting everything for its clients, see point 3. - Free death or disability insurance

“You now receive up to 25% more of your pension assets in the event of disability or death. For every CHF 10'000 of assets invested in securities (calculated based on the previous month), VIAC offers you a free basic cover of CHF 2'500 (max. CHF 250'000) in the event of death or disability (70% – degree of disability).” - Mortgage

And finally, THE feature that makes me love VIAC, even more, is their mortgage! If you’re a VIAC client, you can get a mortgage at a really great rate (SARON especially) with the Bank WIR, which agrees to take your pillar 3a invested in a Global 100 strategy as collateral!!!

The reason to choose the finpension 3rd pillar

The only reason for me (who has his mortgage at VIAC) to choose finpension instead of VIAC in 2025 is diversification.

I can’t see VIAC or finpension going bankrupt for fraudulent management and losing everything… but you can never be sure of anything, as we saw recently with the bonds issued by Crédit Suisse, which vanished over the span of a weekend…

So, if you have to choose a strategy of opening multiple 3rd pillar accounts (to maximise your wealth tax savings when you withdraw), I’d recommend opening:

- 3x 3a pillars with VIAC

- 2x 3a pillars with finpension

Or vice versa, if you prefer finpension blue to VIAC green:

- 3x 3a pillars with finpension

- 2x 3a pillars with VIAC

Then you split 3/5 of your maximum annual amount between VIAC or finpension, and send the other 2/5 to finpension or VIAC.

Best 3a pillar summary in 2025 (in one table)

| VIAC | finpension | |

|---|---|---|

| Performance ranking | 1st ex æquo | 1st ex æquo |

| Fees | 0.44% base fee | 0.39% |

| Loyalty program | Yes (up to CHF 7'500 free management credit), reducing fees to 0.36% and you receive an additional 25% of your pension assets in the event of disability or death | Fee credit of CHF 25 per referral |

| Maximum in global equities | 99% | 99% |

| The maximum amount of portfolios | 5 | 5 |

| Formal identification | ✅ | ✅ |

| Fund provider | Swisscanto and UBS | Swisscanto and UBS |

| Languages supported | FR / DE / IT / EN | FR / DE / EN |

The case of the MP family

Our two 3rd pillars with Mrs. MP are with VIAC and finpension.

Initially, we only had Mrs. MP’s 3a pillar with VIAC, as mine was locked into a damned mixed life insurance policy (NEVER MAKE THIS MISTAKE!)

Then, in September 2022, we finally managed to close our mortgage AND my mixed 3a pillar linked to life insurance!

This allowed us to do three things:

- Switch our mortgage to VIAC/Bank WIR

- Transfer my pillar 3a to VIAC

- Free up cash to invest in our first rental property in Switzerland

We then split our maximum pillar 3a amount between VIAC and finpension.

Conclusion

In 2025, VIAC and finpension are still the best 3rd pillars invested 100% in global equities.

🥇 finpension and VIAC are 1st ex æquo in the Handelszeitung ranking.

The VIAC promo code below gives you free management of your first CHF 2'000 in pension balance on your 3a pension account – and it's valid for life!

===> 3aMust <===

The finpension promo code below gives you a fee credit of 25 Swiss francs (provided you transfer or deposit at least CHF 1'000 within the first 12 months after creating your finpension account).

===> MUSTBC <===

These two 3a pillars allow you to invest the full amount of your annual contribution (i.e. CHF 7'258 Swiss francs in 2025).

Also, this is what matters most to us as Mustachians, VIAC, and finpension offer the best returns with their global strategy invested 100% in equities (taking all fees into account).

So whether you choose VIAC or finpension, you can go ahead with your eyes shut, you’ll be making the right choice!

Thanks to these two solutions, you’ll have the most money in your pocket when you withdraw all your 3rd pillars :)

FAQ 3rd pillar

Is it a good idea to buy back 3rd pillar years?

I asked myself the same question when the OPP 3 law changed on 01.01.2025. You can find my answer to this question in this detailed article.

What languages do these 3rd pillars support?

Even if the language of a platform shouldn’t prevent you from choosing the best 3a pillar on the market, I know that this is a barrier for some readers.

(quick reminder: Deepl solves this problem, with incredible translation quality)

So here are the languages supported by each of the five 3rd pillars:

- VIAC: FR / DE / IT / EN

- finpension: FR / DE / EN

- BLKB: DE

- True Wealth: FR / DE / EN

- frankly: FR / DE / EN

- Selma: FR / DE / EN

- Descartes: FR / DE

What is the 3rd pillar staggered withdrawal?

Taxation of the 3rd pillar is progressive in percentage terms. This means that the larger the amount you withdraw, the higher your tax rate. That’s why it’s advisable to open 5 3a pillars from the get-go to optimise your tax when you withdraw each of them once a year, five years after reaching retirement.

If you’d like to find out more, I’ve written a detailed tutorial on staggered 3rd pillar withdrawals to help you save as much tax as possible.

Is it safe to invest your 3a pillar in the stock market?

By definition, the stock market is a risky investment.

But I like the way the Handelszeitung journalist summarises it:

Those who invest their 3a retirement savings in a broadly diversified way in the stock markets have a better chance of a return. Admittedly, the risk of a price loss increases with stocks. But those who remain invested for 15 years or more have virtually nothing to fear.

Obviously, the keyword is “practically”, because this isn’t a savings account either ;)

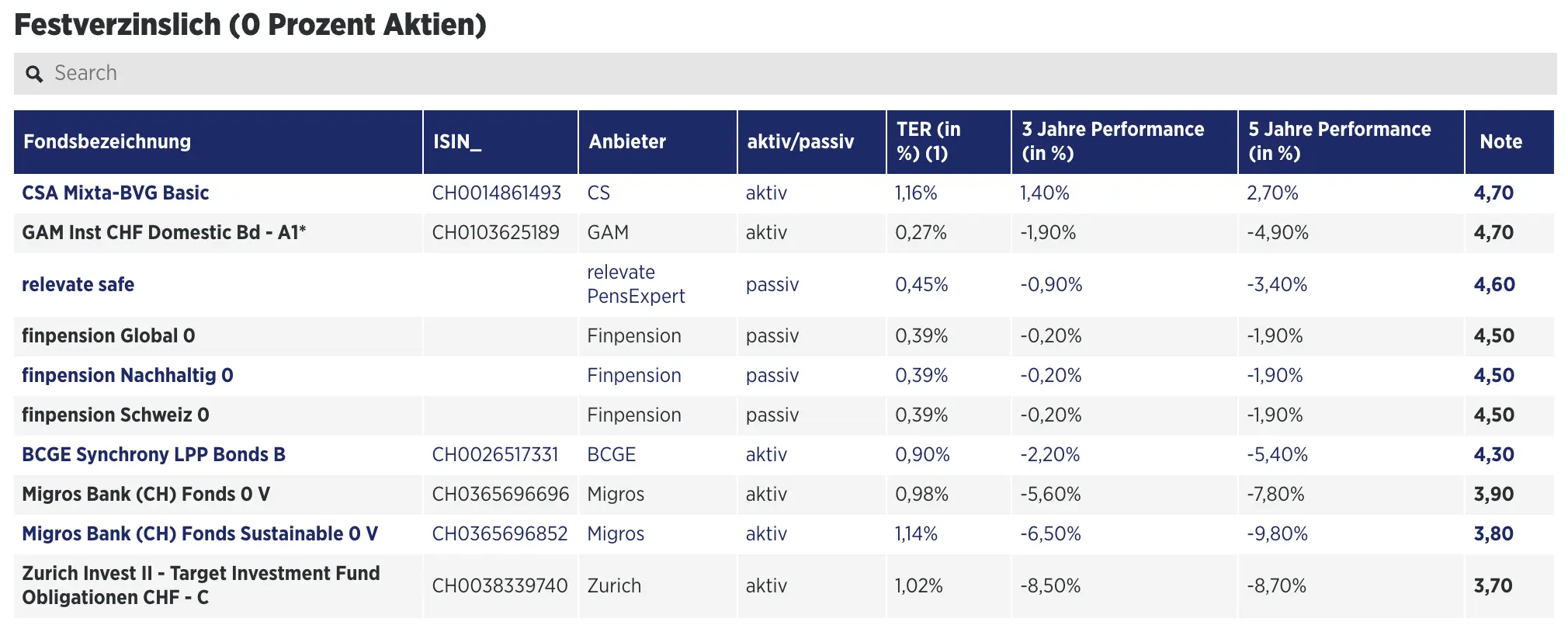

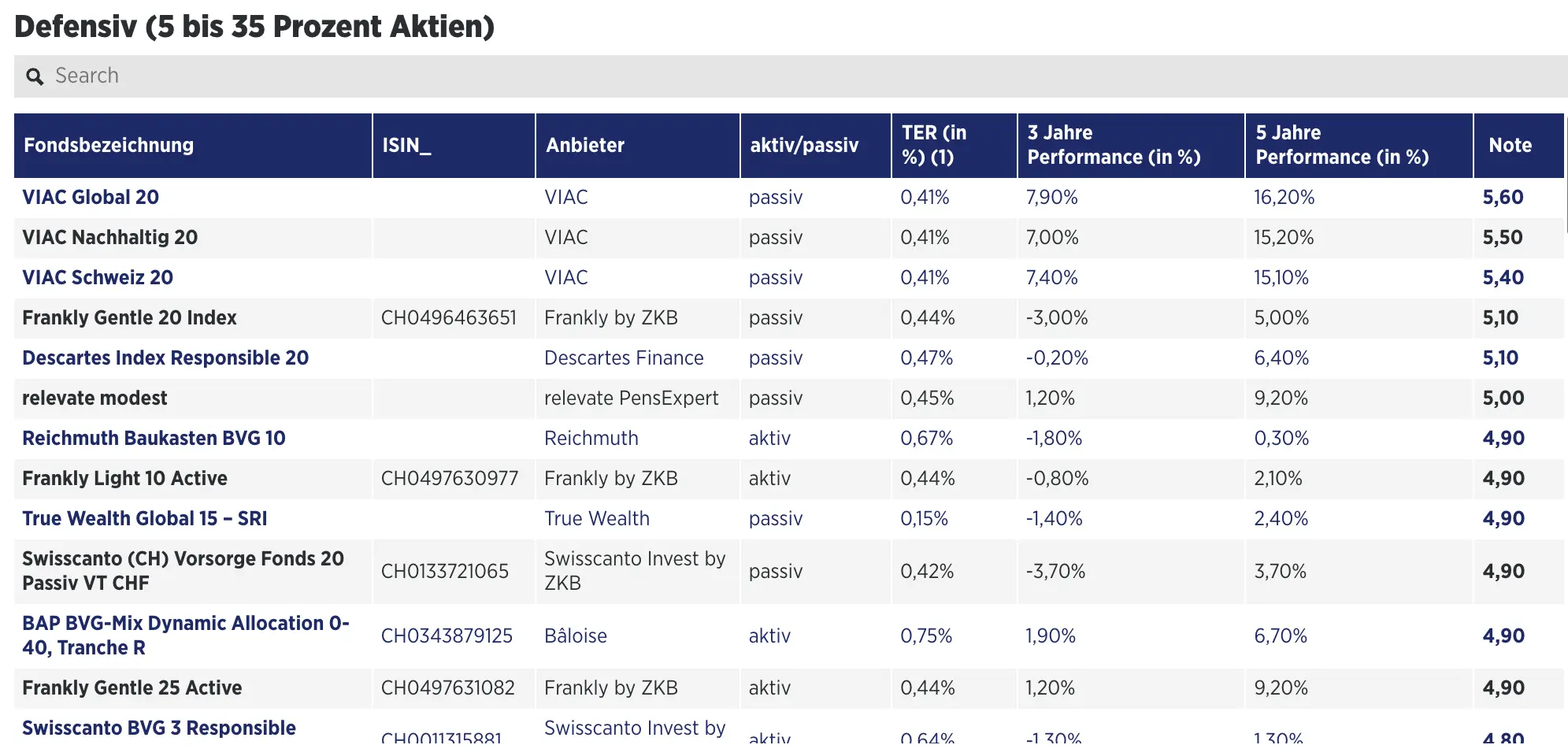

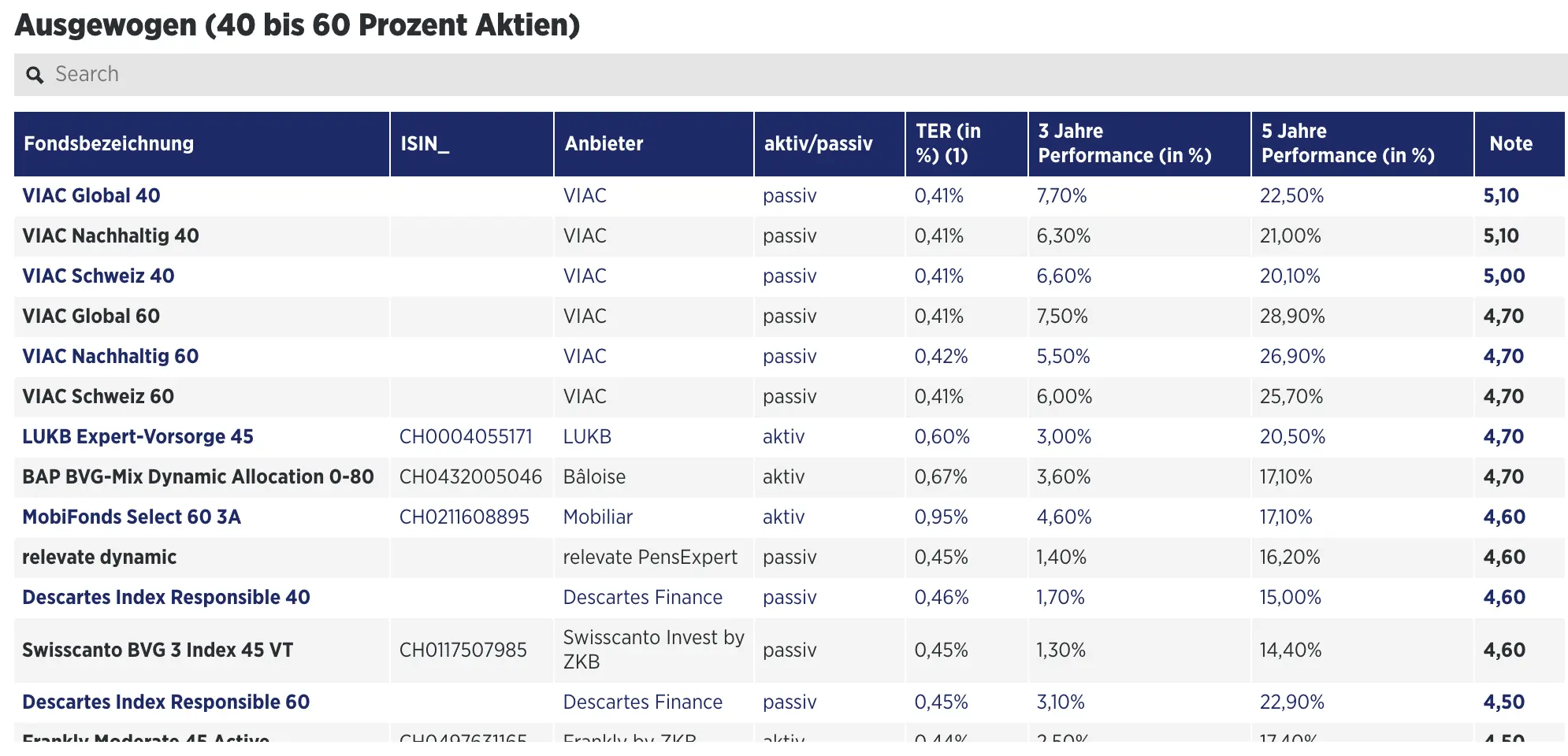

What is the best 3rd pillar if I want to invest less than 100% in stocks?

Personal finance is appropriately named.

It’s personal.

Because depending on your FIRE phase (accumulation upstream, or consumption downstream), you’re potentially going to be less aggressive than me in terms of your asset allocation.

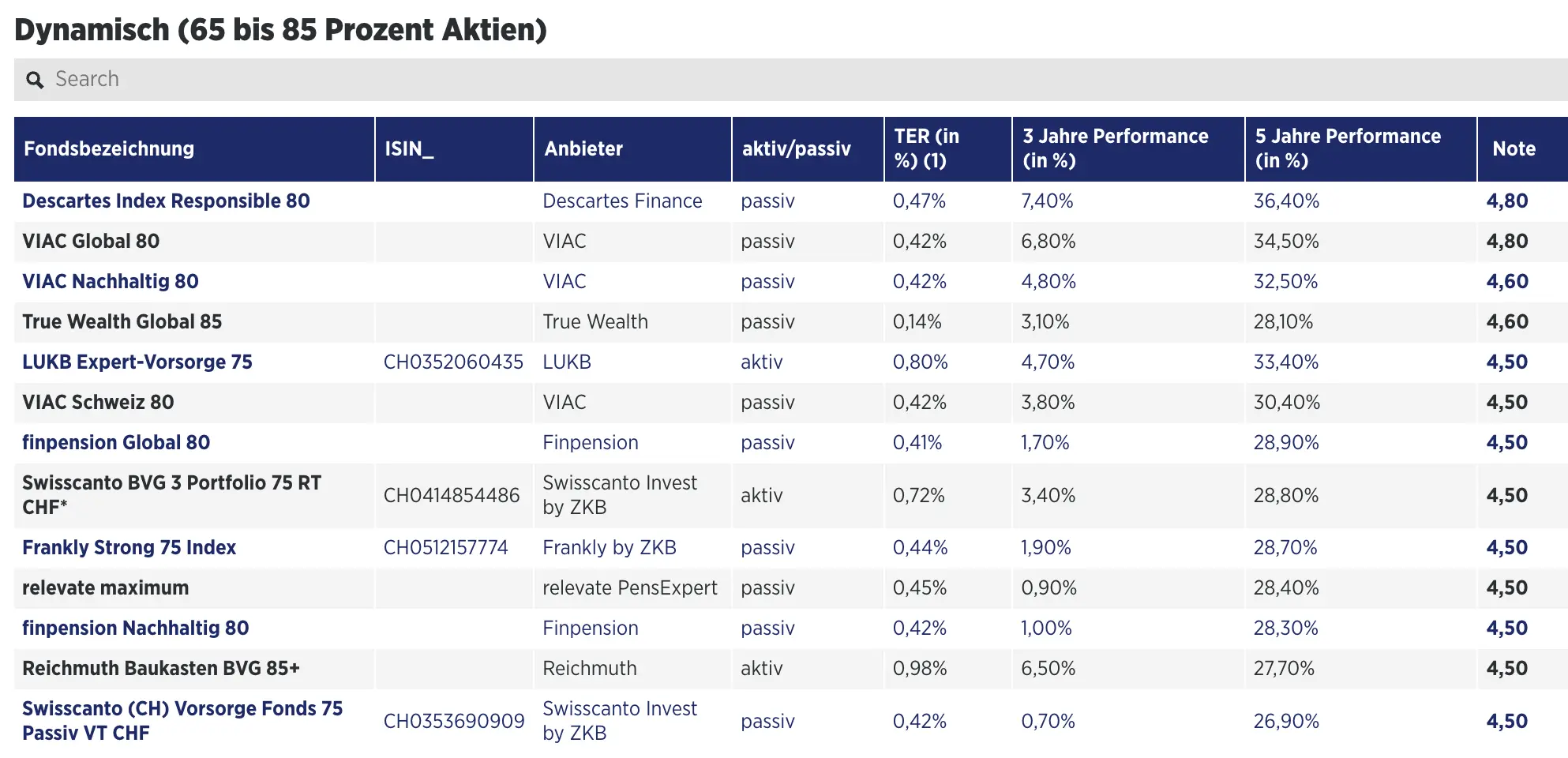

I’m therefore providing you with a screenshot of the various results of the Handelszeitung’s 3a pillar comparison:

Handelszeitung comparison of the best 3a funds with a defensive profile of 10-35% in stocks (source: Handelszeitung)

Handelszeitung comparison of the best 3a funds with a balanced profile of 40-60% in stocks (source: Handelszeitung)

Handelszeitung comparison of the best 3a funds with a dynamic profile of 65-85% in stocks (source: Handelszeitung)

How old do you have to be to start a 3rd pillar?

You have to be over 18 years old to open a 3rd pillar in Switzerland. The law specifies that the earliest a young person can open a pillar 3a account is 1 January following their 17th birthday.

As with any investment, the earlier you make your first payment into your 3rd pillar, the greater the return you will get over the long term.

What do you think of the 3rd pillar from VZ dear MP?

VZ is a reputable and secure Swiss company. Nevertheless, their Pillar 3a solution does not appear in the Handelszeitung ranking. This indicates that the VZ 3rd pillar is not the one offering the best return — something we look for in the first place as Mustachian.

I recommend what I use myself instead: a 3a pillar from VIAC and one from finpension.

What do you think of the Pillar 3a of Yuh?

I’ve left it out, because it’s not one of the top 3rd pillars in the Handelszeitung ranking.

(header image credit: pexels.com)